Yields Hit Session High As Bonds Slump After Record 5Y Auction Tails

Ninety minutes after the Treasury sold a record $63 billion in an ugly 2Y auction, at 1pm we got the day’s second coupon auction when we just saw another record, this time in the form of $64 billion in 5Y notes, the highest amount ever sold for the tenor.

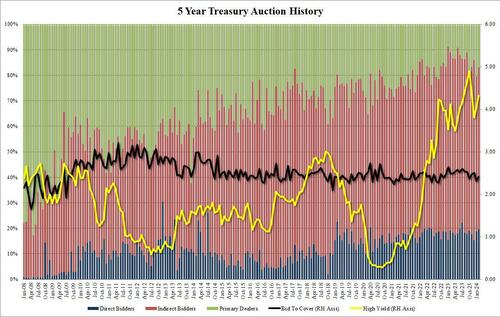

The auction priced at a high yield of 4.320%, up 26.5bps from last month and just like the 2Y auction earlier, this too tailed the When Issued by 0.8bps (the WI was 4.312% at 1 pm).

The bid to cover was a modest improvement from last month’s 2.31, rising to 2.41 but still below the recent average of 2.45.

The internals were, likewise, modestly stronger than the ugly Jan auction, but again left a bit to be desired. The indirect award was 63.5%, up from 60.9% last month but below the 66.3% recent average. And with Directs awarded 19.7%, up from 18.7% last month, and above the 17.8% recent average, meant that Dealers were left holding 16.8% down from 20.5% and in line with the 16.0% six-auction average.

And with 2 of the week’s 3 coupon auction now down on the first day of trading, and with markets realizing just how much supply there is, it’s not surprising that yields have shot up to session highs, with the 10Y rising above 4.30% after briefly trading below 4.22% earlier in the session.

Tyler Durden

Mon, 02/26/2024 – 13:41

via ZeroHedge News https://ift.tt/ZjLkw6R Tyler Durden