US Payrolls Can Send Dollar, Treasuries In Opposite Direction

By Nour Al Ali, Bloomberg markets live reporter and strategist

Another robust showing in US non-farm payrolls could reignite the dollar’s ascent while prompting a decline in Treasuries heading into the weekend.

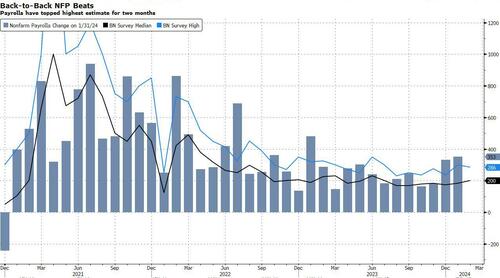

Expectations for February’s nonfarm payrolls hover around 200k, with estimates in a Bloomberg survey within one standard deviation ranging from 168k to 228k. The highest estimate is an outlier projecting 286k.

Data has surpassed expectations for the past two months, with January seeing a surge in wages.

The Fed committee’s outlook for three interest rate cuts this year may be revised during the March 19-20 meeting. Chair Jerome Powell said that the Fed is “not far“ from confidence needed to start cutting rates. That spurred a decline in two-year Treasury yields on Thursday, while traders added to bets on a June cut. The dollar also extended its losing streak to the longest since October.

Should the data surprise once again, it’ll fuel a goldilocks narrative that revives the dollar rally if market bets on a June cut re-adjust. Swaps tied to policy-meeting dates show traders pricing in about 22 basis points of Fed cuts in June, and about 90 basis points by December.

Tyler Durden

Fri, 03/08/2024 – 08:00

via ZeroHedge News https://ift.tt/xRhVzO4 Tyler Durden