Ethereum’s Dencun Upgrade Goes Live: Industry Veterans Share Praise, Skepticism

Ethereum’s much-anticipated Dencun upgrade (portmanteau of two upgrades, ‘Deneb’ and ‘Cancun’), which allows for the reduction of gas fees on layer-2 solutions through proto-danksharding, went live earlier today, March 13, drawing both applause and doubts from speculators.

The Dencun upgrade brings enhancements that boost Ethereum’s efficiency and scalability, among other improvements to the network. The most noticeable benefit of Dencun will be the reduced costs for L2s to post data on Ethereum. This will result in significantly lower gas fees on L2s, potentially up to 90% cheaper based on current activity levels.

To illustrate the impact, let’s look at a comparison of projected gas costs for a DEX swap on major L2s before and after the Dencun upgrade:

For those unfamiliar, the Dencun upgrade is centered around EIP-4844, known as “proto-danksharding.” As Bankless explains, this proposal is named after Ethereum researchers Protolambda and Dankrad Feist, and its main aim is to support the rollup-centric roadmap of Ethereum. It fundamentally changes the structure of Ethereum as a modular blockchain and makes it a more efficient data availability layer for its L2s.

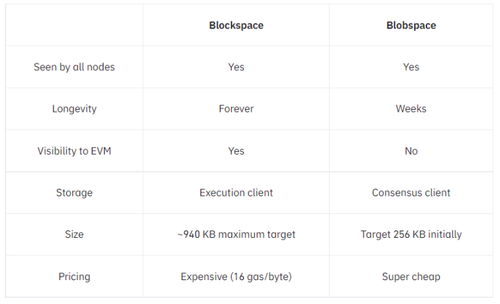

EIP-4844 introduces a new transaction type that carries “blobs,” which are large packets of raw data that L2s post on Ethereum. With the Dencun Upgrade, Ethereum now processes two main types of transactions:

- Regular transactions — these are the standard transactions we’re familiar with, covering actions like ETH transfers and interactions with smart contracts on the mainnet. These transactions are processed and executed by the Ethereum Virtual Machine (EVM) and are stored permanently on the Ethereum blockchain, consuming significant amounts of blockspace. They currently account for about 90% of Ethereum’s gas usage and storage, with the remainder being transaction data posted by L2s.

- Blob-carrying ‘data transactions’ — introduced by EIP-4844, these transactions provide L2s with a more efficient way to post large amounts of their data on Ethereum by storing them in blobs. Unlike regular transactions, they don’t need to be executed by the EVM and are stored on Ethereum temporarily, around 18 days (or 4096 epochs), rather than permanently.

Traditionally, L2s post batches of regular transactions on the mainnet. These transactions are more expensive because they include call data. Call data provides granular details about each transaction – for instance, when transferring tokens, it includes the transfer function’s arguments and other transaction parameters. This level of detail enlarges the transaction size and, consequently, the gas required, as the EVM must read and execute it. While this is necessary for transactions directly on the mainnet, it’s superfluous for L2s that only need Ethereum for data availability.

With EIP-4844 and blob-carrying transactions, the data posted by L2s only includes important details of L2 transactions required for the data availability needs of the chain. These include raw data of the transactions in the form of blobs as well as references or pointers to the blobs within the transaction.

Ultimately, blob-carrying transactions make it drastically cheaper for L2s to post data on Ethereum mainnet. Since blob data doesn’t require re-execution on Ethereum, it’s cheaper to post. This cost-effectiveness is their key advantage when compared to regular transactions.

To summarize, EIP-4844 and blob-carrying transactions introduce several key enhancements:

- Enhanced scalability for Ethereum — Given the constraints on the number of transactions Ethereum can process per block, EIP-4844 and blob-carrying transactions enable a more efficient use of blockspace compared to existing methods.

- Lower fees on L2s via more efficient data availability — With blobs, L2s now have a cheaper way to post data on Ethereum Mainnet. This reduction in costs can be passed on to users, making transactions on L2s much cheaper. Moreover, since blobs are a different type of transaction altogether, they have their own fee market and remain unaffected by any increased activity of regular transactions on Ethereum Mainnet. Lower gas fees are a big part of every L2’s roadmap and vision for onchain adoption, and we are seeing proactive initiatives from all L2 teams to integrate these fee reductions into their ecosystems promptly following the Dencun Upgrade.

- Foundation for harding — Proto-danksharding is an incremental step that introduces some of the concepts of sharding without fully implementing it. For instance, EIP-4844’s blobs will be a crucial part of full sharding. The Dencun Upgrade’s activation of blob transactions allows the community to test Ethereum network’s capacity to handle increased data loads live in production and prepare for the full sharding upgrade.

So what do industry insiders and veterans think of today’s long-awaited upgrade?

Speaking to CoinTelegraph, Ruslan Lienkha, chief of markets at crypto wallet provider YouHodler, said “I don’t think this upgrade will significantly impact ETH’s price in the short term,” “But we may notice an increase in activity on the blockchain. At the same time, I expect ETH’s price to grow in the long term because the upgrade will make ETH much more valuable in the growing competition of new innovative layer 1 blockchain projects.”

But for Mara Schmiedt, CEO of liquid staking development firm Alluvial, the implications of the Dencun upgrade are bullish, even in the short term. “In light of Bitcoin’s recent institutional surge enabled by recent ETF spot market approvals and total value locked in Ethereum’s DeFi ecosystem close to scratching the $100 billion mark, this scalability-focused upgrade is much anticipated,” Schmiedt told Cointelegraph, adding: “Ethereum has faced scalability issues that have acted as a blocker to mainstream adoption and accommodating the growing number of users and transactions.”

For Onno Sterk, chief operating officer of crypto exchange OSL, the Duncun upgrade is nothing short of significant, as it allows Ethereum to fix critical issues that have hindered the network’s development for years. “The digital asset space, while revolutionary, has been marred by issues of high transaction fees and limited scalability,” Sterk told Cointelegraph. “These challenges have not only stifled innovation but also restricted the wider adoption of blockchain technology across various sectors.” He further stated:

“At its core, the Dencun upgrade is centered around proto-danksharding, an innovative approach aimed at drastically reducing transaction fees while simultaneously increasing the network’s processing speed. This development is monumental, as it enables Ethereum to serve as an effective database for other blockchains, thereby facilitating a more interconnected and efficient digital asset ecosystem.”

Over the past year, Ether has seen a 141% return due to a combination of Dencun upgrade optimism, speculation on the approval of spot Ether exchange-traded funds (ETFs), and a broader crypto market recovery, although the asset has somewhat underperformed Bitcoin’s 198% return during the same period. Although crypto enthusiasts are anticipating a favorable decision on Ether ETFs by the United States Securities and Exchange Commission in May, not all share the sentiment.

“From my viewpoint, the SEC will use any excuse to postpone the decision,” said Lienkha, “which is why I am not expecting approvals this spring. However, I think the probability of a final positive decision is quite high.”

Recently, Eric Balchunas, senior ETF analyst at Bloomberg, also warned that the odds of an Ether ETF approval in May are not as rosy as one may expect.

Meanwhile, Alluvial’s Schmiedt emphasized that in order for Ethereum to reach meaningful adoption, “institutional adoption, widespread accessibility, and clear regulatory frameworks” are all necessary factors. “The success of Ethereum relies on the active participation of its community members, and I‘d encourage everyone — whether you are a developer, user or investor — to continue contributing your expertise and perspective to help shape the future of Ethereum,” she stated.

Tyler Durden

Wed, 03/13/2024 – 19:20

via ZeroHedge News https://ift.tt/cexwRua Tyler Durden