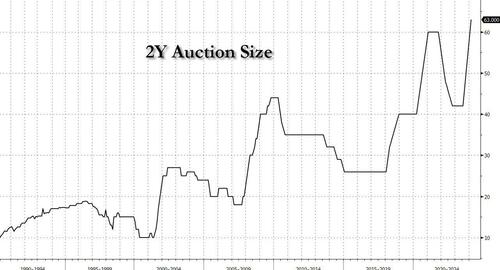

Ugly 2Y Auction Tails As Size Jumps To Record $63 Billion

In the first of today’s two coupon auctions, moments ago the Treasury sold 2 year paper in size… a record $63 billion of size to be precise. This was the biggest 2Y auction in history, and – we aren’t shocking anyone here – it’s only uphill for 2Y treasury auction sizes from here.

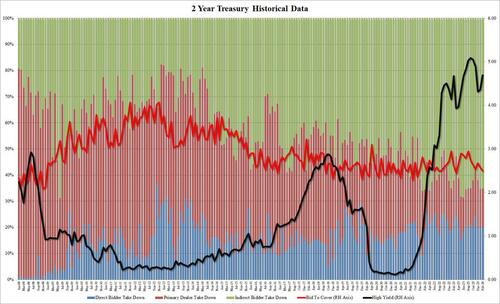

The high yield of 4.691% was 32.6bps above last month’s and also tailed the When Issued 4.689% by 0.2bps, the first tail since November.

There was more mediocrity: the bid to cover dropped to 2.492, down from 2.571 last month and the lowest since March 2023.

The internals were less ugly: Indirects took down 65.2%, flat from last month’s 65.3% and above the six-auction average of 62.8%. And with Directs taking down 20.1%, or the most since November, Dealers were left holding 14.73%, down from 14.83% last month and the lowest since September.

Overall, this was a subpar auction which however is to be expected with the size hitting a record high, and only set to rise from here. The market reaction was quick, with yields across the curve rising, and the 10Y yield hitting session highs of 4.29% moments after the auction.

Tyler Durden

Mon, 02/26/2024 – 11:53

via ZeroHedge News https://ift.tt/Ek3ZPVb Tyler Durden