Crypto Crack-Up Continues As Stocks & Bonds Sink Ahead Of CPI

With all eyes, ears, fingers, and toes tingling ahead of tomorrow’s “most important data item in the whole wide world ever” CPI print (and PPI and Retail Sales later in the week), stocks stumbled on muted volume, bond yields rose, the dollar and gold flatlined, but crypto kept going to the moon…

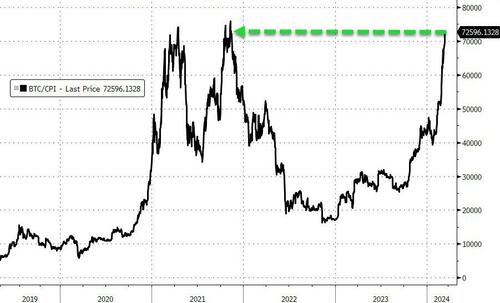

Bitcoin face-ripped once again up to almost $73,000 – well above the prior record nominal high…

Source: Bloomberg

…and getting very close to its inflation-adjusted high…

Source: Bloomberg

Ethereum also surged today, testing up towards $4100 for the first time since Dec 2021…

Source: Bloomberg

It appears crypto (Ethereum in this case) is following the resurgence in inflation expectations priced into the market…

Source: Bloomberg

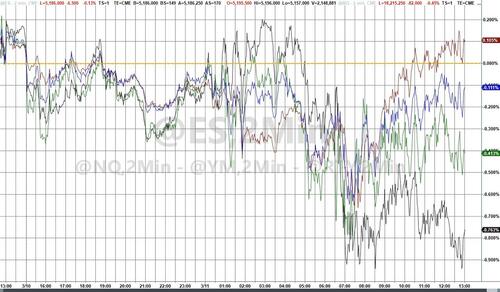

US Equity markets were less enthused on the day, with Nasdaq and S&P red (but Small Caps worst). The Dow desperately tried to cling to green…

NVDA is down almost 8% (close to close) over the past two days – its biggest two-day decline since October – and down almost 14% from its highs to today’s lows…

Source: Bloomberg

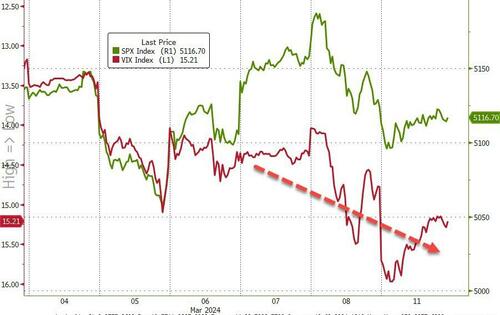

VIX has been bid into this event-risk-prone week…

Source: Bloomberg

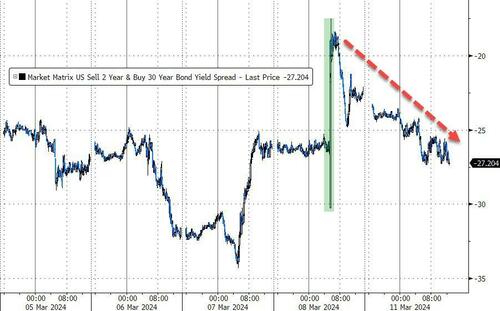

Treasuries were sold today with the short-end underperforming…

Source: Bloomberg

The yield curve (2s30s) bear-flattened, erasing Friday’s payrolls steepening…

Source: Bloomberg

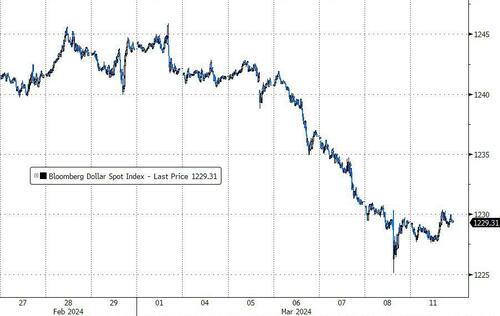

The dollar ended the day down (very very) marginally – for its 7th straight down day…

Source: Bloomberg

Gold mirrored the dollar, ending (very very) marginally higher…

Source: Bloomberg

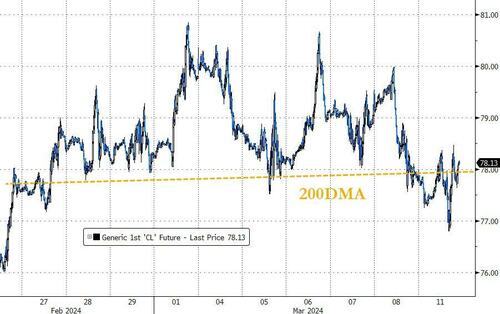

Oil prices ended higher, with WTI finding support at $77, bouncing back above its 200DMA ($77.97)

Source: Bloomberg

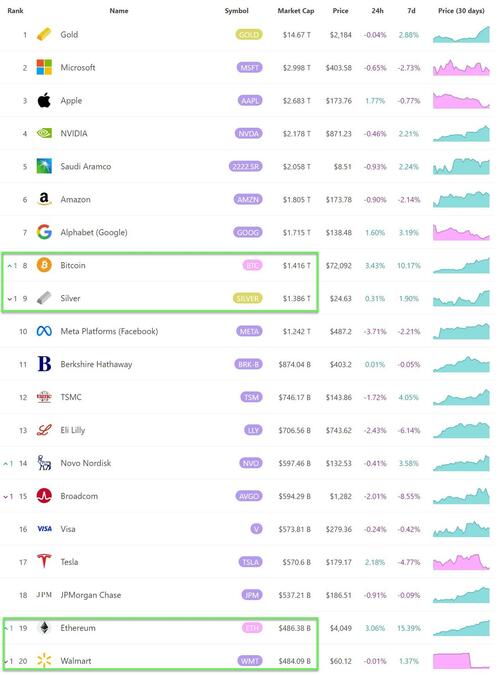

Finally, back to crypto. Bitcoin is now ‘larger’ than Silver and Ethereum has overtaken WalMart in terms of Market Cap…

Overall, the total crypto ecosystem’s value, according to CoinMarketCap, is now closing in on the previous record high around $2.8 trillion.

Tyler Durden

Mon, 03/11/2024 – 16:00

via ZeroHedge News https://ift.tt/rT7PZ1B Tyler Durden