China Sets Economic Growth Target At Around 5% This Year, Will Boost Defense Spending By 7.2%

China will target economic growth of “around 5%” this year as it works to transform its development model (read magically grow while aggressively deleveraging), curb industrial overcapacity (read build less ghost cities while trying to contain the fallout from the biggest real estate crisis in history), defuse property sector risks (read transfer ownership from countless insolvent property developers to the state while encouraging foreign investment) and cut wasteful spending by local governments (read limit corruption in a country where 1 out of every 3 yuan is embezzled, stolen or otherwise vaporized), Premier Li Qiang said on Tuesday according to Reuters.

Li delivered his maiden work report at the annual meeting of the National People’s Congress (NPC), China’s rubber-stamp legislature, in the cavernous Great Hall of the People in Tiananmen Square.

The growth target – already the lwoest in decades – was identical to last year’s but analysts warned that it would be harder to achieve this year than in 2023, when growth was flattered by a low base during the pandemic, and will require stronger government stimulus for China to reach it, as the economy remains reliant on state investments in infrastructure that have led to a mountain of municipal debt.

Almost all of the 27 economists polled by Bloomberg before the National People’s Congress expected Beijing to announce a growth target similar to last year. Economists polled in a separate, broader survey, however, said the economy would likely grow at a more realistic 4.6% in 2024.

“It’s what the Communist Party thinks is needed to keep the Chinese economy going and account for needs like employment,” Chong Ja Ian, an associate professor of political science at the National University of Singapore, said of the GDP goal for 2024.

Investors are watching this year’s “Two Sessions” of the National People’s Congress, the country’s parliament, and the Chinese People’s Political Consultative Conference, the top advisory body, for clues as to how dictator Xi plans to tackle the slowing economy. The premier’s work report, delivered to the NPC’s nearly 3,000 delegates in the Great Hall of the People in Beijing, is the keynote speech of the Two Sessions, laying out the party’s most important annual economic goals and setting the tone for policymakers for the rest of the year.

“We expect a moderate level of policy support, but given a less favourable base effect, pervasively downbeat sentiment, and property market weakness remaining an overhang, reaching 5 per cent growth this year may be more difficult,” ING greater China chief economist Lynn Song said in a note ahead of the work report.

An aborted COVID recovery in the past year has laid bare China’s deep structural imbalances, from weak household consumption to increasingly lower returns on investment and a collapse in loan demand, prompting calls for a new development model.

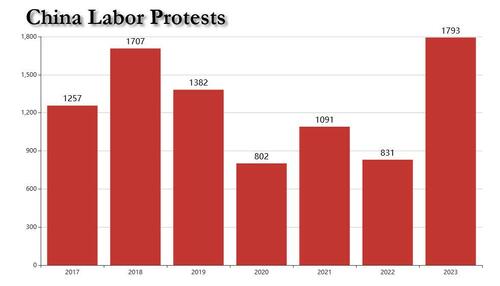

A property crisis, deepening deflation, a stock market rout, mounting local government debt woes and a surge in protests by angry Chines workers have increased the pressure on China’s leaders to respond to these calls.

“We should not lose sight of worst-case scenarios and should be well prepared for all risks and challenges,” Li said.

“In particular, we must push ahead with transforming the growth model, making structural adjustments, improving quality, and enhancing performance.”

There were no immediate details on the changes China intended to implement.

In setting the growth target, policymakers “have taken into account the need to boost employment and incomes and prevent and defuse risks,” Li said, adding China intended to have a “proactive” fiscal stance and “prudent” monetary policy.

China plans to run a budget deficit of 3% of economic output, down from a revised 3.8% last year. While generally in line with expectations, the country’s stock market observers were likely hoping for “an increase in the official fiscal deficit for any clues on policy support for property and other parts of the economy,” said Derek Tay, head of investments at Kamet Capital Partners, adding that China still has other fiscal tools to work with. But, as reported in late 2023, it plans to issue 1 trillion yuan ($139 billion) in special ultra-long term treasury bonds, which are not included in the budget. That said, the impact of such debt on growth would be modest at best: China needs trillions (in USD) in new debt to kick start to languishing and deflating economy.

While the stimulus target is the same as last year, the central government special bond issuance was new compared with a year earlier.

Beijing also plans to boost defense spending by 7.2%, well above the country’s economic growth target of around 5%. The pace of military expansion matches the spending budgeted under former Premier Li Keqiang’s watch last year. This marks the third year in a row of military expansion above 7%, even as the economy continues to slow down.

China trails only the U.S. in military spending and has been beefing up its armed forces amid tensions with the U.S. and the West. President Xi Jinping has emphasized the significance of preparing for the 100th anniversary of the establishment of the People’s Liberation Army in 2027.

The details of the defense budget expansion were not available, but the focus is understood to be on catching up with the U.S. while filling the gap in nuclear capabilities by enhancing other conventional weaponry. it also wasn’t clear if China plans on invading Taiwan this year or will once again kick this particular start to WW3 to next year.

The special bond issuance quota for local governments was set at 3.9 trillion yuan, versus 3.8 trillion yuan in 2023. China also set the consumer inflation target at 3% and aims to create over 12 million urban jobs this year, keeping the jobless rate at around 5.5%. Meanwhile, it remains unclear what China’s all-important youth unemployment is – the data was suspended for reporting when it hit a record over 20% and has since been restored in a several adjusted format which nobody trusts.

“The Chinese government does not want to stimulate the economy too much, … and also wants to keep leverage relatively low,” said Xia Qingjie, economics professor at Peking University. The budget deficit target can be adjusted later this year, if needed, Xia added.

According to Paul Pong, managing director at Pegasus Fund Managers, for China to achieve 5% economic growth this year forceful measures focused on boosting consumption will be needed as the property sector becomes a smaller driver of growth, with electric vehicles, sportswear and healthcare sectors are among the areas that might benefit most.

To achieve the 5% growth target, China will need to take measures to ease developers’ financing stress to avoid any unfinished homes. Sentiment remains weak, especially among foreign investors, given the property problems in China.

Analysts expect China to lower its annual growth ambitions in the future. The International Monetary Fund projects China’s economic growth at 4.6% this year, declining further in the medium term to about 3.5% in 2028.

Li also said, that China will continue to pour resources into tech innovation and advanced manufacturing, in line with President Xi Jinping’s push for “new productive forces.” Some analysts have criticized this policy, however, saying it exacerbates industrial overcapacity, deepens deflation and heightens trade tensions with the West. At the same time, reform advocates, worried about record low consumer confidence and plunging investor and business sentiment, want China to return to a path of pro-market policies and boost household demand.

The NPC is not the traditional venue for sharp policy shifts, which are usually reserved for events known as plenums, held by the Communist Party between its once-every-five-year congresses. One such plenum was initially expected in the final months of 2023. While it could still take place later this year, the fact that it has not yet been scheduled has fuelled investor concerns over policy inaction.

The extent to which China’s economic expansion is reached or spread across the entire economy is increasingly difficult to ascertain independently given greater restrictions on data accessibility, said Chong Ja Ian, an associate professor of political science at the National University of Singapore, said of the GDP goal for 2024.

As noted earlier, China also abruptly scrapped a three-decade tradition for the premier to hold a press conference at the NPC, fanning fears about opaque policymaking.

Tyler Durden

Mon, 03/04/2024 – 22:40

via ZeroHedge News https://ift.tt/UdvzAXN Tyler Durden