At 3:15 in the morning on May 10, 1774, King Louis XV of France passed away after a grueling, two-week battle with smallpox.

Upon hearing the news, his heir and grandson– 19-year old Louis XVI, reportedly cried out, “God protect us, I am too young to rule. . . I have learned nothing and the universe will fall upon me.”

But the new young king did manage to make at least one very bold decision almost immediately: he appointed a controversial French economist named Turgot to head up the nation’s finances.

Everyone knew by 1774 that France was in serious trouble. The national debt had soared to a record high thanks to so many years of war, extravagant spending, corruption, and blatant mismanagement.

Annual interest payments on the debt were becoming so vast that France had to borrow more money just to pay interest on the money they had already borrowed. And lenders were becoming increasingly worried that the government would default.

As a result, interest rates rose considerably. Investors who loaned money to the French government demanded rates as high as 12% to compensate themselves from the risk of potential default.

Louis XVI knew that this was completely unsustainable, and that France was headed for a major crisis if the government didn’t take urgent action to reverse course.

And that’s why he hired Turgot– possibly the only person in the kingdom with the balls to do what was necessary.

It wasn’t rocket science; Turgot knew exactly what needed to be cut. It was obvious:

By the early 1770s, the court at Versailles included the entire royal family, along with a whopping 886 aristocrat freeloaders– plus their wives and children. Add to that number 295 cooks, 56 hunters, 47 musicians, plus various other secretaries, chaplains, physicians, and other entourage, plus thousands of guards to protect everyone.

In total the royal court had over 16,000 mouths to feed, not to mention the handsome salaries paid to all of these useless officials.

The annual pensions alone, which were paid just to a handful of the king’s closest friends, consumed more than TEN PERCENT of the government’s annual budget.

But on top of this blatant spending problem, France also had a productivity problem. High taxes, excess regulation, and government price controls virtually eliminated any incentive to produce. Plus businesses faced endless battles with the guilds, which were essentially the unions of that era.

So, when Turgot was charged with fixing the country’s financial woes, he knew exactly what to do. And he sketched out his plan to the king the very night that he was appointed:

“In the present moment, I confine myself, Sire, to call to your recollection three ideas: No national bankruptcy. No increase of taxes. No new loans. . . To obtain these three points there is but one method– that of reducing the expenditure. . .”

Turgot knew that the economy needed to become more productive, so he wasn’t willing to raise taxes. He wouldn’t cause a financial crisis by defaulting on the debt. And he certainly wasn’t going to increase the debt by borrowing more money.

The solution was obvious, and Turgot got to work almost immediately.

With the King’s support, he made deep, deep cuts to the royal court. He also liberated trade and commerce by taking power away from the guilds, eliminating price controls, and reducing regulation.

And it worked. By the end of 1775, Turgot had balanced the budget and restored France’s creditworthiness such that he was able to refinance a large portion of the French debt with foreign investors at a rate of just 4%.

He turned everything around in just barely a year.

Unfortunately for France, however, Turgot had made a lot of enemies. The nobles, the guilds, and even the church hated him. So, on May 12, 1776, the King gave in to the pressure and fired Turgot. France then quickly resumed its decline.

The larger point is that it is possible to turn a giant ship around. France was in dire straits when Turgot took over. But he managed to reverse course in a year.

The US is now at a similar point (though frankly much worse) as when Turgot took over French finances.

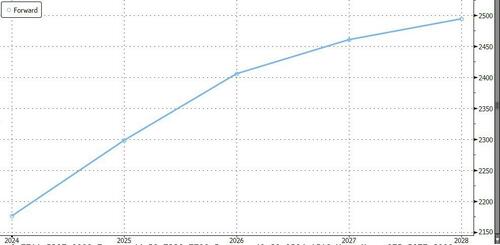

France’s budget deficit in 1774 was roughly 10% of total tax revenue, while the budget deficit in the US last year was closer to 40%. Nevertheless, it’s still possible for America to turn things around.

And just like France in 1774, the answers are obvious. Turgot knew that every other government expenditure combined paled in comparison to France’s #1 cost: the royal court.

Similarly, everything else in the US government budget combined pales in comparison it its #1 cost: entitlement spending.

Obviously, there is plenty of fat to trim everywhere in the US government; the Defense Department routinely wastes tens of billions of dollars, let alone the billions wasted in other departments.

And while those cuts would be helpful, they won’t amount to anything unless the #1 issue is tackled.

Entitlement spending, which includes Social Security, Medicare, and various welfare programs which the government now politely calls “income security”, cost a whopping $3.75 TRILLION in Fiscal Year 2023. This is the obvious place to start.

But Joe Biden made it very clear in last night’s State of the Union that he has absolutely no intention of doing that.

He could have been honest. He could have leveled with voters that there is almost no chance of balancing the budget without obvious entitlement reform… and that failing to balance the budget will result in an existential financial crisis.

At a minimum he could have said nothing.

But instead, he specifically ruled out entitlement reform (for the second year in a row) and explicitly said, “If anyone here tries to cut Social Security or Medicare or raise the retirement age I will stop them!”

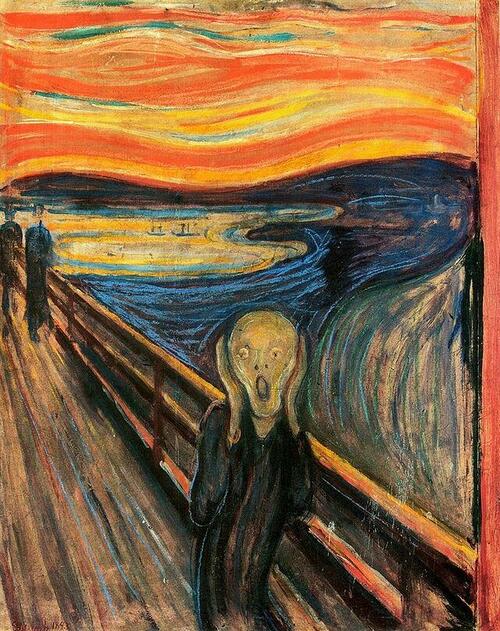

Now, Joe Biden may think that he’s doing the right thing. But this is classic Inspired Idiocy.

When Hawaii’s Supreme Court recently ruled that the “Spirit of Aloha” takes precedence over the second amendment, they thought they were doing the right thing. Or when the FTC sued last week to block a grocery store merger, they thought they were doing the right thing.

Even the eco-terrorists who sabotaged a Tesla factory in Germany this week believe they’re doing the right thing.

Inspired Idiots always think of themselves as righteous. Unfortunately, they’re completely misguided and almost always wrong. They understand nothing, but they’re really passionate about it.

And that’s the danger.

This coming fiscal crisis is completely avoidable if the people in charge would simply take it seriously. But the President pledged last night that he will do absolutely nothing to stop it, and in fact continue making it worse.

The good news is that, while the Inspired Idiots in charge keep steering the country directly into the crisis, individuals can take rational steps to mitigate the worst consequences… and potentially even benefit from the opportunities that arise.

That’s why it’s so important to have a clear understanding of these obvious risks, and to have a Plan B.

Source

from Schiff Sovereign https://ift.tt/5sNuUIn

via IFTTT