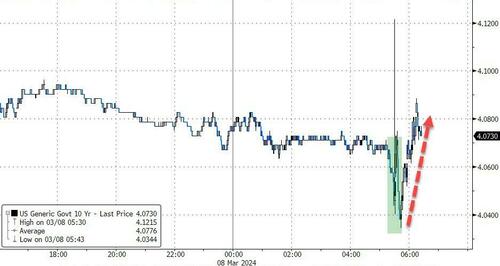

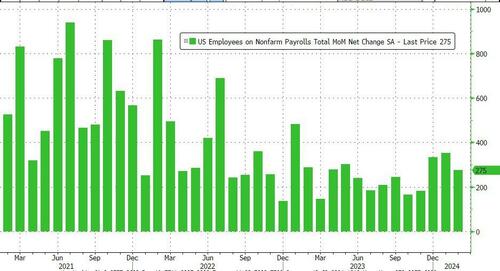

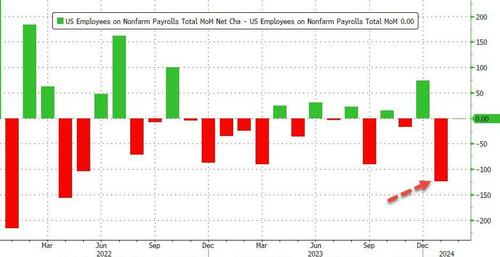

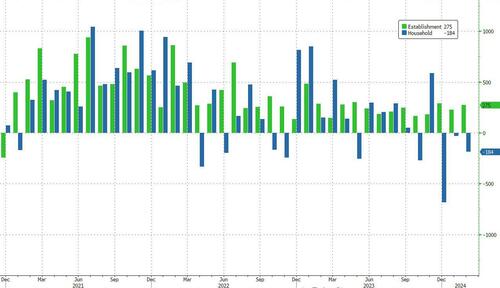

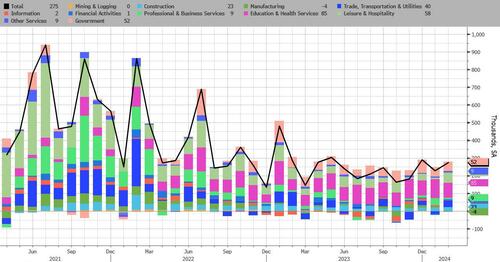

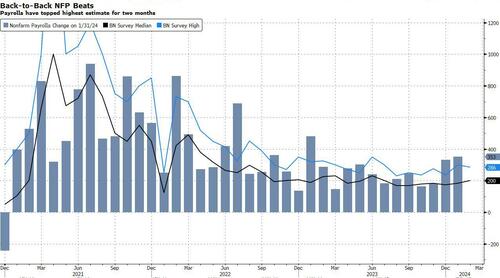

US stock-index futures reversed earlier gains and traded near session lows before the release of the February jobs report at 830am (consensus expects a 200k print, a slowdown from last month’s 353k print: see full preview here) and after Fed Chair Jerome Powell indicated the central bank is getting close to the confidence it needs to cut interest rates. S&P 500 futures were down 0.2%, while Nasdaq 100 and Dow Jones futures were down 0.3% at 8:00am ET, reversing earlier gains of as much as 0.2%. Powell said Thursday the Fed will “begin to dial back”rates once it’s confident inflation is moving sustainably at 2%. 10-year yields slid to a one-month low 4.07%, and the dollar skidded for the sixth straight day after the yen surged following a Reuters report the BOJ may hike as soon as this month. Across Europe, bond yields dropped and the euro slipped, after the ECB lowered its inflation forecast, indicating monetary easing could begin in June, a view more rate-setters backed on Friday. Commodities are mixed with Energy flat, metals higher, and Ags mixed. NFP is today’s macro data focal point. Fed’s Williams speaks later but mkt remains focused on Powell’s comment of “not far” from having confidence to cut rates.

In pre market trading, both AVGO and MRVL traded down after reporting disappointing earnings; they are trading -2.4% and -5.9% pre-mkt but NVDA is +3.2% pre-market, taking its market cap increase this year to more than $1 trillion as demand for AI chips shows no signs of letting up. The stock on track to rise for a seventh consecutive session, its longest winning streak since November. The world’s most valuable semiconductor maker is valued at about $2.32 trillion and is inching closer to Apple’s $2.61 trillion market cap and MSFT’s $3.04 trillion.

The balance of the Mag7 are higher ex-MSFT. Consumer earnings were positive, led by COST and GPS but COST appears to be a sell the news event; stocks are+7.4% and -5.0% pre-mkt, respectively. Here are some other notable premarket movers:

- AerSale sinks 20% after the aircraft engineering company reported revenue and adjusted profit for the fourth quarter that trailed estimates.

- Amylyx Pharmaceuticals tumbles 80% after the company said the AMX0035 PHOENIX study missed endpoints.

- Broadcom slips 1.8% after the chipmaker reported semiconductor solutions revenue that missed the average of analysts’ estimates

- Carvana rises 5% as RBC issued an upgrade and doubled the price target to a Street-high $90.

- Costco drops 4.1% after the warehouse club chain reported second-quarter revenue and gross margin that didn’t meet consensus expectations. Citigroup said it’s hard to see catalysts that can drive Costco’s shares higher.

- DocuSign rises 8.6% after the e-signature company reported fourth-quarter results that beat expectations and gave an outlook that is seen as strong.

- Domo falls 12% as the application software company’s outlook pointed to ongoing growth pressures.

- Eli Lilly & Co. slips less than 1% as the company’s Alzheimer’s disease drug donanemab faces further delays in gaining approval

- Biogen gains 3.7%; Biogen markets Leqembi with partner Eisai, which received FDA approval to treat Alzheimer’s in July

- Funko jumps 7% after the maker of bobble-head dolls reported fourth-quarter profit and sales that came in ahead of estimates.

- Gap advances 8% after the clothing retailer reported fourth-quarter EPS that topped consensus expectations. Jefferies highlighted the continued improvement in results at Gap’s namesake brand and Old Navy.

- Marvell Technology slips 5.6% after the chipmaker gave a first-quarter forecast that was weaker than expected. Analysts note that AI was unable to offset weakness in other parts of the business.

- MongoDB drops 8.8% after the database software company gave a full-year forecast that was much weaker than expected.

- Porch Group rises 22% after the home services software company reported revenue for the fourth quarter that beat the average analyst estimate.

- Samsara jumps 14% after the application software company’s full-year forecast topped analyst estimates.

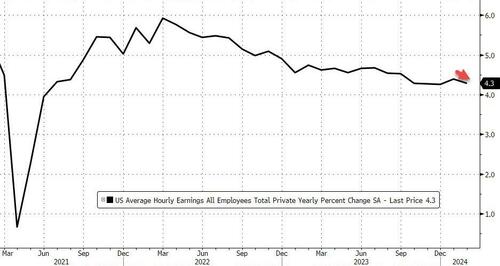

How markets move from here will likely be determined by US employment data, with the consensus forecasting that 200,000 new jobs were created last month, well down from January’s 353,000. The crowd-sourced whisper number is 215k. Hourly wage growth is also expected to slow (full preview here).

“If we get a very robust number, the bond market looks vulnerable,” said Charles Diebel, a macro advisor to Mediolanum International Funds. “It may also start challenging risk assets’ performance, which is based on expectations that interest rates and bond yields will fall.”

Elsewhere, late on Thursday Joe Biden delivered the State of the Union Address in which he stated they will work to rebuild the economy and that unemployment is at a 50-year low, Biden said he is seeking to make healthcare tax credit permanent, while he added that Americans pay more than anywhere else in the world on prescription drugs and he is ending this.

European stocks were also in the green, with the Stoxx 600 up 0.2% and set to log a seventh consecutive week of gains. The financial services subindex leads gains, led by UBS, which rises to a 16-year high on a Morgan Stanley upgrade; energy names also gained. Among individual stock movers in Europe, HelloFresh SE plunged by a record 48% after the meal-kit firm said it no longer expects to achieve previously provided 2025 goals. DS Smith Plc climbed almost 8% after Mondi Plc agreed to buy the company for £5.1 billion ($6.5 billion) to create one of the largest makers of packaging. Here are some of the biggest movers Friday:

- UBS gains as much as 4.8% after being raised to overweight at Morgan Stanley, predicting a strong comeback for the investment banking pipeline will spur long-term structural upside for the bank

- Grifols rallies as much as 26% from near 12-year lows after the company filed annual consolidated accounts with an unqualified opinion from auditor KPMG

- Maire shares rise as much 6.7% in Milan after Algerian state energy company Sonatrach awarded the Italian company a $1.1b contract for a linear-alkyl-benzene plant

- DS Smith gains as much as 7.6% to 350p after Mondi agreed to buy the company for £5.1 billion in an all-share deal that would create one of the world’s largest makers of packaging

- Informa rises as much as 2.4%, after the publishing firm’s earnings. Raised guidance, overshoot on revenue and larger-than-expected buyback in 2024 were highlights, according to analysts

- Mattioli Woods soars as much as 32% after Pollen Street Capital’s deal valuing the company at about £432m; Deal represents a premium of about 34% to Mattioli Woods’ March 7 closing price

- HelloFresh plunges by a record 48% after the meal-kit firm said it no longer expects to achieve previously provided 2025 goals, while setting 2024 profit target well below analyst expectations

- Suess MicroTec falls as much as 7% as Hauck & Aufhaeuser downgraded the German semiconductor company to hold, noting a mismatch in valuations and Ebit margins

Earlier in the session, Asian stocks rose, on track to cap a seventh-straight week of gains, as technology shares rallied again on dovish signals from the US central bank as well as ongoing optimism about artificial intelligence. The MSCI Asia Pacific Index advanced as much as 1%, extending its weekly gain to about 2% and set for its longest weekly win streak in more than three years. Tech harware shares were the biggest boosts to the regional gauge, with TSMC rallying for a fifth day. Most markets gained, with Hong Kong, South Korea and Japan among the leaders. India was closed for a holiday.

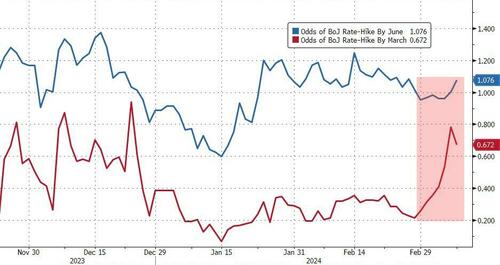

In FX, the Bloomberg Dollar Index is down 0.1%. The Japanese yen raced to the top of the G-10 FX leader board, rising 0.8% versus the greenback after Reuters reported the Bank of Japan are leaning toward exiting negative rates in March. The weaker dollar also helped the pound scale a seven-month high.

In rates, treasury yields dropped to a one-month low with price gains led by belly, extending Thursday’s sharp steepening move in the 5s30s spread ahead of February jobs report. Treasury yields richer by 1bp to 2bp across the curve with belly-led gains steepening 5s30s by 1bp on the day, after the spread ended Thursday wider by almost 5bp. US 10-year yields around 4.07% with bunds outperforming by 2.5bp in the sector. German government bonds have gained as several European Central Bank policymakers suggested an April interest rate hike should not be completely ruled out. A crucial gauge of wages in the euro zone also slowed at the end of last year. German two-year yields fall 6bps to 2.78%. According to BBG, the IG dollar issuance slate is empty so far with no offerings expected; six companies priced $7b Thursday, sealing third straight weekly total over $50b.

In commodities, oil prices are little changed, with WTI trading near $79. Gold surged above $2,160 an ounce, rising for an eighth day. The precious metal could rise to $2,300 in the next six to 12 months, analysts at Citigroup Inc. predicted.

“Macro and rates aside, we are seeing massive buying by China, not only at central bank level, but also from a wholesale level, with demand flows for January and February being the most on record,” Ned Naylor-Leyland at Jupiter Asset Management said in a note.

Bitcoin took a breather and holds just above $67k while Ethereum continues to advance as it closes in on USD 4k.

Looking to the day ahead, the main data highlight will be the US jobs report for February. Otherwise, there’s the German and Italian PPI readings for February. From central banks, we’ll hear from the Fed’s Williams and the ECB’s Simkus and Holzmann.

Market Snapshot

- S&P 500 futures up 0.1% to 5,167.25

- STOXX Europe 600 up 0.2% to 504.07

- MXAP up 1.1% to 177.85

- MXAPJ up 1.2% to 538.05

- Nikkei up 0.2% to 39,688.94

- Topix up 0.3% to 2,726.80

- Hang Seng Index up 0.8% to 16,353.39

- Shanghai Composite up 0.6% to 3,046.02

- Sensex little changed at 74,119.39

- Australia S&P/ASX 200 up 1.1% to 7,846.98

- Kospi up 1.2% to 2,680.35

- German 10Y yield little changed at 2.27%

- Euro down 0.1% to $1.0932

- Brent Futures up 0.6% to $83.43/bbl

- Gold spot up 0.3% to $2,167.50

- US Dollar Index little changed at 102.79

Top Overnight News

- Japanese corporate wages are set to jump as annual negotiations w/unions wrap up on March 13, paving the way for the BOJ to eliminate neg. yields by April. RTRS

- A growing number of Bank of Japan policymakers are warming to the idea of ending negative interest rates this month on expectations that this year’s annual wage negotiations will yield strong results. RTRS

- China’s auto sales in Feb crashed 21% Y/Y and 46% M/M, although a sharp rebound in sales and production was forecast for this month. WSJ

- For American tech companies in China, the writing is on the wall. It’s also on paper, in Document 79. The 2022 Chinese government directive expands a drive that is muscling U.S. technology out of the country—an effort some refer to as “Delete A,” for Delete America. WSJ

- Huawei and its partner SMIC relied on US technology to produce an advanced 7-nanometer chip last year, people familiar said. The revelation underscores the fact that China still can’t entirely replace foreign components and equipment. Separately, China is raising more than $27 billion for its largest chip fund to counter US curbs. BBG

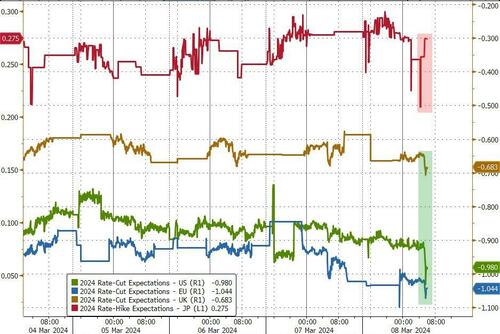

- Momentum built for a June ECB rate cut as policymakers echoed that prospect, with a few — such as Francois Villeroy — even suggesting a swifter move in April shouldn’t be completely ruled out. But officials won’t necessarily lower rates at every meeting once the cuts start, Martins Kazaks cautioned. BBG

- Joe Biden targeted Donald Trump in his State of the Union address without mentioning his rival by name. He laid out the makings of a reelection platform including plans to raise taxes on the wealthy and corporations. Biden also sought to portray his age as an asset, going out of his way to appear energetic. BBG

- Saudi Arabia has transferred a $163bn stake in national oil group Aramco to its sovereign wealth fund as the once conservative state investment group seeks to grow its assets to fund projects to modernize the economy. The transfer of 8 per cent of Aramco to the Public Investment Fund is the third time in the past two years the government has increased the sovereign wealth fund’s stake in the world’s largest oil producer. FT

- Concentration within the US equity market has surged to a multi-decade high. The 10 largest US stocks now account for 33% of S&P 500 market cap and 25% of S&P 500 earnings. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks took impetus from the fresh record levels on Wall Street amid dovish tailwinds. ASX 200 printed a fresh record high as the top-weighted financial industry led the gains seen in most sectors. Nikkei 225 initially approached just shy of 40,000 but with gains capped after disappointing Household Spending. Hang Seng and Shanghai Comp. were somewhat varied as the Hong Kong benchmark conformed to the upbeat mood, while the mainland was less decisive amid lingering tech-related frictions between the US and China.

Top Asian News

- China NPC Standing Committee said it will formulate a financial stability law, a law on rural collective economic organizations, a value-added tax law and a private sector promotion law, while it will revise the mineral resources law, enterprise bankruptcy law, unfair competition law, accounting law, public bidding law, the statistics law, and civil aviation law. Elsewhere, Hong Kong’s government issued a draft of a new national security law which includes state secrets, espionage, and foreign interference, according to Reuters.

- US lawmakers advanced a bill on Thursday that would ban TikTok in the US unless it cuts ties with its Chinese parent ByteDance within six months, while House Majority Leader Scalise said the House will vote next week on the TikTok crackdown.

- Three US Senators urge President Biden to hike tariffs on Chinese imported autos saying they could endanger American automotive manufacturing, according to a letter.

- China is raising a USD 27bln chip fund in order to counter mounting US restrictions, according to Bloomberg

European bourses, Stoxx600 (+0.2%) are mixed and trade has been contained within recent ranges, as the US NFP at 13:30 GMT / 08:30 ET remains in focus. European sectors are mixed; Financial Services takes the top spot, led higher by UBS (+4.1%), which benefits from a broker upgrade at Morgan Stanley. Energy is also higher, benefitting from broader strength in the crude complex. Telecoms is found near the bottom of the pile. US Equity Futures (ES +0.1%, NQ U/C, RTY +0.2%) are modestly firmer, and with trade fairly rangebound as traders await the US NFP report at 13:30 GMT / 08:30 ET. In terms of stock specifics, TSMC (+3.5%) benefits after reporting that its revenue rose 11.3% Y/Y.

Top European News

- Vivendi Advances Plan to Split Media Conglomerate in Four

- CPP to Acquire 17.5% Stake in NetCo From Telecom Italia

- Just Group Rises on Dividend Boost, ‘Record Low’ Business Strain

- Grifols Shares Jump as Auditor Greenlights Its Annual Accounts

- ECB’s Simkus Says Interest-Rate Cuts May Begin in June

- Zelenskiy Travels to Turkey in Bid to Shore Up Defense Support

- HelloFresh Slumps Most Ever After Meal-Kit Maker Scraps Target

- Klarna’s CEO Looks to Google for ‘Perfect’ Listing Blueprint

- BE Semiconductor Volume Jumps to More Than Five Times Average

FX

- DXY is flat as losses in EUR offset gains in JPY. The range for the session is 102.69-90 with NFP set to be the main driver for the USD. A soft release could see the DXY move closer to 102; a level not breached since 5th Jan.

- EUR is the only currency across the majors on the backfoot vs. the USD with ECB speakers out in full force and guiding markets towards a June cut. The pair is potentially showing some fatigue after venturing as high as 1.0955 with traders mindful of NFP later which will likely act as the main catalyst for the pair today.

- JPY has continued to extend on its weekly gains vs. the USD as markets increasingly position for a more hawkish BoJ amid reporting that the BoJ is to review its YCC programme and “leaning toward” ending negative rates in March. USD/JPY now down as low as 146.89; a soft NFP print could see the 200DMA come into view at 146.17.

- Antipodeans are both firmer vs. the USD with AUD marginally more so. AUD’s climb this week has seen it rise from 0.6477 base to a current peak of 0.6644 after taking out its 10, 21, 50, 100 and 200DMAs.

- PBoC set USD/CNY mid-point at 7.0978 vs exp. 7.1863 (prev. 7.1002).

BOJ

- BoJ considers new quantitative monetary policy framework, via JiJi; would show the outlook of JGB buying amount.

- BoJ is to reportedly review Yield Curve Control as it considers new quantitative policy framework, according to JiJi.

- BoJ leaning towards ending negative rates in March and key determinant will be outcome of March 13 wage talks, via Reuters citing sources.

- BoJ is reportedly mulling buying nearly 6tln of JGBs under new quantitative policy framework, according to JiJi.

ECB

- ECB’s Villeroy says an ECB rate cut is “very likely” in Spring, describes Spring as April-June 21st. More and more confident on inflation. Need to avoid haste on rates and avoid acting too late. Timing for cuts remains a minor issue, there is a large consensus that risks are in balance and a rate cut will come. French economic growth will surpass the European average.

- ECB’s Kazaks says they could take pauses on the rate-cutting journey, via Bloomberg; wage growth appears to be easing somewhat. Rate cut bets are more consistent with the baseline. How much easing occurs this year is data dependent. ECB will not be on autopilot once reductions commence.

- ECB’s Muller says they need more confidence on prices prior to conducting rate cuts, via Bloomberg. Optimism is returning to the EZ.

- ECB’s Rehn says a faster than expected slowdown in inflation is good news. Risks of a premature rate cut have substantially decreased; matter of cuts will be reviewed in April and June.

- ECB’s Simkus says there are all conditions to move to a less restrictive monetary policy; a cut in June is “very likely”; a cut in April cannot be ruled out but probability is low.

- ECB’s Holzmann says rate change may be in preparation.

- ECB’s Vasle reiterates current level of interest, if held long enough will get inflation to target.

- ECB’s Nagel sees a rising chance of a rate cut before policymakers’ break for summer, although this will be data-dependent, but the prospects have brightened, according to Bloomberg.

Fixed Income

- Bunds are bid, after stronger than expected German Industrial Orders and a slew of ECB speakers which are on the dovish-side/echo-Lagarde overall and increasing the focus on June while a handful have not entirely dismissed April. Bunds printed a session high at 133.84 and is yet to surpass its WTD high at 133.96.

- USTs have been moving in tandem with EGBs with fleeting pressure on the latest BoJ sources piece via JiJi/Reuters but action overall is relatively contained into the US NFP report.

- Gilts are the incremental outperformer despite a lack of specific newsflow. Action which has taken Gilts to within a handful of ticks of the WTD peak and around 50 ticks above post-Budget levels. Currently around 99.80 and higher by 39 ticks thus far.

Commodities

- Crude is now lower after spending much of the session in the green despite a lack of fresh headlines this morning and a rather tentative risk profile ahead of the US jobs report. Brent Apr sits around USD 83.00/bbl after making peaks at USD 83.84/bbl earlier.

- Precious metals are in the green despite a steady Dollar this morning, with some possible tailwinds from heightened geopolitics as the Israeli incursion into Rafah looms if no ceasefire deal is reached. XAU topped yesterday’s USD 2,164.80/oz high and rose to a fresh ATH of USD 2,168.79/oz this morning.

- Base metals are higher the board amid the recent tailwinds seen on Wall Street and then APAC, with dovish rhetoric from Western G10 central banks keeping the complex propped up.

- Shanghai Warehouse Stocks: Copper +24.7k/T, +11.5%; Zinc +11k/T, +11.3%; Lead +9.9k/T, +18.8%

Geopolitics: Middle East

- US President Biden announced that the US military will construct a port in Gaza to allow more humanitarian aid to arrive and confirmed there will be no troops on the ground while a senior official earlier stated that the port is to allow Gaza humanitarian aid deliveries and will take weeks to complete, while troops to remain on vessels offshore.

- Two civilians reportedly killed in a Turkish airstrike in the Duhok province of northern Iraq, via Reuters citing sources.

- “Iranian presidential aide: If Kuwait decides to extract oil and gas from the Durra field, we will do the same”, according to Al Arabiya

Geopolitics: Other

- US President Biden stated during the State of the Union Address that they are facing an unprecedented moment and he assures that Russian President Putin will not stop at Ukraine, while he added they can stop Putin by helping Ukraine with weapons and his message to Putin is that they will not walk away and will not bow down.

- North Korean leader Kim Jong-Un guided an artillery firing drill on Thursday, according to KCNA.

US Event Calendar

- 08:30: Feb. Change in Nonfarm Payrolls, est. 200,000, prior 353,000

- 08:30: Feb. Change in Manufact. Payrolls, est. 7,000, prior 23,000

- 08:30: Feb. Change in Private Payrolls, est. 165,000, prior 317,000

- 08:30: Feb. Unemployment Rate, est. 3.7%, prior 3.7%

- 08:30: Feb. Underemployment Rate, prior 7.2%

- 08:30: Feb. Labor Force Participation Rate, est. 62.6%, prior 62.5%

- 08:30: Feb. Average Weekly Hours All Emplo, est. 34.3, prior 34.1

- 08:30: Feb. Average Hourly Earnings MoM, est. 0.2%, prior 0.6%

- 08:30: Feb. Average Hourly Earnings YoY, est. 4.3%, prior 4.5%

DB’s Jim Reid concludes the overnight wrap

As you read this, I’ll be embarking on my first business trip to Australia for a decade before a brief run through Asia. My memories of this trip in the years gone by is turning up to meetings on Monday morning in Sydney having not slept at all on Sunday night and feeling absolutely awful due to a combination of tiredness and being on a caffeine drip. If there’s a silver lining, the era- and season-defining Liverpool vs Man City game kicks off at 2.45am Sydney time on Monday morning. So I’ll have something to keep me company as I can’t sleep.

As I take off, wondering how I’m going to fill the next 24 hours, welcome to yet another payrolls Friday. I’ll be viewing it on the plane WiFi somewhere around Iraq by my calculations. Ahead of this, markets continued to advance yesterday, with investors growing more hopeful about the prospect of rate cuts this year, particularly after the ECB’s decision leant in a dovish direction. That helped equities climb on both sides of the Atlantic, with the S&P 500 (+1.03%) up to another record high and moving back into positive territory for the week. In fact, if the S&P can hold those gains today, then that would mean it’s recorded 17 out of 19 weekly gains for the first time since 1964. So we’re on the brink of a major milestone, with little seemingly able to knock markets from their gains at the moment.

That ECB decision was a big catalyst for the rally, since although it left rates unchanged, several aspects suggested the window for rate cuts was coming into view. For instance, its latest inflation projections were revised downwards, with headline inflation seen at 2.3% this year, 2.0% in 2025, and 1.9% in 2026, while core inflation is expected at 2.6% this year, 2.1% in 2025 and 2.0% in 2026. So in a couple of years the ECB is pointing to core being back at target and headline being slightly underneath. Alongside that, the near-term growth forecast was revised down, with 2024 lowered by two-tenths from December to 0.6%. In President Lagarde’s comments, there was also something of a steer towards June, saying that “We will know a little more in April, but we will know a lot more in June”. Our European economists continue to see June as the likely starting point for cuts, while noting that Lagarde’s tone gave the impression that the ECB wants to move slowly through the easing cycle. See their full reaction here.

In turn, that meant investors dialled back the prospect of an April cut, which now stands at just 14%, whereas the prospect of a cut by June was largely stable at 92%. So there’s a pretty solid conviction that June is now most likely, and that’s the same month that markets are expecting the Fed’s first rate cuts as well, with a cut 96% priced by June.

The amount of Fed rate cuts priced in by December rose by +4.5bps to 92.4bps yesterday, helped by some dovish-leaning remarks from Powell. Speaking to the Senate Banking Committee, the Fed chair suggested the FOMC was “not far from” the confidence it needed “to begin to dial back the level of restriction”. Later on, Cleveland Fed President Mester struck a measured tone affirming expectations of rate cuts later this year but saying that “the bigger mistake would be to move rates down too soon or too quickly”.

The central bank news flow was generally very positive for markets, since for much of February, the trend had been to push out the timing of rate cuts, and there was growing speculation that they might not happen at all this yea r. But this week we’ve now seen both the Fed and the ECB signal that they want to dial back their restrictive policy soon, which has led to growing confidence that rate cuts are set to happen as soon as the summer. Clearly we’ve got the US CPI release next week, and we’ve seen inflation narratives shift a lot over the last couple of years, but when it comes to markets, there’s a growing confidence that the soft landing and rate cuts are still firmly on the table.

That backdrop led to another round of all-time highs for equities, with the S&P 500 (+1.03%) reaching another record, and taking its YTD gain above 8%. The advance was a broad-based one, which saw the small-cap Russell 2000 (+0.81%) hit its highest level in almost two years, whilst the Magnificent 7 (+2.46%) had its best day since Nvidia’s earnings a couple of weeks ago. Meanwhile in Europe, the STOXX 600 (+0.99%) closed above the 500 mark for the first time, and there were fresh records for the DAX (+0.71%) and the CAC 40 (+0.77%) as well.

Whilst equities were rallying strongly across the board, the picture was also positive but more mixed on the rates side. In the Euro Area, yields moved lower following the ECB decision, with those on 10yr bunds (-1.5bps), OATs (-2.1bps) and BTPs (-2.5bps) all falling back. Meanwhile, in the UK there was a noticeable flattening in the curve, with the 2yr yield up +4.1bps, and the 10yr gilt yield up +0.6bps, which followed the fiscal easing in the previous day’s budget from the government. Then in the US, there was a bull steepening, with the 2yr yield down -5.3bps to 4.50% and the 10yr down -1.9bps to 4.085%.

The front-end US rates move weighed on the dollar, with the broad dollar index (-0.53%) posting its sharpest decline of the year for the second day in a row. The euro rose to its strongest level against the dollar since mid-January (+0.32% to 1.094), despite initially trading lower during the ECB press conference.

Overnight in Asia, equities are mostly rising across the board with the Hang Seng (+1.38%) leading the gains as I type, with the KOSPI (+1.14%) and the Nikkei (+0.26%) also higher. That strength follows on from growing anticipation yesterday that the Bank of Japan would end their negative interest rate policy as soon as the meeting on March 19. So equities in the west go up on rate cutting expectations whilst in Japan they go up on rate hiking ones!

That meant the Japanese Yen was the strongest-performing G10 currency yesterday (+0.82%), hitting its highest level against the dollar in over a month. Elsewhere in the region, China has seen a couple of negative headlines within the property sector, with several companies seeking restructuring options on their debt. Off the back of this, Chinese equities are currently trading sidewards, with the CSI 300 down -0.05%, and the Shanghai Comp up +0.12%. US futures are fairly flat.

Looking forward, attention will be back on the US today, as the February jobs report is coming out. In terms of what to expect, our US economists are forecasting a +200k increase in nonfarm payrolls, which would keep the unemployment rate at 3.7%. For their full preview and to register for their post-release webinar, see here. The print follows some very strong reports over the last couple of months, and the January print had nonfarm payrolls growing by +353k, the highest in 12 months. The uncertainty is around storms in the survey week and a low response to last month’s survey so the prospects of a big miss or revisions in either direction are higher than normal. Ahead of that, we also got the weekly initial jobless claims yesterday, but that was much as expected, coming in at 217k over the week ending March 2 (vs. 216k expected).

Lastly, the rally in gold (+0.63%) continued over the last 24 hours, which sent the precious metal up to a new record of $2158/oz in nominal terms. It also marked its 7th consecutive daily advance, which is the first time that’s happened since 2021. Bitcoin also edged up yesterday, rising +1.28% by the end of the European session to $67,332, and is currently trading at $67,000 as I type. In a short update, Marion Laboure and Cassidy Ainsworth-Grace explain five reasons why Bitcoin reached a record high and why they expect prices to continue to go even higher this year. See here for the report.

To the day ahead now, and the main data highlight will be the US jobs report for February. Otherwise, there’s the German and Italian PPI readings for February. From central banks, we’ll hear from the Fed’s Williams and the ECB’s Simkus and Holzmann.

MASK SLIPS: With hard drugs wearing off fast Joe Biden has a truly shocking moment of honesty & lucidity.

MASK SLIPS: With hard drugs wearing off fast Joe Biden has a truly shocking moment of honesty & lucidity.

BOEING SUFFERS ANOTHER MID-AIR ENGINE FIRE

BOEING SUFFERS ANOTHER MID-AIR ENGINE FIRE