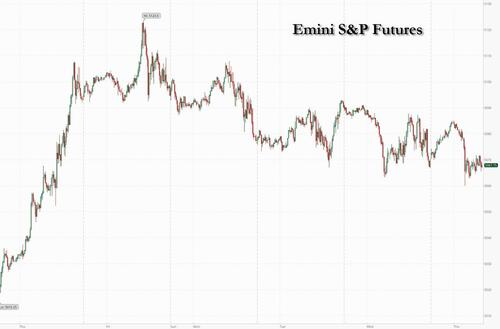

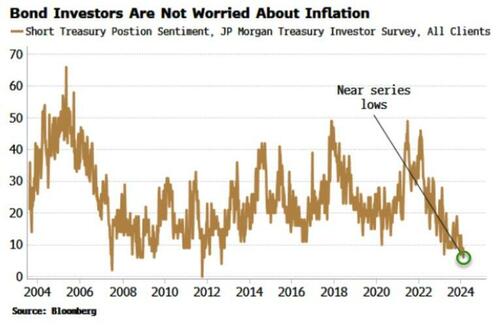

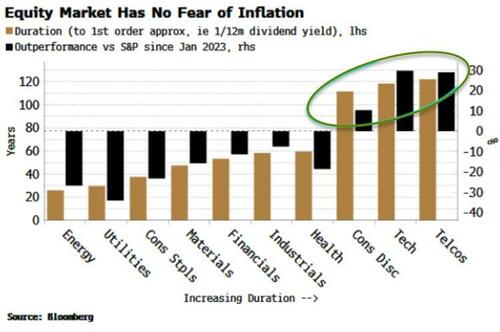

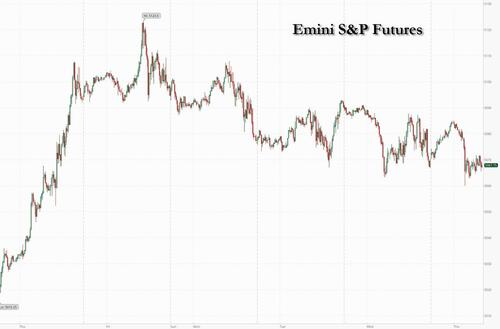

For the third day in a row, US equity futures dropped and bonds fell as investors braced for a print of the Federal Reserve’s favorite inflation metric, which will help identify the path forward for interest rates. As of 7:45am, futures contracts for the emini S&P 500 and the Nasdaq 100 both retreated by about 0.2%, off the worst levels of the session. European stocks fluctuated during another crowded day on the earnings calendar, while Asia closed modestly higher. MegaCaps are mixed with NVDA -1.3% and AAPL -0.7%, the largest movers pre-mkt. Bond yields are up 3-6bps as the yield curve bear flattens; the US Dollar is weaker while the yen holds most of the advance spurred by strongest signal yet from Bank of Japan that the end is near for its negative interest-rate policy. The commodity complex is also lower; oil is flat, while bitcoin continues to surge and was last seen around $63,000. Today’s macro data focus includes PCE/Core PCE, jobless claims, and regional activity indicators. While PCE has been de-risked due to the CPI print, there is still potential for volatility given positioning in the bond market. Month-end rebalancing is thought to provide additional pressure on stocks irrespective of PCE.

In premarket trading, cloud software giant Snowflake shares plunge 23% after the company gave a forecast for first-quarter product revenue that is weaker than expected. Analysts noted that the shares were pressured by a combination of CEO Frank Slootman stepping down and a conservative guide. Peers also decline, with MongoDB down 4.2%, and DataDog sliding 3.0%. Elsewhere, WW International, fka as Wight Watchers, shares crasjed 25% after the “health and wellness” company issued full-year revenue guidance that missed expectations. The company also said Oprah Winfrey has decided to not stand for re-election at its annual shareholders meeting in May, having served on the board since 2015. Here are some other notable premarket movers:

- C3.ai (AI US) shares jump 17.58% after the software firm’s third-quarter revenue beat estimates, showing that demand remains robust for its artificial intelligence-related products. Analysts highlighted strength in its subscription revenues, and demand from government clients.

- CRH (CRH US) shares gain 6.3% in New York premarket trading after the building-materials firm reported “excellent” full-year results, according to Davy, with UBS highlighting the firm’s strong growth prospects in 2024.

- Duolingo (DUOL US) shares soar 20% after full-year revenue guidance from the language-learning software company beat expectations, while fourth-quarter earnings per share also surpassed forecasts. A number of analysts lifted their price targets on the stock, noting robust growth in user numbers.

- HP Inc. (HPQ US) shares fall 3.4% after the computer hardware company reported first-quarter results that missed expectations on key metrics amid ongoing weakness in the market for personal computers.

- Macy’s (M US) shares dip 0.6% after the department store chain was downgraded to market perform from outperform at TD Cowen, which said the company’s restructuring plans will take some time to drive upside to guidance.

- Monster Beverage (MNST US) shares advance 5.6% after the energy-drink maker reported fourth-quarter gross margin that beat consensus estimates. Analysts saw the results as solid overall, highlighting the gross margin beat in the quarter, as well as the strong start to the first-quarter.

- Okta (OKTA US) shares rise 29% after the application software company reported fourth-quarter results that beat expectations. Analysts view the results as a relief in the wake of a recent breach.

- Paramount Global (PARA US) shares advance 3.9% after the media company reported results that were seen as mixed, although revenue in its direct-to-consumer (DTC) streaming business beat expectations.

- Salesforce (CRM US) shares fall 1.8% after the application software company gave a full-year revenue forecast that was weaker than expected, though analysts said it could be conservative. It also initiated a dividend of 40c/share and increased the share buyback authorization by $10b.

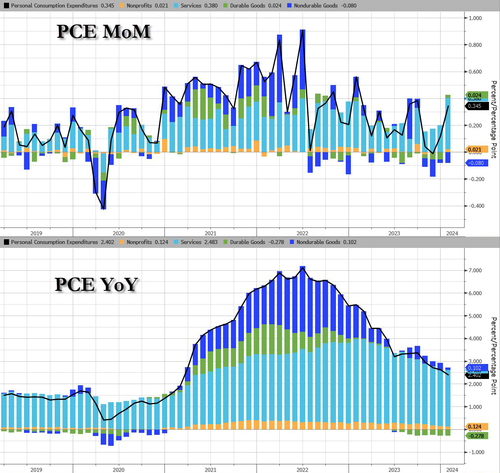

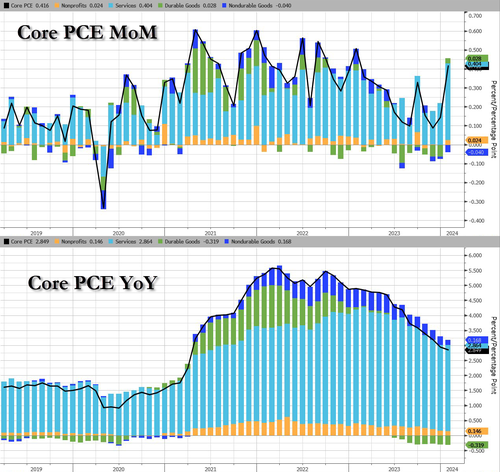

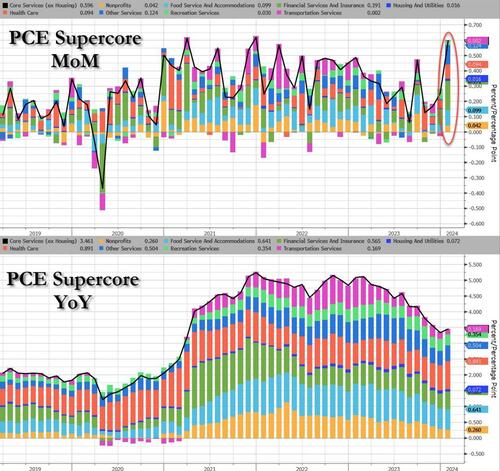

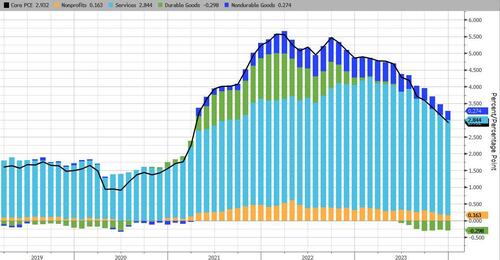

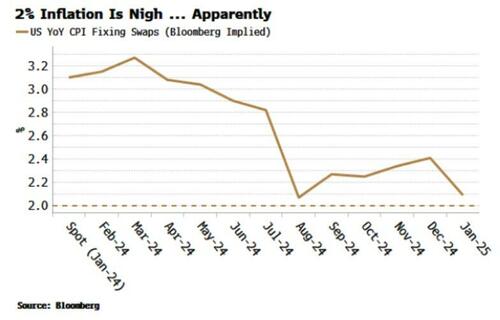

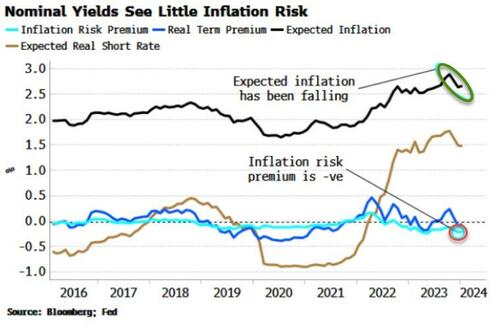

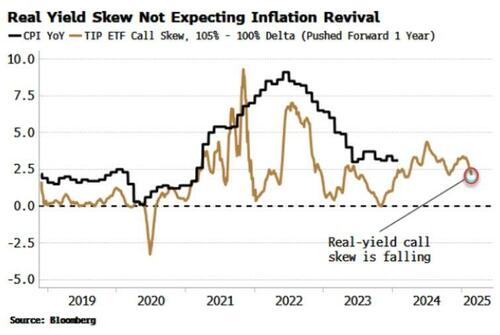

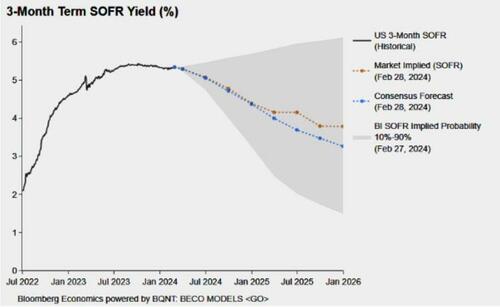

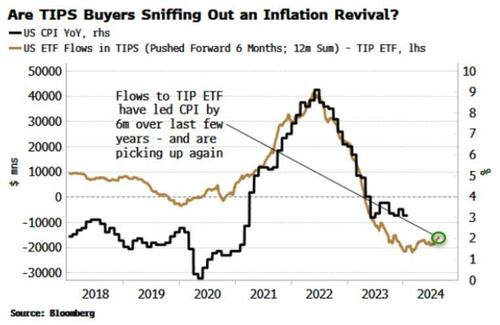

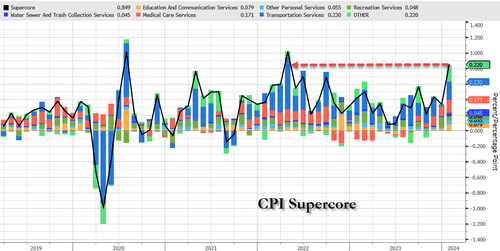

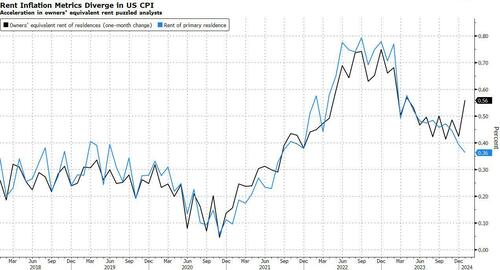

Thursday’s core PCE report, where the core print is expected to rise 0.4% MoM and 2.8% YoY, will likely validate recent commentary from Fed officials showing no rush to ease monetary policy and underscore the twists and turns on the route to the central bank’s 2% inflation target. A higher-than-anticipated reading could undermine expectations for three quarter-point rate cuts by year-end.

“The market always needs to focus on something, and with earnings out of the way and the rates outlook priced in, inflation is the next catalyst,” said Beata Manthey, equity strategist at Citigroup Inc. “It’ll depend on how bad or good the print is today, but when we look at the fundamentals, earnings have shown they’re delivering.”

Stocks are rounding off a strong February, with the S&P 500 and the Nasdaq 100 up more than 4% after excitement around artificial intelligence drove a tech-powered, record-breaking run on Wall Street. MSCI’s global equity index is rising for a fourth month, its longest winning streak since 2021.

For Ulrich Urbahn, head of multi-asset strategy and research at Berenberg, trading on the final day of February is likely to be influenced more by month-end rebalancing than by data, as inflation trends have already been priced into markets following this month’s consumer and producer price reports.

“The focus on PCE ‘because that’s what the Fed cares about’ is valid,” Urbahn said. “But it’s mostly already baked in the cake. Markets will be more affected by some rebalancing flows as equities have hugely outperformed bonds this year.”

New York Fed President John Williams said Wednesday the central bank has “a ways to go,” in its battle against inflation and Atlanta Fed chief Raphael Bostic urged patience in regard to policy tweaks. Meanwhile, traders are currently pricing around 80 basis points of easing by year-end — almost in line with what officials in December indicated as the likeliest outcome. That would equate to three cuts in 2024 — as the Fed moves have historically been increments of 25 basis points. To put things in perspective, swaps were projecting almost 150 basis points of cuts this year at the start of February.

“Fedspeak and economic data so far this week suggest that central bankers remain data-dependent, which raises volatility around key economic data releases, and that inflation seems to be re-accelerating in the short term, which may make it harder to reach the 2% inflation goal,” Kathleen Brooks, research director at XTB, wrote in a note.

European stocks fluctuated during another crowded day on the earnings calendar as traders reduced bets on how fast and far the European Central Bank will lower interest rates this year after a flurry of inflation readings from the region. Moncler SpA rallied after the Italian luxury company beat profit expectations. Air France-KLM slumped after a fourth-quarter loss. The Stoxx 600 added 0.1% with construction, media and retail shares the best performers. Here are the most notable movers:

- Haleon rises as much as 9%, the most since Dec. 2022, after delivering results that were better than feared, following the weak numbers posted by rival Reckitt yesterday

- Universal Music Group gains as much as 6.5%, the most since July, after the Amsterdam-listed music and entertainment group impressed with its fourth-quarter earnings

- Moncler shares rise as much as 6.3%, to the highest since June, after the Italian luxury company reported results that beat estimates

- Eiffage gains as much as 5.4%, the most since March 2022, as Morgan Stanley flags the infrastructure company’s strong cash generation and in-line earnings performance

- AMS-Osram shares plunge 45% after a major customer — believed by analysts to be Apple — canceled the Swiss chipmaker’s key project around microLED

- Howden Joinery rises as much as 8.5%, the most since Dec. 2020, after 2023 results broadly met estimates

- Drax climbs as much as 8.6% after the UK renewable energy company’s results, which analysts say look solid. Morgan Stanley highlights Drax’s long-term guidance and positive impact

- Argenx falls as much as 4.5% after it reported full-year results that analysts said weren’t surprising

- Beiersdorf shares fall as much as 6.1%, their steepest drop since May 2022, after the Nivea maker reported results that RBC described as “disappointing”

- Technip Energies shares reverse an earlier gain to slip as much as 3.6%, after the France-based engineering and technology company posted a 2023 Ebit beat but issued guidance that missed

In FX, the dollar steadied, while the yen was the best-performing G-10 currency, rising 0.4% versus the greenback, the most in more than a week, after Bank of Japan Board Member Hajime Takata sent one of the strongest signals yet that the end is near for its negative interest rate policy.

In rates, Treasury yields rose, with the more policy sensitive two-year note up five basis points. 10-year TSY yields last traded around 4.31% near session high, outperforming gilts by around 3bp in the sector; the UK curve cheaper on the day by as much as 7bp in 5-year sector. Yields in Europe climbed after mixed readings on price pressures from France and Spain, with German inflation coming in on the softer side of expectations (CPI printed 0.4% MoM, vs exp. 0.5%, and 2.5% YoY, vs exp 2.6%). Traders reduced bets on how fast and far the European Central Bank will lower interest rates this year after a flurry of inflation readings from the region – Bloomberg Economics still expect euro-area headline inflation to slow on Friday. Short-end bonds are leading a selloff in European government debt. German two-year yields rise 7bps to 2.99%. IG dollar issuance slate empty so far; seven names priced $14.4b Wednesday, taking weekly volume past $50b; issuers paid about 6bps in new-issue concessions on order books said to be 3.8x oversubscribed. Robust calendar could materialize Thursday if inflation readings are benign. US January personal income and spending data at 8:30am New York time include PCE inflation gauge with potential to alter corresponding outlook for Fed.

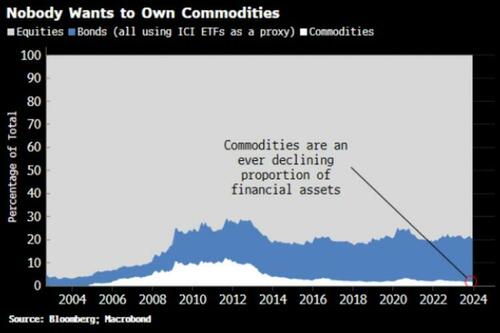

In commodities, oil prices are little changed, with WTI trading near $78.50. Spot gold falls 0.2%. Bitcoin jumps ~3% and is above $62,000.

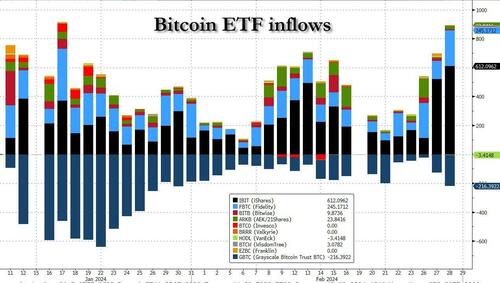

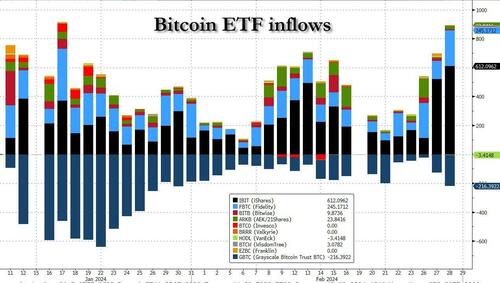

Bitcoin continues to march higher and back above the $62k level, after it was revealed that yesterday’s record volume surge across the ETF sector led to a record net inflows as demand for crypto just won’t slow. Meanwhile, Ether continues to outperform, printing a peak incrementally above USD 3.5k. Elsewhere, Coinbase said all services on Coinbase.com have been restored; after some users reported a zero balance on their accounts.

Looking to the day ahead now, the US economic data calendar includes weekly jobless claims (8:30am), February MNI Chicago PMI (9:45am, three minutes earlier to subscribers), January pending home sales (10am) and February Kansas City Fed manufacturing activity (11am). Fed speakers scheduled include Bostic (10:50am), Goolsbee (11am), Mester (1:15pm, 3:30pm) and Williams (8:10pm). Elsewhere, there’s the February flash CPI inflation prints from Germany and France, along with German unemployment for February, UK mortgage approvals for January, and Canada’s Q4 GDP. From central banks, we’ll hear from the Fed’s Bostic, Goolsbee, Mester and Williams.

Market Snapshot

- S&P 500 futures down 0.3% to 5,065.00

- STOXX Europe 600 little changed at 495.04

- MXAP up 0.4% to 172.73

- MXAPJ up 0.2% to 524.61

- Nikkei down 0.1% to 39,166.19

- Topix little changed at 2,675.73

- Hang Seng Index down 0.2% to 16,511.44

- Shanghai Composite up 1.9% to 3,015.17

- Sensex little changed at 72,263.43

- Australia S&P/ASX 200 up 0.5% to 7,698.70

- Kospi down 0.4% to 2,642.36

- German 10Y yield little changed at 2.49%

- Euro little changed at $1.0847

- Brent Futures down 0.4% to $83.32/bbl

- Gold spot up 0.0% to $2,035.55

- U.S. Dollar Index down 0.16% to 103.81

Top Overnight News

- The Supreme Court’s decision to take up Donald Trump’s bid for immunity from criminal prosecution raises the prospect that a trial to hold him accountable for trying to overturn the 2020 election could face a lengthy delay — potentially until after the November election

- An Illinois judge barred Trump from appearing on the Republican presidential primary ballot, marking the third state to impose such a ban on the former president for his role in the insurrection at the US Capitol on Jan 6.

- Ben Bernanke’s global savings glut is drying up. Long-term interest rates worldwide may be heading higher as a result.

- China banned a top-performing quant fund from the stock-index futures market and vowed tighter oversight of high-speed trading, expanding a crackdown on computer-driven investment strategies that some have blamed for exacerbating market turmoil

- Wall Street traders bracing for key inflation data waded through mixed economic figures and remarks from Federal Reserve speakers for clues on the interest-rate outlook.

Earnings

- Covestro (1COV GY) – Q4 (EUR): adj. EBITDA 132mln (exp. 99mln), Revenue 3.35bln (exp. 3.44bln). Decides not to pay a dividend. Expects economic conditions to remain challenging in 2024. Guides Q1 EBITDA 180-280mln (exp. 204mln). Guides initial FY24 EBITDA 1-1.6bln (exp. 1.36bln), Revenue 14-15bln (exp. 14.7bln). Shares +1.8% in European trade

- IAG (IAG LN) – FY (EUR): Revenue 29.5bln (exp. 29.4bln), adj. Net 2.66bln (exp. 2.29bln), adj. Operating 3.5bln (exp. 3.5bln). 92% booked for Q1 and 62% for H1. Positive outlook for 2024, expect to generate significant cashflow throughout the year. Shares +1.2% in European trade

- MTU Aero (MTX GY) – FY23 (EUR): Adj. Revenue 6.3bln (prev. forecast 6.1-6.3bln), Adj. EBIT 818mln (prev. forecast 800mln), Adj. Net Income 594mln (exp. 600mln). Outlook: FY Revenue 7.3-7.5bln, Adj. EBIT margin 12%. Shares -0.5% in European trade

- Snowflake (SNOW) – Q4 2024 (USD): Adj. EPS 0.35 (exp. 0.18), Revenue 774.7mln (exp. 760.4mln); Q1 product revenue view 745-750mln (exp. 769.5mln), FY25 product revenue view 3.25bln (exp. 3.46bln). (Newswires) Shares -22.8% in pre-market trade

- Salesforce (CRM) – Shares slipped by 1.6% in afterhours trade as it provided light guidance for the FY. Q4 adj. EPS 2.29 (exp. 2.26), Q4 revenue USD 9.29bln (exp. 9.22bln). Increases share repurchase authorisation by USD 10bln. Initiated a common stock dividend of USD 0.40/shr. Sees Q1 adj. EPS between USD 2.37-2.39 (exp. 2.20), and Q1 revenue between USD 9.12bln-9.19bln (exp. 9.19bln); sees FY25 revenue between USD 37.7bln-38.0bln (exp. 38.6bln). Shares -1.8% in pre-market trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were choppy at month-end after the lacklustre handover from the US ahead of PCE price data. ASX 200 eventually shrugged off the initial indecision and briefly climbed above 7,700 to eke a fresh record high. Nikkei 225 briefly dipped below the 39,000 level amid a firmer currency and hawkish comments from BoJ’s Takata, although the index gradually recovered all of its losses in late trade. Hang Seng and Shanghai Comp. were positive with outperformance in the latter which momentarily reclaimed the 3,000 level amid lower yields and after the PBoC voiced support for Shanghai’s high-level opening up financially, while it was also reported that China is to crack down on illegal activity to maintain market order. Conversely, the gains in Hong Kong were limited with earnings on the radar.

Top Asian News

- US limits the sales of Americans’ data to China and other rivals with President Biden signing an executive order restricting the ability of data brokers to sell sensitive information abroad, according to WSJ.

- BoJ Board Member Takata said Japan’s economy is at an inflexion point of changing the ‘norm’ that people think wages and prices are not rising, while he added achievement of the price target is coming into sight despite the uncertainty of the economic outlook. Takata also said need to consider taking a flexible response including exit from monetary stimulus and that momentum is rising in this spring’s wage talks with many companies offering higher-than-2023 wage hikes. BoJ Board Member Takata later stated that he would call for a gear shift in policy and not go backwards but added he has not made up his mind yet on a monetary policy decision when asked about whether to end negative interest rates in March or April, while he is not thinking of raising interest rates one after another and said gradual steps will be needed amid mixed circumstances surrounding small firms.

- RBNZ Governor Orr said as aggregate demand has slowed, it has been harder to pass on cost increases and he is confident the current level of the OCR is restricting demand, while the inflation outlook is very balanced. Orr said the economy has developed as they expected and the latest data confirmed inflation is slowing, while he added the easing of interest rates won’t happen anytime soon.

European bourses, Stoxx600 (+0.1%) are mixed and trade has remained rangebound throughout the session; the DAX 40 (+0.4%) outperforms, and continues to trade towards/at ATHs. European sectors are mixed; Construction & Materials takes the top spot, lifted by gains in CRH (+7.3%) post-earnings. Tech is found at the bottom of the pile, with many of the chip names continuing to underperform. US Equity Futures (ES -0.3%, NQ -0.3%, RTY +0.1%) are mostly lower, with trade continuing the downbeat price action seen in the prior session. In terms of individual movers, Salesforce (-1.9%) slipped on its results, which although reported strong metrics, its FY25 guidance missed analyst expectations.

Top European News

- ECB’s Vasle said the ECB is looking at a rate-cutting phase if there are no big surprises and the timing of cuts depends on inflation.

- ECB will continue to put a ‘floor’ underneath market interest rates in the years ahead, though banks will have a greater role in determining how much liquidity they want, via Reuters citing sources.

- UK appoints Clare Lombardelli as the the next BoE Deputy Governor for monetary policy; replaces Broadbent who leaves at the end of June.

- ECB’s Holzmann says a serious discussion at the ECB on rate reductions is unlikely before June, via Politico [published Feb. 28th]

FX

- DXY is a touch softer as a by-product of JPY strength. DXY has ventured to a low of 103.75, stopping shy of the 200DMA at 103.69 and yesterday’s low at 103.60. The fate for the index today will almost certainly be determined by US PCE metrics.

- EUR marginally gains vs. the USD amid a slew of EZ data with (on balance) firmer regional CPIs taking focus ahead of tomorrow’s EZ-wide metrics. EUR/USD mounted yesterday’s best at 1.0840.

- JPY is the standout outperformer across the majors following “hawkish” BoJ comments overnight. This has given JPY some reprieve with USD/JPY pulling back to a low of 149.62 (matches 21DMA) from a high of 150.69. A hot core PCE release could reverse the pair’s fortunes and bring attention back to the YTD peak at 150.88.

- Differing fortunes for the antipodes with AUD/USD back on a 0.65 handle after bottoming out yesterday at 0.6488 post-USD strength. NZD/USD remains above yesterday’s 0.6082 trough but is unable to reclaim 0.61 status.

- PBoC set USD/CNY mid-point at 7.1036 vs exp. 7.1938 (prev. 7.1075).

Fixed Income

- The bearish narrative continues for Bunds; French CPI sparked some initial downside, though further hotter-than-expected releases from Spain and Germany (state), firmly guided the hawkish direction. Bunds have been drifting lower and are now at a fresh YTD low at 131.62, with the 10yr yield above 2.5%.

- USTs are driven by EGBs so far but also potentially positioning into the US January PCE data, which will be gauged to see if it conforms to the hotter narrative of other January pricing metrics; currently holds just above 110-00.

- Gilt price action conformed with EGBs into the latest BoE mortgage data with no reaction to the numbers despite lending and approvals printing below/above their respective forecast ranges. EGB-driven action has similarly pushed Gilts to a fresh YTD low at 96.83.

Commodities

- Crude benchmarks are under modest pressure but are comparably contained when judged against Wednesday’s whipsaw price action; currently holds around the USD 82/bbl mark.

- Spot gold is incrementally softer initially benefitting from a weaker Dollar, though now off best levels; USD 2032/oz 50-DMA remains untested with the current low at USD 2034/oz.

- Base metals are bid and deriving support from USD downside, the overall European risk tone and strength in China.

Geopolitics

- Japan’s top currency diplomat Kanda said using frozen Russian assets for Ukraine must be based on international law and he thinks EU’s proposal is along those lines, while he added that Japan strongly condemned Russia’s invasion of Ukraine at the G20 and that the G7 discussed ways to make use of frozen Russian assets for Ukraine reconstruction.

- Russian President Putin says “don’t they understand there is danger of nuclear conflict?”; on talk of NATO troops in Ukraine, says consequences for the intruders will be more tragic and we have weapon which is able to hit targets on their territory.

- Ukraine sees a risk of Russia breaking through its defences by the summer unless allies increase supplies of ammunition, according to Bloomberg sources

US Event Calendar

- 08:30: Feb. Initial Jobless Claims, est. 210,000, prior 201,000

- Feb. Continuing Claims, est. 1.87m, prior 1.86m

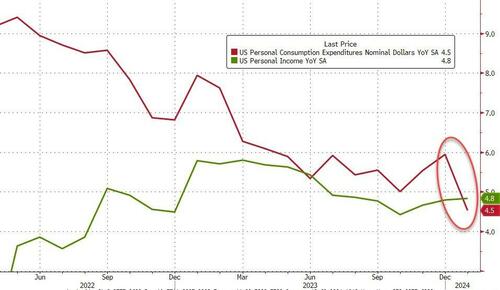

- 08:30: Jan. Personal Income, est. 0.4%, prior 0.3%

- Jan. Personal Spending, est. 0.2%, prior 0.7%

- Jan. Real Personal Spending, est. -0.1%, prior 0.5%

- 08:30: Jan. PCE Deflator MoM, est. 0.3%, prior 0.2%

- Jan. PCE Core Deflator YoY, est. 2.8%, prior 2.9%

- Jan. PCE Core Deflator MoM, est. 0.4%, prior 0.2%

- Jan. PCE Deflator YoY, est. 2.4%, prior 2.6%

- 09:45: Feb. MNI Chicago PMI, est. 48.0, prior 46.0

- 10:00: Jan. Pending Home Sales (MoM), est. 1.5%, prior 8.3%

- Jan. Pending Home Sales YoY, est. -4.4%, prior -1.0%

- 11:00: Feb. Kansas City Fed Manf. Activity, est. -2, prior -9

Central Bank Speakers

- 10:50: Fed’s Bostic Participates in Fireside Chat

- 11:00: Fed’s Goolsbee Gives Remarks on Monetary Policy

- 13:15: Fed’s Mester Speaks on Financial Stability and Regulation

- 15:30: Fed’s Mester Speaks to Yahoo Finance

- 20:10: Fed’s Williams Participates in Moderated Discussion

DB’s Jim Reid concludes the overnight wrap

Happy February 29. I’m hearing lots about how this day happens every four years, but strictly speaking that’s not true. The rule is it’s a leap year if it’s divisible by 4, unless it’s divisible by 100, but not if it’s also divisible by 400. Make sense? So 1700, 1800 and 1900 weren’t leap years, 2000 was a leap year, but 2100 won’t be one. In other words, you get one every 97/400 years rather than 1/4, as the earth’s rotation around the sun is actually a bit less than 365.25 days. This might seem trivial (and you may be right), but the previous Julian calendar hadn’t adjusted for this and had a leap day every four years, hence the shift to the modern Gregorian calendar from the 16th century onwards. But when countries made the adjustment, it meant the date shifted forward. So in Britain, the recorded date went from 2 September 1752 one day to 14 September 1752 on the next, skipping over the 11 calendar days in the middle.

If we missed the next 11 days right now, we’d skip over an awful lot, including the next US jobs report, an array of US primary elections on Super Tuesday, the ECB’s policy decision, Fed Chair Powell’s congressional testimonies, and the UK budget. But today, the main focus will be on the PCE inflation data from the US, which is the measure of inflation that the Fed officially targets, and is therefore closely watched in markets. Readers will remember that a couple of weeks ago, the CPI and PPI inflation reports both surprised on the upside, and the components that feed into the core PCE reading are pointing to a strong print for January. As a result, o ur US economists are expecting core PCE to come in at +0.36% for the month, which if realised would be the strongest monthly print since another +0.36% reading in February last year. So that’s one to look out for as investors seek to gauge the timing of potential rate cuts from the Fed.

Ahead of that, markets in Asia have put in a mixed performance overnight. Chinese equities have advanced, including the CSI 300 (+1.11%) and the Shanghai Comp (+1.00%), and the Shanghai Comp is currently on track to record its best monthly performance since November 2022. But other indices have been more negative, and the Hang Seng is down -0.02%, the Nikkei is down -0.02%, and the KOSPI (-0.49%) has posted larger declines. Futures have also been subdued, with those on the S&P 500 up just +0.05% after yesterday’s decline.

In Japan, sentiment wasn’t helped by the latest industrial production data, which showed a decline of -7.5% in January (vs. -6.8% expected), which is the biggest monthly decline since May 2020. Nevertheless, investors have continued to grow in confidence that the end of the negative interest rate policy could be near, following comments from the BoJ’s Hajime Takata, who said that “my view is that the price target is finally coming into sight”. That’s helped the Japanese Yen to strengthen +0.44% against the US Dollar overnight, whilst 2yr government bond yields are up +2.3bps to 0.18%, which is their highest level since 2011. Moreover, overnight index swaps are now pricing in a 33% chance of a move away from negative interest rates at the next meeting in April, up from 21% the previous day.

Ahead of that yesterday, markets were mostly in a holding pattern, with the S&P 500 (-0.17%) still experiencing little movement since Nvidia’s earnings last week. The latest decline means the index is still on track for a weekly loss, and there were larger falls for the NASDAQ (-0.55%) and the Magnificent 7 (-0.58%). Meanwhile in Europe, the story was also one of losses yesterday, with the STOXX 600 down -0.35%. That said, the DAX (+0.25%) continued to outperform, posting a 6th consecutive advance and closing at a fresh all-time high.

Over on the rates side, the moves were also modest in scope yesterday, though yields did extend moderate declines during the US session. This came even as central bank speakers continued to echo the recent consensus on policy, suggesting that rate cuts are likely to happen over the coming months, but not yet. For instance, Boston Fed President Collins said that it “will likely become appropriate to begin easing policy later this year”, but also that “I want to see more evidence of a sustained trajectory to price stability”. Separately, New York Fed President Williams said that they still had “a ways to go on the journey to sustained 2% inflation”. Meanwhile at the ECB, we heard from Slovakia’s Kazimir, who said in a Reuters interview that for a rate cut, “June would be my preferred date, April would surprise me and March is a no go”. Lithuania’s Simkus made similar comments, saying that “June is really the month to consider the rate cut”. And later in the evening, Germany’s Nagel said that “we can’t make any mistakes in the final stretch of the journey”, suggesting it would be “fatal” if rates were eased too early only for inflation to rebound.

That backdrop saw expectations for rate cuts tick up a little yesterday. For the Fed, investors still expect that June is the most likely meeting for a cut, with futures pricing in a 77% chance of a cut by June (up from 73% the day before). In turn, that helped yields on 2yr Treasuries fell -5.6bps, while 10yr yields were down -3.9bps to 4.265%. Over in Europe the bond rally was more marginal, with yields on 10yr bunds (-0.6bps), OATs (-1.2bps) and BTPs (-1.8bps) all seeing modest declines.

Although yields were falling yesterday, there were fresh signs of an increase in market expectations for US inflation, with the 2yr breakeven up +2.6bps to 2.77%, which is their highest level since March last year. 2yr zero-coupon inflation swaps were also up +3.9bps to 2.43%, the highest since October, so we’re seeing that across several instruments. That came as Brent crude (+0.04%) closed at its highest level since early November, at $83.68/bbl. Moreover, it’s clear that higher oil prices are filtering through into the real economy, and data from the AAA showed US gasoline prices remained at $3.294 per gallon on Wednesday, in line with their level on Tuesday and their highest level since November.

On the data side, yesterday saw a very modest downgrade to US GDP growth in Q4, with the second estimate coming in at an annualised +3.2% (vs. +3.3% first estimate). The release also showed that core PCE prices grew a bit faster than thought in Q4, at an annualised rate of +2.1% (vs. +2.0% first estimate). However, the revisions still left annual GDP growth for 2023 at +2.5%, in line with the initial estimate.

Finally in US political news, congressional leaders agreed a deal yesterday evening to avoid a partial government shutdown that would have started after March 1. The deal would extend funding to March 8 for several departments, and others to March 22.

To the day ahead now, and data releases from the US include PCE inflation for January, personal income, personal spending and pending home sales for January, the weekly initial jobless claims, and the MNI Chicago PMI for February. Elsewhere, there’s the February flash CPI inflation prints from Germany and France, along with German unemployment for February, UK mortgage approvals for January, and Canada’s Q4 GDP. From central banks, we’ll hear from the Fed’s Bostic, Goolsbee, Mester and Williams.