Victor Davis Hanson: One Angry Biden Lie After Another

Victor Davis Hanson’s calm and reasoned response with Tucker Carlson to President Biden’s SOTU address is worth every second:

Victor Davis Hanson discusses with Tucker Carlson, Joe Biden’s SOTU address.

Never has he seen a more angry speech to our country.

Credit: these two awesome Americans. @TuckerCarlson @VDHanson pic.twitter.com/9xUKeuJ2cn— Big Fish (@BigFish3000) March 8, 2024

But the professor put digital pen to paper in a post on X this afternoon, laying out all the details.

A demagogic fuming Biden gave another Phantom of the Opera speech blasting conservatives for all the destruction that he has caused and has resulted in his own historic unpopularity.

All too aware that he was confused and incoherent, his handlers felt that the antidote was to come out barking and bellowing at his imaginary enemies.

Any Never Trumper who would vote for such a screeching maniac is suicidal. The night’s nadir? Joe, of the Hunter-Biden family consortium, damned the money-grubbing “rich” who “don’t pay their fair share of taxes”—all of this when his own son is now facing multiple felony counts for not paying any income tax at all! And Joe himself has received lots of family money without paying tax on such “loan repayments”.

In truth, Biden gave the most livid state-of-the-union address in modern memory, a surreal teleprompted rant from a “get off my grass” old man. At points, he started howling at the seated opposition and even called out Supreme Court Justices. Determined not to reveal cognitive decline, Biden instead came late to the podium shouting nonstop, grimacing in reptilian style for over an hour.

If the planned Adderall-fueled screaming was to prove he was still alive, most would have preferred his drowsy incoherence.

But mostly the speech was one of abject lies as he either blamed all his disasters on others or claimed they were his greatest achievements.

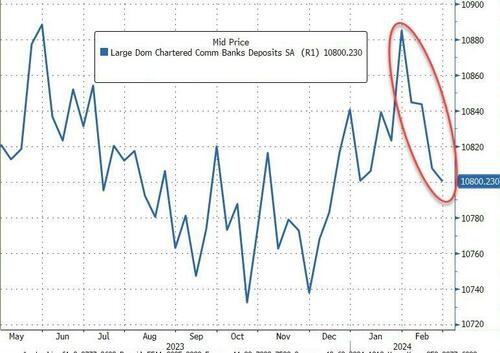

Deficits? Why does he think we have high inflation and high interest rates after he took office? The debt was $28 trillion when he came in and now after just 3 years it is nearly $35—and is now growing by $1 trillion every 100 days. At the current rate a two-term Biden presidency would have in aggregate added $22 trillion more to national debt.

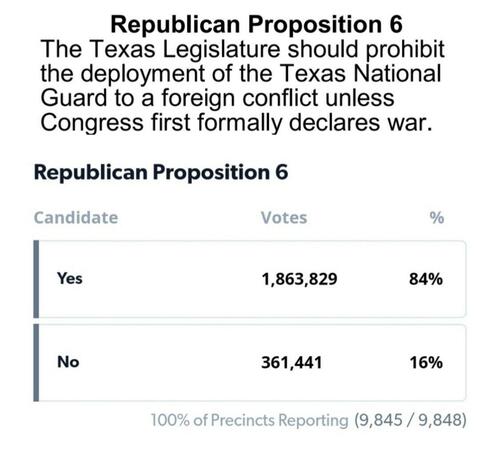

Ukraine? Biden started out with Ukraine, not inflation, not the border, not crime. Does he remember he suspended military aid to Ukraine upon taking office? Does he know that Putin did not invade a neighboring country in just one administration of the last four? Does he know why? Does he recall his humiliation in Afghanistan that green lighted

Putin? There are now 700,000 combined casualties in Ukraine and so what is the plan to end our Verdun? Another 6-month-long “spring offensive” against fortified lines?

Abortion? Biden screamed that the Dobbs decision outlaws abortion and threatens women’s lives when it allows any state to let its own people determine their own laws. Is Trump’s plan to let the states decide and to favor a 16-week ban more sensible than Biden’s abortion on demand that would allow some 5,000-10,000 partial birth or post-21 weeks abortions?

The Border? Do we remember Mayorkas bragging in detail how Biden rescinded all of Trump executive orders (he listed them by name) to destroy the border and let in 8-10 million illegal aliens? Biden campaigned on just that, calling on illegal aliens to “surge” the border.

Inflation? It is up 17% since he took office! Prices of the stuff of life have risen 30%—staple foods, fuel, appliances and care, shelter, mortgages. etc. January 6? In Bidenland a buffoonish afternoon riot now trumps Pearl Harbor—or the 120 days of looting, rioting, violence, death, and injury of summer 2020?

Gaza? Basically Hamas murders, rapes, tortures, and mutilates1,200 Jews, takes 250 hostages, rapes and murders untold numbers of them, is shielded by civilians beneath mosques, schools, and hospitals, and then the US blames Israel for retaliating. Biden cites bogus Hamas fatality figures, and promises to build a US port on the Gaza coast to pour in massive aid to Hamas-controlled Gaza.

This furious speech was a preview of the 2024 campaign. The Democratic nominee will run on abortion, January 6, and the ‘booming’ economy, hope leftwing prosecutors can bankrupt or incarcerate Trump, and ensure that in all the swing states 70 percent of the electorate do not vote in person on Election Day.

Tyler Durden

Fri, 03/08/2024 – 19:40

via ZeroHedge News https://ift.tt/E5PscIk Tyler Durden