Seismic Shift: Indonesia Floods Market With Cheap Nickel, Sparking Wave Of Unprofitable Mines

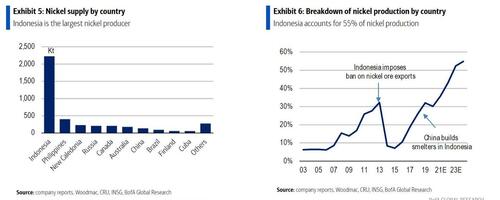

The global nickel industry is experiencing a seismic shift as Indonesia emerges as a major low-cost supplier, contributing to a collapse in prices of the metal used in everything from making stainless steel to high-grade batteries.

Nickel is trading at just above $17,400 a ton, according to the London Metal Exchange, down from $48,800 a ton in early 2022.

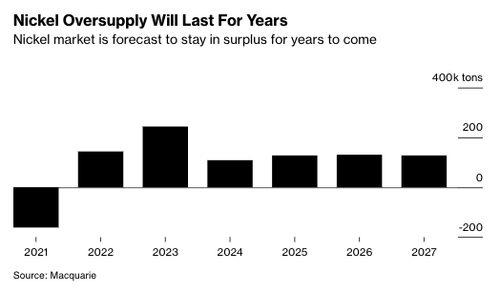

Miners are writing down their businesses and closing mines due to a massive drop in income. At least six projects were closed in Australia last year as Indonesia flooded the world with cheap nickel. Bloomberg notes the supply of cheap nickel could mean upwards of at least half the world’s mines could become unprofitable.

Christel Bories, the head of Eramet, told the Financial Times that Indonesia has the world’s largest nickel reserves and could soon account for 75% of all high-grade nickel production by the end of the decade.

“It has really made a big part of the old traditional players structurally non-competitive for the future,” Bories said, adding, “This is part of the industry will either disappear or be subsidized by governments.”

She continued: “The uncompetitive mines elsewhere will close. I’m not sure there will be so many governments deciding to subsidize big production with a lot of money just to compete with Indonesia production.”

Bories’ gloomy prediction for the oversupplied nickel markets is similar to other mining CEOs, like BHP chief executive Mike Henry, who recently warned that its flagship nickel business in Australia could close in the next few months. He said help from the government “may not be enough” to save the company’s nickel operation in the western part of the country.

Two weeks ago, BHP wrote down the entire value of its Western Australian nickel mining operation. The firm reported a shocking 86% year-on-year plunge in net income for the second half of 2023.

Bloomberg pointed out that Indonesia’s move to flood the world with cheap nickel will keep markets oversupplied through the decade’s end.

“There is a serious structural challenge as a result of Indonesian nickel,” said Duncan Wanblad, chief executive officer of Anglo American Plc. The miner was forced to take a $500 million writedown on its nickel business last week.

Wanblad added: “They don’t seem to be letting up anytime soon.”

The imploding nickel market is great news for electric vehicle companies, who were once battered by skyrocketing battery material costs during Covid.

Tyler Durden

Thu, 02/29/2024 – 19:25

via ZeroHedge News https://ift.tt/uVBXCNi Tyler Durden