Jamie Dimon Sees “Little Bit Of A Bubble In Stock Markets Right Now”, But BofA Says Buy Because This Time It’s Different

“One fact of financial life should never be forgotten. Wall Street – to use the term in its figurative sense – would like its customers to make money, but what truly causes its denizens’ juices to flow is feverish activity. At such times, whatever foolishness can be marketed will be vigorously marketed – not by everyone but always by someone.”

– Warren Buffett, Berkshire Hathaway 2023 investor letter

One week ago, a polite feud broke out among some of Wall Street’s top strategists, when – nearly a year and a half after turning bearish when the S&P hit 3,500 and remaining steadfastly so every since – JPM’s equity strategist Marko Kolanovic goalseeked the usual selection of bearish reasons including “froth” and “complacency” to “explain” why the market melt up can not be sustained (instead of actually correctly predicting that the market will continue to melt up) and warned that the bubble is bursting. At the same time his colleague at Goldman, head of US equity strategy David Kostin, who has been far more constructive on stocks and has even raised his 2024 S&P price target not two but three times in the past few months, literally said that this bubble is different…

… and that 1999 and 2021 were worse, as “the prevalence of extreme valuations today looks far less widespread than in 2021 after adjusting for market concentration“, in other words, it is a bubble but only in the handful of stocks that really matter for the market… so there’s nothing to worry about this time or something. Here is the punchline:

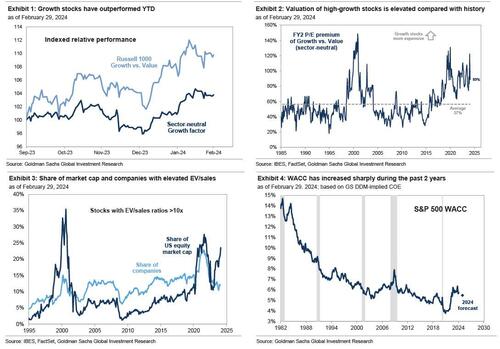

The recent rally has driven the share of market cap in stocks with extremely high valuations to levels similar to those reached during the euphoria of 2021.

However, the prevalence of extreme valuations today looks far less widespread than in 2021 after adjusting for market concentration. The number of stocks with elevated EV/sales ratios has declined sharply from the peak in 2021. Unlike the broad-based “growth at any cost” in 2021, investors are mostly paying high valuations for the largest growth stocks in the index. This dynamic more closely resembles the Tech Bubble than 2021. However, in contrast with the late ’90s, we believe the valuation of the Magnificent 7 is currently supported by their fundamentals.

Another key difference between the market today and in 2021 is that the cost of capital is much higher today than it was then. In 2021, the implied weighted average cost of capital (WACC) of the S&P 500 fell to 3.8%, its lowest level in decades. The low cost of financing meant growth plans could be funded relatively cheaply at the same time as a low discount rate benefited the valuations of growth stocks with cash flows in the distant future. As inflation surged and the Fed hiked sharply, the cost of capital spiked. The WACC now equals 5.7%.

Translation: the bubble of Fabulous Four or so stocks that have done all the heavy in the past year may be poised to pop, but it’s not really a bubble as “this time is different”, plus it not like all those ridiculous EPS forecasts that see earnings growing exponential in perpetuity for AI/mega tech names, can all be wrong… can they?

Well, maybe they can… according to the world’s most powerful banker, Jamie Dimon, who was speaking at an Australian Financial Review business summit event, “little bit of a bubble in equity markets right now.“

The troubling admission, which framed Dimon’s far less optimistic admission about the US economy, in which he said that the “chance of a soft landing in the next year or two is half” of what the world is pricing in, “probably 70%-80%”, came just hours after JPM’s Marko Kolanovic issued his weekly fire and brimstone sermon hoping that this week, this is the week, when he will finally be right and stocks will finally crash back to the mid-3000s.

In his latest JPMOrgan View note, Kolanovic once again tried to come up with any reason whatsoever that scare the bank’s clients and keep them out of what has so far been a 40% rally from the October 2022 lows (which is when Marko turned bearish), and said that the recent rush into momentum stocks like the Mag 7 has typically been followed by a correction whenever it has occurred in the past: as a result “while it is unclear whether the recent deceleration is simply a pause in the rally or the start of a pullback, in our view the risk-reward is negatively skewed.”

Kolanovic went on to caution – yet again – the bubble in Mag 7 stocks, writing that it’s only a matter of time before it all comes crashing down, to wit:

“a combination of High for Longer and the Halo Effect of LLM stocks has created market dislocations across global equities over the past year. Extreme crowding into Momentum has steadily risen along with equity investor positioning. Momentum is a dynamic stock factor that changes its exposure depending on macroeconomic and fundamental conditions. As such, it often becomes crowded, followed by an inevitable and often sharp correction (i.e. momentum crash)… NVDA has a causal relationship to S&P 500; given this relationship coupled with very bullish investor sentiment and positioning, we caution investors that this relationship is likely to work in reverse when the AI euphoria peaks.

…

As such, we keep a defensive allocation in our model portfolio, unchanged vs. last month, with an UW in equities and credit vs. OW in cash and commodities.”

Fundamentally, Marko is not wrong of course (and those interested can read more in his full note available to pro subs in the usual place), the problem – as anyone who listened to him and shorted stocks in September 2022 when we said his bearish pivot actually marked the market bottom, which we humbly suggest has been the best market-timing call this decade…

Kolanovic turned bearish. Bottom https://t.co/bXVFOHDoRS

— zerohedge (@zerohedge) September 30, 2022

… is that when it comes to timing market inflection points, the Croat strategist is an epic disaster, about as accurate as Cramer or Gartman. Which is why, sadly for the skeptics, as long as Marko remains bearish the market will rise.

Which, incidentally, is something that another Wall Street strategist would complete agree with: in her latest note published just one week after she hiked her year-end S&P price target from 5,000 to 5,400 in keeping with all the other lemmings who chase price and then goalseek reasons to justify their groupthink, BofA’s Savita Subramanian said that she has “had a full week of feedback and pushback” since raising her year-end price target to 5,400, and notes that she hears “that sentiment is now “full bull”, the market is trading in bubble-like territory, and it is time for something else to break from the Fed’s aggressive monetary policy.“

She goes on to address several of the FAQs, essentially derivatives of one very direct question on a recent call: “Savita, are you forecasting a bubble?”

Q: What defines a bubble, and is the S&P 500 one?

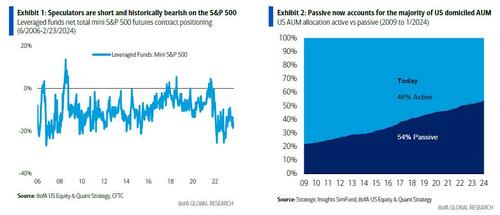

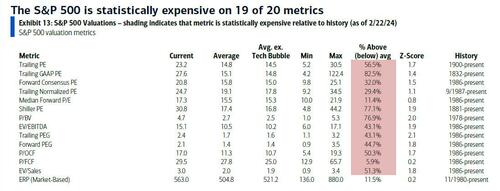

A: Prior market bubble conditions include (1) a gap between price and intrinsic value, (2) democratization of the asset class, and (3) rampant speculation, often amplified by the use of leverage. Housing in 2007, Tech in 2000, tulips in 1637 are examples that tick these boxes. But the S&P 500 today does not: passive/index ownership (most of which is a proxy for the S&P 500) makes up just over half of US equity float, but Japan passive equity reached 80%. Moreover, CFTC data show net short positions by speculators. The gap between price and intrinsic value is high based on snapshot PE multiples, but the ex-Magnificent 7 trades closer to long-term average multiples, and, more importantly, today’s index lacks comparability to prior decades’, in our view.

* * *

Q: So historical valuation doesn’t matter?

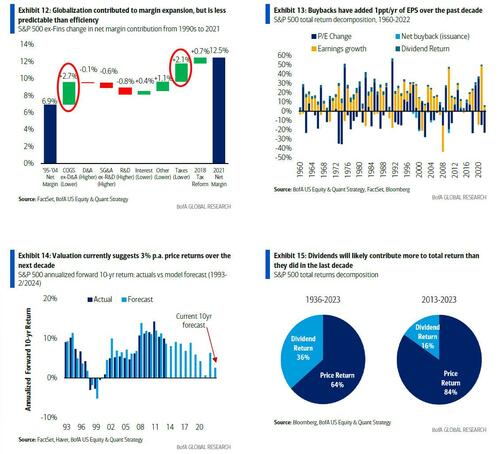

A: Valuation matters. But comparing a trailing PE today to a trailing PE of prior decades makes little sense given the index’s mix shift (ZH: right, because it’s different this time… never heard that one before). Furthermore, companies have been forced to abandon low quality EPS growth (levered buybacks, global cost/tax arbitrage) to focus on efficiency, yielding more predictable margins and warranting a higher multiple. Finally, valuation is a poor predictor in the short-term (r-sq of 10% for 1yr returns) but is all that matters in the long-term. Today it indicates lower price returns over the next decade with a higher proportion of total return from dividends (ZH: so… don’t buy then? We are confused…)

Q: Is it 1995 or 1999?

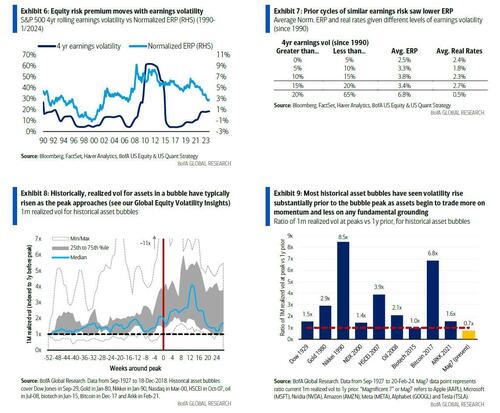

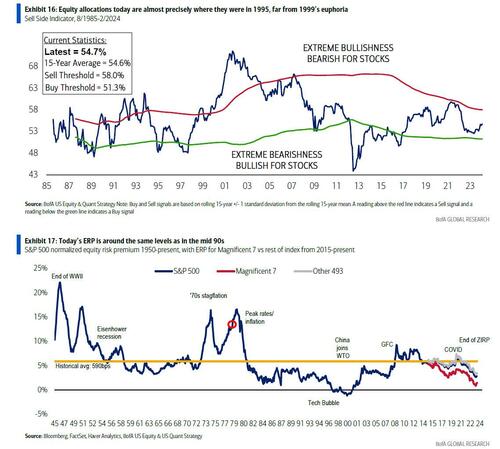

A: More 1995. US equity sentiment is at almost precisely the same level as in 1995 based on our Sell Side Indicator – neutral, not wildly bullish like 1999. The S&P 500 ERP is at almost the same level as in the mid-90s, and actually went negative by 1999. The efficiency/productivity themes of today (AI, automation) are nascent like the PC revolution was in the mid-90s. In 1999, Tech was valued on price to eyeballs, today, the earnings contribution and capital discipline of TMT is similar to that of 1995’s Nifty 50.

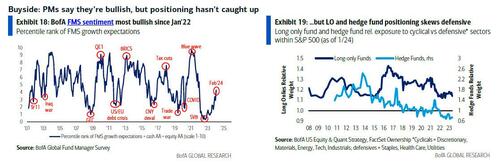

Q: Where is equity sentiment today, really?

A: The net message of investor sentiment frameworks is neutral on US equities. Bull markets end with euphoria, and today euphoria has been ring-fenced to themes (AI, GLP-1 etc.) Sentiment has warmed up on equities since mid-2023, driving our slightly lower level of conviction in an up market, but is nowhere near bullish levels of prior market peaks. In our view, this bull market has legs.

In retrospect that is not even the worst, most goalseeked defense of the current tech bubble; And FWIW, we won’t even bother to debunk all the points brought up here. Instead we will leave it to the capable hands of Savita’s own co-worker Michael Hartnett who has done a phenomenal job of countering the bullshit of the “it is only a small bubble, plus this time it’s different” argument over, and over and over, and over again.

More in the full BofA report available to pro subs in the usual place.

Tyler Durden

Mon, 03/11/2024 – 23:00

via ZeroHedge News https://ift.tt/1wq5le3 Tyler Durden