These Are The 5 Charts The FDIC Does Not Want You Paying Attention To

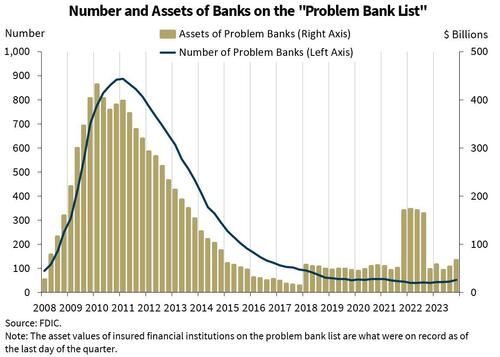

Washington’s “Problem Bank List” rose again last quarter, capping off a year when US lenders struggled to cope with higher interest rates and more overdue loans for commercial buildings and credit cards.

Bad Banks Rising

The FDICs’ confidential tally of lenders with with financial, operational or managerial weaknesses had grown by eight banks to 52, representing 1.1% of the institutions it oversees. The total assets held by those firms increased by $12.8 billion last quarter to $66.3 billion.

Although the number of firms on the FDIC’s list remains relatively low compared with historical highs, it continues an increasing trend that started early last year.

Always-friendly Senator Liz Warren lambasted Fed Chair Jay Powell today, claiming that “greedy bank executives” were behind bank failures, and the Fed needs to do its job of regulating those institutions.

Powell responded by saying they’ve reached out to banks with high levels of uninsured deposits and high levels of office real estate debt, adding that The Fed is examining whether they are “being truthful” with themselves.

With regard to being “truthful”, as we detailed previously, many of the loans on banks’ books are dramatically mispriced (over-valued):

“The worry now is that such firesales will set an example for other major investors seeking a way out of the turmoil too, forcing a wholesale crash in the Manhattan real estate market which until now had managed to avoid real price discovery.”

Warren responds by exclaiming that Powell has “gone weak-kneed” on bank regulation, concluding with this shot across the bow:

“the American people need a leader at the Fed who has the courage to stand up to these banks.”

Of course, The FDIC’s Quarterly Banking Profile would not be complete without the obligatory comment that ‘Overall, the FDIC said that the sector remains strong and resilient.’

“The banking industry continued to show resilience after a period of liquidity stress in early 2023,” Martin Gruenberg, the head of the agency, said in a statement.

He added that the industry faces significant risks that could affect credit quality, profits and liquidity. The FDIC chief flagged concerns around commercial real estate loans.

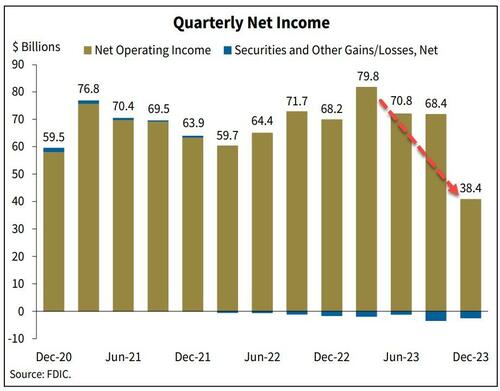

Bank Incomes Plummeting

Aggregate net income for the 4,587 FDIC-insured commercial banks and savings institutions declined $30 billion (43.9 percent) from the prior quarter to $38.4 billion.

Higher noninterest expense (up $26.6 billion, or 18.9 percent), lower noninterest income (down $6.5 billion, or 8.8 percent), and higher provision expense (up $5.2 billion, or 26.5 percent) drove the decline in net income in the fourth quarter.

Higher provision expense occurred as the industry built reserves, primarily for credit card and commercial real estate loans.

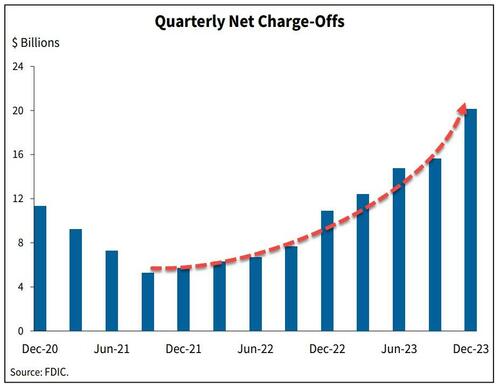

Charge-Offs Are Accelerating (above pre-pandemic levels)

The industry’s net charge-off rate increased 14 basis points from the prior quarter and 29 basis points from the prior year to 0.65 percent, 17 basis points above its pre-pandemic average.

As an aside, The FDIC now estimates $20.4 billion in losses arising from the failure of both SVB and New York-based Signature Bank, up 25% from its $16.3 billion November estimate.

The industry’s net charge-off rate is 17 basis points above its pre-pandemic average.

Nonfarm nonresidential commercial real estate loans also contributed to the increase in net charge-offs, particularly among non-owner occupied properties in which the net charge-off rate of 0.51 percent was the highest level since fourth quarter 2012.

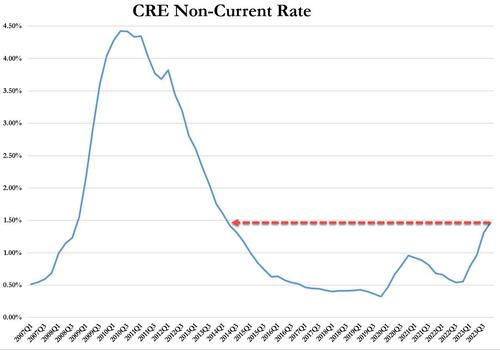

CRE Loan delinquencies soaring (highest since 2014)

Late payments on commercial properties that aren’t owner occupied are at the highest level since the first months of 2014, Gruenberg, the FDIC chairman, said in his remarks.

Powell says there will be bank failures from CRE troubles, but not at big banks, repeating an earlier comment that troubled CRE loans are manageable and more an issue for smaller and medium-sized banks.

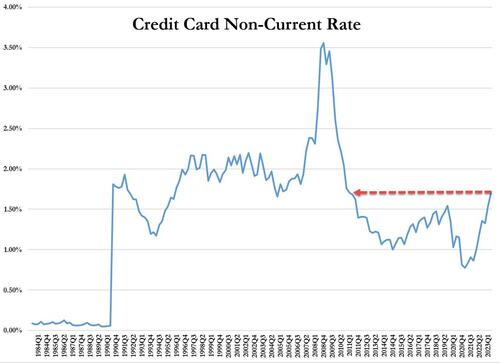

Credit-card delinquencies also soaring (highest since 2011)…

Credit card loans led the annual increase in net charge-off balances. Delinquent credit cards haven’t been this high since the third quarter of 2011…

The net charge-off rate on credit card loans was 4.15 percent, the highest rate for this portfolio reported by the industry since first quarter 2012.

While credit cards and nonfarm, nonresidential commercial real estate loans drove the quarterly increase in the noncurrent rate, residential mortgages drove the quarterly increase in the share of loans 30-89 days past due.

But, apart from all that, as Powell said in the last two days: ‘the banking system is strong and resilient’.

And how do you think these charts will look as banks face an imminent shift to tougher capital and liquidity regulations.

Tyler Durden

Thu, 03/07/2024 – 12:25

via ZeroHedge News https://ift.tt/LRFsWE2 Tyler Durden