What AI CapEx Boom? World’s Biggest Network Provider Slashes Jobs As Tech-Spend Sinks

If NVDA et al. are all going to the moon on CapEx (yes we know its GPU/CPU spend) then why is the world’s largest manufacturer of computer networking equipment slashing jobs after a slowdown in corporate tech spending wiped out its sales growth.

Presumably all those GPUs/CPUs need to be ‘networked’ to each other and the world?

We asked ChatGPT, just to be sure…

The expansion of AI (Artificial Intelligence) and the increasing demand for GPUs (Graphics Processing Units) have significant implications for networking companies like Cisco, primarily through indirect relationships that stem from the broader ecosystem of data centers, cloud computing, and internet infrastructure.

Here’s how these connections unfold:

Increased Data Center Needs: AI and GPU-intensive tasks require substantial computational power, which is often provided by data centers. As companies and institutions deploy more AI models, the demand for data center capacity increases. Networking equipment, such as switches, routers, and security appliances provided by companies like Cisco, is critical for the operation, reliability, and efficiency of these data centers.

Enhanced Network Requirements: AI applications, especially those relying on real-time data analysis and decision-making (like autonomous vehicles or IoT devices), necessitate robust, low-latency networks to function effectively. The growth in AI applications can drive demand for advanced networking technologies, including those supporting higher speeds and lower latency. Cisco, being a leading provider of networking equipment, stands to benefit from this trend as organizations upgrade their networks to support AI applications.

Cloud Computing Expansion: Many AI models are trained and deployed in the cloud due to the vast computational resources required. This has led to an expansion of cloud infrastructure, where Cisco’s networking solutions play a crucial role in connecting and securing cloud environments. As cloud providers expand their infrastructure to accommodate AI workloads, they need to invest in networking gear, benefiting manufacturers like Cisco.

Edge Computing Growth: AI applications often require processing at the edge of the network to reduce latency. This necessitates a distributed network architecture, where data is processed closer to where it is generated rather than being sent back to a central data center or the cloud. Cisco and similar companies offer solutions for edge computing, including networking equipment that can handle the demands of AI-driven applications at the edge.

Security Concerns: With the expansion of AI and increased connectivity, security becomes even more critical. AI systems themselves can be targets for cyberattacks, and they also increase the complexity of IT environments. Networking companies like Cisco, which also provide cybersecurity solutions, are crucial in securing the data and the pathways it travels across.

In summary, while Cisco and similar networking companies are not directly involved in the production of AI models or GPUs, the expansion of AI and the demand for GPUs are tied to increased requirements for networking infrastructure. This, in turn, can drive business for companies like Cisco that provide the necessary networking hardware, software, and services to support these growing technologies.

So, back to CSCO results…

Having already lowered the bar at the last earnings, the giant tech company has said that it’s been hit by a temporary “pause” in orders from customers who are busy installing equipment they’ve already acquired.

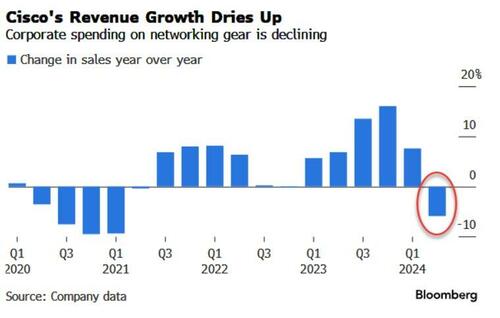

In Cisco’s fiscal second quarter, which ended Jan. 27, revenue fell 6% to $12.8 billion. That was the company’s first contraction in three years. Profit was 87 cents a share, minus some items. Analysts had estimated revenue of $12.7 billion and earnings of 92 cents a share.

Analysts expect demand for Cisco’s products to remain under pressure, as clients in the telecom industry restrict spending as do cloud companies that are prioritizing clearing their excess inventory of networking gear.

This led the tech giant to cut its fiscal third quarter sales to $12.1-$12.3 billion (down from the $13.1 billion consensus), and slash profit expectations to 86c/share from 92c/share. For the full year, revenue expectations were cut to $51.5 – $52.5 billion (from $53.8 – $55 billion consensus).

But the CEO was very confident…

“We delivered a solid second quarter with strong operating leverage and capital returns,” said Chuck Robbins, chair and CEO of Cisco.

“We continue to align our investments to future growth opportunities. Our innovation sits at the center of an increasingly connected ecosystem and will play a critical role as our customers adopt AI and secure their organizations.”

Investors have been waiting to see how much Cisco will benefit from surging spending on artificial intelligence computer systems.

Earlier this month, it announced it’s working with chipmaker Nvidia Corp. to help corporate clients more easily deploy AI.

But, if that’s such a great opportunity, why is the company cutting 5% of its global workforce?

Apparently, the restructuring is to focus on high-growth areas, three sources familiar with the matter told Reuters earlier this month.

However, judging by the market’s reaction, the forecast adds to concern that businesses are reining in tech spending.

CSCO’s shares are down 6% after hours – back at their lowest since November’s earnings plunge…

Maybe we are just too old and dumb to realize that chatbots don’t need to be networked?

Tyler Durden

Wed, 02/14/2024 – 17:45

via ZeroHedge News https://ift.tt/WEoMeXH Tyler Durden