FInal Q4 2023 GDP Revision Comes In Red Hot 3.4%, Beating Estimates

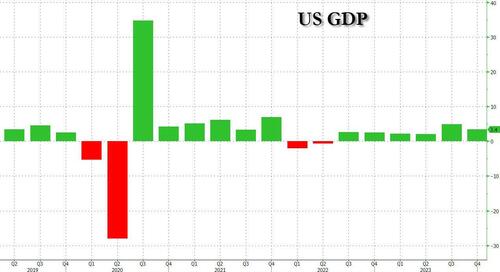

It’s ancient history by now, but moments ago the Biden Bureau of Economic Goalseeking Analysis reported that in its third estimate of Q4 GDP, the US was estimated to have grown by 3.4% (3.440% to be precise), above the 3.2% reported last month and above the 3.2% estimate.

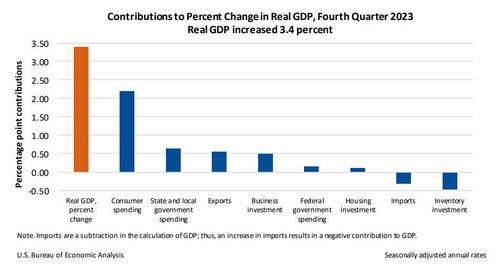

The increase in the fourth quarter primarily reflected increases in consumer spending and state and local government spending that were partly offset by a decrease in inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

The update from the second estimate reflected upward revisions to consumer spending, business investment, and state and local government spending that were partly offset by downward revisions to inventory investment and exports. Imports were revised down. Here is a more detailed analysis:

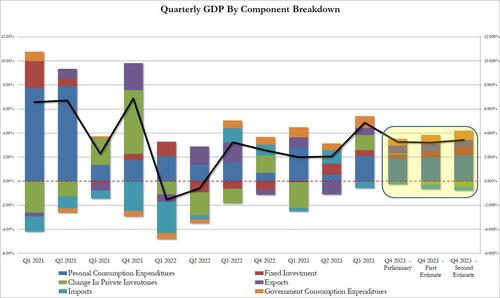

- Personal Consumption contributed 2.20% to the bottom line GDP of 3.4%, or two-thirds of the total, up from 2.00% in the previous estimate and up from 1.91% in the first calculation.

- Fixed Investment added another 0.67% to the bottom line, also a solid improvement to the 0.43% previous estimate

- The change in private inventories subtracted 0.47% from the bottom line print, a deterioration to the -0.27% first revision and far below the positive +0.07% contribution in the first estimate.

- Net exports were little changed at +0.25% (consisting of 0.55% exports less 0.3% imports) vs 0.32% in the first revision (0.69% exports less 0.37% imports).

- Finally, government consumption increased modestly to 0.79% of the bottom line, up from the 0.73% estimated previously.

Here the biggest contribution was personal spending, which increased even more than initially suspected, and reflected increases in both services and goods. Within services, the leading contributors were health care (both outpatient and hospital services), other services (led by professional and other services), as well as food services and accommodations. Within goods, the leading contributors to the increase were other nondurable goods (led by pharmaceutical products) as well as recreational goods and vehicles.

Here is a visual summary:

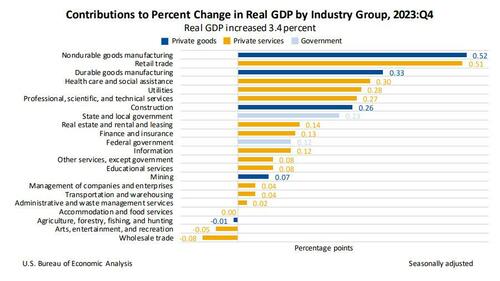

The BLS also provided a breakdown of GDP by industry, noting that the value added of private goods-producing industries increased 7.0%, private services-producing industries increased 2.6%, and government increased 3.1 percent. Overall, 18 of 22 industry groups contributed to the fourth-quarter increase in real GDP

- Within private goods-producing industries, the largest contributors to the increase were nondurable goods (led by petroleum and coal products and chemical products), durable goods manufacturing (led by machinery), and construction.

- Within private services-producing industries, the increase was led by retail trade (led by motor vehicle and parts dealers), health care and social assistance (led by ambulatory health care services), utilities, and professional, scientific, and technical services (led by computer systems design and related services).

- The increase in government reflected an increase in state and local government as well as federal government

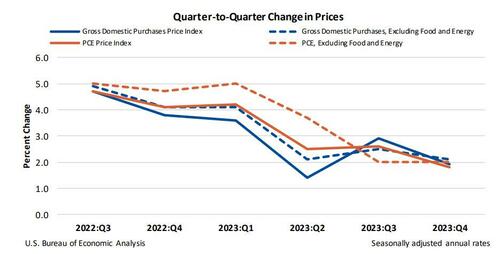

Turning to prices, the Q4 2023 numbers are completely irrelevant especially with the latest Feb monthly PCE data out tomorrow (when markets are closed), but here goes anyway:

- GDP prices increased 1.9% in the fourth quarter after increasing 2.9% in the third quarter. Excluding food and energy, prices increased 2.1% after increasing 2.5 percent.

- PCE prices increased 1.8% in the fourth quarter after increasing 2.6% in the third quarter. Excluding food and energy, the all-important – if extremely delayed – PCE “core” price index increased 2.0%, the same increase as in the third quarter. The core PCE came in just below expectations of a 2.1% print.

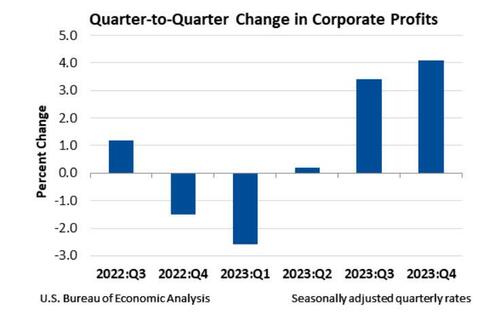

Finally, looking at corporate profits, these increased 4.1% at a quarterly rate in the fourth quarter after increasing 3.4% in the third quarter. Corporate profits also increased 5.1% in the fourth quarter from one year ago. More details:

- Profits of domestic financial corporations increased 1.3 percent after increasing 2.0 percent.

- Profits of domestic nonfinancial corporations increased 5.9 percent after increasing 4.1 percent.

- Profits from the rest of the world (net) decreased 1.7 percent after increasing 1.7 percent.

Tyler Durden

Thu, 03/28/2024 – 09:05

via ZeroHedge News https://ift.tt/doSmxI1 Tyler Durden