Beige Book Warns Consumer Spending Slowing Due To “Heightened Price Sensitivity”, Sees Mounting CRE Fears

One month after the lukewarm January Beige Book found “little or no change” In US economic activity, which in turn followed the fare more downbeat November Beige Book found which economic activity was “slowing“, moments ago the Fed released the latest, March, Beige Book in which we find more green shoots glimmers as economic activity “increased slightly”, on balance, since early January, with eight Districts reporting slight to modest growth in activity, three others reporting no change, and one District noting a slight softening. Oddly enough, the Fed found a modest acceleration in economic activity even though “consumer spending, particularly on retail goods, inched down in recent weeks.” To justify this assessment, the Fed mentioned several reports which cited heightened price sensitivity by consumers and noted that households continued to trade down and to shift spending away from discretionary goods.

Taking a closer look at various economic segments, we find the following notable recent developments:

- Activity in the leisure and hospitality sector varied by District and segment; while air travel was robust overall, demand for restaurants, hotels, and other establishments softened due to elevated prices, as well as to unusual weather conditions in certain regions.

- Manufacturing activity was largely unchanged, and supply bottlenecks normalized further. Nevertheless, delivery delays for electrical components continued.

- Ongoing shipping disruptions in the Red Sea and Panama Canal did not generally have a notable impact on businesses during the reporting period, although some contacts reported rising pressures on international shipping costs.

- Several reports highlighted a pickup in demand for residential real estate in recent weeks, largely owing to some moderation in mortgage rates, but noted that limited inventories hindered actual home sales.

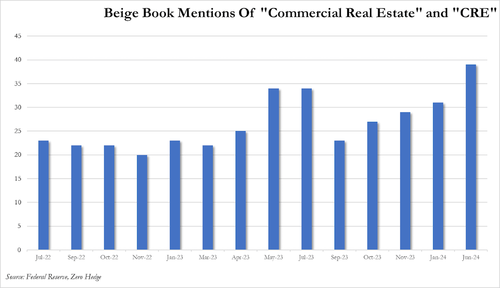

- Commercial real estate activity was weak, particularly for office space, although there were reports of robust demand for new data centers, industrial and manufacturing spaces, and large infrastructure projects.

- Loan demand was stable to down, and credit quality was generally healthy despite a few reports of rising delinquencies.

Unlike the recent ISM reports, both mfg and services, the Fed found that employment “rose at a slight to modest pace in most Districts” while labor market tightness eased further, with nearly all Districts highlighting some improvement in labor availability and employee retention. Some more labor market details:

- Businesses generally found it easier to fill open positions and to find qualified applicants, although difficulties persisted attracting workers for highly skilled positions, including health-care professionals, engineers, and skilled trades specialists such as welders and mechanics.

- Wages grew further across Districts, although several reports indicated a slower pace of increase. Employee expectations of pay adjustments were reportedly more in line with historical averages

And in bad news for those expecting a soft landing, the Fed cautioned that price pressures persisted during the reporting period, although several Districts reported some degree of moderation in inflation. Furthermore, while contacts highlighted increases in freight costs and several insurance categories, including employer-sponsored health insurance, businesses found it harder to pass through higher costs to their customers, who became increasingly sensitive to price changes. The good news is that the cost of many manufacturing and construction inputs, such as steel, cement, paper, and fuel, reportedly fell in recent weeks.

Looking ahead, the Fed said that “the outlook for future economic growth remained generally positive, with contacts noting expectations for stronger demand and less restrictive financial conditions over the next 6 to 12 months.” Boy are they in for a surprise.

Turning to the specific regional Feds, we found these summaries notable:

- Boston: Economic activity increased at a slow pace, and employment gains were modest. Output prices increased slightly, and wage growth held steady at a moderate pace. Residential realtors expressed growing optimism as both property listings and pending home sales increased. Uncertainty persisted concerning the fate of maturing office property loans, but the outlook for the sector did not worsen.

- New York: Regional economic activity flattened after a period of sustained weakness. Labor market conditions remained solid as employment grew slightly and wage growth picked up to a moderate pace. Labor demand and labor supply continued to come into better balance. Consumer spending declined modestly. The pace of selling price increases remained modest.

- Philadelphia: Business activity resumed a slight decline during the current Beige Book period—as it had for most of 2023. Employment grew slightly, and labor availability improved. Wage and price inflation subsided further, but housing affordability continues to squeeze consumers, especially those in lower-income households. Generally, sentiment improved, but firms remained cautious with subdued expectations for future growth.

- Cleveland: District business activity increased slightly. Some firms noted increased labor availability, reduced turnover, and easing wage pressures. Cost and price pressures changed little. Some manufacturers raised prices to cover higher costs, while some restauranteurs planned to absorb them. Business services firms continued to raise rates based on market conditions.

- Richmond: The regional economy saw little growth, overall. Consumer spending softened slightly as poor weather conditions over the last several weeks led to reduced sales. Imports and shipments of consumer goods picked up as retailers replenished inventories. Domestic manufacturing softened, however. Real estate market activity improved slightly. Nonfinancial service demand was unchanged. Employment rose and price growth was unchanged, keeping inflation moderately elevated.

- Atlanta: Economic activity was little changed. Labor markets and wage pressures eased. Nonlabor costs moderated, on balance. Consumers remained cost conscious, and higher prices squeezed household budgets. Travel and tourism remained strong. Home sales declined. Commercial real estate conditions slowed. Transportation activity was mixed. Manufacturing slowed somewhat. Overall loan demand declined.

- Chicago: Economic activity increased modestly. Employment increased modestly; nonbusiness contacts saw a modest increase in activity; business spending increased slightly; manufacturing activity was flat; and construction and real estate and consumer spending declined slightly. Prices and wages rose moderately, while financial conditions tightened modestly. Prospects for 2024 farm income deteriorated some.

- St. Louis: Economic activity has increased slightly since our previous report. Contacts reported that consumer demand slowed beyond seasonal norms. While labor markets remain tight overall, an increasing number of firms reported being fully staffed or overstaffed relative to consumer demand. Price growth has slowed in recent months. Contacts reported a mixed outlook for the coming year, although the outlook has improved since mid-December.

- Minneapolis: District economic activity was up slightly. Employment grew some, but labor demand softened. Wage pressures continued to moderate, and prices rose modestly. Consumer spending declined slightly, thanks to slow winter tourism. Commercial construction remained slow, but some markets saw single-family activity improve. Manufacturing, mining, and energy activity increased.

- Kansas City: Economic activity in the Tenth District was stable. Job gains were modest, and wage growth, while elevated, was tied closer to worker performance. Price sensitivity rose among consumers, even as prices rose moderately. Commercial real estate contacts indicated skepticism around recent appraisals of property valuation, not wanting to be in a position of trying to “catch a falling knife.”

- Dallas: Economic activity expanded modestly, with most sectors holding steady or experiencing slight to modest growth. Wage growth was moderate, and input cost and selling price growth was generally at or below average. Texas firms were more bullish on demand expectations than late last year, with more than half of the firms’ expecting increases over the next six months. Outlooks overall were less pessimistic.

- San Francisco: Economic activity grew slightly, employment levels rose slightly, and price and wage growth eased. Retail sales were stable, and demand for services grew modestly. Demand for manufactured products changed little, and conditions in agriculture were stable. Real estate activity rose slightly overall. Financial sector conditions were little changed.

One particular highlight: The Atlanta Fed notes said that “commercial real estate conditions slowed”, while the Kansas City Fed said that “Commercial real estate contacts indicated skepticism around recent appraisals of property valuation, not wanting to be in a position of trying to “catch a falling knife.”

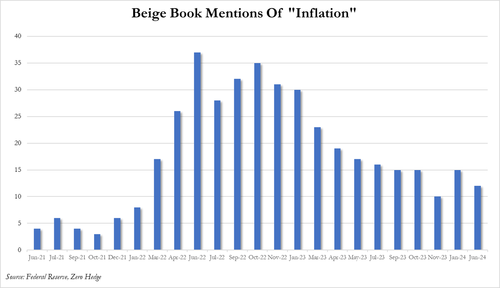

Finally, taking a visual approach to the data, we find that after mentions of inflation dropped to 10, or the lowest since Jan 2022 in November, before rebounding in January to 15, in March the number of mentions dipped again, this time to 12, suggesting that prices may indeed be resuming their grind lower.

And speaking of commercial real estate, while Powell is doing his best to pretend that there is nothing to worry about, today’s bailout of NYCB notwithstanding, the Fed itself is clearly worried as shown in the chart below which summarizes all mentions of “commercial real estate” and “CRE” in the latest beige book.

More in the full Beige Book (link).

Tyler Durden

Wed, 03/06/2024 – 14:33

via ZeroHedge News https://ift.tt/hjriwRt Tyler Durden