Stellar 30Y Auction Sees Biggest Stop Through Since Jan 2023

After a solid 3Y auction and a sloppy 10Y, moments ago the Treasury closed out the week’s coupon issuance with the final bond sale of the week when it sold 30Y paper in what was a stellar auction.

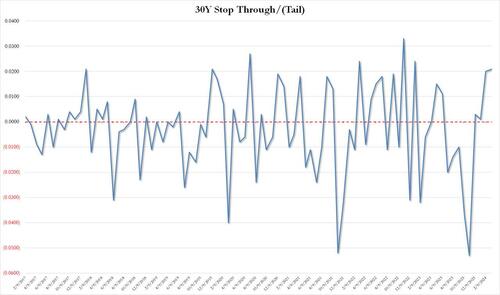

The 29-Year, 11-Month reopening priced at a high yield of 4.331%, down from last month’s 4.360% and stopped through the 4.352% When Issued by 2.1bps, the biggest stop through since Jan 2023, and the 4th in a row as the market appears to have substantial appetite for duration.

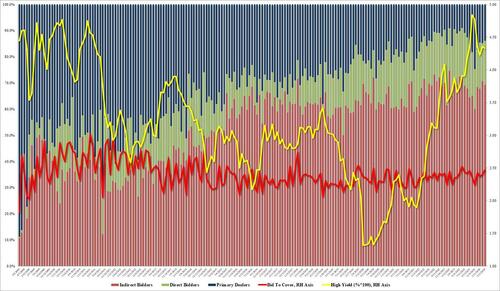

The bid to cover was also stellar, jumping to 2.47 from 2.40, the highest since June.

The internals were also strong with Indirects awarded 69.3%, down from 70.7% in Feb but aside for that outlier, the highest since June and well above the six-auction average of 66.1%. And with Directs awarded 16.8%, above the recent average of 13.2%, Dealers were left holding 13.9%, the lowest since August 2023.

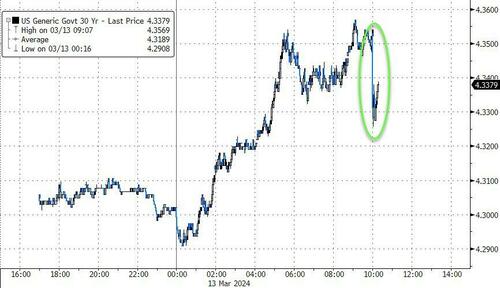

Overall, this was a stellar auction, and a fitting end to a week where yields have moved notably higher. Not surprisingly, yields dropped after news of the solid bond sale hit, but even so yields were still about 3bps higher on the day following concerns that Japanese bond yields are about to soar after the BOJ hikes rates next week.

Tyler Durden

Wed, 03/13/2024 – 13:26

via ZeroHedge News https://ift.tt/zHOvbfk Tyler Durden