Corporations Are Losing The ESG Battle, Forcing Them To Hide Advocacy

Authored by Kevin Stocklin via The Epoch Times (emphasis ours),

Wall Street titans appear to be having an increasingly hard time reconciling the conflicting goals of progressive activism and shareholder returns.

Until recently, many banks, asset managers, and insurers portrayed these goals as complementary, asserting that climate risk is financial risk and that the competence of management can be assessed by its commitment to social justice goals.

Today, however, those narratives are rarely heard.

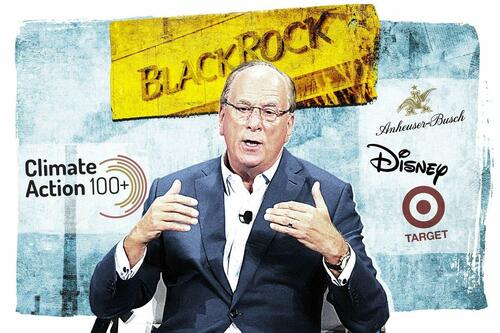

BlackRock, JPMorgan Chase, and State Street recently exited from Climate Action 100+, a coalition of the world’s largest fund managers that pledges to “ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change.”

On the heels of that exit, 16 conservative state attorneys general have demanded answers from BlackRock’s directors regarding the firm’s continued membership in other similar groups, which they assert could be a conflict of interest with its fiduciary responsibility to investors.

“We applaud BlackRock’s reevaluation of its status [with Climate Action 100+],” the attorneys general wrote in a Feb. 27 letter to BlackRock’s directors, “but we also note that BlackRock remains a member of other groups such the Net Zero Asset Managers initiative (NZAM), the United Nations Principles for Responsible Investment (UNPRI), and Ceres.”

Republican state officials praised a recent trend of banks’, fund managers’, and insurance companies’ departures from climate clubs. However, they question whether the Wall Street firms are actually changing direction or simply changing optics.

“I’m afraid nothing has really changed other than the public’s stance,” Montana Attorney General Austin Knudsen told The Epoch Times.

“But what really concerns me is that, if what these groups and these asset managers were doing was so righteous, why are they running from it now?”

Mr. Knudsen led the efforts to draft the letter to BlackRock directors.

Attorneys general from Alabama, Arkansas, Georgia, Indiana, Iowa, Louisiana, Mississippi, Missouri, Nebraska, South Carolina, South Dakota, Texas, Utah, Virginia, and West Virginia also signed the letter.

Power in Hands of a Few

At the center of the controversy is that so many corporate shares are owned by a relatively small number of financial firms.

According to a 2019 study in the Harvard Business Review, institutional investors—asset managers, insurance companies, banks, and state pension funds—owned 80 percent of the shares in the S&P 500 index of the United States’ largest companies.

“One of either BlackRock, Vanguard, or State Street is the largest shareholder in 88 percent of S&P 500 companies [and] they are the three largest owners of most DOW 30 companies,” the report states.

This concentration of power has raised concerns, particularly when the firms pledge to work in unison to target fossil fuel companies.

Critics argue that the issue is not only how institutional fund managers invest clients’ money, but also how they vote the corporate shares that they own on their clients’ behalf.

Climate Action 100+ has boasted of having a 75 percent success rate in compelling target companies to get on board with the net-zero agenda.

Although many financial firms have also been pursuing climate and social-justice goals and are also members in climate-activist alliances, BlackRock has been a lightning rod for criticism on this issue, largely because of its size and outspoken support for those goals.

BlackRock is the world’s largest asset management company, with about $10 trillion in assets under management.

“They’re involved in a lot of pension systems, and a lot of state investment systems, and I think they’re getting the most attention because they’ve got the most assets,” Mr. Knudsen said. “But I think other similar groups should take notice of this, and we’re hoping they do.”

BlackRock said it’s in the process of reviewing the letter from the attorneys general but disputes the allegations of conflicts of interest.

“BlackRock and its funds’ Boards of Trustees act in full accordance with their fiduciary obligations and in the best interests of all fund shareholders,” Christopher van Es, director of corporate communications at BlackRock, told The Epoch Times.

BlackRock has also refuted the charge that it has disinvested from the oil and gas industry.

In December 2022, Dalia Blass, BlackRock’s head of external affairs, testified before the Texas state Senate, “We participate in Climate Action 100 to engage in dialogue with other participants, market participants, [and] governments so that we understand issues that are relevant to our clients.”

Ms. Blass denied that BlackRock pressured companies to go along with the alliance’s climate agenda.

Texas state Sen. Bryan Hughes, a Republican, responded: “BlackRock’s website says, ‘We have joined Climate Action 100 to help ensure the world’s largest greenhouse gas emitters take necessary action on climate change.’”

Texas state Sen. Lois Kolkhorst told BlackRock at the hearing that she prefers Texas not to do business with the firm because it and the Lone Star state have “different goals.”

“Maybe you can’t serve two masters,” she said.

Read more here…

Tyler Durden

Sat, 03/09/2024 – 09:20

via ZeroHedge News https://ift.tt/ojycf5B Tyler Durden