Europe’s Record Rally Leaves Behind Riskier Firms

By Michael Msika, Bloomberg Markets Live reporter and strategist

Investors are piling up bets into the largest stocks by market value but also into the ones with the strongest balance sheets, while leaving more risky companies behind.

The broadening of the rally to other parts of the market doesn’t look like it’s coming just yet. Caution is the name of the game when it comes to corporate fundamentals, with the quality factor leading returns on a long-short basis over the past three months, and the trend extending further in February.

Investors have turned increasingly bullish about European stocks, with their optimism driving the European benchmark to a record high last week. Even so, a Goldman Sachs basket of companies with weaker balance sheets has been underperforming peers with stronger ones at a pace not seen since mid-2022 — a period when US rates went from 1% to more than 3% in about three months.

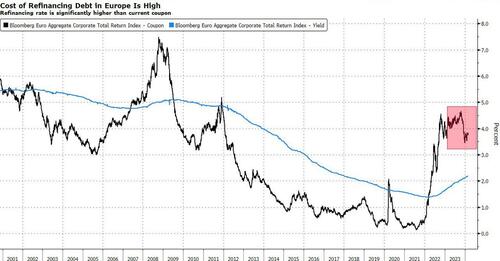

“These baskets are heavily influenced by interest rates given their sensitivity to rising cost of debt,” say Goldman strategists including Guillaume Jaisson, keeping an underweight on these companies. They add that cost of debt isn’t a problem for the overall market given balance sheets are not stretched overall.

Jaisson notes that some constituents of the basket like BAT, Fresenius, GN Store Nord, Siemens Healthineers and Stora Enso committed to reducing debt during the last earnings season, implying less focus on capex or shareholders’ returns. Meanwhile, Bayer even announced it will cut dividends by 95% to focus on its balance sheet, and others such as Atos have been under pressure following refinancing difficulties.

“We think these companies will remain constrained now that they need to operate in a higher interest rate environment and especially if we see yields move higher,” they say. The caveat is that a pick-up in activity, combined with rate cuts from the major central banks, could create a rotation out of momentum trades and into cyclical assets such as weak balance sheets and small caps.

In the meantime, investors are being selective, widening the gap between what is seen as the healthier sections of the market. In terms of performance themes, the market is back to the things that worked well for most part of the rally, as mega cap, tech and pricing power stocks are performing well.

Sentiment toward riskier parts of the market, which briefly seemed to play catch up and stoked concern about potential “buy everything exuberance,” is once again sobering up and deflating the notion of too much risk is being deployed.

Yet, while sharing a similar view to Goldman’s Jaisson about the continued outperformance of cash-rich companies versus stocks with high refinancing costs, JPMorgan strategists led by Mislav Matejka are more pessimistic about the overall direction of equities. They see some downside ahead, especially as key drivers of resilient corporate profitability are likely to turn weaker.

“In aggregate, and despite a few notable exceptions, corporate profit margins are elevated in a historical context, and appear to be peaking,” they say. Corporates managed to lock in low financing costs ahead of rate hikes but this will normalize over time, as will productivity gains and the currently strong pricing power.

“The historical pattern where profit margins always start to move lower ahead of the next economic downturn is clear,” they say.

Tyler Durden

Wed, 02/28/2024 – 05:45

via ZeroHedge News https://ift.tt/knN6HRq Tyler Durden