Early in the spring of 1956, only weeks after Elvis Presley released his debut studio album, and actress Norma Jean Mortenson had her name legally changed to Marilyn Monroe, a budding 25-year-old businessman from the American Midwest fatefully registered his first-ever company.

His name, of course, was Warren Buffett. And the company he founded was called Buffett Associates– which was formed with $105,000 of capital from his friends and family.

The US economy at the time was absolutely booming. Interest rates in 1956 were at historic lows. Inflation was practically zero. Economic growth was a dizzying 7%. Productivity growth was strong.

The US was no longer at war. And the national debt– which had reached a peak of 120% of GDP in the 1940s due to the costs of World War II– had been cut in half… and was falling further each year.

America was proudly capitalist, and the government actually made sound and effective investments, like the US federal highway system. Businesses reaped the benefits: corporate earnings across the S&P 500 index soared.

Yet, at the time when Buffett formed his business in 1956, stocks were still cheap… trading at less than 12x earnings (versus nearly 30x today).

It’s hard to imagine better economic or market conditions: a high growth, capitalist economy with low inflation, low debt, high productivity, and cheap stocks? Buffett could have hardly picked a better time to get started.

And, although there were plenty of ups and downs along the way, those pristine conditions lasted throughout the first several decades of his career.

Buffett is obviously one of the most talented investors to have ever lived, and he surrounded himself with other incredibly talented people.

But (and he would probably be the first to admit) his success would not have been as great without the power and dynamism of the US economy behind him.

And this is why Warren Buffett has long been one of America’s biggest economic cheerleaders.

Over the past 15+ years, Buffett has had an insider’s view of some very concerning trends. The US national debt has been rising out of control. The Federal Reserve has made a mess of the dollar. Woke fanatics have hijacked capitalism.

Yet through it all, Buffett has maintained a calm, persistent optimism in America; he routinely dismisses concerns over the debt, or the dollar, or the future of the US economy, and has seemed to believe that nothing could ever derail American progress.

But as I read through his annual letter this past weekend, it seems that even Buffett’s legendary optimism is starting to crack.

First, it’s clear that even Buffett thinks that government regulation has gone way too far.

Buffett explains, for example, that utility companies were “once regarded as among the most stable industries in America” because of their consistent profitability.

Yet he laments that the utility companies he acquired were a “severe earnings disappointment” in 2023 due to over-regulation from fanatical politicians.

Buffet complains that “the regulatory climate in a few states has raised the specter of zero profitability or even bankruptcy (an actual outcome at California’s largest utility and a current threat in Hawaii).”

“In such jurisdictions,” he writes, “it is difficult to project both earnings and asset values in what was once regarded as among the most stable industries in America.”

In the end, he tells shareholders that he “did not anticipate or even consider the adverse developments in regulatory [changes] and . . . made a costly mistake in not doing so.”

He goes on to talk about America’s dilapidated infrastructure, which is in critical need of maintenance and reinvestment. And Buffett cites the case of BNSF Railway (the largest freight rail in the US) which he acquired in 2009.

BNSF, he explains, has had to spend tens of billions of dollars to fix up its rail network “simply [to] maintain its present level of business. This reality is bad for owners. . .”

But it’s not just BNSF. And it’s not just railways. Almost ALL infrastructure in the US is in serious need of repair.

Obviously, the US government made a halfhearted attempted to address infrastructure challenges when it passed a $1 trillion investment package in 2021. But “the consequent capital expenditure” that’s truly required to fix it, Buffett writes, “will be staggering.”

One final point worth mentioning is Buffett’s comments on size. Again, when he started his first partnership in 1956, he only had $105k to invest, and he could move nimbly in and out of the market.

Today, Buffett’s company has almost $170 billion in cash, which is virtually impossible to manage efficiently. He writes that it’s “like turning a battleship”, and that the days of being quick and nimble “are long behind us; size did us in…”

Buffett, of course, is talking about his own company (Berkshire Hathaway). But the same could just as easily be said for the US government.

Think about it– if someone of Buffett’s extraordinary talent admits that he cannot efficiently deploy $170 billion, how are Joe Biden or Transportation Secretary Pete Buttigieg supposed to be able to invest that $1 trillion infrastructure money?

Quite poorly, I’d imagine.

Buffett does acknowledge that “America has been a terrific country for investors.” And he’s absolutely right. It still is, for the most part.

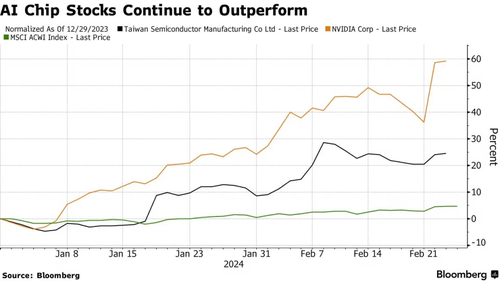

Nvidia is an easy example: it simply would not have been able to achieve the same level of success had it been based in most other countries. If Nvidia were a Chinese company, for example, it would have been taken over by the CCP long ago, and CEO Jensen Huang would have probably been disappeared.

But one of the most important caveats of investing applies to the US economy as well: “past performance does not guarantee future results.”

Warren Buffett enjoyed some of the most pristine economic conditions imaginable for the vast majority of his nearly 70-year career. And as I have written several times, it is absolutely possible that America’s best days are still ahead.

There is clearly a future scenario in which small-scale nuclear reactors generate clean, low-carbon, ultra-cheap energy which powers highly productive AI and robotic automation. Economic growth is off the charts, and tax revenue soars as a result. The national debt eventually melts away, and the US re-establishes its primacy by out-producing and out-innovating the competition.

But at the moment there are serious issues to contend with.

US productivity is anemic. So is economic growth. War, inflation, cyberattacks, border crisis, social conflict, the rise of adversary nations, decline of the US dollar’s dominance, etc. are all pervasive challenges.

(Not to mention potential near-term consequences– like the impact of Russia, China, North Korea, and terrorist groups sending so many of their operatives across the southern border.)

The government not only isn’t fixing these problems, but they seem to be making them worse by the day.

So, it’s important to take notice when even someone as optimistic as Buffett starts complaining.

Source

from Schiff Sovereign https://ift.tt/jBwI6rs

via IFTTT