Euro Slides After ECB Cuts 2025 Inflation Forecast To 2.0% Target

As previewed earlier, there were no notable surprises in the ECB’s announcement, which kept all three key rates unchanged (Marginal Lending 4.75% Refinancing 4.5%, Deposit 4.0%).

More importantly, while some were expecting the ECB to change its guidance, it did not and instead it kept the language unchanged to wit: “The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner” adding that “based on its current assessment, the Governing Council considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal. The Governing Council’s future decisions will ensure that policy rates will be set at sufficiently restrictive levels for as long as necessary.”

Furthermore, the governing council reiterated that “rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission.”

Some other highlights:

Financial Conditions

- Financing conditions are restrictive and the past interest rate increases continue to weigh on demand, which is helping push down inflation.

Inflation

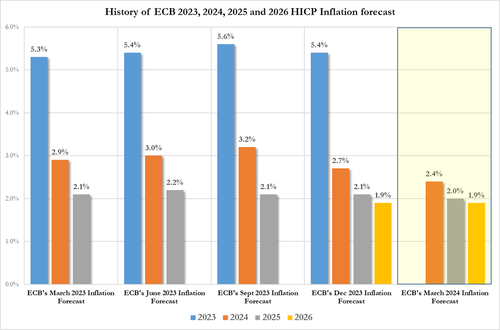

- The ECB said that it has revised inflation expectations down, in particular for 2024 which mainly reflects a lower contribution from energy prices. Staff now project inflation to average 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026. The projections for inflation excluding energy and food have also been revised down and average 2.6% for 2024, 2.1% for 2025 and 2.0% for 2026.

Besides the downward revision to inflation, the ECB also revised down their growth projection for 2024 to 0.6%, “with economic activity expected to remain subdued in the near term. Thereafter, staff expect the economy to pick up and to grow at 1.5% in 2025 and 1.6% in 2026, supported initially by consumption and later also by investment.”

To summarize:

HICP Inflation projections:

- 2024: 2.3% (prev 2.7%)

- 2025: 2.0% (prev 2.1%)

- 2026: 1.9% (prev 1.9%)

GDP projections:

- 2024: 0.6% (prev 0.8%)

- 2025: 1.5% (prev 1.5%)

- 2026: 1.6% (prev 1.6%)

On net, while the ECB failed to provide some near term rate cut guidance, and in fact the verbal guidance was unchanged from before, what the market viewed as a dovish signal was the ECB’s revision to its 2025 inflation forecast from 2.1% to 2.0%, and matching the ECB’s inflation mandate.

The bottom line is that much of the statement was a reiteration of the previous, with the guidance for policy and language around APP/PEPP the same, with no explicit tip toward policy easing. However, as the market reaction indicates, the key development was the latest macroeonomic projections. where inflation forecasts were revised lower across the board for headline and core. It is those alterations that spark a dovish reaction seen across both EGBs where yields are sliding and the EURUSD where the kneejerk reaction has been lower.

And now all attention turns to Lagarde’s press conference.

Tyler Durden

Thu, 03/07/2024 – 08:43

via ZeroHedge News https://ift.tt/O5Du3iM Tyler Durden