Futures Rebound After Biggest Rout Since March 2023; Bitcoin Soars

After the worst rout for US stocks since March 2023, which followed hotter than expected CPI prints across the board andsparked fears the Federal Reserve may not cut interest rates as soon as expected, US equity futures and Treasuries rebounded with S&P 500 futures adding 0.6% and rising to 5,000 after the worst inflation-day drop for the index since September 2022, while Nasdaq futures rose 0.6% as JPM writes that “markets will see if yesterday was a blip and today’s relief rally is sustainable or if it is a deadcat bounce.” 10Y Treasury yields retraced some of the previous day’s surge, but held above 4.3% as traders trimmed bets for an early Fed rate cut. In a mirror image response, UK’s FTSE 100 jumped by almost 1% after the latest UK CPI print came in lower than expected; European bourses began the session on a mixed footing and trade was generally tentative, before eventually the Stoxx moved into the green. Oil prices are little changed, with WTI trading near $78. Spot gold falls 0.1%. Bitcoin gains over 3% and is back above $50,000. There are not notable data releases today; Thursday’s Retail Sales and Friday’s PPI have implications for the inflation outlook and yield curve. Today kicks off another day of Fedspeak with both Barr and Goolsbee.

In a hilarious screwup overnight, Lyft first exploded over 60% after the company “mistakenly” guided 500bps of EBITDA margin growth, adding more than $3BN in market cap, before the company admitted there was a typo and the real number was 50bps. Still, the stock jumped 22% this morning after the ride-sharing company’s results did beat expectations modestly on key metrics.

Here are some of the other most notable premarket movers:

- Airbnb falls 4% after suggesting that demand in the current quarter wouldn’t be as robust as the last.

- Cryptocurrency-linked stocks rally as Bitcoin shows resilience to the higher-than-expected US inflation print and advances beyond the $50,000 mark: Cleanspark (CLSK) +14%, Marathon Digital (MARA) +12%, Riot Platforms (RIOT) +9%

- GoDaddy slips 2% after revenue guidance missed estimates.

- Instacart drops 5% after the online grocery delivery firm reported fourth-quarter revenue that missed expectations.

- MGM Resorts falls 3% as a drop in revenue from regional business dragged on overall quarterly results.

- QuidelOrtho plummets 38% after the diagnostics company issued a full-year adjusted earnings per share forecast that missed expectations.

- Robinhood jumps 14% after the online brokerage firm reported fourth-quarter net revenue that beat estimates.

- Uber gains 6% after unveiling a buyback plan totaling as much as $7 billion in shares.

- Upstart drops 14% after its guidance for the first quarter disappointed.

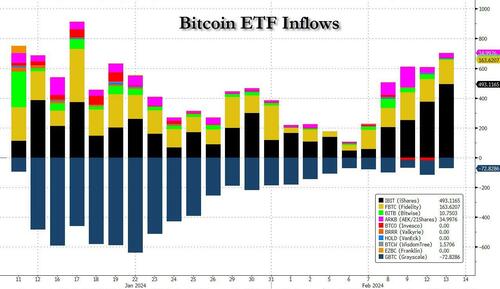

Meanwhile, the surge in crypto continues with Bitcoin rising above $51,000, the highest since Dec 2021 as the relentless net inflows in bitcoin ETF hit a record high.

The CPI data came as a disappointment for investors pushing US stocks to a record, and European peers to just short of one, on mounting hopes for imminent rate cuts. Fed swaps shifted full pricing of a rate cut to July from June after the data and global bonds erased the last remnants of a rally that started in December.

Despite the setback, investors riding bets on an eventual Fed pivot to easier policy aren’t hitting the sell button. BlackRock Inc. portfolio manager Russ Koesterich sees the setback as temporary, with potential for further upside to US stocks of 6-8% this year and possibly four rate cuts still in the offing.

“Despite yesterday’s action in the stock market it’s probably going to to be a decent year for US equities,” Koesterich said in an interview with Bloomberg TV. “There’s reason to stay long equities. I don’t think the narrative changes. We still think that the Fed will begin cutting late this spring or in the summer. We still think three, maybe four, cuts are likely.”

There was better news Wednesday for UK traders looking forward to policy easing by the Bank of England. Inflation in Britain came in lower than forecast in January, with underlying price pressures not rising as much as markets and the BOE feared. The pound reversed earlier gains after the data, while UK bonds rallied and UK stocks rallied as traders priced in deeper and earlier interest-rate cuts by the Bank of England after consumer prices rose less than expected in January. The jump in gilts saw UK 10-year yields fall 8bps to 4.07%. The FTSE 100 rose 0.8% and outperformed its European counterparts.

Europe’s Stoxx 600 began the session on a mixed footing and trade was generally tentative, before eventually moving into the green, rising 0.3% as the drug and grocery sector outperformed while miners lagged. ASML Holding NV said the semiconductor market has reached its nadir and there are now are signs of a rebound. Heineken NV shares slumped after the world’s second-biggest brewer warned that persistent inflation and economic worries will weigh on beer demand in 2024. ABN Amro Bank NV rallied after it unveiled a fresh share buyback with the Dutch state participating, as part of its planned sell down in the lender. Here are some of the most notable European movers:

- Capgemini shares gain as much as 4.2% after the French IT firm said its sales growth is expected to reach a trough in the first quarter as demand for tech projects recovers.

- Coca-Cola HBC shares rise as much as 6.5% after a yearly trading update, with analysts praising past investments and lower-than-expected cost guidance.

- ABN Amro shares jump as much as 6.3% after beating 4Q earnings estimates and announcing a €500 million share buyback. Analysts expect the bank’s targets to trigger consensus upgrades.

- Delivery Hero shares rise as much as 4.7% after issuing a trading update for the full year which soothed investor concerns, and achieved free-cash-flow breakeven in the 2H.

- Fresenius Medical Care shares rise as much as 5.2% after dialysis provider peer DaVita reported upbeat results for the fourth quarter.

- Bilfinger shares gain as much as 9.1% after the German industrial services firm forecast 2024 Ebita margin in the range of 4.9% to 5.2%, up from this year’s 4.3% level.

- ProSieben shares rise as much as 12% after the broadcaster reported preliminary Ebitda ahead of estimates and offered a more optimistic profit outlook compared with two months ago.

- Heineken shares fall as much as 6.5% in Amsterdam after the brewer reported full-year organic revenue that missed estimates.

- Norsk Hydro shares fall as much as 3.8% after the aluminum firm reported adjusted 4Q Ebit that missed estimates due to metal market costs.

- Castellum shares slide as much as 4.7% after the real estate investment company delivered mixed results. Morgan Stanley also highlighted the company’s elevated leverage.

- Thyssenkrupp shares fall as much as 10% after the steel company burnt through cash in the first quarter, casting doubt on its ability to deliver its full-year target.

- Entain shares fall as much as 5.2% after US joint-venture partner MGM Resorts reported falling revenue from its regional operations.

Earlier in the session, Asian stocks fell the most in four weeks, tracking an overnight selloff on Wall Street on tempered expectations for Federal Reserve interest-rate cuts after hot US inflation data: traders slased expectations for a Fed cut before July after the latest CPI print. Hong Kong stocks erased early losses as the market reopened after holidays. The MSCI Asia Pacific Index declined as much as 1.1%, with Toyota, Samsung and Commonwealth Bank among the biggest drags. Key measures fell more than 1% in Japan and South Korea, with losses also notable in Australia and India. Markets remained shut for holidays in mainland China and Taiwan, while Indonesia was closed for its presidential election.

- Hang Seng conformed to the risk-off mood on return from the holiday and with mainland Chinese markets shut.

- Nikkei 225 retreated with the biggest stock movers influenced by earnings results, although further losses in the index were somewhat cushioned by the recent currency weakness.

- ASX 200 declined with underperformance in the top-weighted financial sector after Australia’s largest lender CBA reported a drop in H1 profit and warned of financial strain from higher rates in 2024.

- Indian stocks ended the day higher, erasing intraday losses, with state-owned enterprises leading the charge even as technology stocks dragged. The S&P BSE Sensex rose 0.4% to 71,822.81 in Mumbai, after falling as much as 1% earlier, while the NSE Nifty 50 Index advanced by a similar measure. The MSCI AC Asia Pacific index ended 0.4% lower.

“While a single data point does not make a trend, the relentless risk rally over the past months has left little room for error when it comes to the inflation fight,” said Jun Rong Yeap, a market strategist at IG Asia. “A surge in the US dollar and the negative handover from Wall Street offer reasons for some de-risking.”

In FX, the Bloomberg dollar index was slightly lower as the yen advanced after Japan’s currency officials warned authorities stood ready to take steps in the market if needed to curb rapid moves.

- USD/JPY slipped as much as 0.3% to 150.35, paring some of Tuesday’s 1% gain after Masato Kanda, vice finance minister for international affairs, said authorities are on call 24 hours a day, 365 days a year and are always ready to take appropriate steps as needed.

- Finance Minister Shunichi Suzuki reinforced the view, with the comments coming after hotter-than-expected US consumer inflation data boosted the dollar to the highest level against the yen since November

- “I would expect the weakness of the Japanese yen to probably last longer than we expected and most investors had hoped for,” Hebe Chen, analyst at IG Markets said on Bloomberg Television. The message from the Bank of Japan is that “they are still patient about their monetary policy”

- The Norwegian krone led currency gains, following data showing Norway’s economy expanded for a second quarter in a row at the end of last year

- The pound fell 0.4% versus the greenback and was the worst performing G-10 crrency after and traders priced in deeper and earlier interest-rate cuts by the Bank of England after inflation came in lower than expected

In rates, treasuries held a bull-steepening bias heading into early US session with front-end yields richer by around 5bp on the day. US 10-year yields around 4.29%, richer by ~3bp on the day. Front-end-led rally in Treasuries steepens 2s10s spread by 2.5bp, back toward middle of Tuesday range’s, while 5s30s widens 3bp, paring Tuesday’s aggressive flattening move. UK curve sees sharp steepening rally after a miss in UK CPI data prompted traders to price in deeper and earlier interest-rate cuts by the Bank of England. In 10-year sector gilts outperform by 5bp vs Treasuries; 2-year UK yields drop almost 10bp on the day. Move follows a front-end-led rally in gilts after UK consumer prices rose less than expected in January. US session includes two scheduled Fed speakers and no major economic data.

In commodities, oil steadied after a mixed US inventory report, while OPEC and the IEA offered contrasting outlooks for the global crude market. WTI traded near $78 while gold was locked in a narrow range after plunging below $2,000 an ounce for the first time in two months while Bitcoin traded near the $50,000 mark.

Looking to the day ahead, in terms of data releases, we have UK January CPI, RPI, PPI and December house price, Eurozone Q4 GDP, employment, December industrial production, and Canada January existing home sales. We will also be hearing from the Fed’s Goolsbee and Barr, and the ECB’s Vujcic, Nagel, and Guindos, and earnings from Cisco, Sony, Occidental Petroleum, Kraft Heinz, Barrick Gold, Albemarle, and Twilio.

Market Snapshot

- S&P 500 futures up 0.3% to 4,988.50

- STOXX Europe 600 up 0.3% to 484.26

- MXAP down 0.4% to 167.42

- MXAPJ little changed at 510.82

- Nikkei down 0.7% to 37,703.32

- Topix down 1.1% to 2,584.59

- Hang Seng Index up 0.8% to 15,879.38

- Shanghai Composite up 1.3% to 2,865.90

- Sensex up 0.5% to 71,910.87

- Australia S&P/ASX 200 down 0.7% to 7,547.74

- Kospi down 1.1% to 2,620.42

- German 10Y yield little changed at 2.36%

- Euro little changed at $1.0705

- Brent Futures little changed at $82.73/bbl

- Brent Futures little changed at $82.72/bbl

- Gold spot down 0.1% to $1,990.46

- U.S. Dollar Index little changed at 104.89

Top overnight news

- Mike Gallagher, head of the US House China committee, will visit Taipei next week with a group of lawmakers in a show of support for Lai Ching-te ahead of his May inauguration as president of Taiwan. The hawkish Wisconsin Republican will arrive in Taiwan on February 21, according to three people familiar with his plan, including two Taiwanese officials who expect him to lead a delegation of seven US lawmakers. FT

- The yen weakened past 150 per dollar for the first time since November, prompting pushback from Japanese officials. The country’s top foreign exchange official Masato Kanda said speculative moves “aren’t desirable.” BBG

- Russian President Vladimir Putin’s suggestion of a ceasefire in Ukraine to freeze the war was rejected by the United States after contacts between intermediaries, three Russian sources with knowledge of the discussions told Reuters. RTRS

- UK CPI for Jan modestly undershoots the Street in Jan (core +5.1% vs. the Street +5.2% and headline +4% vs. the Street +4.1%), a relief for markets after the US reading on Tues. RTRS

- The ECB requires additional evidence that inflation is returning to its goal before it can safely begin loosening monetary policy, according to Vice President Luis de Guindos. BBG

- US crude inventories gained by 8.5 million barrels last week, API data is said to show. That would be the biggest increase since mid-November if confirmed by the EIA. Distillate supplies fell for a fourth week and gasoline stockpiles also dropped. BBG

- Tom Suozzi, a former Democratic congressman, won a closely watched special House election in New York on Tuesday, narrowing the Republican majority in Washington and offering his party a potential playbook to run in key suburban swing areas in November. NYT

- CIA Director William Burns concluded negotiations with top Middle Eastern officials on Tuesday without making major strides toward a deal between Israel and Hamas that would free hostages and pause fighting in the Gaza Strip, according to officials familiar with the talks. WSJ

- Jeff Bezos offloaded more than $4 billion in Amazon stock over four trading days, less than two weeks after disclosing a plan to dispose up to 50 million shares. Bezos hasn’t explained why he’s selling now, but he may be hoping to save on taxes. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks declined amid headwinds from the US where hot inflation unwound Fed rate cut expectations. ASX 200 declined with underperformance in the top-weighted financial sector after Australia’s largest lender CBA reported a drop in H1 profit and warned of financial strain from higher rates in 2024. Nikkei 225 retreated with the biggest stock movers influenced by earnings results, although further losses in the index were somewhat cushioned by the recent currency weakness. Hang Seng conformed to the risk-off mood on return from the holiday and with mainland Chinese markets shut.

Top Asian News

- Japan’s top currency diplomat Kanda said recent yen moves are rapid and is watching FX moves with a high sense of urgency, while he said they will take appropriate actions if needed on forex and are ready to take action on FX anytime 24 hours all year round. Furthermore, Kanda said rapid FX moves could have an adverse impact on the economy and he suggested appropriate responses to the weak yen could include intervention.

- Japanese Finance Minister Suzuki said he is watching the FX market with even stronger urgency and that rapid FX moves are undesirable, while he won’t comment on the FX level and intervention.

- Japanese Chief Cabinet Secretary Hayashi says will not comment on FX levels; important for currencies to move in stable manner reflecting fundamentals

European bourses, Stoxx600 (+0.3%) began the session on a mixed footing and trade was generally tentative, before eventually moving into the green. And love is in the air for the FTSE 100 (+0.8%), as weakness in the Pound (post-CPI) lifts the index off its feet. European sectors hold a mostly positive bias, with Media taking the spotlight, helped by significant post-earning strength in ProsibenSat (+9.2%). Basic Resources is hampered by broader losses in underlying base metal prices. US equity futures (ES +0.4%, NQ +0.6%, RTY +0.9%) are firmer across the board and attempting to pare back some of the prior day’s hefty losses, sparked by the hotter-than-expected CPI. The RTY outperforms after significant losses yesterday and as Bitcoin continues to advance past USD 50k.

Top European News

- ECB’s de Guindos says incoming data continues to signal weakness in the near term; some forward-looking survey indicators point to a pick-up in growth further ahead; deflationary process is continuing.

- ECB’s Vujcic says ECB seems to be getting the inflation fight right.

- German Economy Minister says German economic recovery may be delayed further by strikes, geopolitics, and weak foreign demand; inflation-dampening factors in Germany likely to persist over the rest of the year.

- German Direct Investments in China rose 4.3% Y/Y to a record high of EUR 11.9bln in 2023; investments in China as a share of overall German investments abroad rose to 10.3% – the highest level since 2014, according to IW Institute.

- UK ONS says UK House Prices -1.4% Y/Y in Dec (vs -2.1% in Nov)

Earnings

- Airbnb Inc (ABNB) – Q4 2023 (USD): Revenue 2.22bln (exp. 2.16bln), Gross booking value 15.5bln (exp. 15.2bln), Adj. EBITDA 738mln (exp. 643.5mln), Adj. EBITDA margin 33% (exp. 29.9%); to buy back up to 6bln of Class A common stock. Q1 revenue view 2.03-2.07bln (exp. 2.02bln). Shares -5.5% in the pre-market

- Thyssenkrupp (TKA GY) – Q1 (EUR): Revenue 8.18bln (exp. 8.8bln); cuts FY net profit guidance and now expects to break even (exp. +472mln; prev. “slight increase” ); Co. says the steel industry is currently facing a very challenging environment. COMMENTARY: Lower volumes of materials and raw materials had a negative impact. With lower volumes and prices overall, Materials Services posted a figure of EUR 2.9bln for both order intake and sales (prev. EUR 3.3bln and EUR 3.2bln, respectively) in a weak economic environment. Shipment volumes were stable compared with the prior year, order volumes decreased, mainly driven by lower demand from automotive customers. OUTLOOK: In a difficult market environment characterized by geopolitical and trade conflicts, ThyssenKrupp anticipates that macroeconomic development in the current fiscal year will be challenging overall. Shares -8.7% in European trade

- Capgemini (CAP FP) – FY23 (EUR): Net 1.66bln (exp. 2.15bln, prev. 1.55bln Y/Y), Revenue 22.5bln (exp. 22.6bln). To propose a renewal of Aiman Ezzat as CEO. Guides initial FY24 Revenue flat to +3%, Op margin 13.3-13.6%, Organic FCF 1.9bln. BoD has decided to recommend the payment of a dividend of EUR 3.4/shr. Shares +4.3% in European trade

- ProsiebenSat.1 (PSM GY) – Q4 (EUR): Adj. EBITDA 335mln (exp. 311.8mln), Revenue 1.28bln (exp. 1.3bln). Prelim FY23 Adj. EBITDA 578mln (exp. 554.2mln), Guides initial FY24 Adj. EBITDA 575mln (exp. 558.6mln). Shares +7.5% in European trade

FX

- DXY is overall steady but the USD is showing varying performance vs. peers. DXY has eclipsed yesterday’s peak of 104.96 but is yet to print on a 105.00 handle. Above which, there is clean air until 105.73 which was the November 14th peak.

- EUR printed a fresh YTD trough as the post-US CPI pressure on the pair continued. 1.0696 is the low print thus far with downside targets including the 14th November low at 1.0692.

- GBP is bottom of the pile across the major following softer-than-expected UK inflation metrics which have put an August cut back on the table. Cable fell to a trough of 1.2544 after taking out yesterday’s low of 1.2573 and the 200DMA at 1.2563.

- JPY is attempting to claw back some lost ground vs. the USD after printing a 2024 high at 150.88 yesterday; remarks from MOF & others in focus, but USD/JPY remains well above 150.00.

Commodities

- Crude is incrementally firmer and little changed following the US CPI, but still underpinned by geopolitics. On that note, reports this morning suggested escalating tensions between Israel and Lebanon, with one report stating “This morning’s attack on Safed by Hezbollah marked the most significant attack since the war’s onset.”

- Spot gold trade sideways and continues to hold beneath USD 2,000/oz, with the yellow metal awaiting impetus from geopolitics or Fed speak.

- Base metals are mixed but copper prices remain softer following the downbeat APAC mood, although newsflow remains quiet thus far and price volatility minimal.

- US Energy Inventory Data (bbls): Crude +8.5mln (exp. +2.6mln), Gasoline -7.2mln (exp. -1.2mln), Distillate -4.0mln (exp. -1.6mln), Cushing +0.5mln.

- EU Commission’s Sefcovic said after meeting White House officials that he understands the US pause in LNG export approvals will not affect US LNG shipments to Europe in the next two to three years.

- Citi says gold market seems biased to tactically correct to USD 1,925-50/oz at some point in the next 1-3 months

- Global LNG trade reached 404mln metric tons in 2023, according to Shell’s LNG outlook; China is likely to dominate LNG demand growth this decade; gas market remains structurally tight

Geopolitics: Middle East

- “Israeli media: Sirens sound for the third time in Safed”, according to Al Arabiya.

- Al Jazeera reporter notes “This morning’s attack on Safed by Hezbollah marked the most significant attack since the war’s onset.”

- “Israeli media: War Council discusses how to respond to heavy Hezbollah bombardment of Israel”, according to Al Jazeera.

- Israeli Minister of National Security Gvir calls on PM Netanyahu to hold an urgent meeting, says that “the shelling from Lebanon is not sporadic strikes but an actual war”, according to Al Jazeera

Geopolitics: Other

- North Korea fired multiple cruise missiles off its east coast, according to Yonhap.

US event calendar

- Nothing scheduled

Central Banks speakers

- 09:30: Fed’s Goolsbee Speaks in Q&A

- 16:00: Fed’s Barr Speaks at NABE Conference

DB’s Jim Reid concludes the overnight wrap

Happy Valentines’ Day to all our readers. The uneasy brokered agreement at home where we both agree not to give each other cards/gifts will be tested today as I have to work out whether I was actually expected to ignore that or not. I can guarantee that my wife will keep her side of the bargain!

US CPI certainly didn’t keep its side of the bargain yesterday as Cupid dropped his dovish arrows and instead delivered a red-hot inflation print. We’ll review it in more detail below but the print sent 10yr Treasury yields soaring up +13.5bps, the S&P 500 down -1.37%, the Russell 2000 (-3.96%) to its worst day since June 2022, and took out nearly a whole 25bps Fed cut by December.

Linked into this it’s fair to say my macro view has had to evolve over the last few months as a US recession around the end of 2023 looked less likely. First a reminder of the sequencing of my view in recent years to recap how I currently think about the macro world. In 2020/early 2021 when the money supply exploded at its strongest pace since WWII, it was pretty obvious that you would get high inflation that was far more than just supply side driven. As such we made an early, way out of consensus call that the Fed would have to raise rates to over 5% as we reached the start of their hiking cycle. From that point on it was pretty difficult to see how you could avoid a hard landing, given how far behind the curve the Fed was, albeit with an appropriate lag. I thought you would get a US recession by the end of 2023. However the GDP revisions last September did suggest that excess savings would now not run out until the end of 2024 rather than the end of 2023 and this was a little bit of a wakeup call for my view.

I started this year being most convinced that the combination of the perfect soft landing of the economy, with growth and inflation moving to trend and 6-7 cuts was unlikely. Although soft landing prospects had risen, the tails on either side of that remained elevated simply because the forces have been so big in either direction, especially alongside knowing that monetary policy lags are long and variable. We had the biggest increase in the US money supply since WWII and then the largest contraction since the 1930s, and the first since just after WWII. So to pad out the metaphor, to perfectly land the plane required you to program the steering wheel for landing, hours in advance, without knowing the exact nature of the very strong crosswind speeds at the airport. Once you got into your descent near the airstrip, your controls only helped you on your next take-off.

Of course it’s possible that everything can be perfectly calibrated, and the probabilities have gone up of late, but it still requires a huge amount of good fortune. Indeed the US CPI print hinted that there could be monetary overhang left in the system. This excess savings has helped the economy successfully survive over a year or so of very tight credit and lending standards. However does it also mean that inflation will struggle to make that final journey back to 2%? In conclusion while the soft landing outcome is still in the ascendancy, I would say a no landing scenario is under priced. It might not happen but the forces in both directions have been so big that the degree of certainty must be reduced as to which landing we get and therefore some hedging of bets is prudent.

Our US economics team’s reaction to the data is here but in brief we saw the headline CPI result come in at 0.3% month-on-month (vs 0.2% expected), with the year-on-year value at 3.1% (vs 2.9% expected). Core CPI, which excludes food and energy prices, rose 0.4% month-on-month (vs 0.3% expected), its highest value since last May. This brought the core CPI up to 3.9% year-on-year (vs 3.7% expected), reducing the already slim chances that the Fed will be lowering rates in the near-term.

Shelter caught everyone by surprise and increased 0.6% in January, the largest factor in the monthly increase in the core index. If that was the only anomaly, the report might have been seen as a one-off. But we also saw ‘supercore inflation’, which covers core services ex housing, rise to 4.3% YoY, its highest level since last May and with the largest monthly increase (+0.85%) since April 2022. So a major blow to the disinflation narrative in US services. The measure had been stalling at just under 4% in the last few months. Together with the strong nonfarm payrolls for January, this CPI report will give the Fed less confidence of sustainably reaching 2% inflation. Attention will next shift to the PPI print on Friday and whether its signal for PCE inflation, which the Fed targets, is any more sanguine. Note that some of the strong services CPI drivers (healthcare, airfares) do not enter PCE, instead being taken from the PPI. So there is still some hope for the inflation doves later this week.

A March cut was largely taken out of play after the number, as the probability of a 25bps cut fell from 18% to 11%. A full 25bps cut is now only just priced in by the June meeting. Overall, the market took out -24.6bps of expected cuts in 2024, with 87bps priced in by the December meeting as of yesterday’s close. That is down from a peak of 168bps on January 12, and nearing the 75bps of cuts pencilled by the median FOMC member in the last SEP in December. The broad dollar index (+0.76%) benefitted from the rates repricing, rising to its highest level in three months.

10yr Treasury yields shot up by nearly 16bps from its intraday low just before the data and slightly extended this rise later on to close +13.5bps higher at 4.315%, its highest level since late November. 2yr yields climbed +18.3bps to 4.66%, their largest rise since last March. Europe was not spared, as investors took out -11.3bps of expected ECB cuts to the December meeting, sending 10yr bund yields +3.3bps higher on the day and more than 6bps above their levels before the US CPI print. 10yr Gilts (+9.3bps) underperformed after earlier seeing stronger-than-expected wage and unemployment numbers. Next stop is this morning’s UK inflation just as this appears in your inboxes.

Adding to overall inflationary worries, WTI crude prices rose +1.24% to $77.87/bbl, and Brent +0.94% to $82.77/bbl. This increase came even as a monthly report by OPEC showed that there has been uneven delivery of its new quarterly production cuts in the first month of its new agreement.

Equity markets inevitably suffered against the day’s inflationary backdrop. The S&P 500 fell -1.37% on the day, slipping back under the 5,000 level. Things had looked even bleaker, with the S&P rallying in the final half an hour, having been around -2% down on the day. The selloff was broad, hitting smaller US corporates hard. The Russell 2000 dropped -3.96%, its largest daily decline since June 2022, and moved back into the red in year-to-date terms (-3.10%). This volatility sent the VIX up +1.9 points on the day, its largest rise since October. Technology also struggled, with the NASDAQ down -1.80% and the Mag 7 down -1.54%, although with Nvidia (-0.17%) once again surpassing Amazon (-2.15%) in terms of market capitalisation. The STOXX 600 also retreated, falling -0.95%.

One tech sector that’s performed strongly this year is the semiconductor one which is up +7.01% in the US YTD even if it was -2.01% yesterday. Marion Laboure and Cassidy Ainsworth-Grace, alongside the DB company analysts, have just published a 2024 outlook for the sector where they analyse the top three trends of this year, AI demand, economic cycles, geopolitics, and our equity outlook. See more here.

In Asia, the sell-off is fairly measured and hasn’t accelerated overnight. The KOSPI (-1.04%) is leading losses followed by the S&P/ASX 200 (-0.96%) and the Nikkei (-0.90%). Meanwhile, the Hang Seng (+0.15%) is reversing opening losses of around -1.8% after returning to trade from the Lunar New Year holiday. Outside of Asia, US stock futures are flat but with 2yr yields -3.8bps after yesterday’s bond rout with 10yr yields -1.4bps.

In FX, the Japanese yen (+0.25%) is trading slightly higher again against the dollar after spiking weaker through 150 after the US CPI print yesterday. Masato Kanda, Japan’s top currency official, indicated that the authorities would take appropriate action if needed to stem the weakness in the currency while describing the recent currency movement as rapid and speculative. At the same time, the yield on 10-year JGBs (+3.1 bps) briefly touched 0.765%, the highest since mid-December, possibly highlighting that US CPI increased the chances of an early move by the BOJ to raise interest rates. Elsewhere we await the results of the Indonesian election.

Additional data releases from yesterday included US NFI small business optimism, which fell to 89.9 (vs 92.3 expected) from 91.9 in December. In Europe, the Germany ZEW investor expectations for February rose to 19.9 (vs 17.3 expected) but current assessment fell to a bleak -81.7 yesterday (vs -79.0 expected), its weakest since the early months of Covid. Our German economists see continued weakness for the near to medium term and published a report yesterday detailing the disappointing Q1 sentiment data and downside risk to their already below consensus GDP forecast. If the US data hadn’t improved of late, they may have cut their pessimistic -0.2% 2024 GDP forecast further. See their report here.

Finally, to the day ahead, in terms of data releases, we have UK January CPI, RPI, PPI and December house price, Eurozone Q4 GDP, employment, December industrial production, and Canada January existing home sales. We will also be hearing from the Fed’s Goolsbee and Barr, and the ECB’s Vujcic, Nagel, and Guindos, and earnings from Cisco, Sony, Occidental Petroleum, Kraft Heinz, Barrick Gold, Albemarle, and Twilio.

Tyler Durden

Wed, 02/14/2024 – 08:15

via ZeroHedge News https://ift.tt/hdaNkpD Tyler Durden