LAW, IGIW, SAS, GCBE, MBS, ROTST…. A Day For Acronyms

By Peter Tchir of Academy Securities

A Day for Acronyms

IGIW

Let’s start with IGIW. I’m not sure it is an official one, but we can go with I Got It Wrong. I came into this week stating that it would be far more difficult for stocks to bounce 5% than drop 10%. I was looking for yields to continue their upward trajectory. 10-year yields finished the week lower by 11 bps and the Nasdaq was up by almost 3%. I continue to look at a wide variety of sentiment indicators, positioning indicators, etc. and see extremely aggressive positioning, but so far it has worked for those positioned that way.

GCBE

Probably another one I just made up, but Global Central Bank Easing was the theme of the week.

The Bank of Japan (BOJ) hiked rates, finally going back to positive yields! They officially ended “yield curve control,” but the 10-year yield was already at 0.7% (down from almost 1% in November), so that didn’t have much of an impact. It might have been the most dovish “tightening” ever, which says a lot!

The Swiss National Bank (SNB) surprised the market by cutting rates. Markets responded positively to this surprise move. Maybe I was in a bad mood at the time, but I’m wondering why we spend so much time worrying about what the 20th largest economy by GDP does with rates? I saw some tweets at the time, which seem accurate, but Bitcoin’s market cap is bigger than the Swiss GDP. That is mostly irrelevant and comparing apples to oranges (or chalk to cheese, for our U.K. readers), but it did strike me as a sign of the times. While I’m on this portion of the rant, we seem to care much more about the SNB than we do about the BOC (Bank of Canada), despite Canada’s economy being more than double the Swiss economy, and far more trade is affected by that currency and their interest rate policy.

The ECB (European Central Bank) and the BOE (Bank of England) set the stage for future rate cuts, buoying global markets.

The Fed is being taken as being quite dovish as well. I think that take is overstated (Post FOMC Thoughts), but given the overall tone of GCBE, it is an understandable take (at least in the heat of the moment). The FOMC (Federal Open Market Committee) does seem a bit nervous about jobs, and the balance sheet is getting to levels where they may need to restrain QT (Quantitative Tightening) as some level of balance sheet is required for our banking system to function efficiently.

While the central banks have been “jawboning” markets in this direction, this week’s series of back-to-back-to-back meetings seemed to solidify the view for markets.

One “odd” thing is that I haven’t heard the words “American Exceptionalism” much in reference to these bank policies. Yes, we are all excited that every other bank is definitively dovish, but shouldn’t they be when their economies and markets are behind ours?

How the election campaign will affect Fed policy remains to be seen, but unfortunately for the Fed, in a world where every decision is held under a magnifying glass and examined for political motivations, it will be difficult to convince many people that their actions are apolitical. I think this is really going to hamstring what they can do in September and November, so a cut in June with maybe another “pre-emptive” cut in July makes sense, but I am not expecting more than that without the economy taking a big hit.

MBC

Made By China. Yes, yet another completely made-up acronym, but it fits. I almost went with MCGA (Make China Great Again), since we had these hats, but I really want to keep to our theme on the transition from Made in China to Made by China.

Sticking to Made By China, we laid out the threats, risks, and opportunities in Made By China 2025.

In this month’s ATW – Around the World with Academy Securities, we touched on several important issues, but more and more, the geopolitical lens is beings focused on China’s goods and brands. From some conversations in D.C. and Vegas with our GIG (Geopolitical Intelligence Group), it is clear that many departments in D.C. are very focused on China and what is an “appropriate” relationship with China. Much of the focus is at the National Security level, but the definition of “national security” includes things like manufacturing, energy security, etc., making it much more all-encompassing than what people typically think of as “national security.” This is going to affect how we treat China and is, without a doubt, going to impact how China responds to us in ways that the market still doesn’t seem to be pricing in.

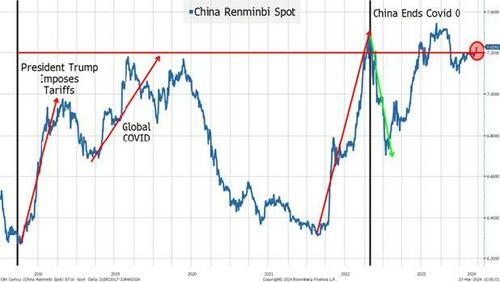

CNY (Chinese Renminbi – or yuan) and the PBOC (People’s Bank of China) should be watched. So far, China has not done a lot, by historical or even U.S. standards, to turn their economy around. They’ve had some stimulus here and there and implemented some rules to stymie stock market sellers. However, so far, their response seems to be appropriate if their economy was merely in the doldrums, and not on the precipice of a serious decline (which many people suspect is the real case).

But just this past week they allowed the currency to drift above 7.2. Allegedly that level represents key support, and while it has been higher in the past, many have expressed concern that this recent breach could be part of an effort to seriously devalue the currency in an attempt to make their exports cheaper. That seems pretty darn obvious to me. Their way out of their economic malaise is to produce more goods in China. Since companies, in general, are not looking to expand their manufacturing in China, they will need to manufacture and sell their own brands! The concept of “China Inc.” is that the government and corporations are inextricably linked and work together in ways that are just not possible (or even conceivable) in the U.S. and Western Europe.

Which brings us to Temu and Shein. Neither are acronyms, so they don’t quite fit today’s title, but they are so important to the Made By China theme that they need to be mentioned. Personally, and it is just my preference, I have not used either site and avoid pulling them up, let alone clicking on them. Yes, I am in the camp that has had concerns about the data on TikTok for a long time. In any case, I’m told that many of the products sold on Temu have apps associated with them to access their features. That seems a bit scary to me. Maybe I’m just a paranoid luddite, but…

Shein, as a representative of “fast fashion,” is likely to be hit by a French bill Penalizing Fast Fashion. I think the argument goes along the lines that “the clothes are so inexpensive and people throw them away much sooner than normal, creating a strain on the environment.” That seems to be a stretch, but yet again, it highlights the selling of Chinese made goods by their own brands. This is a threat to sales from “our” brands, whose stocks are in “our” indices.

Maybe I’m just more attuned to it, but the number of people who seem to want to “check out a BYD vehicle” seems to have increased. Not sure if anyone I’ve been talking to actually plans to buy one (I’m not even sure if you can), but people are suddenly curious about the brand. Word of mouth marketing is often mentioned as one of the more effective means of marketing a brand, and it almost seems like BYD is getting to that level even in the U.S. You cannot buy them here, though they sell buses here apparently if generative AI is to be trusted and confirmed on Reddit (which should be congratulated on their successful IPO).

ROTST or ROON

Okay, I’ve fully Jumped the Shark (JTS) on acronyms. Neither Rallying On The Same Thing (ROTST) nor Rallying On Old News (ROON) are phrases that are commonly used, but what the heck, we’ve come this far, so let’s finish with this.

I’m not going to apply it to the Fed because I can see where it was “technically” new news, or at least contrasted against fears that had gotten priced in. But two things hit me this week on this front:

- Semiconductor manufacturer crushes earnings. Stock soars 10% or more. I get it, to some degree, but at what point do we price in that the last quarter, the next quarter, and likely the next year are going to be great? Stocks, in many cases up 50% or more in a short period of time, pop on good news (and yes, it is definitively good news), but how is some of this not priced in? It’s not like every time Steph Curry hits a 3 everyone argues that he is undervalued – it is expected of him, given his current valuation. It has this feeling that the same headlines keep triggering positive responses, but will that last?

- The excitement of the CHIPS Act finally providing something that almost seemed tangible was interesting. I guess, since it has taken so long for anything tangible to come out of that bill, maybe the market had started to underprice the money that in theory was available. Maybe, with people becoming too pessimistic about the complexity and restrictions associated with the Act (there are a lot of them), the market wasn’t pricing in much value to companies that now should get priced in. Maybe, but it seems like old news. What was “new” news is the fact that while this money has been earmarked (or allocated, or set aside, or approved), it has not yet been funded. It is yet another form of stimulus and increased debt that the market seems to be ignoring (or at least it did last week).

BTR

Since we barely dip, does anyone who has been waiting to BTD (Buy The Dip) need to Buy The Rally (BTR)? Just suck it up, and get max long stocks, bonds, and credit?

I don’t think so, but I was caught by surprise by how much we could rally while facing many big issues (the biggest of which, by far, is the competition from Made By China). I also was surprised at how much we could rally on what seems (after weeks and weeks of positive news) to be just more of the same news that should already be priced in.

I know that LAW (Long And Wrong) is sometimes used, but I’m not sure what is the opposite of that? SAS (Short and Stupid)? I do know “don’t fight the Fed” but despite the apparent GCBE, I don’t think I’m fighting the Fed.

We get a lot of economic data next week, so we will have plenty of opportunities to judge the state of the economy and the trajectory of inflation.

LOTL

One subject coming up, especially within Academy’s GIG, is Living Off The Land. My initial reaction was that this was about “preppers” and I felt good about having a well and expanding our garden. Turns out that it is all about cyber. In fact, a particularly nefarious and difficult to catch cyber-attack. CISA published on LOTL back in February. Maybe because it was competing with Super Bowl coverage, it didn’t get the attention it deserves, but it is coming up in more and more conversations. Please look for Academy’s SITREP on this important subject early next week.

Finally, one thing that I think many across the country can agree with is let’s hope the old adage of March, In Like a Lion, Out Like a Lamb holds true, as I for one am “done” with winter!

Tyler Durden

Sun, 03/24/2024 – 16:20

via ZeroHedge News https://ift.tt/y6NkQTx Tyler Durden