Peter Schiff: Booming Stock Market Mirrors Dot-Com Bubble

Via SchiffGold.com,

This week Peter covers the highlights of the last few weeks of volatile trading, paying special attention to Nvidia, Wall Street’s favorite AI stock, and Newmont Corporation, a heavy hitter in the gold mining industry.

Both companies’ shares experienced dramatic price action, with NVDA gaining $260 billion in market cap and pulling the market up after an excellent earnings report. Newmont, on the other hand, saw shares fall 7% after a disappointing last quarter.

Peter explains how monetary policy influences the profitability of mining:

“Part of the big problem for Newmont and all the other mining stocks is that it’s so much more expensive to mine gold now … Now why is that? Inflation. Inflation is taking a huge toll on the profits of these companies because the price of gold has not risen as much as the cost of mining it. And that is again why I keep saying gold mining stocks are the ironic victims of inflation.”

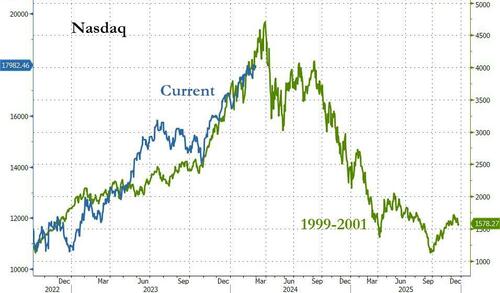

Nvidia and the tech sector’s recent surge is reminiscent of the market in the late 1990s, right before the Dot-com bubble popped:

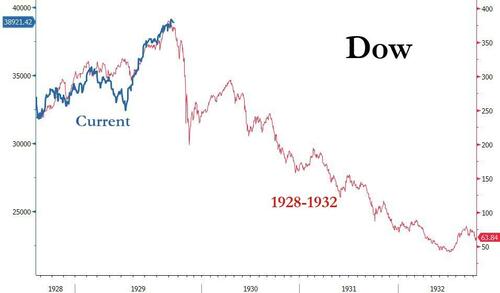

“What’s really significant about today’s situation is that you’ve got 1999-2000 all over again in the stock market, but it’s more like 2008 in terms of the disaster that’s waiting around the corner. We didn’t have a financial crisis in 2001. That didn’t happen until 2008.”

[ZH: Or 1930s…]

This doesn’t mean A.I. technology is doomed to fail. Rather, innovative companies like Nvidia are currently swept up in an overheating economy that will eventually give way to inflationary pressures:

“There’s no doubt that artificial intelligence will be helpful… The markets once again are way ahead of the reality of where all of this is going, and at the same time, they’re overlooking the tremendous economic problems and financial problems that are hiding in plain sight.“

[ZH: It’s different this time…]

Peter also discusses the FOMC minutes that were released this week, which showed Fed officials are still hesitant about cutting interest rates. Gold responded well to this news, as it did last week after higher-than-expected CPI figures were released:

“The gold market kinda shrugged it off, which really shows you the underlying strength in the market. There was a brief sell-off in stocks, but I think investors quickly realized that look, … we’re going to get these cuts… What the markets are focused on is that the hikes are over… We’ve got the wind at our back. The question is… how strong is that wind?”

Recent moves in the price of oil, mortgage rates, and treasury yields suggest these investors are overly optimistic:

“These market indicators are showing that inflation is coming back, that we’ve bottomed out, and we’re just moving higher. And the markets do not expect that this is possible… If they’re wrong, the stock market is going to collapse.”

Markets are expecting rates to fall this spring, but they need to rise:

“If the Fed doesn’t hike rates, it could be even worse— maybe not for the market, but for the dollar, for bonds, and even more bullish for gold… If the Fed doesn’t hike rates, then inflation is just going to run out of control. And in fact, even if the Fed doesn’t cut rates— if it leaves rates where they are— real rates are going down because inflation is going to go up!”

Advocates of rate hikes are wrong when they assert that recent rate hikes constitute “restrictive monetary policy:”

“This is not restrictive monetary policy. Again, less loose doesn’t qualify as tight… What is being restricted? Is the government being restricted? Is there any cutback in government spending? Is the government borrowing less because the Fed has increased the cost of borrowing money? No! The government is borrowing more! In fact, they’re borrowing more to pay the higher interest rates.”

Peter wraps up by discussing a hefty fine leveled against Donald Trump in a New York fraud case. In this case and others, a politicized legal system portends a riskier and increasingly unattractive business environment, both in New York and in the rest of the country:

“One of the reasons that a lot of international money has invested in America over the years is the confidence in our legal system, in the rule of law, in private property— that you can own property, assets, and business here, and you’re protected by the rule of law. It just can’t be arbitrarily taken from you, but what we’re now showing the world is that’s not the case!“

While Wall Street celebrates a record week, Peter’s insights are less optimistic. It is unlikely a handful of tech stocks can perpetually sustain an economy burdened by years of inflation and oppressive government debt. America is addicted to cheap credit, and this addiction will cripple the economy if left unchecked.

Tyler Durden

Thu, 02/29/2024 – 11:00

via ZeroHedge News https://ift.tt/TNRfrgH Tyler Durden