Desperate Dems Demand SEC Block All Future Crypto ETFs, Pressure Brokers Due To “Enormous Risks”

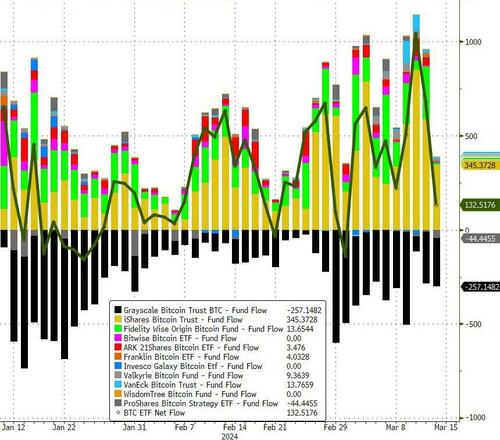

For the 9th straight day (and 15th of the last 16), Bitcoin ETFs saw net inflows yesterday…

Source: Bloomberg

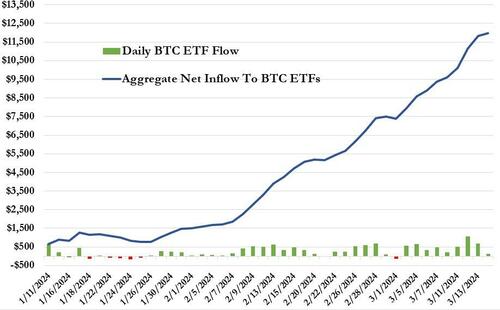

…lifting the total net inflow of assets to $12BN in 44 trading days…

Source: Bloomberg

The unprecedented success of these new investment vehicles in democratizing access to an alternative currency (away from the manipulative money-printing largesse of bigger and bigger government) is apparently pissing Democrats off.

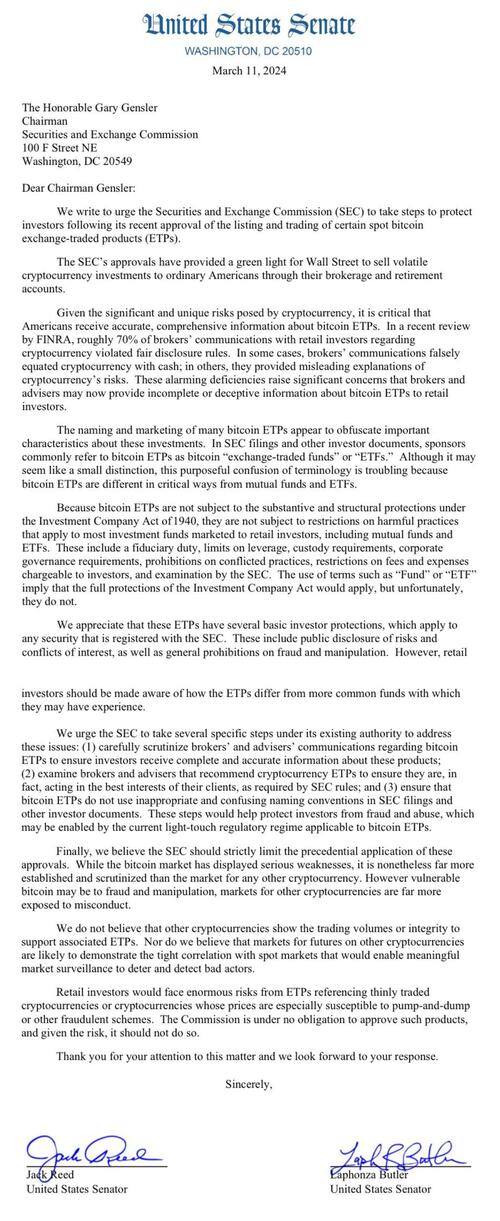

And so, having seen Senator Warren fail in her constant pressure efforts to stop SEC Chair Gary Gensler approving Bitcoiin ETFs, two Democrat Senators are urging the SEC to block any further crypto exchange-traded products (ETPs) to protect retail investors from risks associated with poor broker disclosure and thin liquidity in major cryptocurrencies.

As CoinDesk reports, Sen. Jack Reed (D-R.I.) and Sen. Laphonza Butler (D-CA) write that a FINRA survey disclosed that 70% of brokers’ communications with retail investors violated fair disclosure rules.

“Brokers’ communications falsely equated cryptocurrency with cash; in others, they provided misleading explanations of cryptocurrency’s risks,” they wrote.

“These alarming deficiencies raise significant concerns that brokers and advisers may now provide incomplete and deceptive information about bitcoin ETPs to retail investors.”

The Senators also argue that by naming bitcoin exchange-traded funds as such, the name “obfuscates important characteristics about these investments.”

“Retail investors should be made aware of how these ETPs differ from more common funds which they may have experience,” they said in the letter, writing that bitcoin is not subject to the same protections under the Investment Company Act of 1940 that ETFs which hold shares of various companies would have.

The two lawmakers also say that bitcoin (BTC) – which they call the most established and scrutinized cryptocurrency – is displaying weakness, and other cryptos are far more susceptible to misconduct.

“We do not believe that other cryptocurrencies show the trading volumes or integrity to support associated ETPs,” they wrote.

“Retail investors would face enormous risks from ETPs…whose prices are especially susceptible to pump-and-dump or other fraudulent schemes.”

WTF are you talking about! BTC ETF volumes have been enormous…

Full letter to Gensler below:

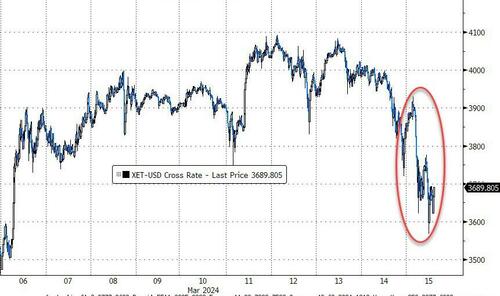

Fox Business’ Eleanor Terrett posted on X last night that optimism about the SEC approving the Ether spot ETFs by May 23rd is waning.

Based on my conversations with people familiar, meetings in recent weeks have been very much one sided, with issuers and custodians trying to rally SEC staff to get the process rolling, but staff not really engaging in meaningful ways like they did with the bitcoin spot ETF applications.

Why?

I’m told that Gary Gensler believes he already placated the industry with the approval of the bitcoin spot ETFs. Also, influential anti-crypto politicians like Sen. Warren are already angry at the SEC for approving the bitcoin ETFs in the first place and are rallying against the same thing happening for Ether.

One source tells me:

“Staff has been very hard to gauge on this and we’re not sure if anyone really knows what’s going on in their heads. But they’re going to have to start work soon if it’s going to have a shot.”

Ether has dropped on the news overnight…

As one might expect, the crypto industry is not taking this bullshit political move laying down and Coinbase chief legal officer Paul Grewal has slammed thr letter

“Respectfully Senators, the evidence points exactly the opposite way,” said Grewal in response.

Grewal explained that the market for many cryptocurrencies smaller than Bitcoin, notably Ether, demonstrated quality metrics that “exceed even the largest traded equities.”

“ETH’s spot market is deep and liquid– only two S&P 500 stocks have higher notional dollar trading volume,” added Grewal.

Grewal added there was direct evidence that Ether’s futures and spot markets were just as correlated as Bitcoin’s.

“When compared to Bitcoin, ETH’s future and spot market demonstrate EXACTLY the same type of high and consistent correlation that would enable market surveillance.”

Crypto is an important building block in updating our financial system for everyone. 7/7

— paulgrewal.eth (@iampaulgrewal) March 15, 2024

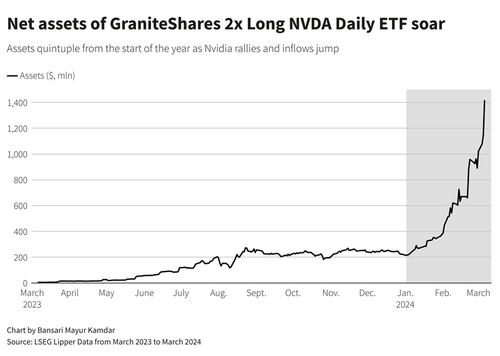

One final question – why are Democrats not demanding the SEC block all current and future levered-NVDA-ETFs?

…and other “enormous risk” assets…

Alright, I’ll make a deal…

If no ether or other crypto ETFs, then no triple levered gold miners ETNs or double levered nat gas ETFs.

Fair is fair.

Gotta protect investors.

— Nate Geraci (@NateGeraci) March 15, 2024

The loss of control over Americans’ sovereignty is clearly what is irking the central-controllers-who-know-best at the heart of the Democratic Party.

None of this is about “protecting investors”…

It’s all about politics.

Sad.

It’s all sour grapes b/c investors want exposure to spot btc ETFs.

Instead of drafting letters, how about politicians put some real effort into actual crypto regulation.

It’s all so tiresome.

— Nate Geraci (@NateGeraci) March 15, 2024

So when November comes around, it’s clear who the party of crypto is… and is not.

There are currently eight proposed spot Ether ETF applications awaiting approval by the SEC, and there have been hopes that other altcoins could eventually tread a similar path.

Tyler Durden

Fri, 03/15/2024 – 08:06

via ZeroHedge News https://ift.tt/T1HvLof Tyler Durden