A Blue State Exodus: Who Can Afford To Be A Liberal

By Mish Shedlock of MishTalk

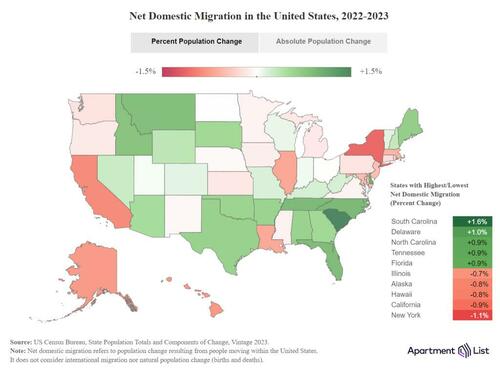

Is the blue state exodus from California, New York, and Illinois making red states like Florida, Texas, and South Carolina more liberal? Studies suggest the answer is no.

Still Ruby Red

South Carolina is one of the beneficiaries of a blue state exodus. But contrary to popular theory, South Carolina Is Still Ruby Red.

Fed up with pandemic restrictions, Sandy Zal uprooted her family from Schenectady, N.Y., three years ago and moved here because of its Republican tilt. She and her husband named their new company Freedom Window Tinting, a nod to South Carolina’s ethos.

The Zals are part of a migration wave that has kept South Carolina ruby red despite an influx of newcomers from blue states. A Wall Street Journal analysis of census data found that a third of the state’s new residents between 2017 and 2021 hailed from blue states and a quarter from red ones, according to census data. The remainder came from closely divided states, including nearby Georgia and North Carolina, or are immigrants.

The Palmetto State is a prime example of why a yearslong wave of migration to the South has largely failed to change its partisan tint. In Florida, for instance, 48% of people who moved there between 2017 and 2021 came from blue states while 29% came from red states, Census figures show. Among those who registered to vote, 44% are Republicans, 25% are Democrats and 28% are nonpartisan, according to L2 data. Texas also has a heavier flow of newcomers from blue states but a greater share who L2 data estimates are Republican.

“When you’re younger you can afford to be a liberal—now you can’t,” he said. John Lush, who is no fan of Trump and will vote for Haley on Saturday, has enjoyed living under South Carolina’s conservative government. “The state politics are very nice. It’s agreeable,” he said.

Who Can Afford to Be a Liberal?

I disagree with the comment by Lush, “When you’re younger you can afford to be a liberal.”

Instead, I propose the first group of people who can most afford to be liberals are the political class that takes advantage of young idealistic fools. The process is accurately called “vote buying”.

The second group that can afford to be liberals are the arrogant elites such as Bill Gates and George Soros.

Understanding Blue State Exodus

Blue state exodus is largely Red or Independent because Republicans and Independents make up the majority of people with enough money to afford a house and choose to do so in a non-blue state for tax purposes.

As a result of blue state exodus, the blue states will get bluer and bluer until the whole thing blows up in the faces of blue state politicians.

What Metro Areas Are Attracting the Most New Renters?

The great escape from Blue states to Red states continued in 2023. California, New York, Illinois, New Jersey, and Massachusetts are the five top states people are fleeing on an absolute basis according to a National Apartment List report on migration.

Top Inbound Metro Areas

Can the young afford to be liberal? The answer is a resounding no in relation to other age groups. Stress is easy to spot by demographics.

Credit Card and Auto Delinquencies Soar

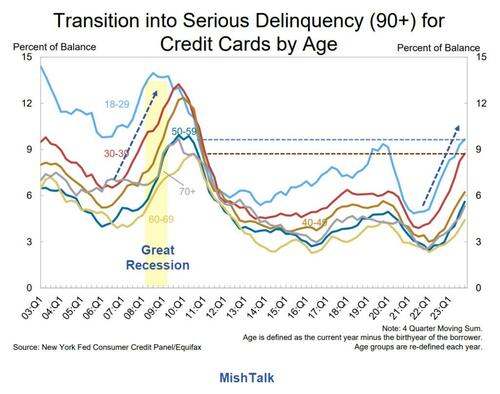

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due. For nearly all age groups, serious delinquencies are the highest since 2011 at best.

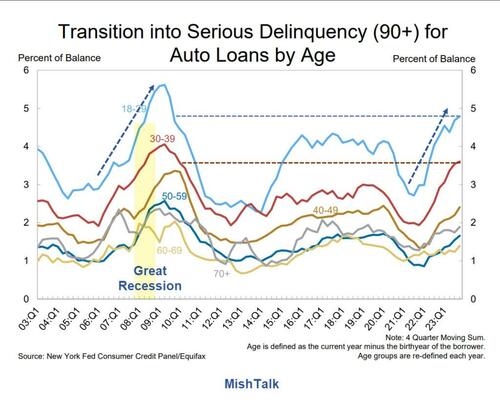

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29. Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

Generational Homeownership Rates

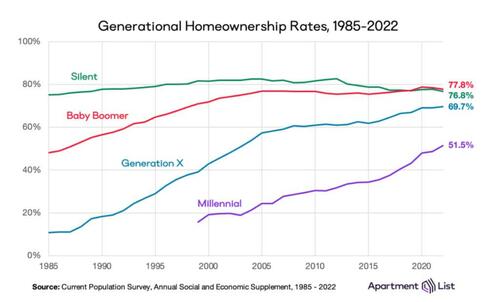

The above chart is from the Apartment List’s 2023 Millennial Homeownership Report

Those struggling with rent are more likely to Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.

The same age groups struggling with credit card and auto delinquencies.

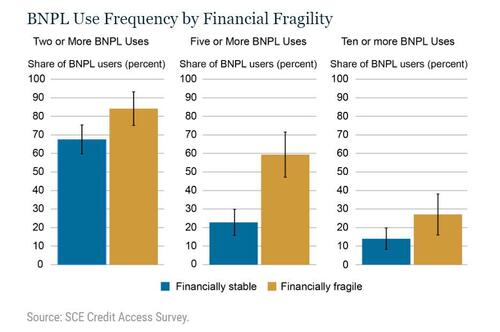

Many Are Addicted to “Buy Now, Pay Later” Plans

Buy Now Pay Later, BNPL, plans are increasingly popular. It’s another sign of consumer credit stress.

The study did not break things down by home owners vs renters, but I strongly suspect most of the BNPL use is by renters.

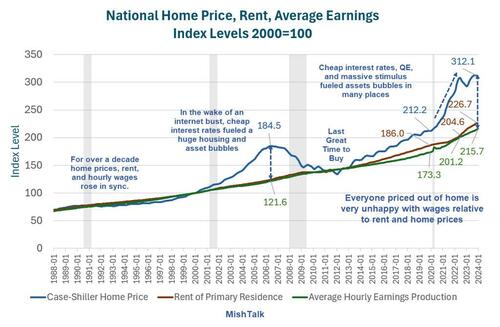

There Are Two Economies But Only One Interest Rate

On average, the economy looks OK. But averages are misleading.

Homeowners are in a position to sell a home and buy one elsewhere, often for cash. They are predominately older. The have-nots cannot afford a home and are trapped where they are.

Tyler Durden

Sun, 02/25/2024 – 10:30

via ZeroHedge News https://ift.tt/lMv3CY5 Tyler Durden