‘Bad News’ Battered Bonds, Big-Tech, & Banks On The Week; Copper & Crude Rip

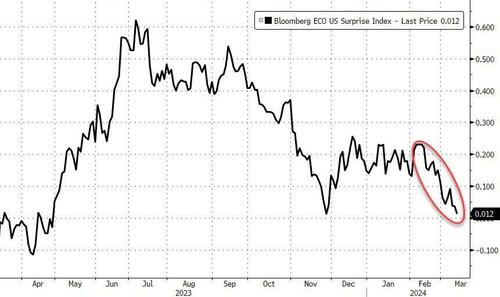

An ugly week on the macro side – hotter than expected inflation, slower than expected growth, weaker than expected labor market data…

Source: Bloomberg

…but the inflation issues sent rate-cut expectations reeling (now less than 3 cuts priced in for 2024)…

Source: Bloomberg

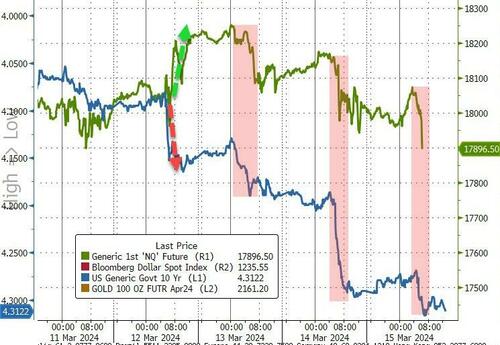

And as rate-cut expectations fell, Treasury yields rose… non-stop… all week with the belly of the curve underperforming (5Y yields up 28bps on the week)…

Source: Bloomberg

Yields all ended back up near their year-to-date highs…

Source: Bloomberg

Higher yields were initially shrugged off by stocks but as they kept rising, there was no arguing…

Source: Bloomberg

Small-Caps and Big-Tech were the week’s biggest losers…

Banks were not pretty this week as The Fed’s BTFP facility expired…

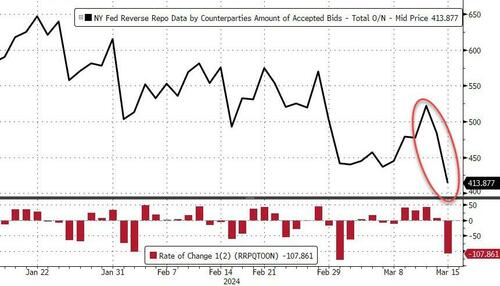

…and liquidity was sucked hard out of the RRP. $108BN drawn down in the last two days to fresh cycle lows…

Source: Bloomberg

Anti-Obesity drug stocks dared to end red…

Source: Bloomberg

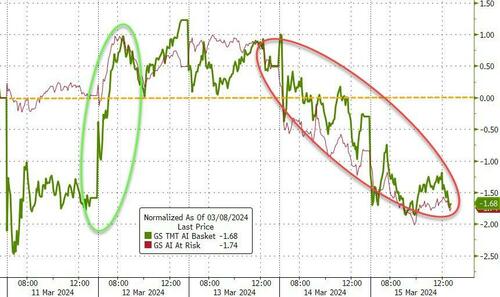

AI stocks also pumped and dumped on the week…

Source: Bloomberg

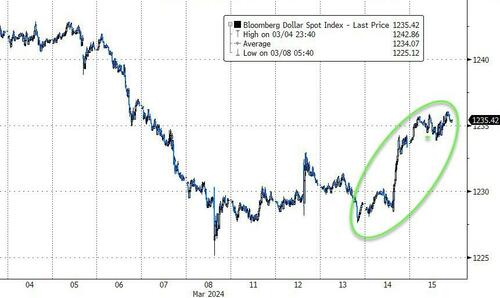

The dollar surged this week – as BoJ chatter picked up – with its best week since mid-Jan (rebounding some from last week’s dollar-plungefest)….

Source: Bloomberg

The dollar’s gains were gold’s losses as the precious metal ended the week down 1%…

Source: Bloomberg

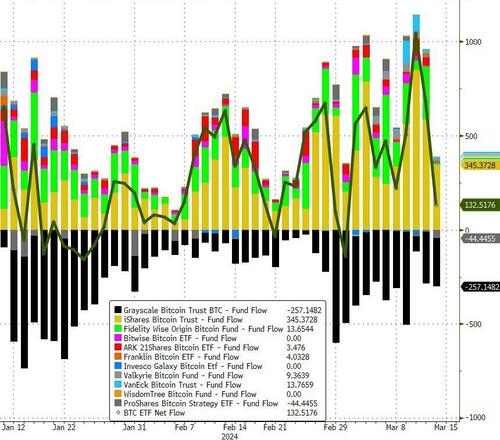

Despite big net inflows this week…

Source: Bloomberg

…bitcoin ended the week only marginally higher (up around 3%), with choppy moves (day-session dips bought overnight), but ened back above $70,000…

Source: Bloomberg

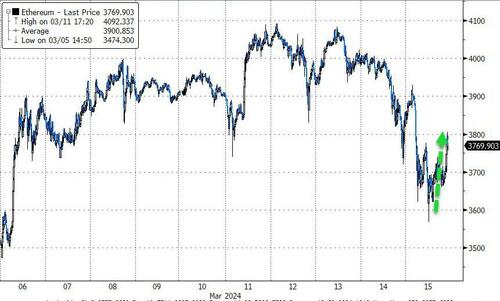

…and ethereum was a little worse, down around 3%, on the week (thanks to Democrats’ letter overnight pressuring the SEC on ETH ETFs)…

Source: Bloomberg

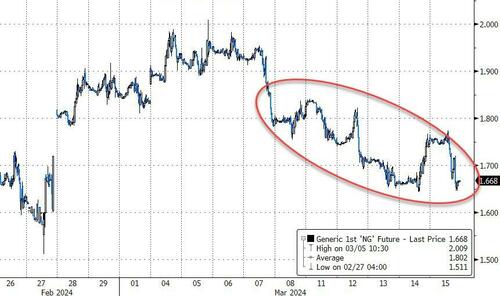

NatGas erased most of last week’s gains…

Source: Bloomberg

Still there were some bright spots…

Crude surged on the week, breaking out of its range to its highest since early November…

Source: Bloomberg

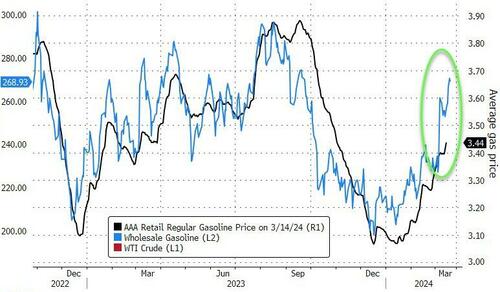

And as goes crude, so goes wholesale gasoline… and then goes pump prices…

Source: Bloomberg

..but it was copper that really regained its legs, surging up to its highest since Feb 2023…

Source: Bloomberg

Finally, was this week’s ‘stalling’ in NVDA ‘the top’?

Source: Bloomberg

How ironic would it be if we saw peak AI just as Jensen unveils his latest and greatest at GTC on Monday?

Tyler Durden

Fri, 03/15/2024 – 16:00

via ZeroHedge News https://ift.tt/AQOBW8I Tyler Durden