Fire, Then Ice: Our Deflationary Future

Authored by Charles Hugh Smith via OfTWoMinds blog,

Lest you weep for those whose phantom wealth will be drained away, recall that few win when a reserve currency dies. Labor can start earning the day after the reset, but the capital lost is gone for good.

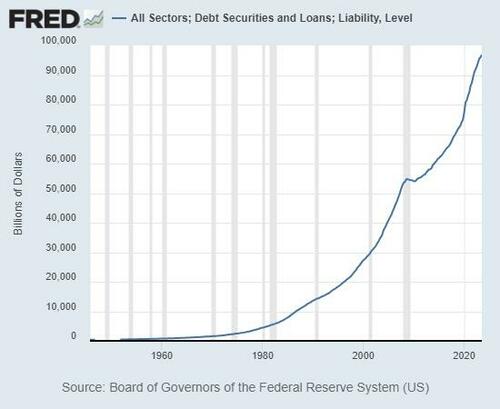

Outside the “everything’s always fine” echo-chamber, the consensus is that easily created fiat currencies will all evaporate as the temptation to continue printing/borrowing money into existence is irresistible: the only way to keep the system from imploding is to devalue the soaring debt and interest payments with inflation, and the dial controlling inflation is money-printing / central banks buying debt and all the related tricks.

The problem is that once the dial is turned to 11, inflationary expectations start feeding back into real-world inflation and inflation then escapes the control of central bankers and government treasuries: creating more money to devalue the currency and service the debt ends up destroying the currency via hyper-inflation.

History offers many examples of this temptation and dynamic. The pain of debts being written off, governments defaulting on bonds and assets crashing is too great, and so we have to print more money / borrow more money into existence to stave off the painful reckoning of debt dependence and central bank hubris.

To stave off the pain of debt saturation / over-indebtedness, monetary authorities collapse the currency and the economy it supported, unleashing maximum pain on everyone who used the currency or owned assets denominated in the currency.

A new dollar is then introduced at a ratio of 1 new unit to 100, or 1,000, or 100,000 of the old dollars. Everyone’s financial wealth is wiped out. Tools, skills, precious metals, buildings, mines, farms, etc., still retain their intrinsic / productive value, but the monetary reset means everyone whose phantom wealth was a form of debt is wiped out.

This dynamic makes perfect sense, and it’s a well-worn pathway for nation-states. Empires, however, might choose differently. The difference between a nation-state and an empire is generally under-appreciated. A nation-state can destroy its currency and bankrupt everyone holding its bonds / debt and start over, but an empire cannot be quite so cavalier, for the “reserve currency” of the empire is its foundation of power.

Yes, the hard power of military power projection is a core strength, along with trade, alliances, cultural and diplomatic soft power, but if the currency evaporates, so does the Imperial Project, and those tasked with maintaining the Imperial Project are forced to calibrate pain by a different standard than politicians and central bankers.

Inflation and the evaporation of the currency is not a solution for the Imperial Project, it is the surrender of all that is great and good. The only viable solution for the Imperial Project is deflation, the forced liquidation of unpayable debts and thus the forced liquidation of all the phantom wealth generated by ever-expanding debt.

Just as inflation has many sources, so too does deflation. Technology can be a source of deflation, as a new technology can dramatically increase supply and durability while dramatically lowering costs. Substitution can be deflationary, as enterprises and consumers swap a cheaper, more abundant substitute for whatever was becoming scarce and costly.

If the sum of “money” circulating in the economy contracts as credit tightens, it becomes harder to borrow more money into existence. Every dollar of debt that’s written down to zero reduces the quantity of money floating around, i.e. the money supply.

If the money that is being created is immediately hoarded by the wealthy, it doesn’t circulate in the economy and therefore it’s the equivalent of debt being extinguished: the supply of money doesn’t expand because the new money has been hoarded, in effect buried in the backyard.

To preserve the Empire, it becomes necessary to wipe out the debt and the phantom wealth it created, 90% of which is held by the hyper-wealthy, super-wealthy and merely wealthy. This is the class that has concentrated wealth and power to the point of destabilizing the social, financial and political orders, and so those tasked with preserving the Empire (the State within the State) will have to strip this powerful class of its phantom wealth indirectly, as the class is too politically powerful to be taken down head-on.

Recall that deflation–the decline in the price of assets, goods and services–is beneficial to wage-earners, as their earnings go farther as prices fall. Profits become harder to come by, and those lending and speculating on ever-higher asset valuations are wiped out.

From the Imperial point of view, this is all good: given that the only goal is to preserve the currency from evaporation, then the takedown of the hyper-wealthy class that threatens to destabilize the Imperial order is equally essential.

Just as inflation is a hidden tax on labor, deflation is a hidden tax on capital. If commercial real estate, stocks and corporate bonds all lose value for a decade, the bottom 90% will only be affected indirectly. If whatever money is being created is funneled into spending at the bottom of the economy–those buying essentials–then the deflation of private debt and assets won’t strip the real economy of money in circulation, it will only strip the wealthy of the capital they were hoarding and speculating with under the guise of “investing.”

Fire, then ice: as inflation (fire) threatens the Imperial currency, the Empire must choose deflation (ice) to preserve its foundation. Currency in active circulation is lumped in with the phantom wealth of debt-based assets, but they are two different things, as Aristotle observed (oikonoma and chrematistics). Just as inflation works slowly to erode the value of labor, deflation works best if it too is gradual, slowly extinguishing phantom wealth over time.

I have endeavored over the years to explain that the concentrated wealth and power of the hyper-wealthy pose an existential threat to the Imperial Project, and the showdown between debt-created phantom wealth and the bedrock of the Imperial Project, its currency, will play out in the next 6 to 8 years.

The “everything’s always fine” echo-chamber holds that inflation to preserve all the debt-created phantom wealth is necessary, but they are focused on serving private wealth, not the Imperial Project. What’s truly essential is to preserve the Imperial currency, and to accomplish that, both the phantom wealth and the power of the hyper-wealthy who own the vast majority of it must be extinguished. Slowly, slowly, but extinguished nonetheless.

Lest you weep for those whose phantom wealth will be drained away, recall that few win when a reserve currency dies. Labor can start earning the day after the reset, but the capital lost is gone for good.

There is much more to discuss here, but let’s take it one step at a time.

* * *

Tyler Durden

Sun, 03/31/2024 – 14:00

via ZeroHedge News https://ift.tt/5jL93CA Tyler Durden