The Weaponization Of Crude Could Trigger The Next Financial Shock

Since Hamas launched a brutal terrorist attack on Israel on October 7 – and the resulting invasion of Gaza by the Israel Defense Forces shortly after to eradicate the terrorist group, the Biden administration has been scrambling to prevent a regional war from erupting during the US election cycle, all while the Federal Reserve is fighting the wicked inflation monster.

Deterring a regional war has been a significant challenge for the Biden administration and will likely require restraint on Israel’s part. The US’ latest bombing campaign against dozens of Iran-backed militia targets across Yemen, Iraq, and Syria has only made the situation worse. At the same time, Houthi rebels continue causing chaos at a critical maritime chokepoint in the southern Red Sea.

There has been an escalation in the Middle East crisis. Navigating this very uncertain macroeconomic climate as the post-1945 economic order fractures – is giving way to a dangerous multi-polar world.

David Asher, a senior fellow at Hudson Institute and former investigator into Covid origins at the State Department, recently penned a note titled “Navigating the New World Disorder: Economic Faultlines, Fissures, Fractures, and Failures.”

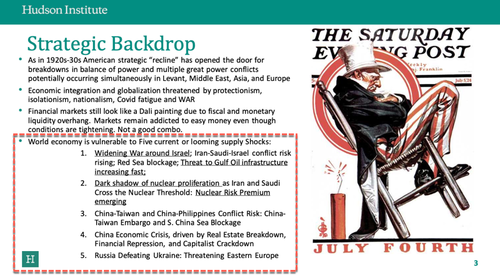

In this note, Asher points to a world that is in crisis, similar to the 1920s/30s.

On slide three, the macro strategist labels five “looming supply shocks” for the global economy.

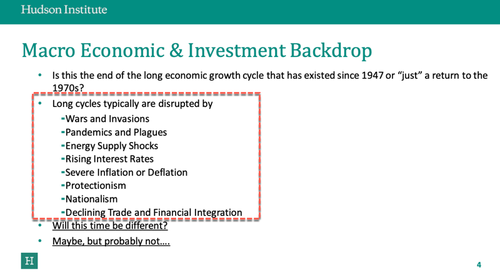

He asks: “Is this the end of the long economic growth cycle that has existed since 1947 or “just” a return to the 1970s?”

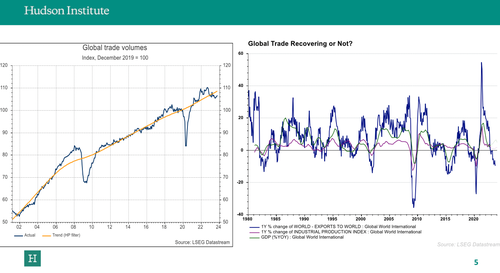

While China’s economy struggles to recover, Asher asks another question: “Is Global Trade Recovering or Not?”

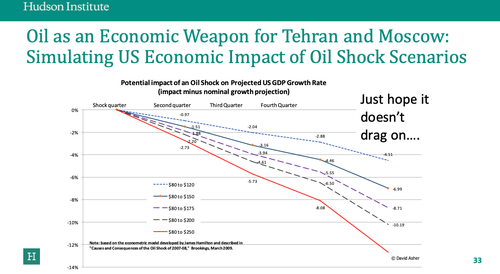

On slide nine, given the mounting risks in the Middle East. He said: “Global oil shock could trigger a crisis ala 2007-2008.”

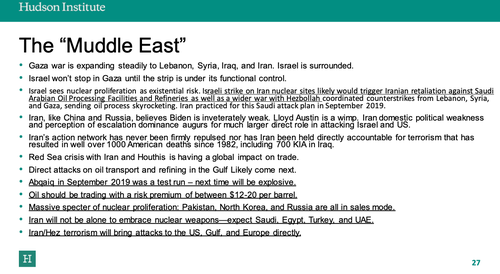

He described a series of events that paint an awful gloomy outlook for the Middle East that have significant consequences for global markets.

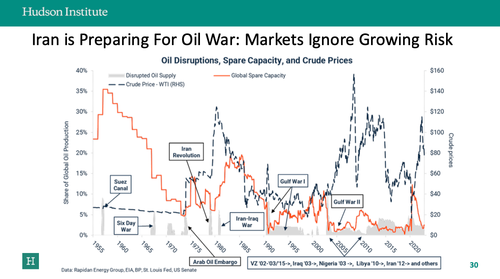

Slide thirty is titled: “Iran is Preparing For Oil War: Markets Ignore Growing Risk.”

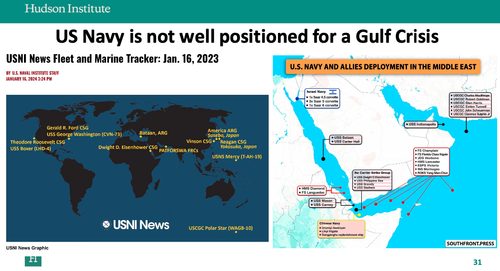

The next slide shows the US Navy needs to be better positioned in the Red Sea and Gulf area to respond to a major crisis. Not being prepared has been the theme so far with the failure of Biden’s Operation Prosperity Guardian to secure the critical Red Sea waterway.

Could Tehran use oil as an economic weapon against the West?

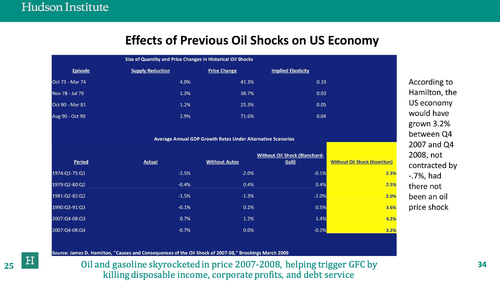

Consider the economic impacts of previous oil shocks…

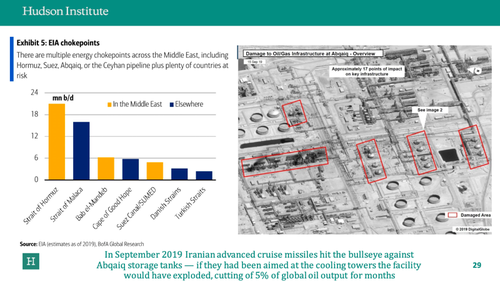

This is where readers need to pay attention: Imagine the scenario where Yemen’s Houthi rebels start targeting key oil facilities in Saudi Arabia.

Remember 2019?

Should a repeat of 2019 occur, then Brent crude prices could surge.

And this would cause a massive headache for Jerome Powell’s inflation fight.

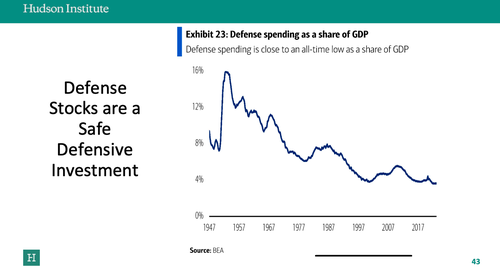

Given all this, are defense stocks a good buy?

The core theme of this note is America’s adversaries in the Middle East could weaponize energy to cause a financial shock. What is necessary for the US military is not just to be focused on the Red Sea chokepoint but also on Saudi’s energy infrastructure because crude prices could be one attack away from spiking over the $100 a barrel level.

There is good news: US crude production is at record highs. The bad news: radical climate change warriors in the White House have drained the SPR and crushed the ability to expand refining capacity.

A perfect storm of higher crude prices is brewing… All eyes on the Middle East.

Tyler Durden

Mon, 03/04/2024 – 04:15

via ZeroHedge News https://ift.tt/F5yDWdm Tyler Durden