A Market Only A Mother Or AI Could Love

By Peter Tchir of Academy Securities

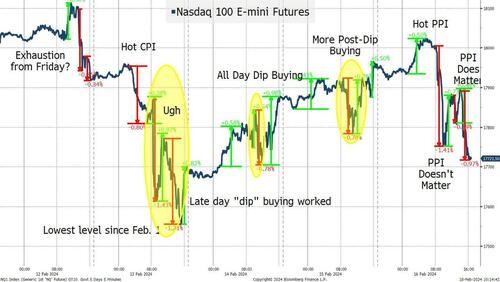

Generally, I like to focus on what will happen, rather than what happened, because people reading this already know what happened. But I found last week so confusing/disturbing/annoying on so many levels, that I think it is worth revisiting what happened. We saw narratives come and go, turn on a dime, and shift almost “willy nilly.” Certainly, price action seemed to influence the narratives as much as the other way around. All of this came on the back of reaching “all-time highs,” which we wrote about last weekend in A Retrospective of All-Time Highs.

On the week, the S&P 500 was down 0.4% – its first losing week in quite some time, and not without more than its fair share of seemingly obligatory “all-time high” headlines. While the drop is only mildly interesting, how it played out and how volatile it was is what really caught my attention. We will focus on the Nasdaq 100, because that was even more “fun” to watch (if your idea of “fun” is absolute torture).

Let’s say we think a 20% return is a good annual number. Then 0.4% would be an “average” weekly return. We had moves of 0.4% or greater multiple times, on multiple days.

To me, that is the sort of market “only a mother could love” because it is painful to be right or wrong by significant amounts (plenty of moves greater than 1%) so quickly. I suppose AI could love this market if some AI trading program managed to catch these moves correctly! If you could have timed this market, there was “easily” 10% to 20% to be made in a single week of day-trading. I suspect no human came close to achieving that (in fact I suspect most humans were busy trying not to get themselves all twisted into a knot), but could some AI have captured this? I doubt it, but certainly something is playing in the back of my mind. Is something out there very good at maybe not just capturing these sorts of movements, but also triggering them? That is the AI that I’m talking about in today’s headline.

AI remains an important driver of the market in its own right. NVDA, almost a proxy for AI growth, has earnings out on the 21st and was up on the week. Apple saw a brief surge in its stock late on Thursday, as headlines hit the tape about how “Apple Readies AI Tool to Rival Microsoft’s GitHub Copilot.” AI adoption will continue to play a big role in the market, and I suspect that it will help investors of all stripes “buy” the dip.

The Inflation Story

CPI came in higher than expected. There are “seasonality” concerns, and ongoing concerns that housing inflation is once again being overstated as OER doesn’t seem to tie into other “real-time” data on rents. I’ve given up ranting about “owner’s equivalent rent” and how it is calculated (purposefully with a long lag) so I will just ignore the topic of conversation this time. Maybe everyone will agree that it overstates it, but after months of pulling together charts on actual rents versus OER during the “inflation panic,” I don’t have the energy to go through that drill again. It is probably overstated, but the Fed seems to think it is important.

PPI, which I normally don’t pay much attention to, has “supposedly” become more important than CPI. I don’t see it that way, but some do, and it also came in hot.

Bonds reacted “rationally” to both numbers – sold off and reduced the timing and number of rate cuts.

Stocks on Tuesday fell more than I would have thought, then bounced more than seems to make sense.

On Friday, after an initial sell-off post PPI (from a strong overnight performance), the markets seemed to shake off the PPI strength. I guess if Tuesday’s CPI surprise didn’t matter, then why should this? I would argue that two wrongs don’t make a right.

The inflation news that caught my eye was in the University of Michigan report. Expectations crept higher for the first time in a few months. The series is volatile, and I think mostly random noise (hence referring to it as CONsumer CONfidence over and over), but the Fed does watch for shifts in expectations, and this data will not give them confidence about how they are managing expectations.

I continue to think the COVID Bumps (detailed in An Eclectic Mix) are playing out and will place downward pressure on inflation (the services demand has peaked and data seems to support a slowdown in much of the sector, away from restaurants). Against that is the ESG, geopolitical, and on/near/friend shoring, all of which create a “safer” and more stable environment, but are inflationary as they are being built out.

Net, net, expect inflation to be stubborn here and possibly rise a touch – confirming that this recent data is not an anomaly, making the Fed’s job more difficult.

The Consumer

One outlier has been the strength of the U.S. consumer. That strength got called into question on Thursday as retail sales came in extremely weak. Not only were the numbers weaker across the board, but the headline number for last month was also revised down.

We’ve had our doubts about the consumer (credit card usage, the fact that so many things were on sale for the holidays, demand pulled forward, etc.), and those doubts seem to have been “rewarded” by this retail sales report. Please see Consumption Glass for more details.

While jobs will be the key and I remain cautious on that, especially the mix of full and part-time jobs, and the difference between creation/loss of high paying jobs versus lower paying jobs.

Markets seemed to take this data in stride on Thursday, likely assuming that the Fed would view this slowing as evidence that they were on the right track in terms of monetary policy. While I can understand that argument (it is legitimate), shouldn’t we be worried that there is something more going on here? While it “doesn’t affect us” (supposedly), both Japan and the U.K. are officially in recessions.

Markets were seeking something to offset the high CPI print and they gravitated to this “weak” data as being “good,” but I think that interpretation will be questioned in the coming days and weeks as more data comes in (which I think will confirm the slowdown).

Who Isn’t Long?

Virtually everything I read describes a market that has gone “all-in”, especially in the sectors that have been driving returns for the past year or more.

I like the RSI (relative strength indicator) as a simple technical tool. It is registering overbought on some of the stocks driving markets and is certainly not showing up as even close to indicating oversold on them.

I’m told equity put/call ratios are showing complacency and a long risk bias. I watch MOSO on Bloomberg (most active options). I like it on volatile days as it gives some clues (I believe) as to the sentiment out there. I found two things very interesting:

- There was some longer-dated put buying on Tuesday, not just a big run-up in volumes of zero- days-to-expiration (0DTE) options. Given how severe the decline was on Tuesday, I expected to see a lot of 0DTE options as the most active. It seems to me that there was some real need to hedge real risk, which was interesting.

- I mostly saw call buying. The volumes that I looked at were skewed to call buying, with several single stocks (as opposed to ETFs) garnering some call buying interest. Are investors being cautious and buying calls or are they so fully invested, that they have to resort to calls rather than outright positions?

I think these both tend to mean that there could be more downside, especially since we didn’t see a 0DTE “gamma” driven move to the downside, and I think, unfortunately, that the market is ripe for such a day.

The CNN Fear and Greed Index has moved into “extreme greed” which is a nice little contrarian signal. The AAII Sentiment Survey receded a little but is still showing a strong bullish bias, which again, is often a contrarian signal.

While there are plenty of reasons why the rally that took us to “all-time highs” can continue, I’m leaning heavily towards the view that too much was bet too quickly on the Fed “pivot” and positioning is too aggressively long risk – making a sharp/rapid decline, that eats away at “dip buyers” with help from 0DTE options, my current base case.

Bottom Line

Let’s start with rates and the Fed.

- 10-year yield to 4.4% to 4.6%. Watch the “structural deficit” and “interest payments as a percentage of all spending” rise to the forefront of things pushing yields higher.

- 2s versus 10s less inverted, but not heading to positive any time soon (-10 bps to 0).

- On the Fed, I’m still at 25/50/25 for cuts in the May, June, and July meetings, but if anything, I fear that I am now in the “too many cuts” camp that I have been fighting for much of this year! Have I really “joined” the enemy? When I started at 4 cuts in total at 3 meetings, the market was pricing in way more than me, and now I’m pricing in the same as the market, but much sooner. I think I need to dial back on this call, but don’t have a scenario I like any better, at least not yet.

Credit. I don’t like credit here. I started that view early last week and am increasingly confident that we will see spreads widen in the coming weeks.

- Looking for tighter spreads when we were “already at the tight end of the range” seemed contrarian at the start of the year and has worked out well. I’m not sure “long credit” is as crowded as equities, but it is no longer contrarian.

- It is difficult to be bearish on stocks and expect credit to do well, so that plays into the analysis.

- Finally, I do pay close attention to how “day old” new issues perform. I look at bonds issued a couple of weeks ago that no longer have as much trading related to the initial allocation and underwriter positioning to gauge how liquid the market is. I watch not just how the bonds are quoted, but also how executable those quotes are, and I believe that we’ve transitioned into a “warning” phase.

- Overall, I still expect credit to do well and encourage investors to be overweight credit versus Treasuries, but I think there will be better entry points.

Equities. Maybe after mentioning “Cheech and Chong” last week, I just want to be able to write a report titled “Up in Smoke”, so I have to be aware of my own biases. Having said that, the market has skewed heavily towards being bullish. Within that, it is extremely bullish on a subset of names. Between positioning and price action, I think that the risk of the next 5% move being to the downside is much higher than the probability that we will go another 5% higher from here. Yes, fighting momentum can be dangerous (and momentum is still higher), but I am not the mother of this stock market, I do not love how it behaved last week, and think that it is a precursor to more downside.

I still like China and commodity related plays (for different reasons), but cannot yet get my hands around re-embracing the “laggards” (anything from equal weight indices, to the Russell 2000, to regional banks and commercial real estate). I want to, but just cannot get there.

We will all see how this version of “all-time highs” plays out, but for now I’m nervous on stocks and bonds! For different reasons, but that could be a troublesome issue for this market to face if stocks and bonds really start moving down together.

On that “cheery” note, enjoy the holiday!

P.S. If any of you happen to have an AI algo that caught most of those moves, can you please share or make it open source and save us all some misery? Thanks!

Tyler Durden

Mon, 02/19/2024 – 17:30

via ZeroHedge News https://ift.tt/jtCq05c Tyler Durden