USDJPY Plunges As Soaring Japanese Wage Growth Sparks Surge in BoJ Rate-Hike Odds

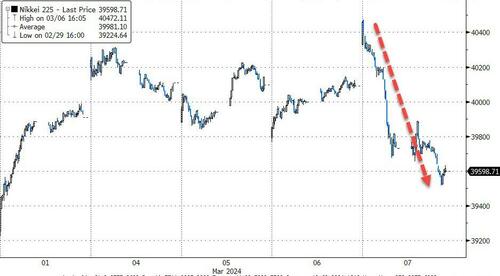

There was notable weakness in Japanese stocks overnight after Japanese wage growth accelerated to the fastest clip since June.

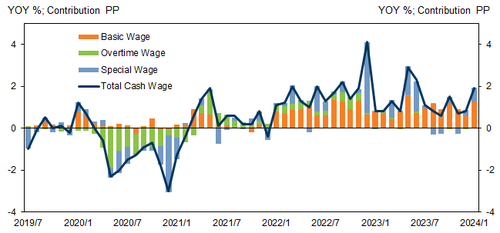

While the basic wage trend unchanged, overall wage growth was lifted by the special wage:

According to monthly wage data released by the Ministry of Health, Labour and Welfare (MHLW), nominal cash wage growth accelerated to +2.0% yoy in January, from +0.8% in December. Growth on a reference “same sample” basis (unaffected by changes in the survey sample) was +2.0%, with growth remaining at the same level since November last year.

The special wage rose sharply by +16.2% yoy and lifted overall wage growth by +0.6 pp. The special wage tends to fluctuate sharply and is particularly susceptible to sample bias. Growth in the special wage on a reference “same sample” basis rose only +5.9%.

Source: Goldman Sachs

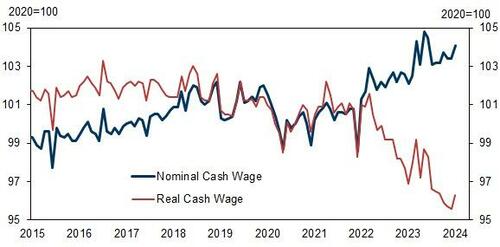

The picture is not a pretty one for the average Jo-san as ‘real’ wages continue to sink…

Source: Goldman Sachs

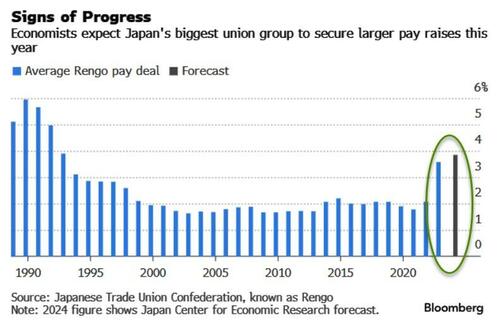

…which has prompted labor unions to make the strongest pay demands in three decades.

Rengo, Japan’s largest labor union federation, announced in the afternoon that the average demand made by its unions this year was 5.85%, the biggest figure in three decades, compared with an initial figure of 4.49% a year ago. Stronger demands from unions this year will bode well for the initial results of Rengo wage talks due for release on March 15.

Source: Goldman Sachs

Prime Minister Fumio Kishida has personally lobbied executives for large wage increases, as he seeks to mollify consumers frustrated over persistent inflation. His government has implemented a number of measures to that end, including tax breaks for companies that raise wages.

This surprise jump in wage growth prompted speculation that the BoJ will move to hike rates this month for the first time since 2007.

“All of a sudden March looks like it’s live, and just a few weeks ago that was much less clear,” said Michael Metcalfe, global head of macro strategy at State Street Global Markets.

“The BOJ has a history of surprising the market, and it doesn’t seem to do forward guidance like other central banks, so there is going to be volatility around and ahead of the meetings.”

Bets on a hike at the March 18-19 meeting are gaining traction (almost 80%) as Bloomberg reports or rumors emerging that some BOJ officials favor an early move while some government officials also support a rate hike.

Source: Bloomberg

…and smashed USDJPY down 3 handles (yen stronger)…

Source: Bloomberg

“Everything is pointing to yen buying,” said Takeshi Ishida, a strategist at Resona Holdings Inc. in Tokyo.

“After an excessive drop in yen volatility and a buildup of yen shorts, both are susceptible to unwinding.”

Bloomberg reports that BOJ officials are getting more confident over the strength of wage growth, according to people familiar with the matter, a view board member Junko Nakagawa backed on Thursday.

“There are signs of a clear shift in businesses’ behavior for setting wages,” Nakagawa said during a speech in Shimane, western Japan.

“Japan’s economy and inflation are steadily making progress toward meeting the stable 2% inflation target.”

The first stop for USDJPY will be 142 based on inflation-adjusted rate differentials, which would imply an upside of 4% from its current levels. Beyond there, its fortunes will lie in the evolution of the interest-rate outlook in the US.

However, as Ven Ram noted yesterday, just getting to zero-bound won’t do the trick for the yen. With realized inflation still running above 2%, the BOJ’s policy rate needs to get a lot higher for inflation-adjusted rates to start biting – and for the yen to keep climbing from here.

Even so, the next 5% or so is the relatively easy part of the yen to climb against the dollar. But its potential goes far beyond – and a lot of that will come down how far the BOJ is willing to go.

Tyler Durden

Thu, 03/07/2024 – 09:50

via ZeroHedge News https://ift.tt/xtzelPH Tyler Durden