Wall Street Scrambles To Abandon DEI As “Legal Assaults” Mount

We’ve been stating for months that both the DEI and ESG gravy trains on Wall Street are finally coming to an unceremonious end. Who would have guessed the profit motive would be incompatible with mindless, unproductive virtue signaling and reverse racism?

The pushback on DEI has been immense, with entire universities and corporations slashing their DEI departments. Subha Barry, former head of diversity at Merrill Lynch, told Bloomberg this weekend: “We’re past the peak.”

The report highlighted yet another shift on Wall Street, wherein programs open to people of color and women are “now open to all”. Imagine that…

For example, Goldman Sachs has adjusted its “Possibilities Summit,” previously exclusive to Black college students, to now welcome White students as well. Bank of America Corp. has expanded its internal programs, initially aimed at women and minorities, to include all employees. Furthermore, Bank of New York Mellon Corp. has been advised by legal counsel to reevaluate and potentially eliminate strict diversity metrics from its workforce evaluations, according to a new report from Bloomberg.

Executives at major banks, including Goldman Sachs, publicly affirm their commitment to diversity, despite acknowledging privately the challenges posed by a growing campaign against DEI initiatives led by figures like Elon Musk and Bill Ackman, the report says.

Efforts to recruit diverse talent through programs for women and minorities are being reassessed, along with other diversity measures within corporations. Bloomberg says the shift is notable compared to the ambitious diversity pledges made by CEOs following George Floyd’s murder in 2020. Almost as if it was just mindless lip service to silence the ‘woke mob’…

The recent Supreme Court decision against affirmative action in colleges has intensified legal challenges to corporate diversity efforts, with banks wary of becoming lawsuit targets over claims of reverse discrimination, the report says.

“The legal assault on corporate diversity initiatives is gathering steam” after the Supreme Court’s rejection of affirmative action at colleges, the report says.

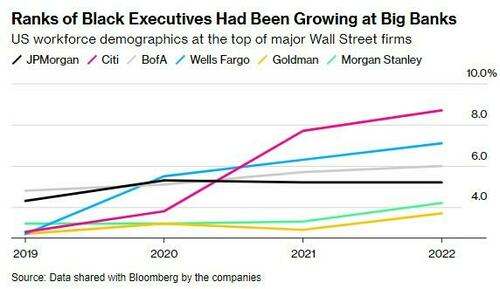

While black people make up about 14% of the total population, their representation in the senior roles at banks like Citi, JP Morgan and Goldman remains 8.7%, 5% and 3.7%, respectively, the note says. However, these figures have grown significantly since 2019:

Several other financial institutions, including the Bank of New York and Bank of America are subtly altering their approaches to diversity and inclusion initiatives.

These changes range from modifying executive compensation linked to diversity progress, adjusting the language around D&I goals, reconsidering certain mentorship programs, and adapting recruitment strategies to avoid explicit references to race and gender.

Despite these adjustments, spokespeople for these banks assert their continued commitment to fostering an inclusive workplace. And, nonetheless, industry consultants (whose meaningless careers and paychecks rely solely on racial division and DEI initiatives to begin with) and some financial executives still emphasize the importance of persevering with D&I efforts, despite these internal and external pressures.

Industry consultant Duarte McCarthy told Bloomberg: “We’re not suggesting that things stop because there’s this fear factor. But rather, take a look.”

Ana Duarte McCarthy, former chief diversity officer at Citigroup concluded: “We’re at an interesting inflection point.”

Yeah, the kind of inflection point that is going to see a lot of former “Chief Diversity Officers” scrambling through LinkedIn and updating their resumes…

Tyler Durden

Mon, 03/04/2024 – 20:40

via ZeroHedge News https://ift.tt/2v6YCsi Tyler Durden