Via SchiffGold.com,

In a compelling guest piece by American historian H.A. Scott Trask, various economic myths are scrutinized and debunked through insightful historical analysis. The article delves into #10 prevalent misconceptions, providing a nuanced understanding of economic principles. Similar to other reality-based historians, Trask’s perspective serves as a valuable guide in dispelling lies and fostering a more accurate comprehension of economic truths.

The following article was originally featured on the Mises Institute. The opinions expressed do not necessarily reflect those of Peter Schiff or SchiffGold.

As an American historian who knows something of economic law, having learned from the Austrians, I became intrigued with how the United States had remained prosperous, its economy still so dynamic and productive, given the serious and recurring economic fallacies to which our top leaders (political, corporate, academic) have subscribed and from which they cannot seem to free themselves—and alas, keep passing down to the younger generation.

Let’s consider ten.

Myth #1: The Broken Window

One of the most persistent is that of the broken window—one breaks and this is celebrated as a boon to the economy: the window manufacturer gets an order; the hardware store sells a window; a carpenter is hired to install it; money circulates; jobs are created; the GDP goes up. In truth, of course, the economy is no better off at all.

True, there is a sudden burst of activity, and some persons have surely gained, but only at the expense of the proprietor whose window was broken, or his insurance company; and if the latter, the other policyholders who will pay higher premiums to pay for paid-out claims, especially if many have been broken.

The fallacy lies in a failure to grasp what has been foregone by repair and reconstruction—the labor and capital expended, having been lost to new production. This fallacy, seemingly so simple to explain and grasp, although requiring an intellectual effort of some mental abstraction to comprehend, seems to be ineradicable.

After the horrific destruction of the Twin Towers in September 2001, the media quoted academic and corporate economists assuring us that the government’s response to the attacks would help bring an end to the recession. What was never mentioned was that resources devoted to repair, security, and war-fighting are resources that cannot be devoted to creating consumer goods, building new infrastructure, or enhancing our civilization. We are worse off because of 9-11.

Myth #2: The Beneficence of War

A second fallacy is the idea of war as an engine of prosperity. Students are taught that World War II ended the Depression; many Americans seem to believe that tax revenues spent on defense contractors (creating jobs) are no loss to the productive economy; and our political leaders continue to believe that expanded government spending is an effective way of bringing an end to a recession and reviving the economy.

The truth is that war, and the preparation for it, is economically wasteful and destructive. Apart from the spoils gained by winning (if it is won) war and defense spending squander labor, resources, and wealth, leaving the country poorer in the end than if these things had been devoted to peaceful endeavors.

During war, the productive powers of a country are diverted to producing weapons and ammunition, transporting armaments and supplies, and supporting the armies in the field.

William Graham Sumner described how the Civil War, which he lived through, had squandered capital and labor: “The mills, forges, and factories were active in working for the government, while the men who ate the grain and wore the clothing were active in destroying, and not in creating capital. This, to be sure, was war. It is what war means, but it cannot bring prosperity.”

Nothing is more basic; yet it continues to elude the grasp of our teachers, writers, professors, and politicians. The forty year Cold War drained this country of much of its wealth, squandered capital, and wasted the labor of millions, whose lifetime work, whether as a soldier, sailor, or defense worker, was devoted to policing the empire, fighting its brush wars, and making weapons, instead of building up our civilization with things of utility, comfort, and beauty.

Some might respond that the Cold War was a necessity, but that’s not the question—although we now know that the CIA, in yet another massive intelligence failure, grossly overestimated Soviet military capabilities as well as the size of the Soviet economy, estimating it was twice as large and productive as it really was. The point is the wastefulness of war, and the preparation for it; and I see no evidence whatever that the American people or their leaders understand that, or even care to think about it. An awareness and comprehension of these economic realities might lead to more searching scrutiny of the aims and methods that the Bush administration has chosen for the War on Terror.

Only a few days after 9-11, Rumsfeld declared that the war shall last as long as the Cold War (forty plus years), or longer—a claim the administration has repeated every few months since then—without eliciting the slightest notice or questioning from the media, the public, or the opposing party. Would that be the case, if people understand how much a second Cold War, this time with radical Islam, will cost us in lives, treasure, and foregone comfort and leisure?

Myth #3: The Best Way to Finance a War Is by Borrowing

Beginning with the War of Independence and continuing through the War on Terror, Americans have chosen to pay for their wars by borrowing money and inflating the currency. Adam Smith believed that the war should be financed by a levy on capital. This way the people of the country understand how much the war is costing them, and then can better judge whether it is really necessary. While he conceded that borrowing might be necessary in the early part of a war, before the revenue from war taxes began to flow into the treasury, he insisted that borrowing be kept to a minimum as a temporary expedient only.

Borrowing increases the costs of war in the form of interest. Inflating the currency, which often accompanies massive borrowing, as it did during the War of Independence, the War Between the States, and the War in Vietnam (just to name three), is the worst method of war finance, for it drives up prices, increases costs, enlarges debt, spawns malinvestments and speculation, and worsens the redistributive effects of war spending.

In 1861, the Lincoln administration decided that the people of the north would not stand for much taxation, and that it would increase the already considerable opposition to the southern war. According to Sumner, the financial question of the day was “whether we should carry on the war on specie currency, low prices, and small imports, or on paper issues, high prices, and heavy imports?” The latter course was chosen, and the consequences were a national debt that soared from $65 million in 1860 to $27 thousand million ($2.7 billion) in 1865, and a massive redistribution of wealth to federal bondholders.

In 1865, the financial question recurred. It was: “Shall we withdraw the paper, recover our specie [gold and silver coin], reduce prices, lessen imports, reduce debt, and live economically until we have made up the waste and loss of war, or shall we keep the paper as money, export all our specie which had hitherto been held in anticipation of resumption, buy foreign goods with it, and go on as if nothing had happened?”

The easy route was taken again (specie payments were not resumed until 1879, fourteen years later, and almost twenty years after the 1861 suspension) and the consequences were an inflation-driven stock market and railroad boom that culminated in the panic of 1873, the failure of the House of Cook, and the Great Railway Strike of 1877, the first outbreak of large-scale industrial violence in American history.

Myth #4: Deficit Spending Benefits the Economy and Government Debt

Three years ago, when then treasury secretary Paul O’Neill objected to the Bush administration’s policy of guns, butter, and tax cuts he was told by the vice president, Dick Cheney, that, “deficits don’t matter.”

Of course, they don’t matter—to him, but they matter to the country. John Maynard Keynes’s prescription for curing a recession included tax cuts and increased government spending. “We are all Keynesians now” should be the new motto inscribed on the front of the Treasury building in Washington.

However, Keynes taught that once the recession was over government spending should be reduced, taxes increased, and the deficit eliminated. Current American policy is to continue deficit spending after the recession is over, and to borrow in peace as well as war. One longstanding criticism of such policies is that government borrowing “crowds out” private investment, thus raising interest rates.

In an era when credit creation is so easy, and interest rates remain low despite massive deficits reaching $500 billion per annum, economists no longer take this objection seriously. Another criticism is that an accumulating debt saddles future generations with a heavy burden, which is both unfair and detrimental to future growth. Once again, economists and politicians regard this objection as groundless. They reason that future generations derive benefits from deficit expenditures—greater security, more infrastructure, improved health and welfare—and that since the principal need never be paid, it is not much of a burden anyway.

They are wrong. By avoiding having to increase taxes, borrowing hides the price to be paid for increased government spending (the destructive diversion of capital and labor from private pursuits to government projects), and defuses potential public opposition to new or expanded government initiatives, here and abroad. It is thus both unrepublican and anti-democratic.

Second, depending on how long the redemption of the principal is deferred, accumulating interest payments can double, triple, quadruple, . . . the cost of the initial expenditure (This country has never yet discharged its Civil War debt!) Third, interest payments represent a perpetual income transfer from the working public to the bondholders—a kind of regressive tax that makes the rich, richer and the poor, poorer. Finally, the debt introduces new and wholly artificial forms of uncertainty into financial markets, with everyone left to guess whether the debt will be paid through taxes, inflation, or default.

Myth # 5: Government Policies to Promote Exports Are a Good Idea

The fallacy that government is a better judge of the most profitable modes of directing labor and capital than individuals is well illustrated by exporting policies. In the twentieth century, the federal government has sought to promote exports in various ways. The first was by forcing open foreign markets through a combination of diplomatic and military pressure, all the while keeping our own markets wholly or partially closed. The famous “open door” policy, formulated by Secretary of State John Hay in 1899 was never meant to be reciprocal (after all, he served in the McKinley administration, the most archly protectionist in American history), and it often required a gun boat and a contingent of hard charging marines to kick open the door.

A second method was export subsidies, which are still with us. The Export-Import Bank was established by Roosevelt in 1934 to provide cash grants, government-guaranteed loans, and cheap credit to exporters and their overseas customers. It remains today—untouched by “alleged” free market Republican administrations and congresses.

A third method was dollar devaluation, to cheapen the selling price of American goods abroad. In 1933, Roosevelt took the country off the gold standard and revalued it at $34.06, which represented a significant devaluation. The object was to allow for more domestic inflation and to boost exports, particularly agricultural ones, which failed; now Bush is trying it.

A fourth method, tried by the Reagan administration, was driving down farm prices to boost exports, thereby shrinking the trade deficit. The plan was that America would undersell its competitors, capture markets, and rake in foreign exchange. (When others do this it is denounced as unfair, as predatory trade.) What happened? Well, it turned out that the agricultural export market was rather elastic. Countries like Brazil and Argentina, depending on farm exports as one of their few sources of foreign exchange, which they desperately needed to service their debt loads, simply cut their prices to match the Americans. Plan fails.

But it got worse: American farmers had to sell larger quantities (at the lower prices) just to break even. Nevertheless, although the total volume of American agricultural exports increased, their real value (in constant dollars) fell—more work, lower profits. Furthermore, farmers had to import more oil and other producer goods to expand their production, which worsened the trade deficit. Then, there were the unforeseen and deleterious side-effects. Expanded cultivation and livestock-raising stressed out and degraded the quality of the soils, polluted watersheds, and lowered the nutritional value of the expanded crop of vegetables, grains, and animal proteins.

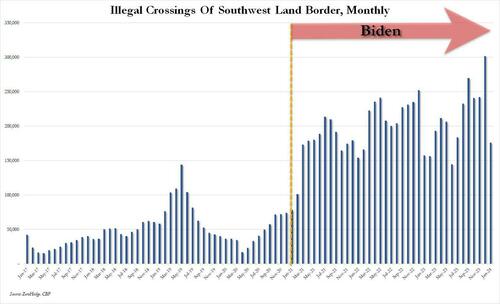

Finally, the policy of lower price/higher volume drove many small farmers, here and abroad, off the land, into the cities, and across the border, our border. Here is an economic policy that not only failed in its purpose but worsened the very problem it was intended to alleviate, and caused a nutritional, ecological, and demographic catastrophe.

Myth #6: Commercial Warfare Works

Sumner pointed out that the Americans declared their political independence, they had not entirely freed themselves from the fallacies of mercantilism. Mercantilists believed that government should both regulate and promote certain kinds of economic activity, the economy being neither self-regulating, nor capable of reaching maximum efficiency if left alone. Thus, in their struggle for independence, the Americans turned to two dubious policies: commercial warfare; and inflationary war finance.

I won’t rehash the history of the depreciating Continental—which led to the confiscation of property without adequate compensation, defrauded creditors, impoverished soldiers and sailors, price controls, a larger war debt—but I will point out what Sumner so amply demonstrated in his financial history of the Revolutionary War: the commercial war harmed the Americans far more than the British.

In the eighteenth and nineteenth centuries, commercial war took the form of boycotts and embargoes. The idea was that by closing our markets to British goods, or by denying them our exports, agriculture and raw materials, we could coerce them, peacefully, into changing their policies. This policy worked only one time, helping to persuade the British to repeal the Stamp Act of 1765; but each time thereafter it was tried it only antagonized them and led to some form of retaliation. In 1774–75, on the eve of war, the Americans stood in desperate need of supplies to prepare for war, and the English offered the best goods at the best prices.

By refusing to trade, hoping to coerce the British into abandoning their own Coercive Acts, the Americans began the war suffering from a supply shortage, which only grew worse; after a few years of war, they found themselves under the necessity of trading with the enemy, which was carried on through the Netherlands and the West Indian islands of Antigua and St. Eustatius. President Jefferson’s embargo of 1807–09 was a complete fiasco. Not only did it fail to accomplish its purpose of forcing the British and French to respect our neutral commerce; it devastated the New England economy, which was dependent on commerce and ship-building, hurt southern planters (who could no longer export), reduced federal tariff revenue, and drove the New England states to the brink of secession.

Myth #7: The Late Nineteenth Century was an Era of Laissez-Faire Capitalism

Certainly, the late nineteenth century was not an era of laissez-faire, despite the stubborn and persistent myth to the contrary. True, there were few government regulations on business, but high tariffs, railroad subsidies, and the national banking system prove that the government was no neutral bystander. Sumner more accurately termed it the era of plutocracy, in which politically organized wealth used the power of the state for selfish advantage.

He also warned, “Nowhere in the world is the danger of plutocracy as formidable as it is here.” For these indiscretions, the manufacturing and bond-holding hierarchy tried to get him kicked out of Yale, where they thought he was poisoning the minds of their sons with free trade heresies. Only during two periods since 1776 has the government mostly left the economy alone: during the early years of the federal republic; and in the two decades previous to the Civil War. The political economist Condy Raguet called the first period of economic freedom, from 1783 to1807, “the golden age” of the republic: Trade was free, taxes were low, money was sound, and Americans enjoyed more economic freedom than any other people in the world. Sumner thought the years from 1846 to1860—the era of the independent treasury, falling tariffs, and gold money—was the true “golden age.”

(Historians consider the presidents during this last period—Fillmore, Pierce, and Buchanan—as among the worst we have ever had. Yet, from 1848–1860, the country was at peace, the economy prosperous, taxes low, money hard, and the national debt was shrinking. This tells us how historians define political greatness.

Myth #8: Business Corporations Favor a Policy of Laissez-Faire

Never in the history of our country have corporations, Wall Street financiers, bond holders, and other large capitalists, as a class or interest, favored a policy of economic liberty and nonintervention by government. They have always favored some form of mercantilism. It is surely significant that the second Republican Party, founded in Michigan in 1854, was funded and led by men who wished to overthrow the libertarian desideratum of the 1840s and 50s. Of course there have been exceptions.

The merchants and ship-owners of maritime New England put up a good fight for free trade and sound money in the early years of the republic, and the New York City bankers in the nineteenth century were conservative Democrats who supported free trade, low taxes, sound money, and the gold standard. But these were exceptions. Consider the testimony of William Simon, who was Secretary of the Treasury under Nixon:

I watched with incredulity as businessmen ran to the government in every crisis, whining for handouts or protection from the very competition that has made this system so productive. I saw Texas ranchers, hit by drought, demanding government-guaranteed loans; giant milk cooperatives lobbying for higher price supports; major airlines fighting deregulation to preserve their monopoly status; giant companies like Lockheed seeking federal assistance to rescue them from sheer inefficiency; bankers, like David Rockefeller, demanding government bailouts to protect them from their ill-conceived investments; network executives, like William Paley of CBS, fighting to preserve regulatory restrictions and to block the emergence of competitive cable and pay TV.

And always, such gentlemen proclaimed their devotion to free enterprise and their opposition to arbitrary intervention into our economic life by the state. Except, of course, for their own case, which was always unique and which was justified by their immense concern for the public interest.

During the nineteenth century, those who clamored loudest and most effectively for government intervention in the economy were businessmen; of course farmers sometimes did so as well. Businessmen sought promotional policies in the form of protective tariffs, a national bank, and public funding of “internal improvements,” such as turnpikes, bridges, and canals. By the 1820s, proponents of this program called it “the American System,” with Senator Henry Clay of Kentucky its most prominent champion. Raguet more accurately referred to it as the “British System.” Clay ran for president on this platform three times, and lost three times (1824, 1832, and 1844). His protégé, Abraham Lincoln, learned from this experience, and so when he ran for president in 1860, hoping to implement the same program, he rarely mentioned it; instead, he promised to save the western territories from the blight of slavery and to overthrow the “slave power”—political camouflage that worked brilliantly.

The American System was an egregious form of redistributive special-interest politics. It enriched Louisiana sugar planters, Kentucky hemp growers, New York sheep herders, Pennsylvania iron mongers, New England textile magnates, canal companies, and railroad corporations—all at the expense of planters, farmers, mechanics, and consumers. The antebellum protectionist movement reached its apogee with the tariff of 1828, doubling tax rates on dutiable imports to an average of 44 percent in 1829 and 48 percent the next year.

At the time, Raguet calculated that the average American worked one month a year just to pay the tariff. To his readers, who paid no direct federal taxes at all, nor any excise taxes, this figure was shocking. In 1830, tax-freedom day was the first of February; today it is in June, rendering our tax burden five times greater.

Another income transfer was affected by the vicious banking system of the time, under which incorporated bankers, without capital, charged interest for lending out pieces of paper and deposit credit, which cost them nothing except the cost of printing. Some libertarians have contended that this was the era of free banking. It was nothing of the sort. Bankers were protected under the shield of limited liability and, during financial panics and bank runs, by special laws authorizing the suspension of specie payments—when they refused their contractual obligation to pay specie for their notes.

And their paper was accepted by the federal and state governments; whether one was buying land, paying import duties, purchasing a bond, or buying bank stock, for the government, bank paper was as good as gold. These plutocratic measures thus effected a redistribution of wealth, long before the emergence of socialism. Sumner said that the plutocrats of his own postbellum era (manufacturers, railroad barons, national bankers, and federal bond holders) were “simply trying to do what the generals, nobles, and priests have done in the past—get the power of the State into their hands, so as to bend the rights of others to their own advantage.” The plutocrats of today are still at it, even more successfully, with almost no opposition.

Myth #9: Hamilton Was Great

Another myth is that the financial genius and economic statesmanship of Alexander Hamilton saved the credit of the infant United States and established the sound financial and economic foundation essential for future growth and prosperity. Ron Chernow’s hagiographic biography of Hamilton is now moving up the best seller charts, cluttering the display tables of Borders and Barnes & Noble, and taking up time on C-Span’s Booknotes; but its greatest contribution will be to perpetuate the Hamilton myth for another generation.

Sumner’s concise and devastating biography of that vainglorious popinjay, written over a hundred years ago, remains the best. He closely studied Hamilton’s letters and writings, including the big three—his Report on the Public Credit (1790), Report on a National Bank (1790), and Report on Manufactures (1791)—and came to three conclusions: first, the New Yorker had never read Smith’s Wealth of Nations (1776), the most important economic treatise written in the Anglo-American world in that period; second, he was a mercantilist, who would have been quite at home serving in the ministry of Sir Robert Walpole or Lord North; and third, Hamilton believed many things that are not true—that federal bonds were a form of capital; that a national debt was a national blessing; that the existence of banks increased the capital of the country; that foreign trade drained a country of its wealth, unless it resulted in a trade surplus; and that higher taxes were a spur to industry and necessary because Americans were lazy and enjoyed too much leisure.

The idea here was that if you taxed Americans more, they would have to work harder to maintain their standard of living, thus increasing the gross product of the country and providing the government with more revenue to spend on grand projects and military adventures. Hamilton was once stoned by a crowd of angry New York mechanics. Is it any wonder why?

Myth #10: Agrarianism or Industrialism: We Must Choose

Historians teach that Americans in the 1790s and 1800s had two economic choices—Hamilton and the Federalists who believed in sound money, banking, manufacturing, and economic progress, and the Jeffersonians who believed in inflation, agrarianism, and stasis. This is a gross simplification. Not all Federalists were Hamiltonian; many despised him. Hamilton dogmatically believed that the United States should become a manufacturing nation like England and that it was the duty of the federal government to bring this about by promotional policies. Jefferson, on the other hand, oscillated between liberalism and agrarianism. At his best, he was liberal, but for a long time he dogmatically believed that the United States should remain an agricultural nation, and that it was the duty of the federal government to keep it in such a state by delaying the onset of large-scale manufacturing.

Hence, to expand trade, it should fight protectionist powers and hostile trading blocs, acquire more agricultural land through purchase or war, and, after obtaining the requisite amendment, fund the construction of internal improvements to foster the movement of agricultural produce to the seaports.

Thus, Jefferson authored the Louisiana Purchase, the Tripolitan War, the Embargo; and his chosen successor, James Madison, the War of 1812, all designed to fulfill this agrarian vision. As president, Madison became ever-more Hamiltonian, supporting the re-establishment of the Bank of the United States, the raising of tariffs, conscription, and the appointment of nationalists to the Supreme Court. He appointed Joseph Story, which is like Ike appointing Earl Warren, or Bush appointing Souter. Meanwhile, in retirement, Jefferson advocated manufacturing to achieve national economic self-sufficiency.

Why Not Freedom?

Besides industrialism and agrarianism, there was a third position—call it liberalism, or laissez-faire—which maintained that the government should promote neither manufacturing nor agriculture, but leave both alone, to prosper or not, expand or recede, according to the unerring guides of profitability, utility, individual choice, and economic law. Inspired by the writings of Adam Smith and David Ricardo, but even more those of the French radical school of Turgot, Say, and de Tracy, whose mottos laissez nous faire (leave the people alone) and ne trop gouverneur (do not govern too much) captured the essence of good government.

Outstanding representatives of this liberal philosophy were the young Daniel Webster, who made his reputation for oratory with fiery speeches on behalf of free trade, hard money, and state rights as a New Hampshire congressman, and the great John Randolph of Virginia, who broke with Jefferson over the embargo and opposed the War of 1812, losing his seat as a consequence, and Condy Raguet, the influential political economist, who was the first American to develop a monetary theory of the business cycle, which he did in response to the panic of 1819. Laissez-faire was the cause of those who opposed plutocracy and supported the people. It represented both the moral high ground and sound economic reasoning.

Conclusion

When he was writing his masterful History of American Currency, Sumner grappled with the question of how North America had withstood levels of inflation and indebtedness that would have ruined any European country. His answer:

“The future which we discount so freely honors our drafts on it. Six months [of] restraint avails to set us right, and our credit creations, as anticipations of future product of labor, become solidified.”

In other words, the country was so productive that the losses engendered by these excesses were quickly made up. He went on:

“We often boast of the resources of our country, but we did not make the country. What ground is there for boasting here?

The question for us is: What have we made of it? No one can justly appreciate the natural resources of this country until, by studying the deleterious effects of bad currency and bad taxation, he has formed some conception of how much, since the first settlers came here, has been wasted and lost.”

The unseen again. Let us begin with geography and resources, to which Sumner alludes. The lower 48 states are entirely in the temperate zone. Apart from the desert states of the southwest, all receive ample rainfall. Most of the land is fertile, and it is abundant. The country teems with natural resources.

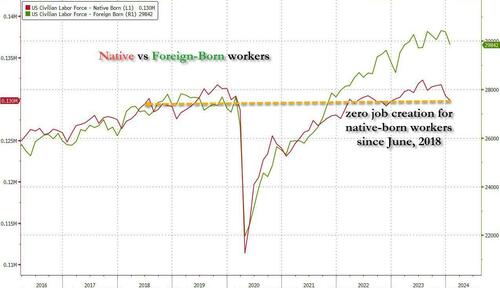

Then there are the people. Until very recently, the United States enjoyed a low density of population, which meant high wages and low land prices. And for centuries, the population has been one of the hardest working in the world, creating an infrastructure to build on. Then there is the culture. Largely because of the influence of Christianity, the debilitating sin of envy has no social standing here, unlike the Third World where it is perhaps the chief impediment to wealth-creation and development.

Also, for the same reason, there is little bribery, which also impedes growth. Finally, there is the tradition of law, respect for private property, tradition of profit, and contractual freedom. These institutions—and not the fallacious ideas, corrupt institutions, and bad policies named above—form the core of American prosperity.