Retail Stocks Increasingly Exposed To Growth Slowdown

Authored by Simon White, Bloomberg macro strategist,

Leading indicators for US retail sales are sending a more mixed message that points to a less upbeat outlook for consumption (~40% of which is retail sales) in the coming months. The retail equity sector is the most cyclical and therefore among the most vulnerable sectors to a growth downturn.

Today we will see the data for February retail sales. Last month’s data was a pretty weak set, and another disappointment this month will leave retail sales on a potentially weak trajectory.

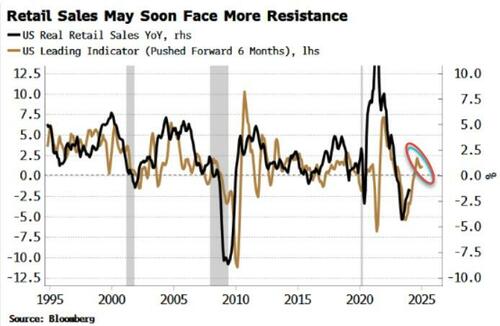

The US leading indicator, which leads retail sales by about six months, has started to turn lower, but from a high level, suggesting the bounce in retail sales will soon come to an end.

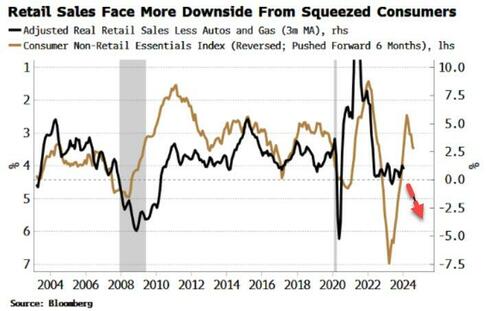

Consumption may also start facing more headwinds from consumers increasingly feeling the pinch. The cost of non-retail essentials has started to rise, which tends to negatively impact retail sales in the coming months.

Other measures of retail-sales demand such as falling mortgage rates and an increased willingness of banks to make consumer loans are still supportive, but their effect is beginning to fade.

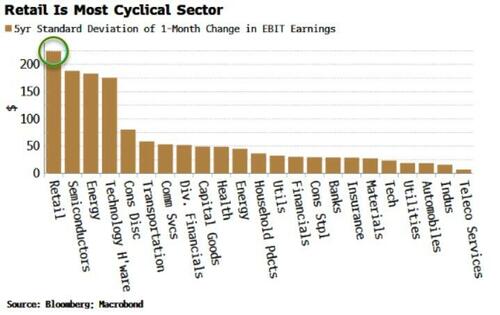

The retail sector in the US has been the third best performing GICS 2 sector this year, after semiconductors and insurance. Moreover, the retail sector is the most cyclical, meaning it is likely to one of most sensitive to a growth slowdown.

The sector is therefore increasingly exposed to a rolling over in the overall momentum of the economy, or a slowing in consumption itself.

Tyler Durden

Fri, 03/15/2024 – 08:25

via ZeroHedge News https://ift.tt/uXl2iPn Tyler Durden