Map Shows West Coast Has A Headquarters Bubble

In the latest client note, “The Flow Show: $1 Trillion Every 100 Days,” Bank of America Analyst Michael Hartnett points out how headquarters locations of mega-corporations have shifted around the country over the last three decades.

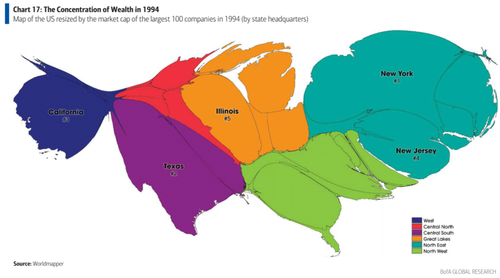

Hartnett first shows a map of the US resized by the market cap of the largest 100 companies in 1994. Notice how most of the companies were based out of New York, Texas, and California.

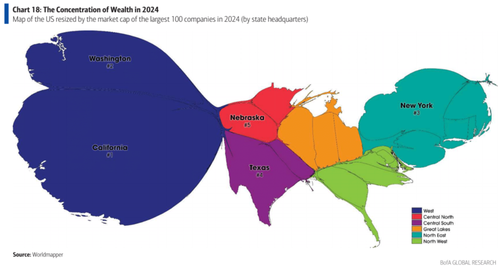

Three decades later, the wealth concentration of mega-corporations has ballooned on the West Coast (not surprising), with California number one and Washington number two. Meanwhile, New York dropped to number three.

The current distribution of wealth concentration of mega corporations on the West Coast is a bubble. This is because companies are fleeing progressive states, plagued with high taxes and violent crime, for ones like Texas, Arizona, Georgia, and Florida.

“You have a number of companies recently that have relocated to Texas because it’s supposed to be a friendlier climate for business. And it’s suddenly not as friendly as it was,” Anthony Johndrow, cofounder and CEO of consultancy Reputation Economy Advisors, told Fortune in a separate report.

The latest Fortune 500 companies that have moved their headquarters to Texas include:

- NRG Energy – moved from Princeton, New Jersey, to Houston

- Tesla – moved from Palo Alto, California, to Austin

- Hewlett Packard Enterprise – moved from San Jose, California, to Spring

- Oracle – moved from Redwood City, California, to Austin

- Charles Schwab – moved from San Francisco, California, to Westlake

- Caterpillar – moved from Deerfield, Illinois, to Irving

- AECOM – moved from Los Angeles, California, to Dallas

- CBRE – moved from Los Angeles, California, to Dallas

We anticipate that the West Coast bubble will continue to deflate in the coming years, with Red states such as Texas and Florida attracting more companies and people due to their safer cities and friendlier business environments.

Tyler Durden

Sat, 03/02/2024 – 07:35

via ZeroHedge News https://ift.tt/P5Cf8Di Tyler Durden