Biden’s Budget Is Unmitigated Bull**it

Following yesterday’s release of Biden’s $7.3 trillion budget, the Biden administration bragged about lowering the deficit by $3 trillion over the next decade – an average of 0.8% of GDP over that period.

This would consist of roughly $2.6 trillion over 10 years in additional spending programs, offset by around $4.8 trillion in tax increases over the same period. Most of the tax and spending proposals have been included in prior budget proposals from the White House, according to Goldman’s Alec Phillips, however there are several new items.

The budget would increase the corporate alternative minimum tax on book income from 15% to 21%, raising $137 billion over the next decade. It also limits a corporation’s ability to deduct employee pay exceeding $1mm/year, raising $272 billion over 10 years. The largest proposed tax increases include; raising the corporate minimum tax from 21% to 28%, as well as a series of tax increases on high-income earners, including new Medicare taxes, and a new 25% minimum tax on incomes over $100 million, raising $500 billion over the next decade.

Of course, it has zero chance of passing under the current Congress – but that’s not the point.

As one DC strategist wrote in a morning email noted by CNBC‘s Brian Sullivan, the budget deficit will still grow by another $16 trillion over the next decade – and that’s with aforementioned tax hikes.

Without them, the deficit grows to $19 trillion.

In short, talk of ‘$3 trillion saved’ is total bullshit in the grand scheme of things, given how much the national debt will grow in the best case scenario.

“No family budget or business could exist with this kind of math,” says Sullivan.

DC strategist email note this morning lays it out well.

The budget deficit will growth another $16 TRILLION over next 10 years. Thats *with* the proposed massive tax hikes.

Without them the deficit will grow $19 trillion.

That’s why you will hear the “deficit is being… https://t.co/W5aideSUx1 pic.twitter.com/ELpg7vyeDM

— Brian Sullivan (@SullyCNBC) March 12, 2024

Sullivan noted earlier that our incompetent, spendthrift government has added 60% to the national debt since 2018 alone.

We’ve added 60% to national debt since 2018

Germany – a country with major economic woes – added ‘just’ 32%.

Maybe it will never matter. Maybe MMT is real. Maybe we just cancel or inflate it out.

Maybe career real estate borrowers or career politicians aren’t the… https://t.co/XZJ5M9mbEu

— Brian Sullivan (@SullyCNBC) March 12, 2024

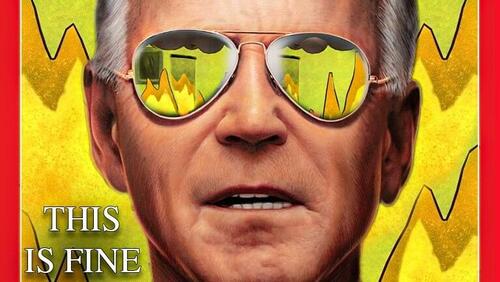

This is fine…

Tyler Durden

Tue, 03/12/2024 – 12:40

via ZeroHedge News https://ift.tt/alcrvtO Tyler Durden