US Services Surveys Signal Stagflation In Feb: Higher Prices, Slower Growth

After the mixed Manufacturing survey picture (ISM puked, PMI spiked), who knows what we’ll get from the Services surveys today.

-

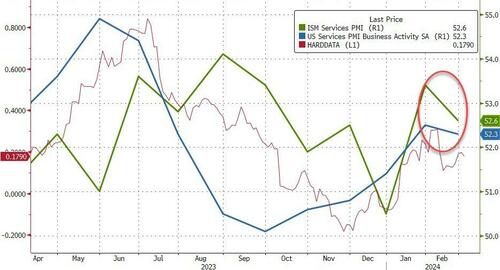

S&P Global’s Services PMI fell from 52.5 in January to 52.3 (final) in February, but we note that is up from the 51.3 preliminary print in early Feb.

-

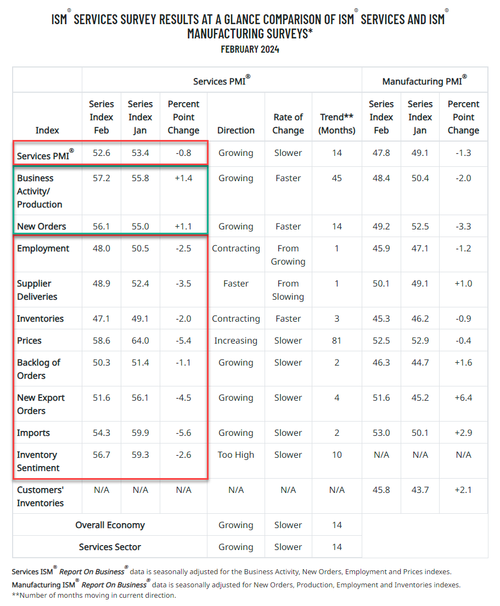

ISM’s Services survey also fell from 53.4 in January to 52.6 in Feb, below the 53.0 expectations.

Source: Bloomberg

Under the hood, ISM’s survey saw employment fall back into contraction at 48.0.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

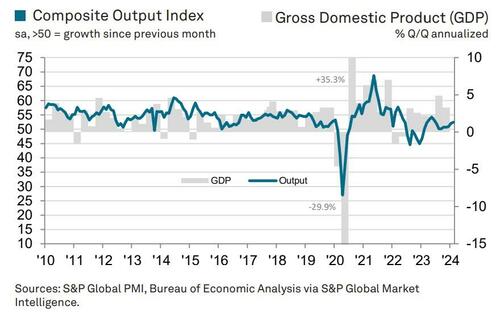

“A further robust expansion of service sector activity in February follows news of faster manufacturing output growth. The goods and services producing sectors are collectively reporting the sharpest growth since last June, hinting at a further quarter of solid GDP growth.

“The acceleration occurred despite a cooling of growth in financial services, linked to the recent pull-back in rate cut expectations. Demand for consumer goods and services has, however, picked up further in February amid the easing of the cost of living crisis and healthy labor market conditions, meaning consumers are once again at the forefront of the economic expansion. “

However, it’s not all rainbows and soft-landing unicorns

“A concern is that alongside this faster growth, the survey has seen price pressures revive.

Although average prices are still rising at one of the slowest rates seen over the past four years, the rate of inflation picked up for goods and services alike in February to hint at some broad-based firming of price pressures that could worry policymakers about cutting interest rates too early.”

So, to summarize, slower growth in services, mixed manufacturing, and higher prices in both… paging Mr. Powell.

Tyler Durden

Tue, 03/05/2024 – 10:05

via ZeroHedge News https://ift.tt/YcnygQT Tyler Durden