The Catalyst That Could ‘Standardize’ Bitcoin

Submitted by QTR’s Fringe Finance

Today in my series called “things people following Bitcoin for the last 13 years have already figured out but I’m presenting as a brand new epiphany”, I wanted to write about a revelation about Bitcoin’s adoption, standardization, and normalization I had this past week. While thinking about what it would take for Bitcoin to receive a massive adoption push in the United States, I was able to think of one such scenario that may not be very far off.

And contrary to what you think, it doesn’t have anything to do with regulation, taxation, accounting standards, or any of the things that are mistakenly talked about as the ebb and flow of Bitcoin adoption on a daily basis. As I learned firsthand while finally doing some research on Bitcoin over the last month, none of those things truly matter. The decentralized nature of the network necessitates that it doesn’t need any of those things to flourish. I noted this in my article last week called “Why I Bitcoin.”

But what I also noted in the same article was that Bitcoin will survive if the people want it to survive. For those who understand the network, they understand that ~20,000 global nodes mean that the network is going to stay up regardless of which politician, jurisdiction, or regulatory agency around the world tries to stand in its way. This is part of the elegance of the network.

And still, having realized that, I think to myself, “What is going to accelerate that adoption so much that we move from now—a point of almost no return for Bitcoin—to a significant point of serious escape velocity?” The answer was right underneath my nose.

When I wrote the title to my article last week called “Why I Bitcoin,” it was just one of those titles that came to me instinctively. Sometimes I spend hours trying to figure out which title is going to be the catchiest, and other times, like with this article, I have the title set out beforehand because it is very clear what I want to say.

But I was walking around over the weekend and wondering where I had heard that phrase before.

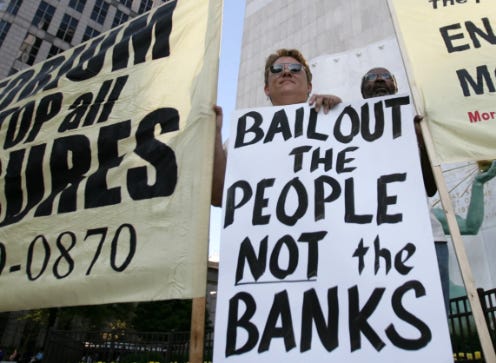

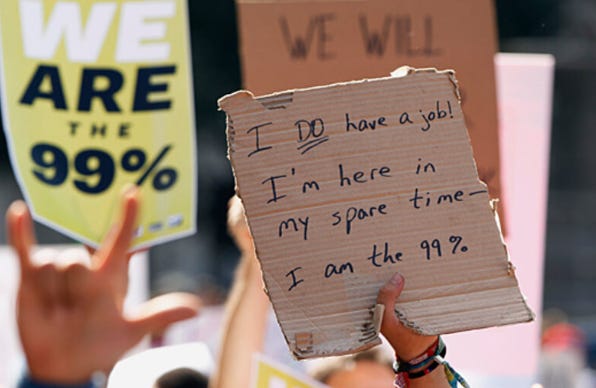

Suddenly, it came to me. In one of my favorite comedy skits, a group of Philadelphia improv comedians went to the Occupy protests that occurred as a result of the 2008 economic crash. In more than one spot, there are signs that say “Why I Occupy.” In fact, this was basically the namesake of part of the Occupy movement. I remember that WhyIOccupy.org was the source for quite a bit of the pissed-off populace at the time; they thought whatever ideology was on that website was their particular brand of solution to the financial crisis.

It was only after remembering that, that I thought in the next major financial crisis, people really are going to have a legitimate exit ramp from the system. Bitcoin is that exit ramp. It’s the thing that people involved in the GameStop frenzy were so desperately looking for, whether they knew it or not, but couldn’t find.

While the GameStop fiasco was taking place, I remember thinking to myself that there were too many people who were pissed off but didn’t have any idea what they were angry about. In chat rooms and on social media, everybody was catching blame but the Federal Reserve. These people were pissed off because they felt like they were getting gypped: they were reacting, whether they knew it or not, to the widening of the inequality gap while they were struggling to make ends meet.

But what they didn’t know was that this wasn’t the fault of Ken Griffin, Citadel, or short sellers; rather, it was the fault of the Federal Reserve.

Nowadays, it’s becoming clearer as the Fed shoehorns that inequality gap even wider. It’s clearer because inflation is a mainstream story and a phenomenon that people can understand. Even if they don’t know why inflation is happening, most people have a semblance of understanding that it has to do with the Fed blowing out the money supply over the last four years and then, to add insult to injury, lying to the public about inflation being transitory.

Support our work by becoming a paying subscriber today & get 50% off FOR LIFE: Get 50% off forever

And those who hoped to repeat GameStop’s success with names like AMC now know that toxic management and a loss-making business can very easily take the air out of any momentum in any type of short, or FOMO, squeeze in any one equity. And they also know that brokerages and regulators can prevent them from transacting in it anytime they damn well please.

During the next major financial crisis, which, in my opinion, isn’t that far away, the same group of pissed-off “have nots” will hopefully direct more of the blame where it belongs: monetary policy. After all, inflation is a brutal tax on the people who can’t afford it and is all but meaningless for the super-rich. And, the super-rich get super richer as a result of quantitative easing and money printing, which directs a disproportionate amount of relief to the stock, bonds and housing market: assets that rich people have that lower-income people do not have.

I would often ask during the Fed money printing over Covid, that if the Fed wanted to print $5 trillion, why wouldn’t they just divide it up evenly amongst all people in the United States and cut us all a check? After all, $5 trillion divided by 300 million people is about $16,500 per person. Putting systemic reasoning aside, this is a fairly simple straightforward question. If you want to stimulate the economy by spraying money all over the place, why not do it equally amongst all of its citizens, instead of playing favorites?

But that isn’t what happened in 2008, and it’s not going to be what happens during the next financial crisis.

What I do think will happen, however, is a new group of “have nots” and economic renegades will be exponentially more informed about how monetary police works, not just as a result of the GameStop fiasco, but also as a new, younger generation has familiarized themselves with the ideological case for Bitcoin. Before I even took to Bitcoin, one of the things I liked about it was the idea that it was forcing a younger generation to understand Austrian economics in a world where we have all but overused and beaten to death our modern monetary theory privileges. Armed with this new knowledge, an entire new generation of pissed-off, regular people will once again bear the cost of socialized losses from nefarious, toxic companies who privatized their profits. And this will be within an inflationary crisis still fresh in their minds. This time there will be no question about who is eroding the purchasing power and the wealth that they have worked for through taxation and inflation.

Which brings me to my point: Bitcoin could very well be the exit ramp that millions of angry people look towards in such a situation.

Unlike with GameStop, Bitcoin actually does have the chance to affect major change because the network’s success is tethered to how large it grows. This means that with every single person who decides to own, or educate themselves about, Bitcoin, they become part of a self-fulfilling prophecy of the network’s success. And, of course, the ideology behind the success of the network is firmly rooted in empowering people just like them: the people who are tired of having what little they earn silently whisked away from them by the dark inflationary financial machinery of the night.

Many people who participated in the GameStop frenzy, including the “apes” over at Reddit’s Wall Street Bets and millions of other retail traders, will be forced to realize that Bitcoin has all of the positives of what they sought to achieve in the past without the negatives. There is no management to mess it up, there is no counterparty to dilute them, there is no one to turn off the buy button and there is essentially no governing or regulatory body to prevent the network from being a success if the people want it to be one. It becomes the digital freedom that all of these people sought out during the last financial crisis but had no effective way to manifest.

2008 was yet another echo of what has become par for the course on Wall Street: every time things get catastrophic, the public bears the cost, gets pissed off and brandishes the torches. But then it eventually blows over and people go about their business.

“I’m starting to feel a little better about this whole thing,” John Tuld says at the end of Margin Call, signifying that the more things change, the more they stay the same.

Bankers and politicians have been relying on this pattern to play out the way it has in the past in order for them to continue to perpetuate the same scheme they’ve been part of for decades. It is, in essence, what enables the miscarriage of justice of everyday Americans bearing the cost of failures of the ultra-rich.

And so, the next time this happens, the investing public could legitimately have a chance to break that cycle for the first time in half a century by adopting Bitcoin. It has a chance to opt them out of the system that they have railed against. Capital flows into Bitcoin and out of traditional financial assets will send a message to major financial institutions who only respond to the opportunity to make fees (see their newfound obsession with Bitcoin now that there’s ETFs for reference). At the same time these flows could add to the self-fulfilling prophecy of the network becoming a success, due to its redundancy essentially serving as the barometer for the health of the network.

It is by no means guaranteed, but if the system ever goes belly up again, and the average person is looking for a true weapon to fight the system – and one that is literally programmed to be the technological braille of the phrases “there’s safety in numbers” and “power to the people,” Bitcoin could shine through and open an epoch for itself that be seen in the future as its adoption Renaissance.

Support our work by becoming a paying subscriber today & get 50% off FOR LIFE: Get 50% off forever

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Mon, 02/12/2024 – 11:20

via ZeroHedge News https://ift.tt/rVZPIn1 Tyler Durden