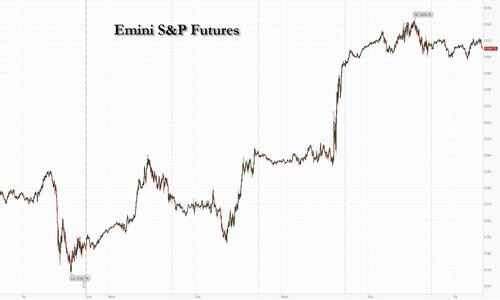

S&P Futures Drop On Last Day Of Best Week Of 2024

Futures dropped modestly but were still on pace for their best week of the year after a raft of central bank meetings indicated that a pivot toward looser policy has been agreed upon at one of the recent central bank conclaves at the BIS tower in Basel, inflation – and 2% inflation target – be damned. As of 7:50am, S&P futures were down 0.2% and poised for a 2.2% weekly advance, the most since mid December; Nasdaq futures were also in the red as they looked to cap another blockbuster week. Friday’s selling came after the latest EPFR data revealed US stocks saw significant outflows in the runup to the Fed’s policy meeting that took the S&P 500 Index to fresh all-time highs. Market euphoria also pushed the MSCI index of global shares more than 2% higher this week so far. Europe’s stock benchmark headed for its longest weekly run of gains in more than a decade. Treasuries rose for a fourth day, taking the 10-year yield almost 10 basis points lower since Monday even as the dollar rose to the highest level in over a month. Gold dipped again after hitting a record high above $2,200 after Powell’s dovish FOMC. There are no scheduled events on the econ calendar; the US session highlight is Powell’s opening remarks at a Fed Listens event in Washington.

In premarket trading, FedEx surged 12% after the parcel carrier’s third-quarter results beat estimates and it announced a $5 billion buyback plan; peer UPS also gained. Lululemon shares slid 12% after the activewear maker warned of a slowdown in US store visits, which led to a lower-than-anticipated sales outlook. Nike tumbled after it warned that sales this year will take a hit as it realigns merchandise to better match shoppers tastes; European sportswear retailers Adidas, Puma and JD Sports all fell in sympathy. Here are some other notable premarket movers:

- Reddit drops 3.4%, paring some of its first-day jump Thursday that saw shares soar 48% above their initial public offering price.

- Tesla declines 3.4% as the automaker has reduced electric car production at its plant in China, according to people familiar with the matter.

Stocks were set to close out their best week of 2024 as thanks to rekindled investor appetite after the Fed meeting midweek fueled hopes policymakers will engineer a soft landing for the US economy with three interest rate cuts this year. A surprise loosening by the Swiss National Bank and a more dovish stance by Bank of England policymakers added to the optimism, lifting equities and government bonds while driving their currencies lower.

“The likelihood of a recession fading provides impetus for stronger markets,” said Max Wolman, an investment director at abrdn in London. “Investors were too bullish on rate cuts by the Fed, this has now been priced out and the market sees three cuts this year as more realistic.”

European stocks edge higher, with the Stoxx 600 set to log a ninth straight week of gains, the longest winning streak since 2012.

Earlier in the session, Asian stocks were mixed after momentum from the fresh record highs on Wall Street waned.

- Hang Seng and Shanghai Comp. suffered amid weak earnings from the likes of CK Asset Holdings, CK Hutchison, CNOOC and Ping An, while tech slumped after a US Commerce Department official said SMIC may have violated US export controls to produce chips for Huawei.

- ASX 200 closed with mild losses with the index weighed on by underperformance in miners amid declines in underlying commodity prices, while the RBA’s Financial Stability Review noted conditions are to remain challenging for households and businesses.

- Nikkei 225 swung between gains and losses in which it initially climbed above 41,000 for the first time but then faltered and briefly wiped out all its gains as participants digested somewhat mixed inflation data which was mostly softer-than-expected but the Core reading matched estimates at a four-month high.

In FX, the dollar extended its gains against major peers, rising 0.4% and headed for its best week in two months as global interest-rate cut bets and jitters around China’s currency bolstered the greenback. The pound fell 0.6% against the dollar following dovish comments from BOE head Bailey in the FT, and deriving little support from stronger-than-expected UK retail sales data.

Despite the expectations for Fed cuts, the dollar may have scope to gain due to weakness in the Japanese yen and the Chinese yuan, while the SNB’s surprise cut has boosted speculation other major central banks may move faster than the Fed to reduce their policy rates. Of note, China’s yuan breached a closely watched technical level. The People’s Bank of China lowered the daily reference rate by the most since early February, a sign to some that Beijing is greenlighting more depreciation amid a bumpy economic recovery. The yen was little changed, trading around 152 per dollar even as Japan’s inflation accelerated to the quickest pace in four months. Traders are watching to see whether the Bank of Japan follows its first rate hike since 2007 — which it delivered earlier in the week — with more increases later this year.

In rates, Treasuries held on to small gains as US session gets under way, supported by rallies in UK and German bond markets and flight-to-quality as worst day in two months for China’s onshore yuan saps risk sentiment. Treasury yields were richer by 2bp to 3bp across the curve with 10-year around 4.24%; bunds and gilts in the sector outperform by 1bp and 2bp. US curve spreads remain within 1bp of Thursday’s closing levels. Next week, Treasury auction cycle starts Monday, including 2-, 5- and 7-year notes for a combined $176b

In commodities, oil held a two-day drop, with traders assessing the outlook for global interest rates and geopolitical tensions in the Middle East. Oil prices were little changed, with WTI trading near $81. Spot gold falls 0.7% to around $2,167/oz.

Elsewhere, Bitcoin traded around $64,000, while gold fell after surging above $2,200 an ounce for the first time.

Looking at today’s calendar, no US economic data scheduled. Fed members scheduled to speak include Powell’s at Fed Listens event (9am), Barr (12:15pm) and Bostic (4pm) as well as the ECB’s Nagel, Holzmann, Centeno and Lane,

Market Snapshot

- S&P 500 futures down 0.2% at 5,295

- STOXX Europe 600 little changed at 509.35

- MXAP down 0.4% to 177.33

- MXAPJ down 1.0% to 534.55

- Nikkei up 0.2% to 40,888.43

- Topix up 0.6% to 2,813.22

- Hang Seng Index down 2.2% to 16,499.47

- Shanghai Composite down 0.9% to 3,048.03

- Sensex up 0.2% to 72,803.56

- Australia S&P/ASX 200 down 0.1% to 7,770.55

- Kospi down 0.2% to 2,748.56

- German 10Y yield little changed at 2.37%

- Euro down 0.5% to $1.0811

- Brent Futures down 0.3% to $85.55/bbl

- Gold spot down 0.7% to $2,167.14

- US Dollar Index up 0.38% to 104.40

Top Overnight News

- Japan’s headline CPI in Feb came in at +2.8% (up from +2.2% in Jan, but below the Street’s +2.9%) while core cooled to +3.2% (down from +3.5% in Jan and below the Street’s +3.3% forecast) (Reuters)

- The BOJ will raise interest rates again by October and may hike at a faster than expected pace with yen weakness among factors that may come into play, according to a Bloomberg survey of economists. BBG

- Chinese leader Xi Jinping plans to meet a group of U.S. business leaders next week after a government-sponsored forum as Beijing steps up efforts to woo American firms amid an exodus of foreign capital. WSJ

- China is scrutinizing PwC’s role in Evergrande’s accounting practices after the developer was accused of a $78 billion fraud, people familiar said. No decision has been made on whether to penalize the company. BBG

- US urges Ukraine to halt attacks on Russian energy infrastructure, warning that continuing them could drive up global oil prices and provoke retaliation from Moscow. FT

- The BOE governor (Andrew Bailey) has signaled markets are right to expect more than one interest rate cut this year, saying he is increasingly confident inflation is heading towards target. FT

- US House Republicans are falling further behind on campaign cash as Speaker Mike Johnson struggles to build a donor network. The NRCC raised $8.2 million in February and began March with $45.2 million on hand. Its Democratic counterpart raised nearly double that and has $59.2 million in the bank. BBG

- NKE reported healthy EPS upside w/the beat driven by higher sales and better margins, but the guidance was weak for FQ4 and H1:25. BBG

- FDX reported solid EPS upside thanks to healthy margins while capital return was increased, but sales fell short and the full-year EPS guide was left essentially unchanged. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed after momentum from the fresh record highs on Wall Street waned. ASX 200 closed with mild losses with the index weighed on by underperformance in miners amid declines in underlying commodity prices, while the RBA’s Financial Stability Review noted conditions are to remain challenging for households and businesses. Nikkei 225 swung between gains and losses in which it initially climbed above 41,000 for the first time but then faltered and briefly wiped out all its gains as participants digested somewhat mixed inflation data which was mostly softer-than-expected but the Core reading matched estimates at a four-month high. Hang Seng and Shanghai Comp. suffered amid weak earnings from the likes of CK Asset Holdings, CK Hutchison, CNOOC and Ping An, while tech slumped after a US Commerce Department official said SMIC may have violated US export controls to produce chips for Huawei.

Top Asian News

- BoJ Governor Ueda reiterated that the BoJ’s JGB holdings will remain at current levels for the time being and they would like to eventually decrease their JGB buying but will take a wait-and-see stance for the time being. Ueda added that the latest decision is based on the understanding that they will leave it to markets to determine long-term rate moves.

- Japanese RENGO 2nd Tally: 5.25% (vs 5.28% in the first tally). Japan RENGO 1st Wage Tally: 5.28% (exp. 4.1%; 2023 final figure 3.6%).

- Japan Government says BoJ will continue to work closely to conduct flexible policy and lead to an end of deflation.

- RBA Financial Stability Review stated conditions are to remain challenging this year for households and businesses, as well as noted that households have trimmed spending and are underpinned by a strong jobs market and savings buffers.

European equities, Stoxx600 (+0.1%) are mostly modestly firmer; Eurostoxx 50 (-0.3%) is lower, with Luxury continuing yesterday’s decline, coupled with a soured risk tone in China overnight. European sectors are mostly firmer; Consumer Products and Services underperforms with sports brands Adidas (-0.4%), Puma (-1.9%) and JD Sports (-3.2%) all hampered by post-earning losses in Nike. Telecoms is found at the top of the pile. US equity futures (ES +0.1%, NQ +0.1%, RTY +0.3%) are modestly in the green attempting to build on the prior day’s strength; Nike (-6.6% pre-market) is lower after the Co. noted it had lost market share in the running shoes business and on was downbeat on its H1’25 revenue outlook.

Top European News

- BoE Governor Bailey said rate cuts were “in play” at future BoE meetings amid signs tighter policy quelled the risk of a wage-price spiral, according to FT.

- ECB’s Nagel says probability is rising that rates will be lowered ahead of the summer break, according to Reuters citing Market News.

- ECB’s Holzmann says investors should consider the risk that the ECB does not lower rates this year.

- Russian Federation Central Bank Key Rate (Mar) 16.0% vs. Exp. 16.0% (Prev. 16.0%)

FX

- DXY now back above pre-FOMC levels (currently 104.40) despite dovish messaging from Powell. Upside likely in part due to softness elsewhere rather than outright chasing USD longs. Next target comes via the 16th Feb high at 104.67.

- EUR is swept up by the broadly firmer USD as encouraging German IFO data was unable to provide support. EUR/USD down to a low of 1.0809 but yet to test 1.08.

- JPY is marginally firmer vs. the USD after printing another YTD peak at 151.86 but stopping shy of the 2023 high at 151.94 and 2022 peak at 151.94. For context the pair started the week off at 149.33. A material turnaround in the pair requires a turnaround in the US rates space.

- Antipodeans are both performing poorly vs. the USD alongside the downbeat mood surrounding China and Yuan depreciation. AUD/USD as low as 0.6511 with the weekly low just above the 0.65 mark at 0.6504.

- CNH is swept up by the firmer USD with USD/CNH as its highest level since November 2023. Reports of Chinese state-owned selling has failed to stop the rot.

- PBoC set USD/CNY mid-point at 7.1004 vs exp. 7.2147 (prev. 7.0942).

- China’s major state-owned banks were seen to be selling dollars for yuan in the onshore FX market to slow yuan declines, according to sources cited by Reuters.

Fixed Income

- USTs are firmer but shy of Thursday’s 110-26+ WTD peak. Specifics light thus far but the docket picks up with Fed’s Powell, Jefferson, Barr & Bostic due.

- Bunds are in the green in a continuation of the week’s overall dovish action for EGBs. Slightly off the session’s fresh WTD high of 132.68, a modest pullback from this occurred after beats across the board to the latest German Ifo (albeit marginal).

- Gilts are firmer though still around 30 ticks shy of Thursday’s 99.91 WTD peak. Specifics light as participants digest the BoE and Bailey’s subsequent press round which was on the dovish side.

- Italy sells EUR 2.75bln vs exp. EUR 2.5-2.75bln 3.20% 2026 BTP Short Term: b/c 1.46x and gross yield 3.31%

Commodities

- Crude is modestly weaker having pared much of the overnight weakness, sparked by broader weakness in the commodities complex amid the recovery in the Dollar and risk-off mood in China. WTI bounced off lows of around USD 80.50/bbl and now holds around USD 81/bbl.

- Weakness across precious metals as the stronger Dollar exerted pressure while Friday newsflow remains quiet. XAU dipped under yesterday’s low (2,166.45/oz).

- Base metals are weaker across the board following the risk aversion from Chinese markets overnight coupled with the recovery in the Greenback.

- US has reportedly urged Ukraine to halt strikes against Russian oil refineries, according to FT.

- India stop taking Russia oil delivered on Sovcomflot tankers, via Bloomberg.

- Pemex reportedly put off repairs at a Gulf of Mexico platform for a number of months, via Reuters citing sources; facility leaked vast volumes of methane due to faulty infrastructure

Geopolitics: Middle-East

- US will reportedly bring a resolution today calling for an immediate ceasefire in Gaza as part of a hostage deal for a vote in the UN Security Council, according to Reuters citing a spokesperson.

- US military said it destroyed one unmanned surface vessel and two anti-ship ballistic missiles launched by Houthis in Yemen.

Geopolitics: Other

- Ballistic missiles were reportedly fired from Crimea towards Zaporizhzhia and explosions were heard, according to a source via social media platform X.

- China’s special envoy for Eurasian affairs said the Russian side appreciates the diplomacy efforts taken by the Chinese side and produced their own take on peace talks, while the side reiterated its willingness and position on holding serious talks on this crisis. China’s envoy also stated that Russia and Ukraine are keeping to their positions and have huge differences when it comes to peace talks but both sides believe that this crisis will be solved through peace talks, according to Reuters.

- China’s embassy in the Philippines said the Taiwan question is not and should never become an issue between China and the Philippines, while it added any attempt to implicate the Taiwan question in maritime disputes between China and the Philippines is dangerous.

- IAEA says Zaporizhzhia nuclear power plant has lost connection to main 750 kV off-site power line amid reports of military action in Ukraine; Back-up 330 kV power line at the nuclear power plant are still working.

- Russia’s Kremlin says Russia needs to fully “liberate” its “new regions” to ensure peoples’ safety there, according to Tass; Russia regards itself in a state of war amid Western intervention on the Ukrainian side.

US Event Calendar

- Nothing on the calendar

Central Bank events

- 09:00: Fed Listens Event, Opening Remarks from Powell

- 12:00: Fed’s Barr Speaks on International Economic, Monetary Design

- 16:00: Fed’s Bostic Participates in Moderated Conversation

DB’s Jim Reid concludes the overnight wrap

The market rally has continued in force over the last 24 hours, driven by growing confidence that rate cuts are finally on the horizon. The one exception is a soft China equity story overnight which we’ll discuss below. Outside of that the momentum has been positive, helped by the Swiss National Bank surprisingly cutting rates yesterday, becoming the first central bank with a G10 currency to do so this cycle. Then shortly after, the Bank of England kept rates on hold, but it marked the first time since September 2021 that none of the MPC members voted for a hike. And of course, all this follows the Fed’s signal on Wednesday that 3 rate cuts were still on the agenda this year, despite upgrading their inflation forecasts. Whether we actually get what is priced in is a moot point, but for the current direction of travel, the promise is all that matters for now.

This dovish news has given markets a significant boost, and marks a big shift from where we began the week. Indeed, it’s worth remembering that it was only last week that the US CPI and PPI numbers surprised on the upside, which led to growing speculation that the Fed would dial up the hawkishness. On top of that, it was only 72 hours ago that the Bank of Japan finally ended their negative interest rate policy.

Whilst markets have been focused on this week’s dovish narrative, it’s worth bearing in mind that sentiment on rates has switched back and forth over 2024. In fact, at the start of the year, investors were looking at the Fed’s March meeting as the most likely date for a first cut. But of course, that meeting happened this week, and now i nvestors are looking towards June as the most likely date. So market pricing has had a continuous habit of shifting forward the likely timing of any rate cuts.

All that being said, the Swiss National Bank’s decision to deliver a cut created a major shift in tone, as they lowered their policy rate by 25bps to 1.5%. Now it’s worth noting that Swiss CPI is at just +1.2%, and core CPI is at 1.1%, so they don’t have the problem of above-target inflation (unlike most other developed economies). But the decision still came as a surprise, with the consensus of economists expecting them to remain on hold. In turn, that meant the Swiss Franc weakened by -0.83% against the US Dollar, and -0.76% against the Euro. And there was a significant outperformance for Swiss government bonds, with the 2yr yield (-8.8bps) down to 0.81%, whilst the 10yr yield (-4.9bps) fell to 0.59%.

The SNB’s decision was then followed up by the Bank of England, who kept their policy rate at 5.25% as expected. Importantly though, the vote split was now an 8-1 decision to keep rates on hold, with one member preferring a 25bp cut. That meant it was the first meeting in two-and-a-half years with no member voting for a rate hike, so that was another dovish milestone. In the statement, they stuck to their language from February that “ Monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term ”. Following the decision, our UK economist sticks to his call for a May rate cut – but only just, and sees the likelihood of a delay to June as on the rise. See his full recap here.

This dovish backdrop led to an array of record highs for the major equity indices, including the S&P 500 (+0.32%), the NASDAQ (+0.20%), the Dow Jones (+0.68%), the STOXX 600 (+0.90%) and the DAX (+0.91%). Alongside that, the small-cap Russell 2000 (+1.14%) was another outperformer, closing at its highest level in almost two years. The Magnificent 7 (-0.43%) were the notable underperformer, mostly due to a -4.09% decline for Apple as an anti-trust lawsuit against the firm was filed by the US Justice Department and sixteen US states.

The risk-on sentiment also boosted other asset classes. US IG and high yield credit spreads both fell to their lowest levels in over two years, while Gold (+1.09%) closed at a new all-time high of $2,181/oz.

That market momentum got an added boost from strong data, with the flash PMIs for March painting a decent picture across the major economies. For instance, the Euro Area composite PMI was up to a 9-month high of 49.9 (vs. 49.7 expected), which adds to the positive data surprises there recently. Meanwhile in the UK, the composite PMI was at 52.9 (vs. 53.1 expected), marking a 5th month in expansionary territory. Over in the US, the composite PMI was at 52.2 as expected, but there was good news elsewhere, as the initial jobless claims fell to 210k over the week ending March 16 (vs. 213k expected), and the Conference Board’s Leading Index ended a run of 23 consecutive monthly contractions, expanding by +0.1% in February. The were also signs of an uptick in US housing activity as existing home sales jumped to 4.38m annualised in February (vs. 3.95m expected), their highest pace in twelve months.

For sovereign bonds, however, there was much more of a contrast between the US and Europe. In the US, yields on 10yr Treasuries saw little movement, ending the day down -0.6bps at 4.27%. In part that was because of the strong data, and the 2yr yield moved up +3.4bps to 4.64%. This morning in Asia, 1-10 year US yields are back down around -2.5bps though. In Europe, there was a clear bull steepening as investors were encouraged by the prospect of rate cuts, which saw yields on 10yr bunds (-2.7bps), OATs (-2.6bps) and BTPs (-3.7bps) all move lower.

Asian equity markets are generally softer this morning with Chinese stocks the biggest underperformers led by the Hang Seng Tech index (-4.27%) followed by the Hang Seng (-3.04%), while the CSI is trading -1.50% lower, inching towards its largest daily drop since January with the Shanghai Composite (-1.41%) also seeing a significant decline. Elsewhere, the KOSPI (-0.44%) is also trading lower while the Nikkei (+0.28%) is bucking the regional trend, and trading just below the 41,000 mark. S&P 500 (+0.07%) and NASDAQ 100 (+0.08%) futures are fairly flat and are not being impacted by the China sell-off.

Early morning data showed that Japanese CPI climbed to +2.8% y/y in February (v/s +2.2% in January; +2.9% market consensus), accelerating at the quickest pace in four months with the Core CPI inflation growing at an annualised +2.8% in February as expected, picking up from the +2.0% annualized pace seen in January. Core, core was a tenth below expectations at 3.2%. The Yen is fairly flat after a 8-day losing streak against the dollar as it still remains a global funder even with the landmark first hike in 17 years earlier this week.

To the day ahead now, and data releases include UK retail sales for February, whilst in Germany there’s the Ifo’s business climate indicator for March. Otherwise, central bank speakers include the ECB’s Nagel, Holzmann, Centeno and Lane, along with Fed Chair Powell, and the Fed’s Barr and Bostic.

Tyler Durden

Fri, 03/22/2024 – 08:19

via ZeroHedge News https://ift.tt/gSMBs29 Tyler Durden