Big-Tech Bounces But Hot Inflation Hits Bonds, Bullion, & Bitcoin

It seems Breakevens were on to something…

Source: Bloomberg

This morning’s CPI was not at all what the narrative-peddlers wanted to see and that sent rate-cut expectations tumbling…

Source: Bloomberg

…and the timing of the first cut extended (May is now off the table)….

Source: Bloomberg

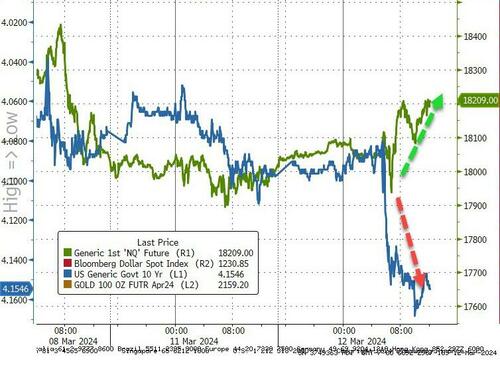

Treasury yields were higher across the board with very little spread across the curve (up around 6bps on the day)

Source: Bloomberg

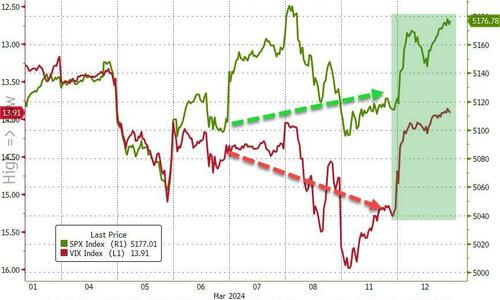

Of course, higher inflation, less dovishness in STIRs, higher bond yields are not a good sign for stocks… but that would be in a normal world. But as we highlighted overnight, this market was priced for worse... and so Nasdaq, S&P, and The Dow all surged higher along with bond yields…

Source: Bloomberg

…just like it has been for months…

Source: Bloomberg

Small Caps did suffer… but all the other US majors were up large with Nasdaq leading…

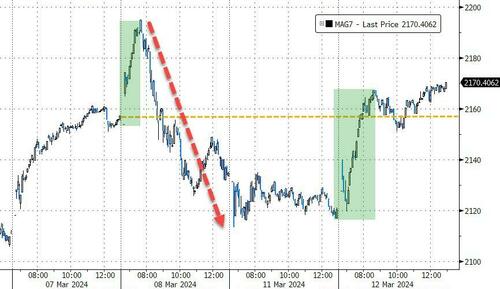

Mag7 stocks bounced strongly to pre-payrolls levels…

Source: Bloomberg

The pre-CPI anxiety priced into VIX was immediately eviscerated…

Source: Bloomberg

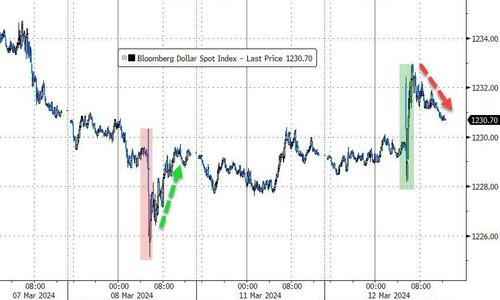

The dollar spiked higher on the CPI data but faded back some gains…

Source: Bloomberg

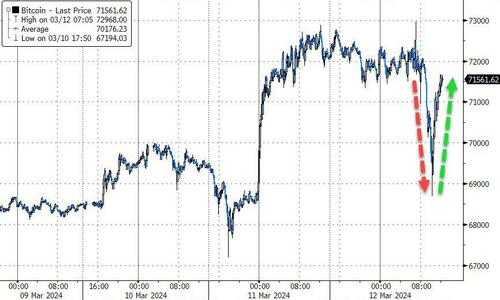

Bitcoin ended lower on the day, but well off its lows after puking down to yesterday’s lows and bouncing off $69,000…

Source: Bloomberg

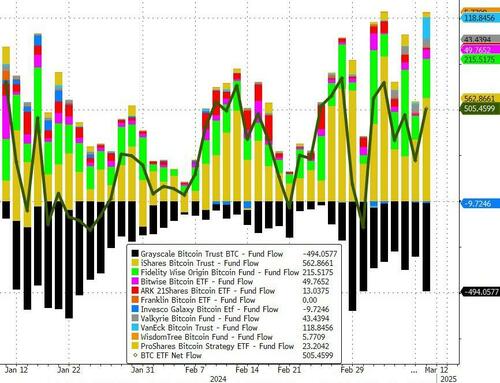

But once again we saw huge net inflows yesterday (over $500mm)…

Source: Bloomberg

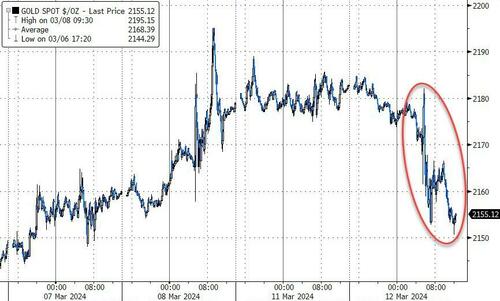

Gold was clubbed like a baby seal, also erasing yesterday’s gains…

Source: Bloomberg

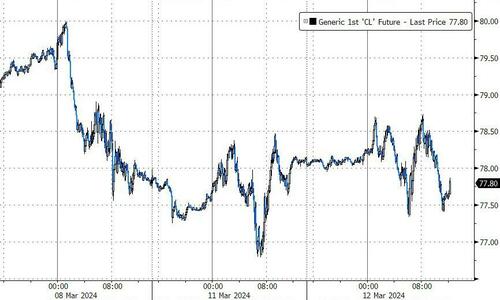

Oil was marginally lower on the day, ahead of tonight’s API inventory data…

Source: Bloomberg

Finally, in case you were under any impression that The Fed is still apolitical…

Source: Bloomberg

And then there’s this… four years ago today, it all started to go pear-shaped…

Four years ago today [March 12, 2020] pic.twitter.com/YvOUNkRfls

— Nicholas Brown (@NicholasABrown_) March 12, 2024

Tyler Durden

Tue, 03/12/2024 – 16:00

via ZeroHedge News https://ift.tt/rbLg0SD Tyler Durden