BoE Holds Rates At 5.25%, But Says Things “Moving In Right Direction”

As expected, The Bank of England (BoE) kept interest rates on hold at 5.25% for the fifth successive meeting, as evidence grows that inflation is falling.

Once again, BoE said that policy would have to stay restrictive for “an extended period of time” even though it expects the annual rate of inflation to fall below its 2% target during the second quarter.

“We are not yet at the point where we can cut interest rates, but things are moving in the right direction,” said BOE Gov. Andrew Bailey.

Additionally, as Bloomberg reports, the central bank said there are indications that previous increases in its key rate are weighing on economic activity and are “leading to a looser labor market.”

It also noted that wages rises are slowing.

U.K. inflation fell to a 2.5-year low of 3.4% in February — more than anticipated — and is now not far off the Bank of England’s target rate of 2%.

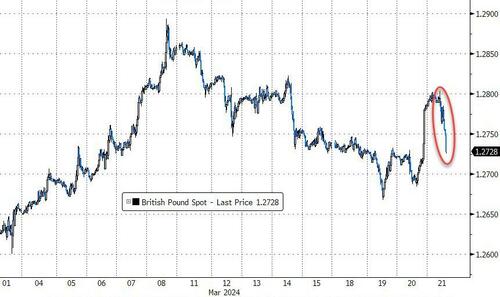

Cable weakened on the BoE statement, erasing yesterday’s Powell-driven gains (dollar weakness)…

Source: Bloomberg

However, there are signs that the central bank is edging toward a cut.

Monetary Policy Committee members Jonathan Haskel and Catherine L. Mann had previously supported a further increase in the key rate, but changed their view and voted with the majority.

For the second straight meeting, MPC member Swati Dhingra voted for a cut in the key rate to 5%.

Interestingly, Newsquawk notes that the statement highlights that among the 8 policy setters who voted for an unchanged announcement there is a wide range of views.

-

At one end, some believe that developments suggest the restrictive stance of policy is having a material impact on reducing inflationary pressures.

-

On the other end of the spectrum (and likely Haskel and/or Mann) some believe wage growth is too high and there are only limited signs of services price inflation returning to a target- consistence pace quickly enough.

As such, while the hawks have moved in-line with the consensus on the vote they are clearly some way from being able to support a cut.

On that, all of the 8 unchanged-voting members agreed that “a further accumulation of evidence on inflation persistence would be required to warrant a shift in the monetary policy stance”, as outlined above there are differences among them on how much evidence is needed.

As Mohamed El-Erian noted on X, “the spotlight now is on the commentary, including the extent to which it correlates with yesterday’s dovish tone and content from Fed Chair Powell.”

Tyler Durden

Thu, 03/21/2024 – 08:11

via ZeroHedge News https://ift.tt/vrRjw81 Tyler Durden