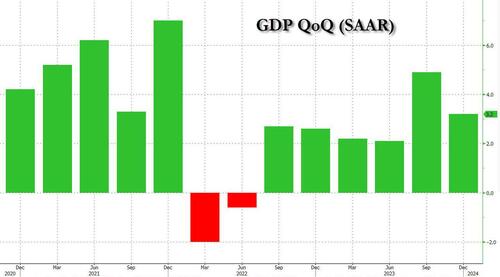

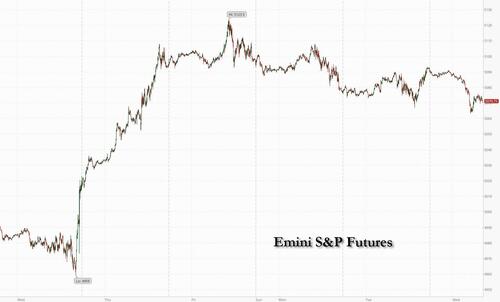

US stock futures slumped, pointing to a weak open on Wall Street with both Tech and small-caps underperforming, as traders braced for today’s revised GDP print and tomorrow’s core PCE report which whisper sees coming in hotter than expected and may further push back on expectations for rate cuts.

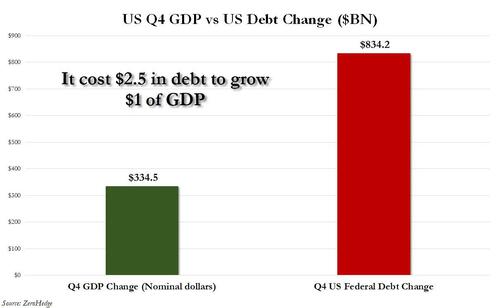

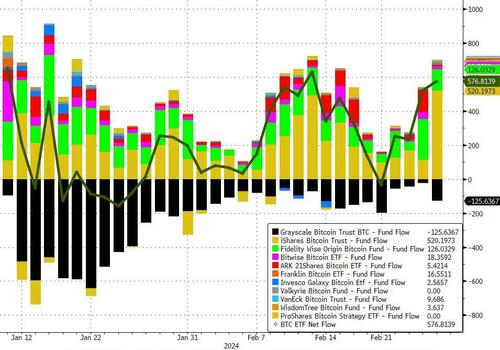

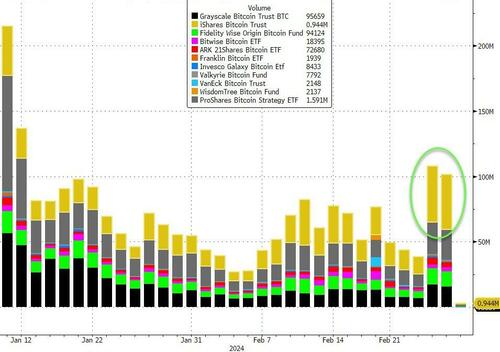

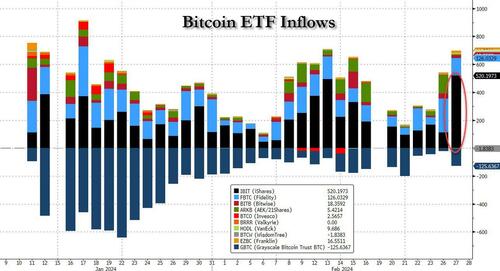

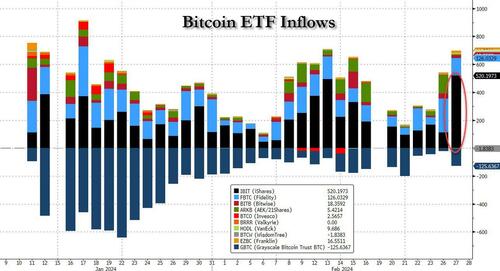

As of 7:50am, contracts on the Nasdaq 100 drop 0.5%, while S&P 500 futures down 0.4% as European stocks hovered below record high while Asia was dragged lower by Chinawhere regulators are taking steps to shrink the size of a popular quantitative trading strategy “Direct Market Access” that contributed to turmoil in the nation’s stock market this month. Bond yields are lower, and the USD is stronger, while commodities are mixed with base metals higher and energy lower. Bitcoin surged again rising just shy of $60K following record inflows into the Blackrock bitcoin ETF. The macro data focus will be on details surrounding the second estimate of Q4 GDP, as well as the latest inventory data (the more important data kicks off tomorrow with PCE and then Friday’s ISM number). Today’s price action may be more about month-end rebalancing where JPM’s Quant & Derivs Strategy team thinks that we could see stocks lose as much as 1.5% on the rebalance and that rebalancing moves can occur before month-end.

In premarket trading, Nvidia dropped 1.3% in premarket trading, dragging the megacap sector lower. Here are some other notable premarket movers:

- Ambarella (AMBA) gains 7% after the company projected revenue for the first quarter that topped the average analyst estimate at the midpoint.

- Array (ARRY) slips 6% following its earnings, which prompted BNP Paribas to downgrade the renewable energy equipment maker and give the stock its only negative analyst rating.

- Beyond Meat (BYND) soars 61% after it reported fourth-quarter sales that surpassed expectations.

- Bumble (BMBL) falls 10% after the online dating company issued first-quarter guidance that was weaker than forecast. The company is cutting about one-third of its workforce after a recent executive shakeup.

- Coupang (CPNG) jumps 8% after South Korea’s largest online retailer reported its fastest revenue growth since 2021.

- Credo Technology (CRDO) gains 7% after the communications equipment company reported earnings that prompted a price target raise at Cowen, which said the results signal the company is “well past the bottom”

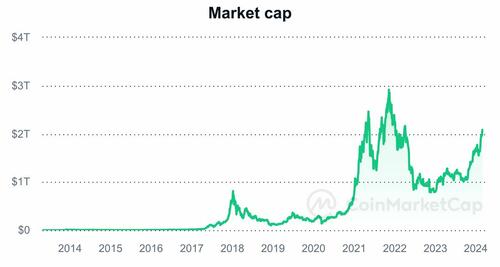

Cryptocurrency-linked stocks gained as Bitcoin advanced for a fifth day, on track for its biggest monthly increased since October 2021. The launch of spot Bitcoin exchange-traded funds in the US in early January has driven a surge in buying, overcoming concerns over slower Fed rate cuts. Bitcoin climbed above $59,000 Wednesday, up almost 40% in the month.

Aside from earnings, attention will be on the latest US GDP print and tomorrow’s inflation numbers and a strong line-up of central bank speakers. Investors are contending with an erosion in expectations for how much the Federal Reserve and European Central Bank will lower rates.

“In December, markets priced sizeable rate cuts in 2024, but what’s happened is we have had slightly problematic inflation prints in most parts of the world,” said Guy Miller, chief market strategist at Zurich Insurance Co. “The US economy has done better than what many people expected, the labor market remains tight and wage gains have been higher than what central bankers are comfortable with.”

Meanwhile, traders have moved to price only 75 basis points of US easing by year-end, in line with what Fed policymakers in December indicated is the likeliest outcome. Treasury yields dipped Wednesday, while a gauge of the dollar strengthened to the highest since Feb. 20.

In Europe, the Stoxx 600 index edged 0.2% lower as investors digested the latest earnings; telecoms and insurance stocks outperforme while personal care stocks are the worst performers, led lower by Reckitt Benckiser, whose sales missed expectations and its shares tumbled 12%, the most since 2008, after the consumer goods company said its sales fell. Tech was also hit after Dutch chip gear firm ASM International slipped as it projected revenue for this quarter that fell far below market expectations. Here are the biggest movers Wednesday:

- Glanbia rose as much as 7.2% on the Irish stock exchange, the most in almost a year, after publishing strong full-year results and announcing a share buyback program.

- Alcon rose as much as 6% after releasing results after the market close on Tuesday that were seen as positive by analysts. Highlights include the Swiss eye-care producer’s above-consensus guidance.

- UCB shares gained as much as 5.1%, to the highest since May 2022, after the biopharmaceutical company reported earnings for the year that beat analysts’ estimates. Citigroup noted the profit share of its Evenity osteoporosis drug is “under-appreciated.”

- Reckitt Benckiser shares drop as much as 10%, hitting their lowest level since March 2020, after the household-goods maker reported a surprise fall in like-for-like sales in the final quarter of 2023, missing expectations across the board.

- St James’s Place plunged as much as 33% after the wealth management firm reported an adjusted pretax loss for the full year, with analysts flagging an ongoing service charge issue and a sharp dividend cut.

- ASM International declined as much as 6.1% in Amsterdam after the chip equipment maker gave a weaker-than-expected forecast for the current quarter, showcasing the challenge in near-term demand before an expected improvement later this year.

- Worldline plunged as much as 17% after the French payment processor reported a net loss of €817 million for 2023 due to goodwill impairments. The results and guidance met lowered expectations, yet investors are still cautious.

- Just Eat Takeaway falls as much as 7.6% in Amsterdam after the food delivery firm issued guidance for 2024 revenue growth which analyst considered cautious.

Earlier in the session, Asian stocks closed lower, dragged by China where the CSI 300 Index dropped as much as 1.3% to touch session low following a report that regulators are taking steps to gradually shrink the size of a popular quantitative trading strategy. Some quantitative funds that manage money for external clients were told to stop accepting new inflows and phase out existing products for “Direct Market Access.” Small-cap indexes fall more: CSI 1000 Index drops as much as 4.5% and CSI 2000 Index -6.8%. Meanwhile, Hong Kong stocks slumped more than 1% as the city’s budget report failed to impress investors. Chinese stocks fell after a recent rally took gauges to resistance levels, with traders looking to this week’s manufacturing report and a key political meeting in Beijing next week for momentum.

“This move to deleverage could lead to an extended drop and might be a replay of the slump in January. This is hits across all gauges, as quants usually hold thousands of stocks at once, and the unexpected move leads to a wave of selling,” says Chen Zunde, fund manager ate Guangdong Fund Investment Co.

- Hang Seng and Shanghai Comp. were pressured amid initial developer-related concerns after a wind-up petition was filed against Country Garden, although the property sector in Hong Kong then recovered after the government announced the cancellation of all demand-side property tightening measures for residential.

- ASX 200 was indecisive with tech strength offset by weakness in telecoms, consumer stocks and financials, while data showed softer-than-expected monthly CPI in January and a miss on Construction Work Done for Q4.

- Nikkei 225 lacked conviction but remained above the 39,000 level in the absence of any pertinent catalysts.

In FX, the dollar has benefited from the risk-off mood. The Bloomberg Dollar Spot Index rises 0.2% as the greenback gains versus all its G-10 rivals. The kiwi is the weakest, falling 1.2% versus the dollar after the RBNZ softened its threat of a hike amid signs inflation pressures are waning. Elsewhere, the New Zealand dollar slid more than 1% after the Reserve Bank of New Zealand delivered less hawkish comments on inflation, citing how most measures of price expectations have fallen. Meanwhile, Nigeria’s naira weakened to a fresh low after a much-bigger-than-expected 400 basis point interest rate increase by the central bank on Tuesday failed to support the currency. The naira has been sapped by a local scarcity of dollars and an outstanding backlog of demand for the greenback

In rates, treasury futures hold small gains accumulated during early London session as bunds and gilts advanced, with yields richer by 1bp-2bp across the curve. Weakness in US technology shares pressures S&P 500 futures, further supporting Treasuries. 10-year Treasury yields at 4.29% are ~2bp richer on the day with bunds slightly outperforming and gilts lagging by less than 1bp in the sector; Tuesday’s notable curve-steepening move remains intact with 2s10s and 5s30s trading near top of Tuesday range. IG dollar issuance slate already includes a few names; seven issuers priced $8.5b Tuesday, leaving weekly total already above the $35b expected. Borrowers paid concessions of less than 2bps driven by order books said to be 3.3 times oversubscribed. US session highlights include 4Q GDP revision, and corporate issuance slate is expected to remain busy.

In commodities, oil fell after a two-day gain as signs of higher US inventories vied with expectations that OPEC+ will extend supply cuts. WTI fell 1.1% to trade near $78. Iron ore resumed its slide, as investors remained undecided about the strength of China’s demand for steel ahead of the nation’s usual peak construction season. Spot gold falls 0.2%.

Bitcoin continues to soar and currently holds just shy of the $60k mark less than $10k away from a new all time high, boosted by a record inflow into the IBIT ETF.

Looking at today’s calendar, US economic data includes second estimate of 4Q GDP, January advance goods trade balance and wholesale inventories (8:30am). Fed speakers scheduled include Bostic (12pm), Collins (12:15pm) and Williams (12:45pm).

Market Snapshot

- S&P 500 futures down 0.4% to 5,071.50

- STOXX Europe 600 down 0.2% to 495.55

- MXAP down 0.7% to 172.05

- MXAPJ down 0.8% to 523.37

- Nikkei little changed at 39,208.03

- Topix down 0.1% to 2,674.95

- Hang Seng Index down 1.5% to 16,536.85

- Shanghai Composite down 1.9% to 2,957.85

- Sensex down 0.8% to 72,478.32

- Australia S&P/ASX 200 little changed at 7,660.42

- Kospi up 1.0% to 2,652.29

- German 10Y yield little changed at 2.45%

- Euro down 0.4% to $1.0803

- Brent Futures down 0.9% to $82.92/bbl

- Brent Futures down 0.9% to $82.92/bbl

- Gold spot down 0.2% to $2,025.50

- U.S. Dollar Index up 0.35% to 104.20

Top Overnight News

- European stocks struggled for traction and US futures slipped as traders brace for a slew of economic data in the second half of the week that will help determine the path of monetary policy.

- Goldman Sachs Group Inc. Chief Executive Officer David Solomon said softer spending by consumers calls into question expectations that the US economy will avoid a recession.

- US President Joe Biden and Republican frontrunner Donald Trump both cruised to victory in their party’s Michigan primary elections Tuesday, with results for the two candidates indicating discontent among Democrats and Republicans for the likely nominees.

- Bond traders no longer expect the Federal Reserve to lower interest rates by more than 75 basis points this year, bringing their view in line with what Fed policy makers have indicated is the likeliest outcome.

- Europe’s biggest asset manager is joining a chorus of investors who are turning bearish on Switzerland’s franc after slowing inflation has eliminated the need for the central bank to prop up the currency.

- Chinese regulators are taking steps to gradually shrink the size of a popular quantitative trading strategy that contributed to turmoil in the nation’s stock market this month, according to people familiar with the matter.

Earnings

- Baidu Inc (BIDU) Q4 2023 (USD): EPS 3.08 (exp. 2.48), Revenue 4.92bln (exp. 4.86bln) Shares -1.2% in pre-market trade

- eBay Inc (EBAY) – Q4 2023 (USD): Adj. EPS 1.07 (exp. 1.03), Revenue 2.56bln (exp. 2.51bln); authorised additional 2bln share repurchase programme and raises quarterly cash dividend 8% to 0.27/shr. Shares +3.2% in pre-market trade

- Beyond Meat (BYND) Q4 2023 (USD): Revenue 73.7mln (exp. 66.8mln), Adj. EBITDA loss 125mln (exp. loss 47mln); FY revenue view 315-345mln (exp. 344mln) Shares +55% in pre-market trade

- ASM International (ASM NA) – Q4 (EUR): Normalised Net 100mln (exp. 137mln, prev. 142mln Y/Y), Normalised Op. 141mln (prev. 190mln Y/Y), Revenue 633mln (exp. 647mln, prev. 725mln Y/Y), Launches 150mln share buyback. Raises dividend to 2.75/shr (prev. 2.50/shr). Guides Q1 Revenue 600-640mln. (Newswires) Shares -3.7% in European trade / peer Nvidia (-1.2% pre-market) lags

- Reckitt (RKT LN) – Q4 (GBP): LFL Sales -1.2% (exp. 1.75%), FY LFL Sales +3.5% (exp. 4.15%), Revenue 3.56bln (exp. 3.6bln). Sees 2024 capital expenditure to be 3-3.5% of Net Revenue. Sees 2024 adj. operating profit to grow ahead of net revenue growth. Shares -10.1% in European trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded cautiously and followed suit to the rangebound performance seen on Wall St where stocks largely ignored weak US data ahead of key events, while the region also digested a couple of data releases and the RBNZ policy announcement. ASX 200 was indecisive with tech strength offset by weakness in telecoms, consumer stocks and financials, while data showed softer-than-expected monthly CPI in January and a miss on Construction Work Done for Q4. Nikkei 225 lacked conviction but remained above the 39,000 level in the absence of any pertinent catalysts. Hang Seng and Shanghai Comp. were pressured amid initial developer-related concerns after a wind-up petition was filed against Country Garden, although the property sector in Hong Kong then recovered after the government announced the cancellation of all demand-side property tightening measures for residential.

Top Asian News

- Hong Kong Financial Secretary Chan said in the budget address that momentum for economic recovery needs to be improved amid global challenges. Chan announced the government is to cancel all demand-side property tightening measures for residential and noted there is room to further adjust measures for the property market, while it will waive stamp duties payable on transfer of REIT units.

- HKMA said the maximum loan-to-value ratios will be adjusted to 70% for self-occupation residential properties valued at HKD 30mln or less, while the maximum LTV ratio will be adjusted from 50% to 60% for non-self-use residential properties.

- RBNZ kept the OCR unchanged at 5.50% as expected, while it slightly lowered its OCR projections and said the OCR needs to remain at a restrictive level for a sustained period. The committee remains confident that the current level of the OCR is restricting demand but also noted that headline inflation remains above the 1%-3% target band, limiting the committee’s ability to tolerate upside inflation surprises. Furthermore, the RBNZ reduced its OCR forecast with the June 2024 view lowered to 5.59% from 5.67% and the March 2025 view lowered to 5.47% from 5.56%.

- RBNZ Governor Orr said during the press conference Q&A that they did discuss a hike in rates and there was strong consensus that the current level of rates was sufficient, while he added that many variables have given them confidence that policy is working and noted that underlying inflation is still a concern, but headline inflation is easing.

- China reportedly tells quants to phase out Direct Market Access (DMA) products blamed for turmoil, according to Bloomberg sources; Chinese markets extended losses following this news.

- PBoC governor and Shanghai party chief held a seminar on Tuesday; PBoC supports Shanghai’s high-level opening up financially

European bourses, (Stoxx600 -0.1%), are mixed, but with clear underperformance in the AEX (-0.7%), after poor results from chip-maker ASM International (-3.8%). European sectors hold a negative tilt; Optimised Personal Care Drug and Grocery is dragged down by Reckitt (-8.9%) post-earnings, whilst Mercedes-Benz (+1.7%) drives Autos higher. US Equity Futures (ES -0.5%, NQ -0.9%, RTY -0.8%) are entirely in the red, paring back most of the gains seen in the prior session, with underperformance in the NQ hampered by Nvidia (-1.9% pre-market).

Top European News

- ECB’s de Guindos says recent inflation outlook has been very positive and prices will continue to decline; we need to be sure that prices will move towards our 2% target

FX

- USD is making gains vs. all peers with January PCE data tomorrow expected to come in hot. DXY has reclaimed 104 status and taken out its 100, 10 and 21DMAs as well as a cluster of highs from last week. Current high today at 104.24.

- EUR is hampered by the broadly firmer USD with EUR/USD oscillating around the 1.08 mark after taking out yesterday’s low of 1.0812.

- GBP is dragged lower by the USD after yesterday’s failure to test 1.27 to the upside. Session low currently sits at 1.2622 with the 22nd Feb low at 1.2612.

- USD/JPY remains arguably the most important pair to watch after printing a high of 150.79 with the YTD peak just above at 150.88. The further the pair climbs, the more likely is jawboning from Japanese officials and speculation over intervention.

- NZD is the standout laggard across the majors as the RBNZ stood pat on rates vs. a 30% chance of a hike accompanied by dovish tweaks to the OCR projections. NZD/USD has erased all of last week’s gains and slipped below the 0.61 mark with the next downside support via its 100DMA at 0.6091. AUD lower in sympathy as well as the region’s soft inflation metrics overnight.

- PBoC set USD/CNY mid-point at 7.1075 vs exp. 7.2023 (prev. 7.1057).

Fixed Income

- USTs are marginally firmer with specifics light and perhaps some follow-through from the dovish RBNZ OCR projections in the absence of other drivers. Action which comes after Tuesday’s bear-steepening.

- Bunds are modestly firmer with specifics light and the focus once again on supply. Bunds are eking out marginal new highs of 132.41 seemingly as US equity futures deteriorate further, but ultimately remains comfortably within yesterday’s 132.02-71 range.

- Gilt price action is similar to that seen in EGBs with Gilts also able to eke out some very marginal gains but well within Tuesday’s 97.22-98.15 bounds; a UK outing produced a wide 2.2bps tail, resulting in modest pressure in Gilts.

- UK sells GBP 4.0bln 4.00% 2031 Gilt: b/c 3.0x, average yield 4.085%, tail 2.2bps.

- Italy sells EUR 8.25bln vs exp. EUR 7.50-8.25bln 3.35% 2029 & 3.85% 2034 BTP and EUR 1.5bln vs exp. EUR 1.00-1.50bln 2031 CCTeu.

- Orders for Italy’s new 6yr BTP Valore retail bond reaches 12bln since the start of the odder, according to bourse data cited by Reuters

Commodities

- A downbeat session for the broader crude complex in what is seemingly a function of a firmer Dollar and a subdued risk tone. Brent May futures have slipped below USD 82.00/bbl.

- The firmer Dollar exerts broader pressure on precious metals, although losses are capped ahead of key US data alongside a number of Fed speakers; XAU approaches USD 2,025/oz to the downside after falling under its 50 DMA at 2,032.15/oz.

- Base metals are softer across the board amid the aforementioned pressure from the stronger Greenback, whilst Chinese markets overnight continued to tumble despite intervention from regulators.

- US Private Energy Inventory (bbls): Crude +8.4mln (exp. +2.7mln), Cushing +1.8mln, Gasoline -3.3mln (exp. -1.5mln), Distillate -0.5mln (exp. -2.1mln)

- Trafigura Chief Economist says oil market talk has shifted to upside risk; oil spreads show a relatively tight market, via Bloomberg TV.

- Citi upgrades 0-3m Palladium price targe price forecast to USD 1200/oz (prev. 950/oz) on the prospect of imminent supply cuts; bounce would present a tactical opportunity for spec selling and producer hedging; sees structural long-term downtrend.

Geopolitics: Middle East

- US Central Command said a US aircraft and a coalition warship shot down five Houthi one-way attack unmanned aerial vehicles in the Red Sea on Tuesday, according to Reuters.

- “Israeli sources: The Israeli delegation returned from Doha after two days of negotiations on the detainee deal without progress”, according to Sky News Arabia

Geopolitics: Other

- China’s Vice Foreign Minister Sun Weidong conducted consultations in Moscow where he met with his counterpart and the Russian Foreign Minister, while he stated that China supports Russia’s BRICS presidency and stands ready to continuously strengthen strategic coordination between both sides in international multilateral platforms. Furthermore, Sun said both sides should strengthen communication and coordination in Asia-Pacific affairs, as well as jointly safeguard regional security and stability.

- South Korea and the US are to conduct annual military drills from March 4th-14th.

US Event Calendar

- 07:00: Feb. MBA Mortgage Applications -5.6, prior -10.6%

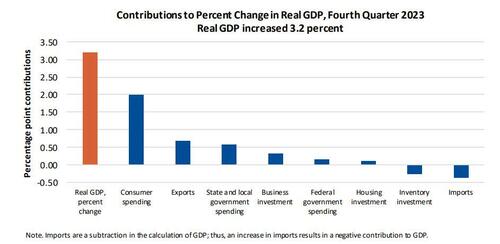

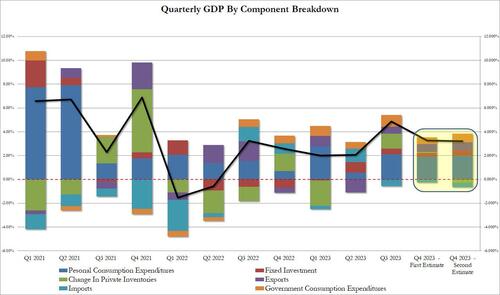

- 08:30: 4Q GDP Annualized QoQ, est. 3.3%, prior 3.3%

- 4Q Personal Consumption, est. 2.7%, prior 2.8%

- 4Q GDP Price Index, est. 1.5%, prior 1.5%

- 4Q Core PCE Price Index QoQ, est. 2.0%, prior 2.0%

- 08:30: Jan. Retail Inventories MoM, est. 0.4%, prior 0.8%

- Jan. Wholesale Inventories MoM, est. 0.2%, prior 0.4%

- 08:30: Jan. Advance Goods Trade Balance, est. -$88.5b, prior -$88.5b, revised -$87.9b

Central Bank Speakers

- 12:00: Fed’s Bostic Participates in Fireside Chat

- 12:15: Fed’s Collins Gives Remarks, Fireside Chat

- 12:45: Fed’s Williams Delivers Keynote Remarks

DB’s Jim Reid concludes the overnight wrap

Henry is on duty tomorrow but given it will be a leap day I wanted to wish all those EMR readers who were born on February 29th a very happy birthday for tomorrow! The last time it fell on a workday was in 2016 so make sure your workmates shower you with 8 years’ worth of gifts.

The week so far has been a bit of a crawl and not the leaps of last week as we await the all important core PCE print tomorrow. Yesterday saw equities post marginal gains (S&P 500 +0.17%), with bond yields edging up across the globe. Despite the subdued tone in markets, there’ve been some important headlines on the political side overnight, as former President Donald Trump seems to be on track to record another primary victory in Michigan. Current estimates are pointing to a big winning margin for Trump (68%) against Nikki Haley (26.8%) with 70% of the vote in, and that comes ahead of Super Tuesday next week, when 15 states will be holding votes on the Republican side. So if Trump is able to keep winning those contests, then he’ll soon have a very substantial delegate lead on the way to the nomination.

Overnight, the Reserve Bank of New Zealand held its official cash rate (OCR) unchanged at 5.5% – a 15-year high but on a day where there was a small chance of a hike delivered a relatively dovish stance. The central bank in its statement highlighted that “core inflation and most measures of inflation expectations have declined and the risks to the inflation outlook have become more balanced”. Following the decision, t he kiwi (-0.94%) is trading at $0.6113, after being one of the best performers in the last month with some hiking probabilities priced in. Bonds rallied with yields on the 10yr government bonds dropping -9.2bps to trade at 4.71% as we go to print.

Asian equity markets are slightly lower as I type with the Nikkei (-0.10%), Hang Seng (-0.27%), CSI (-0.30%) and the Shanghai Composite (-0.67%) declining. Shares of embattled developer Country Garden fell more than -12.0% after it received a liquidation petition in a Hong Kong court over its inability to repay a HK$1.6 billion ($204 million) loan and complicating its debt revamp prospects. On the flip side the HK budget is ongoing and restrictions on the property market have been lifted and boosts to tourism have been announced. Elsewhere, the KOSPI is nearly +1.0% higher this morning after two days of declines. US equity futures are just below flat with yields on 10yr USTs down -0.98bps, standing at 4.29%.

In early morning data, Australia’s CPI unexpectedly remained steady at +3.4% y/y in January (v/s +3.6% expected). YoY Core-CPI was +4.1% in January down from the +4.2% increase seen in December.

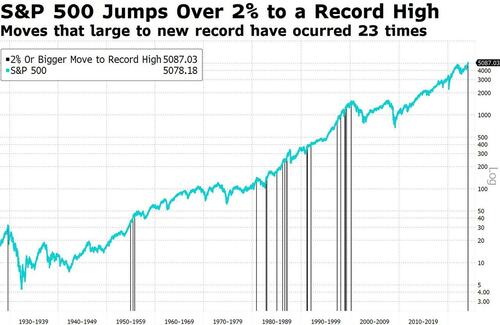

When it came to yesterday, the main story was more that there wasn’t much of a story, with little movement across the major asset classes. Among equities, there were some modest movements, with the S&P 500 (+0.17%) closing just below its all-time high, having basically been in a narrow band since the Nvidia results last week. Currently it’s down -0.21% for the week, meaning it still needs to recover a bit in order to achieve a joint record of 16 weekly advances in the last 18 (currently on 15/17 for first time since 1989). Small-cap stocks continued to outperform, with the Russell 2000 up +1.34%, in contrast to the Dow Jones, which was down -0.25%. Tech stocks saw a marginal outperformance, with the NASDAQ up +0.37% and Magnificent 7 up +0.22%. It shows the signs of the times that Apple yesterday announced the closure of its electric car unit which it set up in 2014 that at one point promised autonomous driving within a reasonable timeframe. The fact that they did this partly to divert resources to AI shows how trends can change.

Over in Europe the aggregate equity move was very similar, with the STOXX 600 up +0.18%, whilst the DAX (+0.76%) posted a 5th consecutive gain to reach a fresh all-time high.

On the rates side, Treasuries saw a mild sell off despite a fairly well digested 7yr auction. By the close, the 10yr Treasury yield was up +2.4bps to 4.30%. That said, there were some interesting trends on inflation expectations, which have continued to move higher over recent days. For instance, while the nominal 2yr yield was down -2.6bps, the 2yr breakeven was up a further +3.6bps to 2.75%, which is its highest level since March last year. Bear in mind that the 2yr breakeven began the year at 2.02%, so we’ve seen a pretty substantial move in just two months, which goes some way to explain why investors now don’t expect the rapid rate cuts that were priced at the start of the year. The amount of Fed cuts priced in 2024 inched down to 77bps, so now essentially in line with the 75bps of cuts penciled in by the median FOMC dot back in December. Patience on rates cuts continued to be visible in the latest Fed comments, with Fed Governor Bowman (hawk) noting that the latest inflation data “suggest slower progress in bringing inflation down toward our 2 percent target”.

Over in Europe, gilts saw some of the largest moves, which followed comments from BoE Deputy Governor Ramsden that “key indicators of inflation persistence remain elevated”. So 2 yr gilt yields were up +4.0bps to 4.33%, and 10yr gilt yields ended the session up +3.4bps at 4.19%, which is their highest level since late November. Elsewhere in Europe there was a similar pattern, with yields on 10yr bunds (+2.5bps) also hitting their highest level since November, at 2.46%.

Elsewhere yesterday, there was a mixed tone from the latest US data. On the negative side, the Conference Board’s latest consumer confidence reading for February was down to 106.7 (vs. 115.0 expected), which is the first decline in four months. Moreover, the preliminary durable goods orders for January were down -6.1% (vs. -5.0% expected). Core capital goods orders were in line at +0.1%, but with the previous month revised down by four-tenths. That said, it wasn’t all bad news, with core capital goods shipments up +0.8% (vs. +0.1% exp) in January and the Richmond Fed’s manufacturing index up to -5 in February (vs. -9 expected), ending a run of 4 consecutive monthly declines. The stronger shipments data saw the Atlanta Fed’s GDPNow model marginally upgrade its estimate for Q1 growth to an annualised 3.25%. If realised, that would be a third consecutive quarter with growth above 3%.

To the day ahead now, and data releases include the second estimate of US GDP in Q4, along with the European Commission’s economic sentiment indicator for the Euro Area in February. From central banks, we’ll hear from the Fed’s Bostic, Collins and Williams, the ECB’s Muller and the BoE’s Mann.