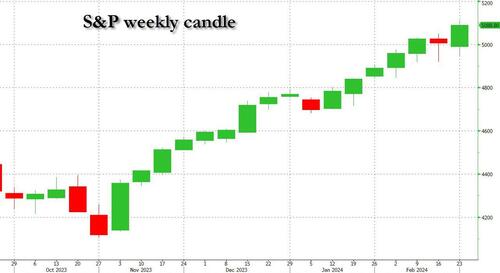

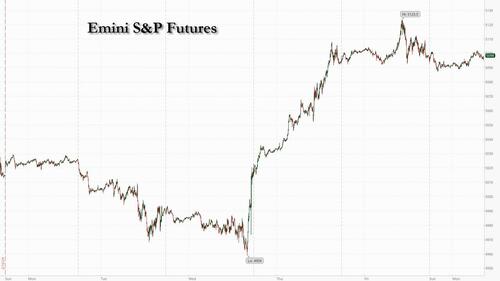

Futures Flat After Record-Breaking Week

After storming higher last week, culminating with their 15th ascent in the past 17 weeks…

… US equity futures indicated a pause for stocks which trade at their all-time highs as investors geared up for a busy week of data, including the Fed’s preferred measure of inflation, the core PCE. As of 8:00am, futures on the S&P 500 and the Nasdaq 100 were fractionally in the red after Wall Street’s record-breaking rally stalled at the end of last week, weighed down by profit taking in megacap tech stocks. Treasuries climb, pushing 10-year yields down by 1bps to 4.24% while the dollar ticked lower.

In premarket trading, Berkshire Hathaway rose as much as 5.5% on track for a record high following its weekend earnings update, setting Warren Buffett’s conglomerate on course for a market value even closer to $1 trillion. Here are some other notable premarket movers:

- Amer Sports shares jump 7.0% after a majority of brokers initiated coverage with buy-equivalent recommendations. Analysts highlighted the strength of its high-end outdoor apparel and equipment brand Arc’teryx.

- HashiCorp shares jump 6.0% as Morgan Stanley raised the recommendation on the software company’s stock to overweight, noting that a resurgence in cloud is starting to benefit the company.

- Intuitive Machines shares fall 33% after officials said on Friday the American-made lander that touched down on the moon likely landed on its side.

- Li Auto ADRs jump 12% after the Chinese EV maker reported better-than-expected profitability and free cash flow for the fourth quarter.

- Fidelity National forecast adjusted earnings per share for the first quarter; the guidance missed the average analyst estimate.

- IBM said it is making changes to its reportable segments to reflect the way the company manages operations and allocates resources.

- Walt Disney Co. should appoint a corporate chief technology officer and focus on technology “transformation,” according to one of the activist investors pressing the company for change.

- Cathie Wood sold shares of Taiwan Semiconductor Manufacturing Corp. for the first time in more than two years, adding to moves to cut exposure in the chipmaker’s key customer Nvidia Corp.

Investor focus this week shifts from earnings to a slate of economic data, including Thursday’s core PCE price index, which is closely watched by the Fed for inflation hints. Q4 US GDP numbers are also due Wednesday, while traders will track comments from a host of central bank officials for clues on the path for interest rates.

“There is a lot of economic data coming in this week, which will be more decisive for whether investors will stay in a risk-on mood,” said Tatjana Puhan, chief investment officer at Copernicus Wealth Management. “We should factor in the possibility that if the US economy remains strong for a few more months and US corporate earnings as well, we should see at least in the US market a further potential for positive momentum.”

On the outlook for equities, strategists at Goldman Sachs said stock markets have room to extend gains beyond their record highs if the economic outlook remains upbeat and investors pour money into recent laggards. The S&P 500’s run to an all-time peak has left investor positioning “extremely” concentrated in the so-called Magnificent Seven, the team led by Cecilia Mariotti wrote in a note. While that does create the risk of a pullback, there’s also “space for bullish sentiment and positioning to be further supported, especially if we start seeing a more meaningful rotation out of cash and into risky assets and laggards within equities,” Goldman wrote.

Meanwhile, as we first reported, the latest Goldman prime figures showed that after piling into tech stocks in the weeks before Nvidia’s earnings, hedge funds are now cashing out and selling at the fastest pace in seven months. Professional managers offloaded their positions for four straight sessions last week, including Thursday, the day after Nvidia posted results. The intensity of the selling ranks in the 98th percentile of the past five years. The data suggests traders are booking profits on their tech wagers after a six-week buying streak and putting that extra cash into less volatile stocks, such as consumer staples. Companies that make household products saw the most net buying in 10 weeks, according to Goldman’s prime brokerage (more here).

European stocks fell after closing at a record high on Friday. The Stoxx 600 is down 0.3%, led by declines in mining shares as iron ore prices drop to the lowest since October; financial services and insurance stocks are the biggest outperformers. Rio Tinto Plc and Anglo American Plc led declines in basic resources amid concerns over Chinese demand. Shares in UK homebuilders dropped after Britain’s top antitrust enforcer opened an investigation to probe potential information sharing between companies. Here are the most notable movers:

- BASF rises as much as 2.2% on the back of results that suggest the German chemicals firm has overcome a slump and is poised for upside. Stifel analysts expect “substantial” earnings gains while Barclays analysts see volumes rebounding

- Zealand Pharma shares jump as much as 20% in Copenhagen, the most since September 2022, after the company’s partner, Boehringer Ingelheim, published trial results on drug candidate Survodutide

- IAG shares gain as much as 2.2% after Barclays raised its full-year Ebit estimate for the airline group, citing strong travel demand seen this summer. Deutsche Lufthansa falls after a downgrade to equal-weight at the broker

- Idorsia surges as much as 45% to the highest since Sept. 21, with trading volume more than double the 3-month daily average

- Wincanton shares gain as much as 11% after CMA CGM increased its final offer to 480p/share; ~6.7% higher than the original 450p/share bid

- Nestle shares fall 1.5% after Stifel cut its recommendation on the Swiss food maker to hold from buy. “The magic is gone,” analysts said, citing waning performance and little confidence it will improve in the short term

- Bank of Ireland shares were down as much as 11%, the most in almost two years, as the lender pointed to a weaker interest rate environment, saying they expect net interest income to be to be 5-6% lower than the fourth quarter

- Bunzl shares fall as much as 5.1%, their sharpest drop in over four months, after the distributor downgraded its revenue outlook for 2024 following a slow start to trading in North America while warning that margins will tighten, according to analysts at Citi

- PostNL shares dropped as much as 8.3%, the most since November, after the Dutch mail carrier’s forecast of normalized Ebit for 2024 missed the average analyst estimate

- International Personal Finance Group’s shares drop as much as 14% after the consumer finance company delayed its full-year results pending a review of a letter from the Polish regulator

Earlier in the session, Asian equities traded in a narrow range, as the ongoing rally in Japanese shares helped offset declines in South Korea and China. The MSCI Asia Pacific Index gained as much as 0.4% before paring much of the advance, with Toyota among the biggest boosts while Tencent weighed on the gauge. Japan’s Nikkei 225 extended its climb after reaching a record-high last week, helped by gains in trading houses after Warren Buffett’s positive comments on the sector’s shareholder-friendly policies. Last week’s rally in Chinese stocks came to a halt, with the mainland benchmark CSI 300 Index on track to snap it longest winning streak since 2018 as investors booked profits. Korean stocks fell as the nation’s much-hyped “Corporate Value-up Program” aimed at improving governance standards and valuations was launched without concrete details or an enforcement plan.

- Hang Seng and Shanghai Comp. marginally declined with weakness seen in Hong Kong consumer stocks, while the mainland was also pressured amid ongoing frictions after China’s MOFCOM slammed the latest USTR report on China’s WTO compliance.

- Nikkei 225 outperformed on its return from the long weekend and extended on record levels.

- ASX 200 finished flat after failing to sustain its early gains with price action indecisive amid a slew of earnings.

- Indian stocks fell for a second session, weighed down by declines in the nation’s largest paintmaker and IT stocks. The S&P BSE SENSEX Index fell 0.5% to 72,790.13 on Monday, while the NSE Nifty 50 Index declined 0.4%. Out of 30 stocks in the index, 25 fell and 5 rose.

“We are still in the early innings, so let’s see if the government releases more details in other dimensions outside what the Korea Exchange can do,” said Homin Lee, senior macro strategist at Lombard Odier. “As in Japan’s case, it takes time to convince investors that you are changing decades-old corporate governance culture.”

In rates, treasuries are back to little changed as US session gets underway after paring gains. The 10-year yield trades 1bp lower at 4.234% vs session low 4.215%; bunds lag by around 2bp in the sector while gilts keep pace; curve spreads broadly remain within 1bp of Friday’s close. The week’s auction cycle, compressed and accelerated for Feb. 29 settlement, begins with $63b 2-year note at 11:30am followed by $64b 5-year note at 1pm, both record sizes; it ends Tuesday with $42b 7-year note. As Bloomberg notes, while US rates stand to benefit this week from month-end rebalancing into bonds following outperformance by equities, Monday’s session includes 2- and 5-year note auctions and a potentially heavy corporate new-issue calendar. Several Fed speakers are slated this week. IG credit issuance slate includes HSBC and SMFG offerings; about $60b is expected this week, and monthly haul stands at nearly $138 billion price, setting the stage for a second straight monthly gross issuance record to fall this year.

In FX, the Bloomberg Dollar Spot Index edged lower, with Sweden’s krona and the euro leading gains against the greenback. The kiwi is the biggest mover among the G-10 currencies, falling 0.4% versus the greenback ahead of the RBNZ interest rate decision on Wednesday; the NZD fell against all Group-of-10 currencies as traders weighed the nation’s monetary policy outlook. NZD/USD dropped as much as 0.6% to 0.6162 as traders pared bullish positions on the kiwi versus the Australian dollar and the greenback ahead of the central bank’s monetary policy decision on Wednesday, according to Asia-based FX traders.

In commodities, oil prices declined again with WTI falling 0.4% to trade near $76.20. Spot gold is little changed around $2,035/oz.

Bitcoin is a touch firmer on the session after eclipsing USD 51k but is yet to convincingly move much higher with specifics light and general newsflow limited. Ethereum shot above $3100 over the weekend, hitting a fresh two year high.

The US economic data calendar includes January new home sales at 10am and February Dallas Fed manufacturing activity at 10:30am; later this week are durable goods orders, consumer confidence, 4Q GDP revision, personal income/spending and ISM manufacturing. Fed speakers for Monday include Schmid at 7:40pm; Barr, Bostic, Collins, Williams, Goolsbee, Mester, Williams, Waller and Kugler are slated to appear later this week.

Market Snapshot

U.S. MARKETS:

- S&P 500 futures down 0.1% to 5,095.00

- STOXX Europe 600 down 0.3% to 495.72

- MXAP little changed at 172.87

- MXAPJ down 0.4% to 526.78

- Nikkei up 0.3% to 39,233.71

- Topix up 0.5% to 2,673.62

- Hang Seng Index down 0.5% to 16,634.74

- Shanghai Composite down 0.9% to 2,977.02

- Sensex down 0.4% to 72,852.56

- Australia S&P/ASX 200 up 0.1% to 7,652.84

- Kospi down 0.8% to 2,647.08

- German 10Y yield little changed at 2.37%

- Euro up 0.1% to $1.0837

- Brent Futures down 0.6% to $81.13/bbl

- Gold spot down 0.1% to $2,032.84

- U.S. Dollar Index little changed at 103.88

Top Overnight News

- Citadel Securities was outbid by Ant for Credit Suisse’s investment bank venture in China. The surprise move will be subject to close regulatory scrutiny as China prefers a foreign buyer, people familiar said. Other bidders may still join the fray. BBG

- Ukraine and its foreign partners could invite Russia to a future peace summit to discuss an end to Moscow’s two-year-old invasion on Kyiv’s terms, a senior Ukrainian official said on Sunday. Switzerland will host a summit to discuss a vision for peace by Ukrainian President Zelenskiy, which could be handed to Russia during a second meeting at a later date, said Andriy Yermak, Zelenskiy’s chief of staff. RTRS

- The widespread drop in global house prices that hit advanced economies has largely petered out, according to a Financial Times analysis of OECD data, leading economists to predict that the deepest property downturn in a decade has hit a turning point. FT

- Berkshire Hathaway’s cash pile hit a record $167.6 billion last quarter as Warren Buffett decried a lack of meaningful deals that would give a shot at “eye-popping performance.” Operating earnings rose. Buffett again endorsed Japan trading firms, boosting their shares. BBG

- Senate Majority Leader Chuck Schumer said congressional efforts to put together a spending package fell short over the weekend, leaving the US to “once again face the specter of a harmful and unnecessary government shutdown” starting March 2. BBG

- Trump secures a strong victory in South Carolina, beating Haley by ~20 points (~60%-40%), relatively inline w/pre-election polls, and while Haley is staying in the race for now, she hinted at exiting after Super Tuesday. Politico

- US national security adviser Jake Sullivan said on Sunday he hoped a “firm and final agreement” on a temporary Gaza ceasefire and the release of hostages could be reached “in the coming days”, after progress in negotiations at the weekend. FT

- Just two new supertankers are due to join the oil tanker fleet in 2024 — the fewest in almost four decades and about 90% below the yearly average this millennium. The shortage comes as the efficiency of the global fleet is faltering amid Red Sea disruptions. BBG

- Last week US equities saw the largest net selling in 5 weeks, driven by Macro Products as well as Single Stocks. Net flows point to rotation out of Tech, HC, and Industrials, while all other sectors were net bought. After a 6-week buying streak, HFs unloaded Tech stocks at the fastest pace in 7+ months, as the sector was net sold for 4 straight sessions incl. Thurs post NVDA results. GSPB

Earnings

- Berkshire Hathaway (BRK.B) – Operating earnings rise, driven by gains in its insurance units; Q4 operating earnings USD 8.481bln (vs 6.625bln Y/Y); FY23 operating earnings USD 37.35bln (vs 30.853bln Y/Y). Berkshire held USD 167.6bln in cash (vs 157.2bln Q/Q). Berkshire made USD 2.2bln of share buybacks in Q4 (vs USD 1.1bln in Q3); FY23 total repurchases were around USD 9.2bln. In his letter, Warren Buffett cautioned about limited future growth prospects, citing scarce transformative deals. He emphasised the challenge of finding significant investment opportunities both domestically and internationally. On future leadership transitions, Buffett said Greg Abel, who runs all non-insurance operations for Berkshire, is ready to be CEO of Berkshire tomorrow. +4.5% in pre-market trade.

- Broadcom (AVGO) – Broadcom is close to selling its end-user computing unit to private-equity firm KKR for USD 3.8bln, CNBC reports. KKR outbid other firms in the auction, and a deal may be announced soon, the report adds. +1.2% in pre-market trade.

- Li Auto Inc (LI) Q4 2023 (USD): EPS 0.75 (exp. 0.29), Revenue 5.88bln (exp. 5.48bln). +11.5% in pre-market trade.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued amid a lack of fresh catalysts ahead of month-end and this week’s key data releases including the Fed’s preferred inflation gauge, while weekend macro newsflow was light and dominated by geopolitical commentary. ASX 200 finished flat after failing to sustain its early gains with price action indecisive amid a slew of earnings. Nikkei 225 outperformed on its return from the long weekend and extended on record levels. Hang Seng and Shanghai Comp. marginally declined with weakness seen in Hong Kong consumer stocks, while the mainland was also pressured amid ongoing frictions after China’s MOFCOM slammed the latest USTR report on China’s WTO compliance.

Top Asian News

- China’s Mofcom commented regarding the US report about China’s WTO compliance in which it noted that the US falsely claims China has created ‘overcapacity’ which fully reflects the US side’s ‘unilateralism and hegemonic behaviour’. Mofcom added the US side ignores the ‘great achievements’ made by China in fulfilling its WTO commitments and denies the important contribution made by China to the multilateral trading system and world economy, according to Reuters.

- China’s Commerce Minister said China is willing to work with New Zealand to implement a free trade agreement and continue to strengthen cooperation in the process of joining the CPTPP.

- US Deputy Treasury Secretary Adeyemo said on Friday that it is clear the Chinese economy is facing challenges from the property sector and demographics, while he is not concerned about headwinds from China’s economic challenges but has concerns about China’s excess production capacity flowing to global markets.

European bourses are a touch softer, Stoxx 600 -0.3%, following a similar APAC handover as newsflow remains light on broader macro themes despite a handful of interesting equity-specific developments. Sectors have a similar negative tilt, Basic Resource & Energy names lag given benchmark pricing. Housing names within the UK are lagging after the commencement of a CMA investigation into the market. DAX 40, +0.2%, the relative outperformer and in close proximity to record levels for both cash and future at 17443 & 17487 respectively. Stateside, futures are essentially flat ES -0.1%, with some modest underperformance in the RTY -0.3%; weekend focus on Berkshire Hathaway numbers/commentary around “limited future growth prospects, citing scare transformative deals”.

Top European News

- ECB is reportedly close to agreeing on a new monetary framework that some officials hope will pave the way to an ultimate revival of the interbank market, according to people familiar cited by Bloomberg.

- EU finance ministers reportedly clash over efforts to centralise markets supervision with Eurogroup President Donohoe noting there is a ‘strong diversity of views,’ and that member states disagree over the level of ambition to build a common supervisory regime as part of the roadmap to progress toward a capital markets union that the EU wants to settle by next month, according to Bloomberg.

- Hopes of a reversal in the UK’s “tourist tax” in the upcoming budget are “diminishing” after the financial secretary to the Treasury warned of the complexities of such a move, according to The Times.

FX

- DXY is a touch softer with the 103.79 trough just above Friday’s 103.76 base before downside support via the 200 DMA at 103.69. Newsflow for the USD light, week’s focal points are PCE & ISM Manufacturing on Thursday & Friday.

- EUR benefitting from the softer USD with specifics light ahead of potential remarks from ECB’s Lagarde later in the session; while action is limited, the single currency has surpassed the 100- & 200-DMAs.

- A similar story for GBP but with EUR/GBP action hitting Cable a touch, nothing from BoE’s Breeden or Pill thus far. Cable at 1.2675 and respecting Friday’s 1.2649-1.2702 bounds.

- Antipodeans lag; no specific driver or catalyst, though potentially profit taking, positioning (RBNZ Wednesday) and the tepid risk tone weighing.

- USD/JPY modestly higher but remains shy of Friday’s 150.77 best and by extension the YTD peak at 150.88; domestic CPI due afterhours.

- PBoC set USD/CNY mid-point at 7.1080 vs exp. 7.1998 (prev. 7.1064).

Fixed Income

- Contained start with specifics light into ECB’s Lagarde. Bunds near the unchanged mark despite printing above Friday’s best at the start of the session. Since, EGBs have been fading and are modestly in the red at 133.06 at worst but well above Friday’s 132.05 base.

- Gilts modestly outperforming, but action directionally and in terms of magnitudes in-fitting with Bunds but just a few hours behind given the lack of APAC trade for Gilts. Similarly surmounted Friday’s 98.17 best before fading though, again in-fitting with Bunds, are well above that session’s 97.10 base.

- USTs firmer but off best. Specifics light and the docket thin to start a key week aside from 2yr & 5yr supply. Yield curve currently under modest pressure and slightly flatter.

Commodities

- Subdued session for crude despite a slew of weekend geopols., though no major escalation thus far. WTI & Brent under modest pressure but have dipped below USD 76/bbl and tested USD 80.00/bbl respectively.

- LNG somewhat uneventful though the complex is digesting an extensive weekend announcement from QatarEnergy (details below). Elsewhere, exports via the Wafa oil field in Libya have closed due to protests, via BBG citing sources.

- Precious metals benefit from the tepid tone, softer USD and slightly weaker yields stateside in a quiet start to a key week of US data. By contrast, base metals are lower across the board given the general risk tone and thus far failing to benefit from the factors supporting precious peers.

- US Treasury official said on Friday the US is encouraged by ‘significant progress’ in the second phase of the Russian oil price cap.

- QatarEnergy CEO said Europe will continue to need gas as part of an energy mix for a very long time and Europe’s gas needs have not peaked, while QatarEnergy also stated that it may need to make additional orders of tankers to ship expanded LNG volumes.

- Exports from the Wafa oil field in western Libya and a subsea natural gas link to Italy were closed following protests, according to Bloomberg citing a person familiar with the matter.

Geopolitics: Middle East

- Israeli PM Netanyahu said that they are all working on a hostage deal but he cannot say if they will have it, while he added that they will be weeks away from total victory once they begin the Rafah operation, according to a CBS interview.

- Israel’s army presented at the war council meeting a plan to evacuate residents from fighting zones in Gaza, according to Al Jazeera. It was also reported that Israeli PM Netanyahu’s spokesman said the war council approved a plan to supply the Gaza Strip with humanitarian aid, according to Al Arabiya.

- Israel’s Defense Minister said there will be no let up in Israeli action against Lebanon’s Hezbollah movement, even if a ceasefire and hostage deal is secured in Gaza, according to AFP.

- White House National Security Adviser Sullivan said Israel, Egypt, Qatar and the US came to a basic understanding of the basic contours of a hostage deal for a temporary ceasefire and the US is hopeful that an agreement could be reached in the coming days, although he noted that a deal is still under negotiation and there will have to be indirect discussions by Qatar and Egypt with Hamas. It was also reported that Egyptian security sources said Qatar will host mediated Hamas-Israel truce talks this week.

- Hezbollah said they targeted a gathering of Israeli enemy soldiers in the vicinity of the Marj site with a volcano missile and achieved a direct hit, according to Al Jazeera.

- US Central Command said Yemen’s Houthis launched one anti-ship ballistic missile likely targeting MV Torm Thor in the Gulf of Aden on Saturday although the missile impacted water causing no damage nor injuries, while US forces shot down two one-way attack unmanned aerial vehicles over the southern Red Sea.

- US and UK forces conducted 9 air strikes in Sanaa, according to Al Masirah TV cited by Reuters.

- UKMTO received a report of a small fast boat behaving in an irregular manner 20NM east of UAE’s Khor Fakkan.

- Syrian Defence Ministry said its forces downed seven drones that tried to target military positions and villages in the vicinity of Hama and Idlib, according to state media.

- Palestinian Authority PM has submitted his resignation to the Palestinian President; “The next phase needs the administration of the PA for all Palestinian territories”.

- Israeli strike targets Lebanon’s Easter Baalbek for the first time since the Gaza war, according to Reuters sources.

Geopolitics: Other

- Ukrainian President Zelensky said he hopes a peace summit in Switzerland will take place in spring and a peace plan prepared with partners in Switzerland will be presented to Russia. Zelensky said that the current moment is the most difficult for Ukrainian unity and that improving troop rotations is critical to the war effort, while he also noted there is a clear plan for a new Ukrainian offensive but didn’t give details and said Russian forces will attempt another offensive in late May or summer.

- Ukrainian President Zelensky said a US aid package is needed within a month and is essential to support troops on the battlefield, according to FT. It was separately reported that Zelensky and Canadian PM Trudeau signed a bilateral security agreement during a ceremony in Kyiv and Zelensky stated via Telegram that Canada is to provide more than CAD 3bln in financial and defence aid this year. Zelensky also signed a security agreement with Italian PM Meloni, while Meloni stated that Italy committed to military support for Ukraine and said peace cannot mean surrender, according to Reuters.

- G7 Leaders’ statement stated they remain convinced that they can ensure Ukraine prevails in fighting for its future and will help Ukraine meet its urgent financing needs, while it added that Ukraine can count on their support for as long as it takes.

- UK PM Sunak called for Western countries to be more aggressive in seizing frozen Russian assets and passing the proceeds on to Ukraine to finance its defence, according to Bloomberg.

- Ukraine attacked Russia’s Novolipetsk Steel plant with drones which caused a major fire at the facility, according to Reuters.

- Russian Defence Ministry said Russian forces took a more advantageous position near Avdiivka and rebuffed seven Ukrainian counterattacks, according to Reuters.

- Russia’s Deputy Foreign Minister said contact with the US over nuclear weapons in space has proven to be unproductive, while he added that the US has not presented any proof of allegations that Russia wants to put nuclear weapons in space.

- US military aircraft intercepted a balloon over Utah on Friday which was said to be small and not manoeuvrable, while the balloon was allowed to continue flying as the US concluded the balloon was not a threat to civil aviation or national security.

- G7 Finance Ministers and Central Bankers are reportedly expected to gold a meeting on 28th Feb to discuss strengthening sanctions against Russia, according to Kyodo.

US Event Calendar

- 10:00: Jan. New Home Sales MoM, est. 3.0%, prior 8.0%

- 10:00: Jan. New Home Sales, est. 684,000, prior 664,000

- 10:30: Feb. Dallas Fed Manf. Activity, est. -14.0, prior -27.4

Central Bank Speakers

- 19:40: Fed’s Schmid Gives Speech on Economy, Monetary Policy Outlook

DB’s Jim Reid concludes the overnight wrap

Tyler Durden

Mon, 02/26/2024 – 08:20

via ZeroHedge News https://ift.tt/cvW31so Tyler Durden