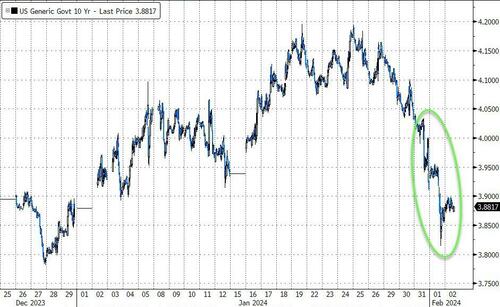

US futures and global markets rallied on Friday after tech megacaps Meta and Amazon.com posted blowout earnings (even as Apple dropped on a plunge in China sales and disappointing guidance) and as investors awaited a jobs report expected to support the case for interest-rate cuts. As of 7:30am, S&P 500 futures rose 0.7% while the Nasdaq 100 rose 1% after the indexes advanced by more than 1% Thursday. Rates were flat with 10Y yields unchanged around 3.88% while the dollar dropped and oil extended losses. All eyes will be on today’s jobs report; we also get the latest Factory Orders, Durables Goods and Michigan sentiment (and inflation outlook) prints.

The sharp gains in the past two days meant that the S&P is once again on track for aweekly gain, which will make it 13 increases in the past 14 weeks!

In premarket trading, Meta soared 17% and Amazon rallied 7.1% after the tech behemoths smashed quarterly profit expectations. The pair’s results boosted social media and e-commerce peers, with Snap up 6.8% and Shopify rising 4.8%. Apple slipped after its earnings showed weakness in China. Big Oil added to the earnings buzz Friday, with Chevron and Exxon Mobil shares rising after both beat profit expectations. Here are some other notable premarket movers:

- Atlassian (TEAM US) shares fell 8.6% as analysts said the application software company’s cloud metrics came in short of expectations.

- Amazon (AMZN) shares jumped 6.7% after fourth-quarter results beat expectations and the company’s outlook for operating income surpassed estimates. Analysts cited operating income and the company’s Amazon Web Services (AWS) businesses as highlights.

- Apple (AAPL US) shares fell 2.7% after weakness out of the greater China region overshadowed strong results in most product categories. Analysts expect that competition in China will intensify.

- Intel (INTC US) shares fell 1.2% following a Wall Street Journal report that the chipmaker is delaying a $20 billion chip facility planned for Ohio, sparking worries over its capital expenditure plans.

- Meta Platforms (META US) jumps 18% after the Facebook parent reported fourth-quarter results that beat expectations and gave an outlook that is seen as strong. It also introduced its first ever dividend.

- Skechers (SKX US) shares slid 10% after the footwear company issued full-year sales and earnings per share guidance that trailed consensus estimates.

- Solo Brands (DTC US) fell 2.5% as JPMorgan double-downgrades the stock to its only underweight rating, citing growing concerns around shifts in the outdoor product retailer’s business model since its IPO.

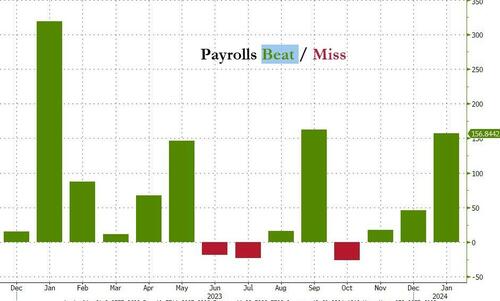

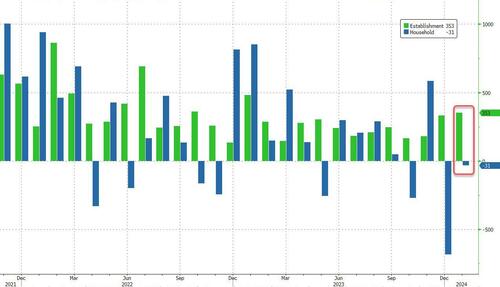

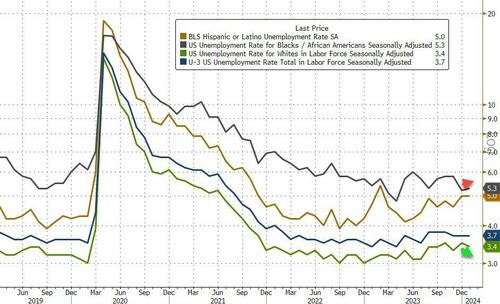

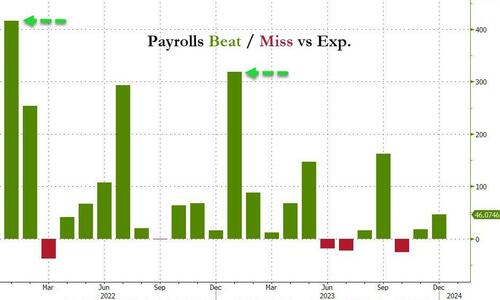

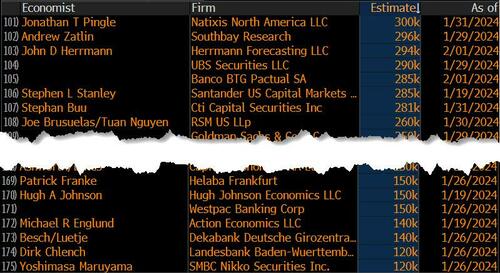

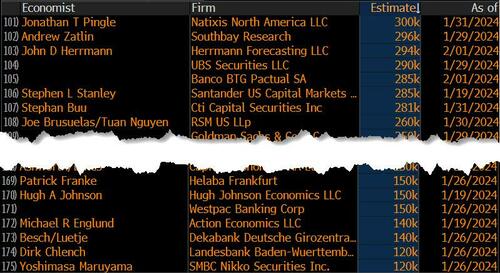

After a torrid week there is one more major market event: Friday’s US jobs report is expected to show a slower hiring pace in 2023 after figures out Thursday showed rising jobless claims, and following annual revisions, indicating the labor market was softer than realized (full preview is here). Wall Street expects 185K payroll gains with a wide range of forecast between 120K and 300K. Bloomberg economists see the unemployment rate edging up to 3.8%, from 3.7% in December.

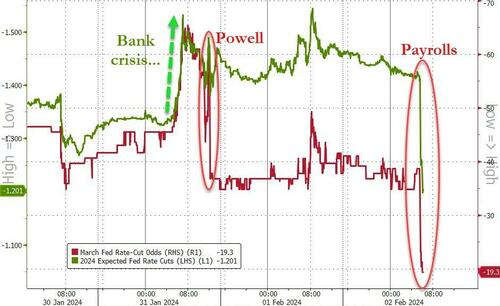

Investors will parse monthly US jobs figures due later for confirmation of further cooling in the labor market that might encourage policy easing by the Federal Reserve.

“Any move closer to 4% could see markets changing bets on when Fed cuts could begin,” economists at Rand Merchant Bank in Johannesburg said in a note to clients.

Investors will also continue to closely track developments around smaller banks as an index for the sector heads for its worst week since the fallout from the banking crisis last May. New York Community Bancorp has plunged 45% since shocking investors Wednesday by reducing its dividend, posting a quarterly loss and ramping up loan-loss provisions for exposure to commercial real estate.

Meanwhile, as investors rush into technology stocks, Bank of America strategists said they see similarities with the bubble of 1999, with markets assuming that the economy will perform strongly, despite tighter monetary policy. While falling yields were pushing the Nasdaq higher in the fourth quarter, the script has now flipped to both rising over the past four weeks. This price action would typically only occur after a recession, such as in 2009 or the dot-com bubble around the turn of the century, BofA strategists led by Michael Hartnett wrote on a note. Hartnett’s view on the rising dominance of tech stocks resembles a warning by JPMorgan strategists earlier this week that the US equity market is increasingly drawing similarities with the dot-com bubble.

European stocks are also higher, led by real estate and auto names. The Stoxx 600 is on course for back-to-back weekly gains for the first time this year, with most subgroups on the regional benchmark notching gains, with the real estate and automotive subindexes the biggest risers, while the energy sector the biggest laggard. Mercedes-Benz Group AG shares rose as much as 3.3% and Danske Bank climbed 6.7%. Here are the biggest movers Friday:

- Danske Bank shares rise as much as 6.5%, the most in three months, after reporting results, with Jefferies saying capital distributions are the “key positive” element

- Vallourec climbs as much as 9.6% after French tube-maker reported “good” preliminary fourth-quarter Ebitda that beat estimates, and will likely also beat 2023 expectations, Oddo says

- Zalando rises as much as 5.7% after Morgan Stnaley raised its rating on the European fashion platform to overweight, saying it will be a key online volume share winner as inflation slows

- OCI jumps to highest since April after the stock was raised to buy by Berenberg, which flags “lots of cash, lots of options” as fertilizer maker is about to unlock $6.1b of divestment proceeds

- SAP gains as much as 2.2% to a record high after Jefferies upgraded the software firm to buy, saying there is now “no reason to question growth” given elevated cloud revenue in its pipeline

- Mercedes rises as much as 3.3% after reporting preliminary industrial free cash flow for the full year that beat the average analyst estimate, with Deutsche Bank seeing upside potential

- Delivery Hero falls as much as 13% to record lows after Malaysian newspaper New Straits Times reported that the food delivery firm’s talks to sell its Southeast Asia business to Grab collapsed

- Electrolux falls as much as 6.8% after the Swedish home appliances firm flagged a gloomy outlook for the first half of 2024, according to Citi. It also failed to pay a dividend last year

- Lem shares fall as much as 8.2%, most since July 2022, after the Swiss electrical component manufacturer’s results missed estimates and it cut its sale guidance

- YouGov falls as much as 2.5%, dropping from a one-month high hit yesterday, after suffering a slow start to the financial year because of the challenging macro-economic environment

- Close Brothers falls as much as 5% as RBC cuts its recommendation on the UK bank to sector perform as it expects shares to be held back by FCA reviews into motor loans and premium finance

Earlier in the session, the picture was more mixed in Asia, where key Chinese benchmarks pared steep declines in a session marked by wild swings. A broader gauge of the region’s stocks climbed 0.7% with South Korean shares leading the charge. The MSCI Asia Pacific Index rose as much as 1.1%, with Tencent among the biggest contributors to the gauge’s gain after China approved a slew of online games. South Korea’s benchmark Kospi headed for its best week since November 2022, boosted by automakers and other holding firms amid a push by authorities for better valuations.

- Hang Seng and Shanghai Comp were both initially boosted with outperformance in automakers after their January delivery updates, while tech names were supported after China’s NPPA approved 32 imported online games. However, stocks then gradually reversed course after the PBoC continued to drain liquidity despite next week’s Lunar New Year holiday. Later in the session Chinese stocks rebounded shortly after the Shanghai Composite fell to fresh multi-year lows under 2,700; with some highlighting increased capital flows from Hong Kong via Stock Connect

- Nikkei 225 gained with headlines dominated by another busy day of earnings results, while Aozora Bank suffered another double-digit drop after it recently flagged losses linked to US commercial property loans.

- ASX 200 printed fresh all-time highs with real estate and tech front running the gains amid softer yields.

In FX, the Bloomberg Dollar Spot Index fell 0.1% while the Australian dollar tops the G-10 FX leaderboard, rising 0.5% versus the greenback. The yen is among the weakest, dropping 0.2%.

- AUD/USD rose as much as 0.5% to 0.6603 as the Australian dollar led G-10 gains against the dollar on bolstered risk appetite; Japanese yen led G-10 losses

- GBP/USD rose as much as 0.2% to 1.2768, the highest level in over a week, as markets bet on the BOE lagging other major central banks in cutting rates; Gilts underperformed Treasuries and EGBs with front-end yields climbing 6-8bps

In rates, Treasuries were unchanged with the curve flatter, pushing 2s10s and 5s30s spreads beyond Thursday’s lows. The move was led by pronounced bear-flattening of gilts curve, a laggard among core European rates. Front-end yields cheaper by around 3bp with long-end slightly richer on the day, leaving 2s10s, 5s30s spreads flatter by 2.5bp and 2bp. Two-year yields rose 2bps to 4.22%, while 10-year yields were little changed around 3.88%, with bunds and gilts lagging by 1.5bp and 6bp in the sector. Dollar issuance slate includes KDB 3Y/5Y; just one deal was done Thursday, bringing weekly volume to just over $20b, in line with $20b to $25b expected; dealers are calling for about $150 billion of new supply in February.

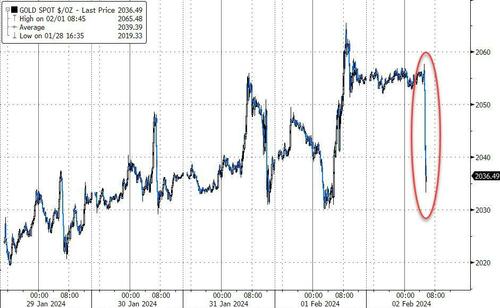

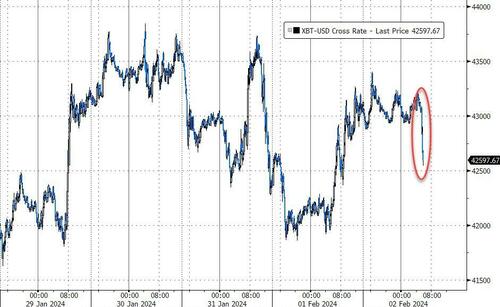

In commodities, oil headed for the biggest weekly loss since early November as negotiations advance for an agreement to pause the Israel-Hamas war in what could be a crucial step toward ending the conflict; oil prices advanced, with WTI rising 0.7% to trade near $74.30, after the contracts settled lower by $2/bbl for WTI and USD 1.85/bbl for Brent after mixed reporting regarding a Gaza ceasefire yesterday; currently Brent holds below the $79.50/bbl. Gold headed for its largest weekly increase since the start of December as lower Treasury yields offered support for the metal, amid the concerns over US regional banks.

Looking to today’s calendar, economic data includes January jobs report (8:30am), January final University of Michigan sentiment and December factory orders (10am). Federal Reserve Chair Jerome Powell will appear on CBS News’s 60 Minutes this Sunday and will discuss inflation risks, expected rate cuts and the banking system, among other topics, the network said; no Fed members are scheduled to speak Friday while other central bank speakers include ECB’s Centeno and BoE’s Pill. Finally, earnings releases include ExxonMobil, Chevron and Aon.

Market Snapshot

- S&P 500 futures up 0.5% to 4,954.25

- STOXX Europe 600 up 0.5% to 486.32

- MXAP up 0.7% to 167.35

- MXAPJ up 1.2% to 510.00

- Nikkei up 0.4% to 36,158.02

- Topix up 0.2% to 2,539.68

- Hang Seng Index down 0.2% to 15,533.56

- Shanghai Composite down 1.5% to 2,730.15

- Sensex up 0.6% to 72,074.30

- Australia S&P/ASX 200 up 1.5% to 7,699.40

- Kospi up 2.9% to 2,615.31

- German 10Y yield up 2 bps at 2.17%

- Euro up 0.2% to $1.0894

- Brent Futures up 0.4% to $79.03/bbl

- Gold spot down 0.0% to $2,054.65

- US Dollar Index down 0.12% to 102.93

Top Overnight News

- Stocks posted broad gains Friday after robust earnings from technology giants and as investors looked forward to a US jobs report expected to show further cooling in the labor market in a boost for hopes of interest-rate cuts.

- Meta Platforms Inc. and Amazon.com Inc. spent 2023 cutting costs and re-focusing their businesses. It was a strategy that upended the lives of displaced tech workers in Seattle and Silicon Valley, but appears to have paid off handsomely for investors who are likely to continue reaping benefits.

- A monthly US jobs report due Friday will probably show a slower pace of hiring in 2023 following annual revisions, according to Bloomberg Economics.

- A sense of panic gripped Chinese investors on Friday as shares swung sharply in the final hours of trading before closing at a five-year low.

- Federal Reserve Chair Jerome Powell will appear on CBS News’s 60 Minutes this Sunday and will discuss inflation risks, expected rate cuts and the banking system, among other topics, the network said.

- Oil headed for the biggest weekly loss since early November as negotiations advance for an agreement to pause the Israel-Hamas war in what could be a crucial step toward ending the conflict.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly took impetus from the gains on Wall St where stocks were underpinned amid a softer yield environment and with US equity futures boosted following the big tech earnings. ASX 200 printed fresh all-time highs with real estate and tech front running the gains amid softer yields. Nikkei 225 gained with headlines dominated by another busy day of earnings results, while Aozora Bank suffered another double-digit drop after it recently flagged losses linked to US commercial property loans. Hang Seng and Shanghai Comp were both initially boosted with outperformance in automakers after their January delivery updates, while tech names were supported after China’s NPPA approved 32 imported online games. However, stocks then gradually reversed course after the PBoC continued to drain liquidity despite next week’s Lunar New Year holiday. Later in the session Chinese stocks rebounded shortly after the Shanghai Composite fell to fresh multi-year lows under 2,700; with some highlighting increased capital flows from Hong Kong via Stock Connect

Top Asian News

- China National Press and Publication Administration approved 32 imported online games, according to Reuters.

- China urges state Cos to step up equity investments in new equity firms, via Bloomberg

- IMF says China growth is projected to slow to 4.6% in 2024 amid the ongoing weakness in the property sector and subdued external demand. Inflation expected to increase gradually to 1.3% in 2024.

European bourses, Stoxx600 (+0.5%), are on a firmer footing, taking impetus from gains in Wall Street and further optimism also stemming from blockbuster earnings from Amazon (+6% pre-market) and Meta (+16.7% pre-market). European sectors are mostly firmer; Autos takes the top spot benefitting from outperformance within the sector in APAC trade and after a positive update from Mercedes-Benz. Energy is the major laggard, dragged down by weaker crude prices following mixed reporting on a ceasefire in Gaza. US equity futures (ES +0.5%, NQ +1.1%, RTY U/C) are firmer, with clear outperformance in the NQ, being led higher by significant strength in Amazon (+6.7%) and Meta (+16.7%) post-earnings; though, Apple is softer by over 2%.

Top European News

- Citi/YouGov UK Inflation Expectations: 12-month 3.9% (prev. 3.5%), 5-10yrs 3.6% (prev. 3.4%). Short-run expectations increased amid an increase in shipping disruption.

- Riksbank comment on the Swedish National Audit Office’s report: Riksbank recognises that circumstances may arise in the future, in which purchases of securities may be an appropriate way to influence inflation. Further analysis is required.

- German Engineering Orders in December -6% Y/Y (Domestic -13%, Foreign -3%), according to VDMA

Earnings

- Amazon.com (AMZN) – Q4 2023 (USD): EPS 1.00 (exp. 0.80), Revenue 169.96bln (exp. 166.21bln).SALES BREAKDOWN:Online stores 70.54bln (exp. 68.91bln). Physical Stores 5.15bln (exp. 5.23bln). Third-Party Seller Services 43.56bln (exp. 41.96bln). AWS 24.20bln (exp. 24.22bln). GEOGRAPHICAL REGIONS: North America 105.51bln (exp. 102.88bln). International 40.24bln (exp. 38.96bln). KEY METRICS: Third-party seller services net sales excluding F/X +19% (exp. +15.9%). AWS net sales excluding F/X +13% (exp. +11.8%). Operating income 13.21bln (exp. 10.49bln). Operating margin 7.8% (exp. 6.17%). North America operating margin +6.1% (exp. +4.12%). International operating margin -1% (exp. -1.27%). Fulfillment expense 26.10bln (exp. 25.2bln). GUIDANCE: Q1 net sales view 138.0-143.5bln (exp. 142.01bln). Q1 operating income view 8-12bln (exp. 9.1bln). CFO said improved delivery speeds have led to increased purchase frequency by customers across major geographies, and there are no immediate plans for dividend. (Amazon/Newswires) Shares rose 7.1% after-market. Index weightings: SPX (3.5%), NDX (4.9%). Shares up 6.1% pre-market

- Meta Platforms Inc (META) – Q4 2023 (USD): EPS 5.33 (exp. 4.96), Revenue 40.11bln (exp. 39.17bln); authorised 50bln increase to share buyback programme and declared cash quarterly dividend of 0.50/shr. KEY METRICS: Advertising revenue 38.71bln (exp. 38.12bln). Facebook DAUs 2.11bln (exp. 2.07bln). Facebook MAUs 3.07bbln (exp. 3.06bln). Ad impressions +21% (exp. +24.6%). Average Family service users per day 3.19bln (exp. 3.11bln). Average Family service users per month 3.98bln (exp. 3.93bln). GUIDANCE: Q1 revenue view 34.5-37bln (exp. 33.34bln). Meta (META) noted the FTC is seeking to substantially modify consent order on Meta and if contesting is unsuccessful, this could impose additional restrictions on its ability to operate and would adversely impact its business. CEO said the Co. is getting ready to roll out AI services more widely in coming months, adds Threads now has more people using it daily than initial launch and Metaverse focus this year is going to be growing mobile version of Horizon. CFO said Co. will discontinue reporting of Facebook monthly and daily active users, Co. expects to maintain an active share repurchase program. (Meta/Newswires) Shares rose 15.2% after-market. Index weightings: SPX (2.2%), NDX (4.2%). Shares up 16.8% pre-market

- Apple Inc (AAPL) – Q1 2024 (USD): EPS 2.18 (exp. 2.10), Revenue 119.58bln (exp. 117.91bln). Greater China revenue 20.82bln (exp. 23.5bln). REVENUE BREAKDOWN: Products 96.46bln (exp. 95.14bln).iPhone 69.70bln (exp. 68.55bln). Mac 7.78bln (exp. 7.9bln). iPad 7.02bln (exp. 7.06bln). Wearables, home and accessories 11.95bln (exp. 12.02bln). Service 23.12bln (exp. 23.37bln). KEY METRICS: Total operating expenses 14.48bln (exp. 14.62bln). Gross margin 54.86bln (exp. 53.56bln). Cash and cash equivalents 40.76bln (exp. 38.81bln). Apple expects March quarter total revenue and iPhone revenue to be similar to the previous year after accounting for inventory replenishment. Expects gross margins between 46%-47% for fiscal Q2. Expects operating expenses of USD 14.3bln-14.5bln in fiscal Q2. Expects services business to show double-digit growth similar to the December quarter in fiscal Q2. CEO Cook said the Co. will make announcements this year on new AI features. CEO Cook added that FX was a headwind for China sales, and the decline in China sales was in part on a stronger USD. (Apple/Newswires) Shares fell 2.9% after-market. Index weightings: SPX (6.6%), NDX (8.7%), DJIA (3.2%) Shares down 2.5% pre-market

- Microchip Technology Inc (MCHP) – Q3 2024 (USD): Adj. EPS 1.08 (exp. 1.04), Revenue 1.77bln (exp. 1.77bln). GUIDANCE: Q4 adj. EPS view 0.46-0.68 (exp. 0.91). Q4 revenue view 1.225-1.425bln (exp. 1.66bln). COMMENTARY: Taking steps to limit discretionary spending and tightly manage inventory levels during downcycle. Cautious about demand in near term given weak macro environment and customers’ ongoing actions to reduce inventory. (Newswires) Shares down 3.1% pre-market

- TomTom (TOM2 NA) – Q4 (EUR): Revenue 143mln (exp. 142mln), Net -11.6mln (exp. -23mln), EBIT -10.4mln (exp. -29mln). FY24 Outlook: Revenue 570-610mln (exp. 600mln). Shares up 9.2% in European trade / Garmin shares up 0.7% in pre-market trade.

FX

- DXY has pivoted around the 103.00 mark compared to levels closer to 103.50 in recent sessions as yield-driven selling in USD saw the index hit a trough of 102.91. In what has been a contained few weeks of trade for the USD, a soft NFP could see a test of the Jan 24th low at 102.77.

- EUR remains supported by recent USD selling but unable to muster a test of 1.09; last breached on Jan 25th at 1.0901.

- JPY is the only major currency softer vs. the USD as the JPY’s recent tepid recovery vs. the dollar pauses for breath. Ultimately, the pair remains at the whim of relative Fed/BoJ expectations. Currently sits at the 21DMA and within yesterday’s 145.89-147.11 range.

- AUD attempting to recoup recent lost ground vs. the USD which saw the pair hit a trough of 0.6508 yesterday.

- PBoC set USD/CNY mid-point at 7.1006 vs exp. 7.1655 (prev. 7.1049).

Fixed Income

- USTs are softer and pivoting Wednesday’s 112-20+ peak ahead of NFP, which is expected to print at 180k (prev. 216k).

- Bunds are weaker by around 60 ticks but still over 100 ticks from the week’s 134.37 trough; the German 10yr yield has recovered back to 2.18% but is still set to close the week out lower.

- Gilts are the relative underperformer but similarly well within WTD 98.56-100.62 parameters with drivers thin post-BoE though we await commentary from Chief Economist Pill.

- Italian Treasury says foreign investors bought 70% of new 15yr BTP syndicated bond

Commodities

- Choppy/contained across the crude complex this morning ahead of US jobs data, and after the contracts settled lower by USD 2.03/bbl for WTI and USD 1.85/bbl for Brent after mixed reporting regarding a Gaza ceasefire yesterday; currently Brent holds below the USD 79.50/bbl.

- Precious metals are trading horizontal in the run-up to the US jobs report in an otherwise quiet European morning; whilst base metals are mixed with early China-induced weakness trimmed as the USD edges lower; XAU holds above USD 2050/oz and within a tight range.

- Iraqi oil exports averaged 3.3mln BPD in Jan (prev. 3.5mln in Dec); Average price USD 77.536/bbl (prev. USD 76.96/bbl in Dec)

Geopolitics

- Hamas said they are still in the stage of consultation between internal and foreign leaders on the exchange deal, while it received the Paris truce proposal but has not given a response to any parties and it is still being studied. Furthermore, it cannot say the current stage of negotiations is zero, but also cannot say they have reached an agreement.

- An Iranian revolutionary guard advisor killed in Israeli strike on Damascus, Syria, via semi-official Iranian News site..

- Iraq’s pro-Iran Al-Nujaba movement vows to keep up attacks on US troops, according to AFP

- North Korea fired several cruise missiles off its west coast, according to South Korea.

US Event Calendar

- 08:30: Jan. Change in Nonfarm Payrolls, est. 185,000, prior 216,000

- Jan. Change in Private Payrolls, est. 170,000, prior 164,000

- Jan. Change in Manufact. Payrolls, est. 3,000, prior 6,000

- Jan. Unemployment Rate, est. 3.8%, prior 3.7%

- Jan. Underemployment Rate, prior 7.1%

- Jan. Labor Force Participation Rate, est. 62.6%, prior 62.5%

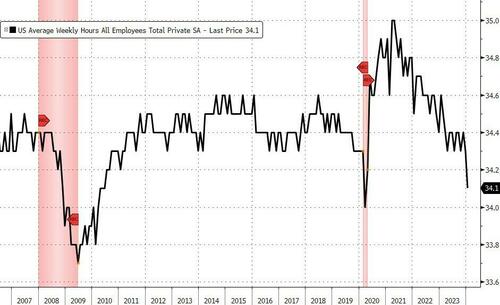

- Jan. Average Weekly Hours All Emplo, est. 34.3, prior 34.3

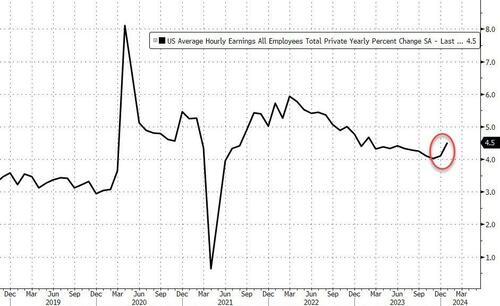

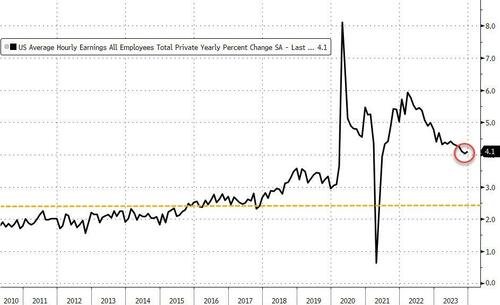

- Jan. Average Hourly Earnings YoY, est. 4.1%, prior 4.1%

- Jan. Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- 10:00: Dec. Durable Goods Orders, est. 0%, prior 0%

- Dec. Durables-Less Transportation, est. 0.6%, prior 0.6%

- Dec. Cap Goods Ship Nondef Ex Air, prior 0.1%

- Dec. Cap Goods Orders Nondef Ex Air, prior 0.3%

- 10:00: Dec. Factory Orders, est. 0.2%, prior 2.6%

- Dec. Factory Orders Ex Trans, est. 0.2%, prior 0.1%

- 10:00: Jan. U. of Mich. Current Conditions, est. 83.5, prior 83.3

- Jan. U. of Mich. Sentiment, est. 78.9, prior 78.8

- Jan. U. of Mich. Expectations, est. 76.0, prior 75.9

- Jan. U. of Mich. 5-10 Yr Inflation, est. 2.8%, prior 2.8%

- Jan. U. of Mich. 1 Yr Inflation, est. 2.9%, prior 2.9%

DB’s Jim Reid concludes the overnight wrap

Welcome to payrolls Friday and if you want a bit of light relief as we draw towards the close of a busy week then note that we have a fancy dress quiz night for parents at my kids’ school tomorrow night and I’m going as Dame Edna Everage. My wife is going to have a field day turning me into her. Why I agreed to this I don’t know and why I’m telling you I don’t know either so please don’t tell anyone. I’m actually hoping some of the younger parents know who she was and don’t just think that’s my normal Saturday night attire.

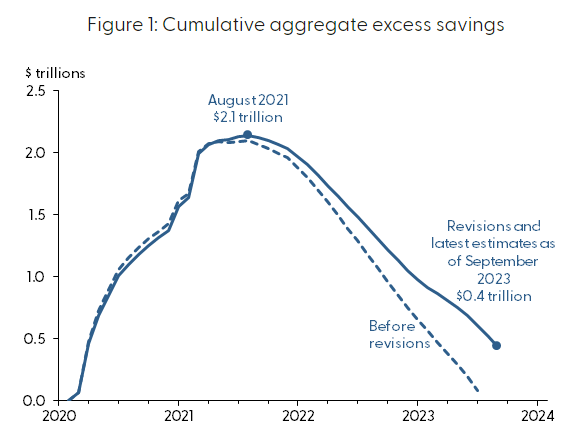

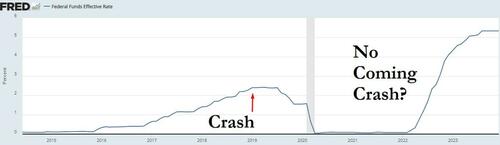

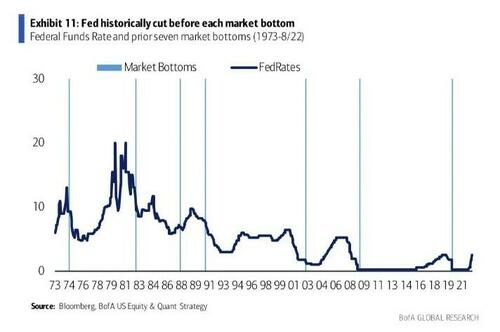

Onto more weighty matters, our recent “ Everything points to a soft landing except… .. history ” pack, suggested that the current US data points to a soft landing (with more evidence yesterday as we’ll see below). However, history cautions that the lags from a hiking cycle are long and variable and regularly have a substantial sting in their tail. Often these come from an unforeseen event. Clearly in this cycle, the Regional Bank shock was dealt with aggressively by the Fed last year. However this was mainly helping them out with high quality assets (e.g. treasuries and MBS) that had been (and still are) marked down. Although the BTFP ends in March, the market generally would expect the Fed to do something similar if the need arose and therefore are less likely to force them to. However if the next round of problems covered CRE then could the Fed really intervene as quickly or as easily given a more challenging moral hazard issue? Underwater CRE which could be impaired is a very different proposition to underwater Treasuries.

We’re clearly some way from that at the moment but it’s worth highlighting that the latest attack on US regional banks is more for fear of potential credit losses than the mark to market losses of high quality securities of last year, which could be more easily mitigated via liquidity measures. On a related theme, it will be interesting to see the Fed’s SLOOS on Monday to see whether banks have continued to loosen conditions relative to what are still very tight lending standards to the wider economy and CRE.

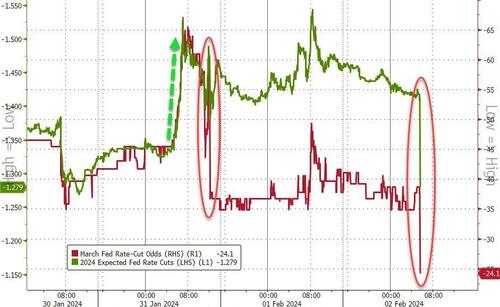

Notwithstanding a second day of US Regional Bank losses (-2.28%), the S&P 500 roared back last night to close +1.25%, reversing most of Wednesday’s -1.61% decline. The market shrugged off the continued concerns over New York Community Bancorp, which fell a further -11.1% (-44.6% over 2-days) after news the previous evening that Moody’s had placed their credit ratings on review for a downgrade. The S&P 500 bank index was down -1.38% (-3.34% over 2-days). But overall, equities seemed to respond to the data whereas the bond market saw a flight to quality as 10yr US yields fell -3.2bps to 3.88%. Overnight in Japan it’s been a similar story, with Aozora Bank currently the worst performer in the Nikkei with a further -15.55% decline, but the Nikkei as a whole is still up +0.70%. Meanwhile, March Fed Funds futures are pricing in a 38% chance of a cut this morning, up from 35% after the FOMC influenced close on Wednesday.

As all that was going on, we then heard from Apple, Amazon and Meta after the close. All three beat earnings estimates, with a mixed but overall positive reaction in extended trading. Meta saw a stunning gain (of c. 15%) after hours, as its revenue guidance for Q1 came in clearly above analysts’ expectations, and the company announced additional share buybacks and its first ever dividend. Amazon gained 7%, also posting a strong profit outlook for Q1. This is despite its sales guidance for Q1 actually coming in a touch below estimates, and investors appeared to reward both companies for their cost control efforts. By contrast, Apple’s shares were down close to 3% in after-hours trading, with a deepening sales slump in China taking the shine off what was otherwise a modest beat. Prior to the results, the Magnificent Seven outperformed yesterday, gaining +1.59%. This morning, NASDAQ 100 futures are trading up +0.99%, and those on the S&P 500 are up +0.54%.

Talking of Apple, they are due to release their Vision Pro headset today. We conducted a survey of over 3,300 consumers to assess their perceptions and readiness for AR, VR, and the metaverse which should give you an idea of how ready consumers are for the next round of technology to be launched from the Magnificent Seven. See the full chartbook on the Metaverse, AR, & VR just published by Marion Laboure and Cassidy Ainsworth Grace here.

Looking forward now, the main highlight today will be the US jobs report for January, which will be one of the first pieces of hard data that covers 2024. Our US economists are looking for a +200k (consensus +185k) rise in nonfarm payrolls, and for unemployment to rise a tenth to 3.8% (in line with consensus). Remember as well that this report is set to see more substantial revisions than usual, since it’s the annual benchmark revision that can affect the numbers throughout the entirety of 2023, and not just the previous two months. It’ll also be an important print when it comes to the timing of rate cuts from the Fed, with March still in the balance regardless of what Powell said 36 hours ago.

Before the jobs report, there was some good news from the ISM manufacturing print, which rose to a 15-month high of 49.1 (vs. 47.2 expected). And on top of that, growth in nonfarm productivity surpassed expectations in Q4, coming in at an annualised rate of +3.2% (vs. +2.5% expected). So that added to the sense that a soft landing was increasingly likely, and it meant the Atlanta Fed’s latest GDPNow estimate for Q1 now stands at an annualised growth rate of 4.2%. The main point of weakness was in the weekly initial jobless claims, which rose to 224k (vs. 212k expected) in the week ending January 27, whilst continuing claims were up to 1.898m (vs. 1.839m expected) in the week ending January 20, the second highest reading since November 2021.

Over in the Euro Area, the main news came on the inflation side, as the flash CPI release for January came in a bit higher than the consensus had expected. That showed headline CPI only fell by a tenth to +2.8% (vs. +2.7% expected), and core CPI also fell a tenth to +3.3% (vs. +3.2% expected). To be fair, that’s the lowest core inflation has been since March 2022, but the slower decline has added to questions about how soon the ECB will actually be able to cut rates. At the same time, we also heard that the Euro Area unemployment rate had remained at 6.4% in December, matching its joint-lowest since the single currency’s formation. These releases saw pricing of a March cut by the ECB decline from 23% to 17%, and overnight it’s down to 16%.

Here in the UK, the Bank of England announced their latest policy decision yesterday, where they left rates unchanged as expected. There were a few elements of ongoing hawkishness in the decision. In particular, the BoE’s latest inflation forecasts showed inflation above target during H2 2024 and 2025, based on market rate expectations. So the implication was that the amount of cuts priced in would keep inflation too high in the years ahead. Moreover, even as 6 of the 9 committee members voted to hold rates, 2 preferred another 25bp hike, whilst 1 voted for a 25bp cut. BoE Governor Bailey also said that they “need to see more evidence that inflation is set to fall all the way to the 2% target, and stay there, before we can lower interest rates”.

But as with the Fed the previous day, there was a growing sense of a gradual shift towards considering rate cuts. Notably, the summary dropped the earlier explicit tightening bias, instead saying that the “MPC remained prepared to adjust monetary policy as warranted “ and adding that it “will keep under review for how long Bank Rate should be maintained at its current level.” In the press conference, Governor Bailey noted that the MPC “won’t leave Bank Rate on hold any longer than we need to”. Markets dialled back the chance of a cut by May, which fell from 77% to 62% by the close, but there was little change in end-24 pricing with over 110bps of cuts priced by the December meeting. Our UK economist continues to see the first rate cut coming in May – see his full reaction here.

When it came to markets in Europe, equities caught up with the post-Fed selloff, and the STOXX 600 (-0.37%) ended its run of 6 consecutive daily gains. Yields also moved lower, although given the CPI print, the declines weren’t as big as the US, with those on 10 yr bunds (-2.0bps), OATs (-0.5bps) and BTPs (-0.5bps) seeing smaller moves. Gilts outperformed, with the 10yr yield down -4.8bps.

Overnight in Asia, there’s been a mixed performance for equities. On the one hand, the KOSPI (+2.76%) has surged this morning, which came as investors expected reforms to the South Korean stock market, which the finance minister announced the previous day. Moreover, the January CPI data surprised on the downside in South Korea, with headline inflation down to +2.8% (vs. +2.9% expected). By contrast, Chinese equities have seen further losses, with the CSI 300 (-0.98%) currently on track to close at a 5-year low, whilst the Shanghai Comp is down -1.25%. Otherwise, the Hang Seng (+0.16%) has posted a modest gain, and the Nikkei is up +0.70%, despite the performance from Aozora Bank (-15.55%).

To the day ahead now, and the main highlight will be the US jobs report for January. Other US releases include factory orders for December, and the University of Michigan’s final consumer sentiment index for January. Central bank speakers include the ECB’s Centeno and the BoE’s Pill. Finally, earnings releases include ExxonMobil and Aon.