Chinese-Owned Tanker Hit By Houthi Missile Despite Safe Passage Deal

Bloomberg’s sources stated on Friday that China and Russia made a deal with Iran-backed Houthis for safe passage of their commercial vessels through the Red Sea and Gulf of Aden.

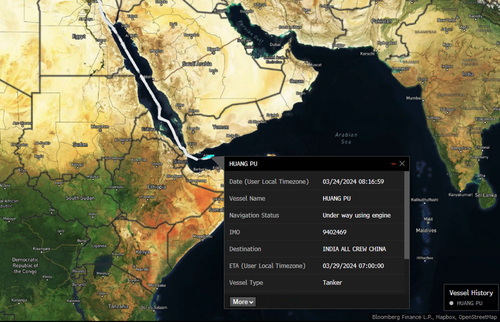

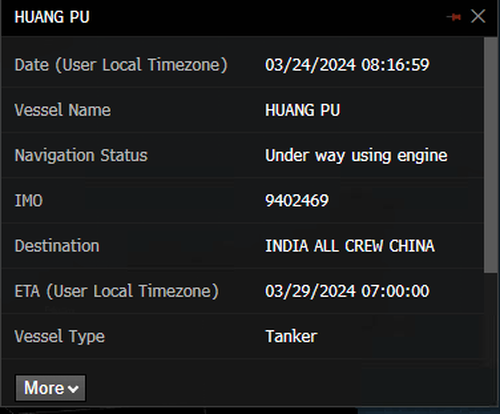

Fast forward to late Saturday night, US Central Command announced on social media platform X that a ballistic missile fired by Houthi rebels hit a Panamanian-flagged, Chinese-owned chemical tanker called “M/V Huang Pu.”

CENTCOM on X provides more details about the attack on the Chinese tanker:

March 23, the Iranian-backed Houthis launched four anti-ship ballistic missiles (ASBM) into the Red Sea in the vicinity of M/V Huang Pu, a Panamanian-flagged, Chinese-owned, Chinese-operated oil tanker.

At 4:25 p.m. (Sanaa time), a fifth ballistic missile was detected as fired toward M/V Huang Pu. The ship issued a distress call but did not request assistance. M/V Huang Pu suffered minimal damage, and a fire on board was extinguished within 30 minutes. No casualties were reported, and the vessel resumed its course. The Houthis attacked the MV Huang despite previously stating they would not attack Chinese vessels.

Between 6:50 and 9:50 a.m. (Sanaa time), US forces, including USS Carney (DDG 64), engaged six Houthi unmanned aerial vehicles (UAV) over the southern Red Sea. Five crashed into the Red Sea, and one flew inland into Houthi-controlled areas of Yemen.

It was determined these UAVs presented an imminent threat to US, coalition, and merchant vessels in the region. These actions are taken to protect freedom of navigation and make international waters safer and more secure for US, coalition, and merchant vessels.

MARCH 23 RED SEA UPDATE

From 2:50 to 4:30 a.m. (Sanaa time)

March 23, the Iranian-backed Houthis launched four anti-ship ballistic missiles (ASBM) into the Red Sea in the vicinity of M/V Huang Pu, a Panamanian-flagged, Chinese-owned, Chinese-operated oil tanker.At 4:25 p.m.… pic.twitter.com/n1RwYdW87E

— U.S. Central Command (@CENTCOM) March 24, 2024

What remains unclear is why the Houthis would attack the vessel if there were a safe passage deal. Also, the ship was broadcasting “India All Crew China,” which Houthi rebels could see.

A separate Bloomberg report stated that one of the world’s top shippers, Maersk, warned the risk level across the Red Sea “remains elevated.”

The shipper says its container ships continue “sailing via the Cape of Good Hope and around Africa is the most reasonable solution at the moment and the one that currently allows the best supply chain stability.”

Rising tensions in and around the Red Sea, especially with an oil tanker being hit this weekend, have some market observers extremely worried about a spillover in attacks across the region and the crude market, ignoring some of these mounting risks.

One of those spillovers that Rapidan Energy Group has pointed out is the increasing risk of a “crippling attack” on Saudi Aramco’s Abqaiq facility, the largest crude oil stabilization plant in the world.

“Geopolitical disruptions: Wars can temporarily stop production or interrupt trade, but if important oil processing or production facilities, like the Saudi Abqaiq stabilization plant that Iran attacked in 2019, were to be severely damaged over a prolonged period, markets would immediately become tighter,” Rapidan Energy wrote in its 2023 global markets outlook.

Given the chaos in Eastern Europe with Ukraine attacking Russian refineries, the global oil market could be nearing a major shock if Houthis begin attacking refineries in Saudi Arabia.

Tyler Durden

Sun, 03/24/2024 – 15:45

via ZeroHedge News https://ift.tt/t68B0Tg Tyler Durden