Big-Tech & Black Gold Surge As Bonds & Bitcoin Purged Ahead Of Fed

After last week’s data and down-trend, Monday started fresh and shiny for BTFDers ahead of this afternoon’s “most important event in the world” – NVDA CEO Jensen Huang’s Keynote at GTC.

NVDA has not made a new high since March 8th!!!! Shock horror, and sold off intraday today from earlier juicy gains… before after dip-buyers stepped in…

Nasdaq and S&P led the day with The Dow lagging and Small Caps red. The last 10 minutes saw some selling pressure spoil the party as at least some got a little nervous ahead of Jensen…

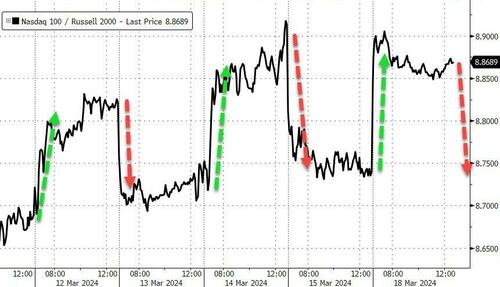

The flip-flopping of NDX/RTY continues… so tomorrow should be a RTY >> NDX day?

Source: Bloomberg

‘Most Shorted’ stocks opened down but were immediately squeezed – though still closed red…

Source: Bloomberg

Treasury yields were higher across the board again today with the long-end underperforming…

Source: Bloomberg

…but rate-cut expectations continued to tumble (now only 70bps of cuts priced in for 2024)…

Source: Bloomberg

…as Breakevens continue to soar (helped by oil)…

Source: Bloomberg

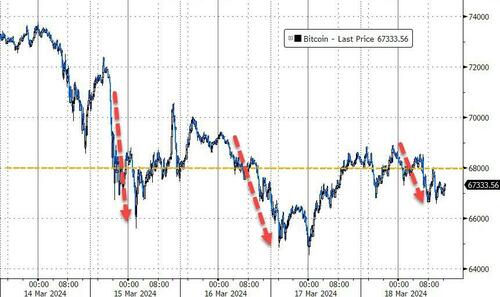

Bitcoin drifted lower today, back below $68,000…

Source: Bloomberg

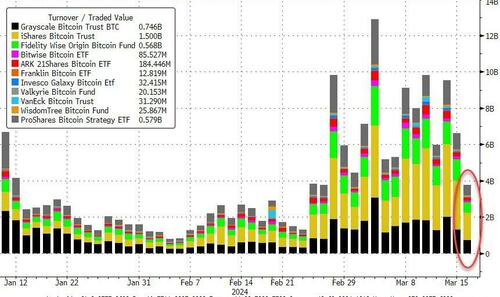

…as BTC ETF volumes were very low…

Source: Bloomberg

The dollar extended last week’s gains…

Source: Bloomberg

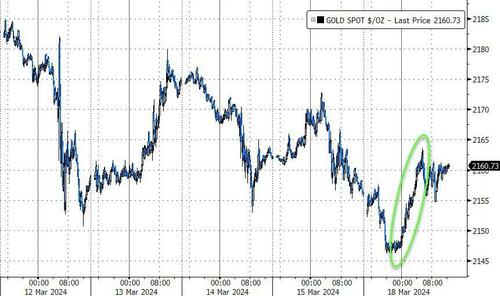

Despite dollar strength, gold managed gains also, back above $2160 (spot)…

Source: Bloomberg

Oil prices soared on China growth hope (macro data overnight), and Russian refinery supply issues (Ukraine drone attacks), as well as Iraq promising to abide by OPEC+ production cuts. WTI topped $83 for the first time sine the first week of November…

Source: Bloomberg

Finally, there’s no way this happens again, right?

Source: Bloomberg

Over to you, Jensen!!

Tyler Durden

Mon, 03/18/2024 – 16:00

via ZeroHedge News https://ift.tt/Hb98PYX Tyler Durden