Crypto Rips, Mag7 Dips, As Super-Short-Squeeze Sends Small-Caps Soaring

Horrible housing data and anecdotally awful manufacturing signals from Texas were the only macro of note as the world awaits an avalanche of FedSpeak and the latest core PCE print later in the week.

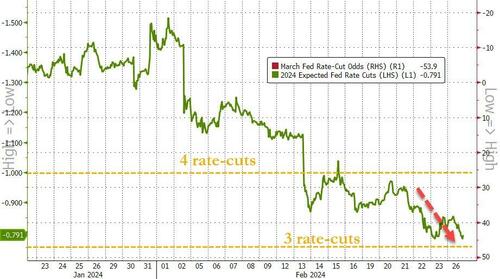

Rate-cut expectations continue to slide (June is now a 50-50 for the start and 2024 now pricing in only 3 cuts)…

Source: Bloomberg

Two ugly bond auctions (2Y and 5Y) helped spur Treasury yields higher (as we note that February’s damage has come amid huge supply and a record $153 BN corporate bond sales). Yields were up around 3bps across the curve, erasing much of Friday’s decline in yields (especially at the short-end)…

Source: Bloomberg

Bitcoin soared up above $54,500 today, the highest since early Dec 2021…

Source: Bloomberg

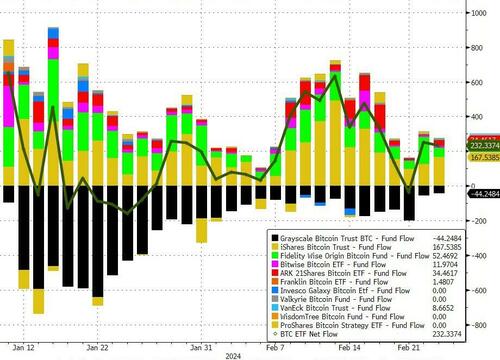

As net inflows into BTC ETFs re-accelerated (and GBTC outflows slowed to a trickle)….

Source: Bloomberg

Ethereum also soared, getting within a tick or two of $3200, its highest since April 2022…

Source: Bloomberg

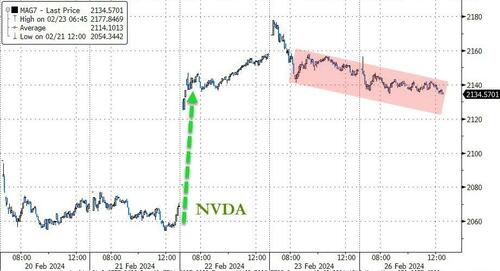

Mag7 stocks continued to limp lower after NVDA’s exuberance last week…

Source: Bloomberg

But ‘most shorted’ stocks were aggressively squeezed up to pre-President’s Day highs today…

Source: Bloomberg

Which helped pull Small Caps up today and lead the pack as S&P, Dow, and Nasdaq all faded into the red in the last hour…

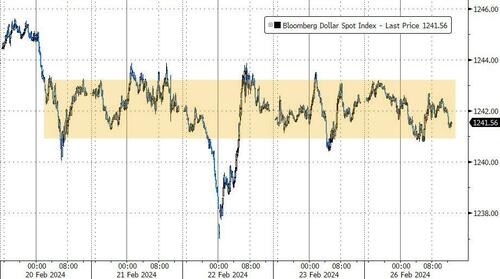

The dollar was very quiet today once again ending practically unchanged for the second day in a row…

Source: Bloomberg

Gold closed marginally lower on the day, but bounced intraday to hold its 50DMA…

Source: Bloomberg

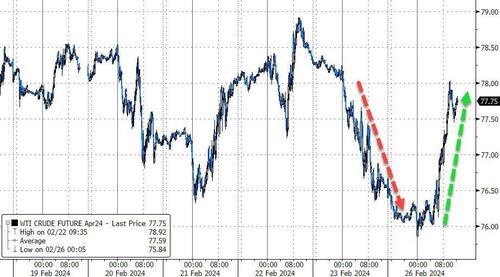

But oil surged, with WTI testing $78 intraday, erasing Friday’s losses…

Source: Bloomberg

Finally, NVDA was only able to add a de minimum 0.6% today, losing momentum three times intraday and completing an inside day (lower high and higher low)…

Does make you wonder, eh?

Source: Bloomberg

Still, at least we have Bitcoin…

Tyler Durden

Mon, 02/26/2024 – 16:00

via ZeroHedge News https://ift.tt/YE2tfrU Tyler Durden