Fed And Treasury Ensure Dollar Downside Is Ahead

Authored by Simon White, Bloomberg macro strategist,

The Fed’s pivot in December and the Treasury’s willingness to run persistently large fiscal deficits will lead the dollar to resume its downtrend from 2022 highs.

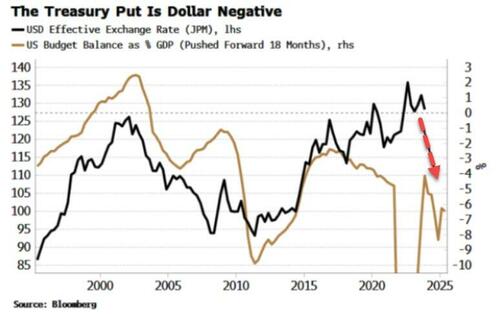

Dollar strength seems to be in vogue again, but fiscal and monetary policy will conspire to make that trend unlikely to persist much longer. Running pro-cyclical fiscal deficits, not just in the US but across much of the developed world, has become the norm. Electorates’ expectations widened after the pandemic, and now there is an unwritten pact between governments and their voters that they will underwrite a growing itinerary of risks from job loss to disease – the Treasury put.

Large fiscal deficits are a long-term negative for the currency as they are inflationary, and considering the US deficit is one of the largest in GDP terms, it poses greater downside risk to the dollar versus other currencies. This will also be a tailwind for the new bull market in stocks.

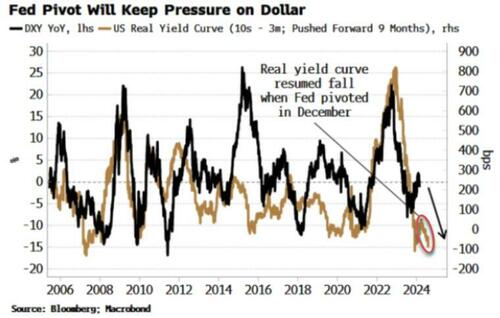

But shorter-term leading indicators are also dollar negative. On this horizon, the real yield curve gives one of the best leads on the dollar, by about six-to-nine months. This is where the Fed’s pivot comes in.

The real yield curve had been steepening last year, as longer-term real yields were rising more than shorter-term ones, due in part to the influence of rising term premium. That would have anticipated a rising dollar. The real yield curve then began to re-flatten, which continued even after the Fed performed its verbal volte-face in December, as longer-term real yields have risen much less than short-term ones.

The DXY index is up ~2.3% this year, versus the average of 1.4% in the first two months of the year (data back to 1980). But the dollar typically sees all its net gains in the first three months of the year (1.7%) versus an average decline of 0.9% through the remainder.

Net positioning in the dollar is flat, leaving speculators free to move with or against it. They should favor the latter, and not be deterred by recent dollar strength (which is fairly unremarkable), and instead look to the seasonally negative latter three quarters of the year, given extra credence by fiscal and monetary policy that will continue to be a headwind.

Tyler Durden

Tue, 02/27/2024 – 12:20

via ZeroHedge News https://ift.tt/KWBicNM Tyler Durden