Oil Hits New Cycle High After China Data, Russian Refinery Attacks, Iraq Supply Cuts

Oil prices hit a fresh four-month high as macro-economic data from China came in ahead of expectations, Iraq said it has reduced its oil exports for the coming months to absorb the oversupply from Jan. and Feb, while Ukrainian attacks on Russian refineries heightened geopolitical risks and reduced the amount of distilled product produced in Russia. As a result, WTI broke out to test $82 overnight, hitting a five month high, while Brent breached $86, a level that seemed inconceivable in late December when the price was in the low $70s.

Source: Bloomberg

Turning to the catalysts, China’s January-February activity data came in above market expectations. Industrial production growth edged up in January-February, against market expectation of a slowdown, as the boost from computer and ferrous smelting industries more than offset the drag from automobile and electric machinery industries.

Fixed asset investment growth also accelerated in January-February, thanks to faster growth in manufacturing and “other” (mostly services and agriculture-related sectors) investment.

However, it wasn’t all rainbows for China as year-on-year growth in retail sales and services industry output both slowed in January-February on a high base last year (when pent-up demand was released right after China reopening).

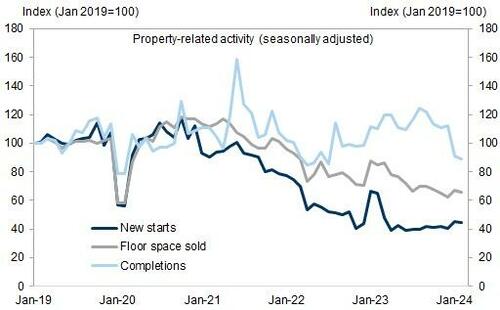

Additionally, the big kahuna showed no signs of improvement as property-related activity worsened broadly and meaningfully in year-on-year terms in January-February, reflecting either unfavorable base effects or sequential weakness.

Labor market statistics remained largely stable. The nationwide unemployment rate (not seasonally adjusted) moved slightly higher to 5.3% in January-February from 5.1% in December, in line with its seasonal patterns, while the 31-city metric remained unchanged at 5.0%.

Argaam News reported that China’s crude oil refining volume at the beginning of this year reached its highest levels ever, with increasing demand for fuel, according to government data issued today, March 18.

The volume of oil refined in January and February rose 3% year-on-year to a record level of 118.76 million tons, which is equivalent to 14.51 million barrels per day, Bloomberg calculations showed. This is due to the rise in Chinese demand for fuel during the Lunar New Year holiday, which began in mid-February.

According to the data, the demand for oil rose during the first two months of this year by 6.1% to 14.36 million barrels per day.

All of these factors combined to push WTI to new four month highs…

“It’s mostly driven by Chinese data,” said Giovanni Staunovo, a commodity analyst at UBS Group AG who said that “Chinese macroeconomic data — including refinery runs and apparent oil demand — have come in on the positive side.”

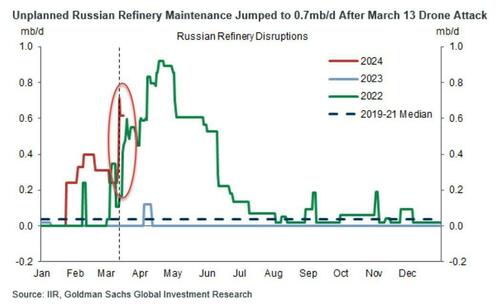

Meanwhile, in Russia, drone strikes over the weekend hit multiple plants, some deep within the country’s territory. Overnight, Goldman’s commodities team published a “chart of the week” (available to pro subs in the usual place) which showed a jump in “unplanned Russian refinery maintenance” to 0.7mb/d after March 13 drone attacks at Rosneft’s 0.4kb/d refinery, which is the largest crude-processing facility in Russia.

As consequence, Russian diesel exports have been falling for weeks after the drone attacks on Russian refineries that first started in January. This supports Goldman’s “structurally bullish view on refinery margins as we see refinery disruptions as an upside risk and initiated a long diesel margin trade.”

Vandana Hari, founder of Vanda Insights in Singapore, echoed Goldman’s optimism: “The strikes on Russian refineries added $2 to $3 a barrel of risk premium for crude last week, which remains in place as we start this week with more attacks over the weekend.”

And with prices surging, Wall Street’s penguins weren’t far behind and Morgan Stanley promptly raised its Brent crude price forecast to $90 a barrel by 3Q, citing tightening supply-demand balances.

“Underpinning the gains is persistent, gradual declines in US oil inventories since the start of the year, together with the latest bullish IEA report indicating higher need for oil from OPEC and thus likely continued global deficit and inventory declines,” said Bjarne Schieldrop, chief commodities analyst at SEB AB.

Finally, Bloomberg reports that in the coming days, traders will get plenty of market insights from the CERAWeek conference in Houston, which starts on Monday. Among speakers scheduled on the opening day are the chief executive officers of Exxon Mobil Corp., Saudi Aramco, Shell Plc and TotalEnergies SE.

Tyler Durden

Mon, 03/18/2024 – 08:37

via ZeroHedge News https://ift.tt/QREuPqd Tyler Durden