SuperCore Inflation Soars In January, Services Costs Re-Accelerate

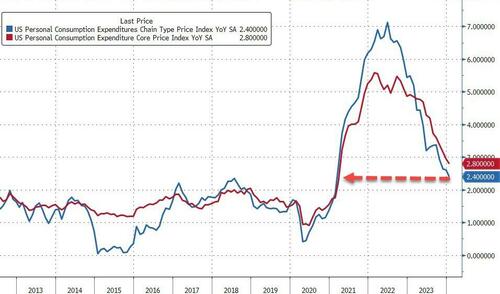

GOOD NEWS… One of The Fed’s favorite inflation indicators – Core PCE Deflator – dropped to +2.8% YoY in January (as expected) – the lowest since March 2021.

Headline PCE Deflator rose 0.3% MoM as expected, down at +2.4% YoY in January …

Source: Bloomberg

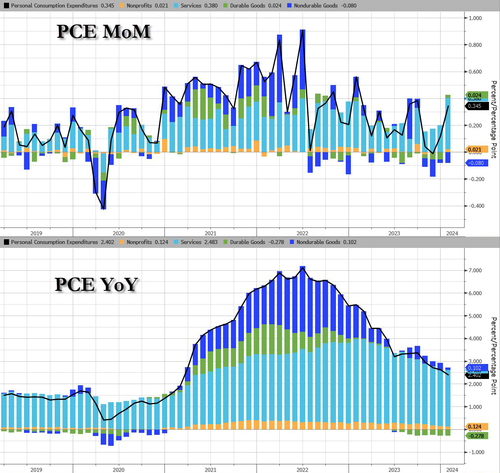

BUT… Services soared on a MoM basis…

However, shorter-term signals are less encouraging:

-

Core PCE 3M annualized rate 2.8% from 2.0%

-

Core PCE 6M annualized rate 2.6% from 2.2%

On a core basis, services costs jumped even more and Durable Goods costs flipped from deflation…

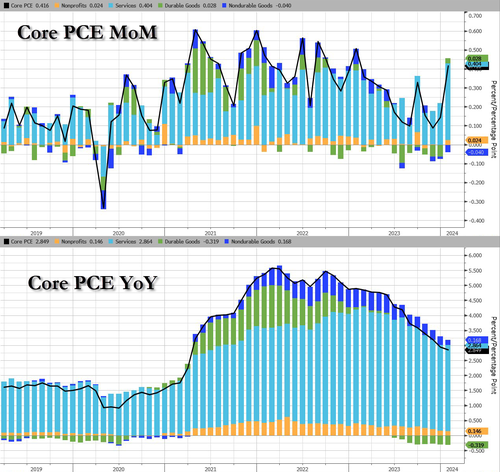

BAD NEWS… Even more focused, from The Fed’s perspective, is Services inflation ex-Shelter, and the PCE-equivalent actually ticked up on a YoY basis to 3.45%, thanks to a large 0.6% MoM jump, considerably bigger than the last few months increases…

Source: Bloomberg

Under the hood, the SuperCore, every sub-element rose MoM…

Source: Bloomberg

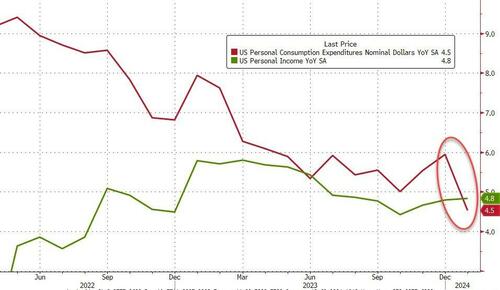

Income and Spending both increased with the former soaring 1.0% MoM (+0.4% exp) but the latter up only 0.2% (in line)…

Source: Bloomberg

Most notably, spending is now rising at a slower pace than incomes on a YoY basis (spending growth at the lowest since Feb 2021)…

Source: Bloomberg

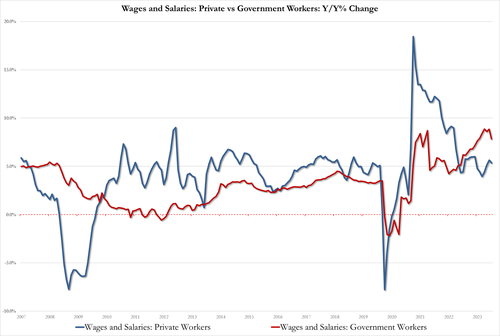

On the income side, Govt wage growth slumped from a record 8.8% in Dec to 7.8% in January

Of course, private wages also dropped to 5.4% in Jan from 5.6% in Dec

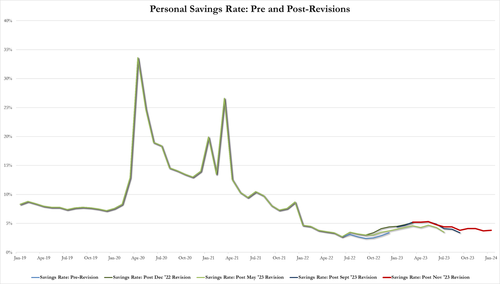

January savings rate rose to 3.8% (from 3.7%)…

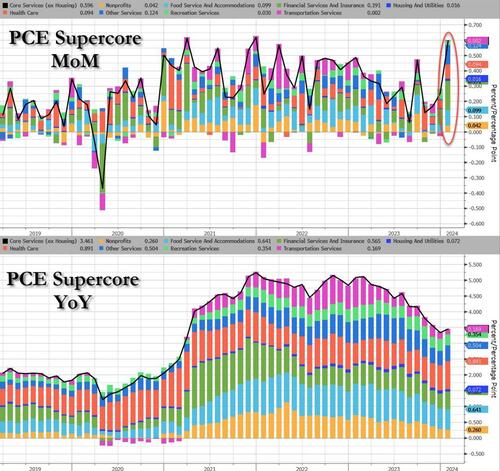

Finally, while the markets are exuberant at the headline disinflation, we do note that it’s not all sunshine and unicorns. The vast majority of the reduction in inflation has been ‘cyclical’…

Source: Bloomberg

Acyclical Core PCE inflation remains extremely high, although it has fallen from its highs.

Is The (apolitical) Fed really going to cut rates 4 times this year with a background of strong growth (GDP) and still high Acyclical inflation?

Tyler Durden

Thu, 02/29/2024 – 08:45

via ZeroHedge News https://ift.tt/cWreXEp Tyler Durden